Energy Transfer LP (NYSE:ET) is a massive company in the natural gas space. With a market cap of over $43 billion, it’s a behemoth in the energy sector. Much of the appeal of the company has come from the high dividend it currently has, at over 9%. I think that there are some potential risks circulating that may leave investors unimpressed. Lacking natural gas price increases could leave less available capital for ET to raise the dividend. The share price has appreciated very well over the last 12 months and has approached a level where I would consider it fairly priced. It trades more or less at a 5 – 6% earnings premium to the sector and a 25% discount on p/fcf to the sector median. I would argue that an earnings discount of around 15% to the sector median is necessary to make it a buy. For the moment, I therefore view ET stock as a hold.

Business Performance

One of Energy Transfer’s most crucial roles is its extensive involvement in the movement of energy resources. Notably, the company plays a central role in the transportation of approximately 30% of the United States’ natural gas supply, underscoring its indispensable contribution to the nation’s energy infrastructure. Furthermore, Energy Transfer is responsible for conveying around 35% of the nation’s crude oil, highlighting its stature as a key player in the energy sector.

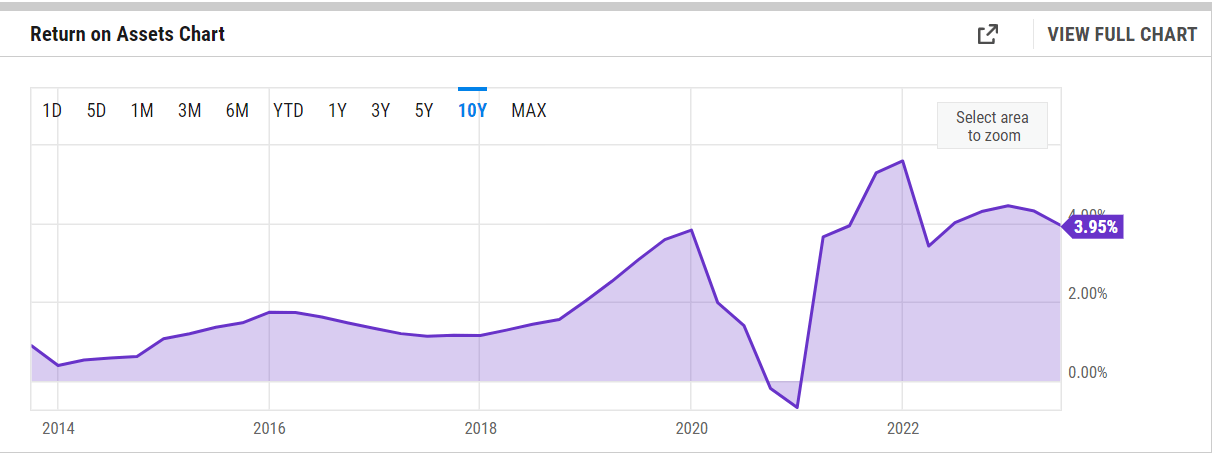

ROA (Ycharts)

Given that, a large asset base of ET is the pipelines and infrastructure for transportation of both oil and gas, a very good metric to look at the performance of the business is the ROA. For ET this means a steady increase over the last couple of years. But we see a dip in late 2020 as the price of natural gas reached some very low levels. For reference, the gross property, plant & equipment for ET is right now valued at $109 billion, a significant increase from the $79 billion it was in 2018.

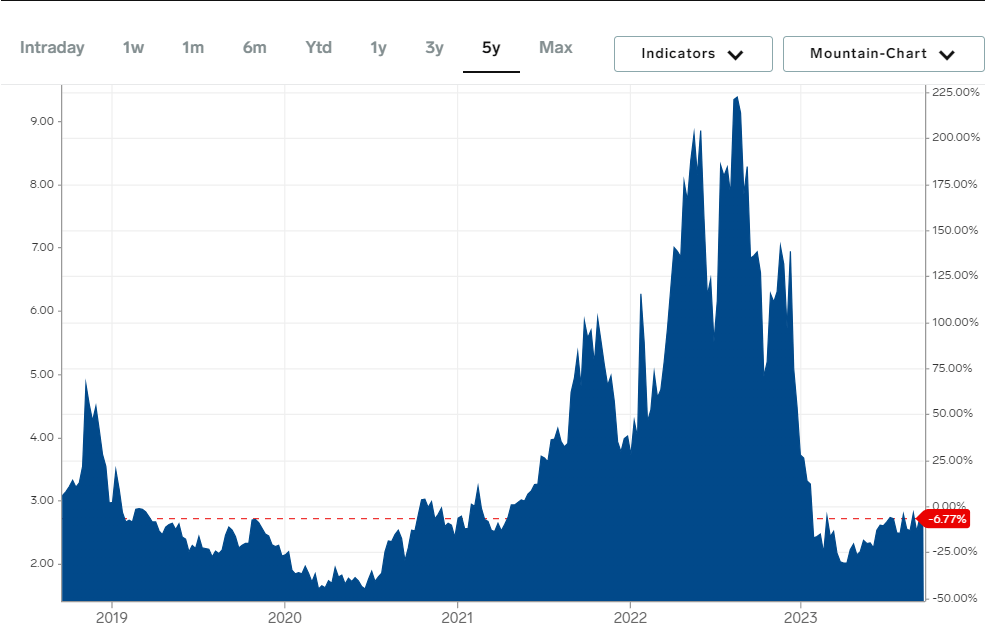

Natural Gas (Business Insider)

Prices reached below $1.62 and resulted in ET posting a negative ROA. It should be said that oil futures also went negative during 2020. Specifically for the latter part of 2020, the oil prices were around $45, but have since doubled. ET has been able to increase its ROA rapidly over the last few years showcasing the strength of its asset base and ability to outgrow some of the momentum of commodity prices. I think this is why the market is giving it a slight earnings premium right now, as the stability of ROA is visible.

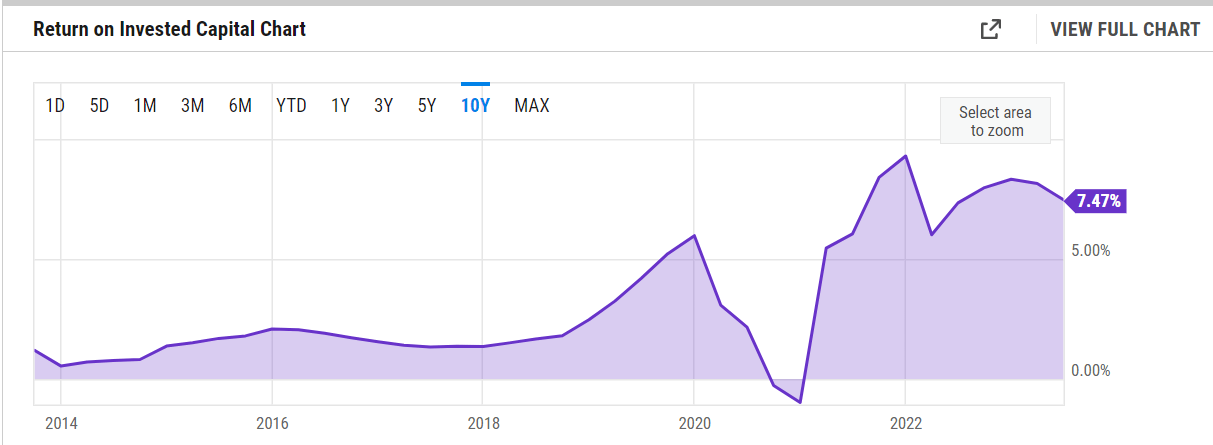

ROIC (Ycharts)

I mentioned earlier that the asset base, or more specifically the pipelines that ET has has rapidly increased since 2018. During this period the ROIC has also improved very well. This has come as commodity prices have increased and the heavy investments that ET made into their infrastructure and pipelines have been paying off.

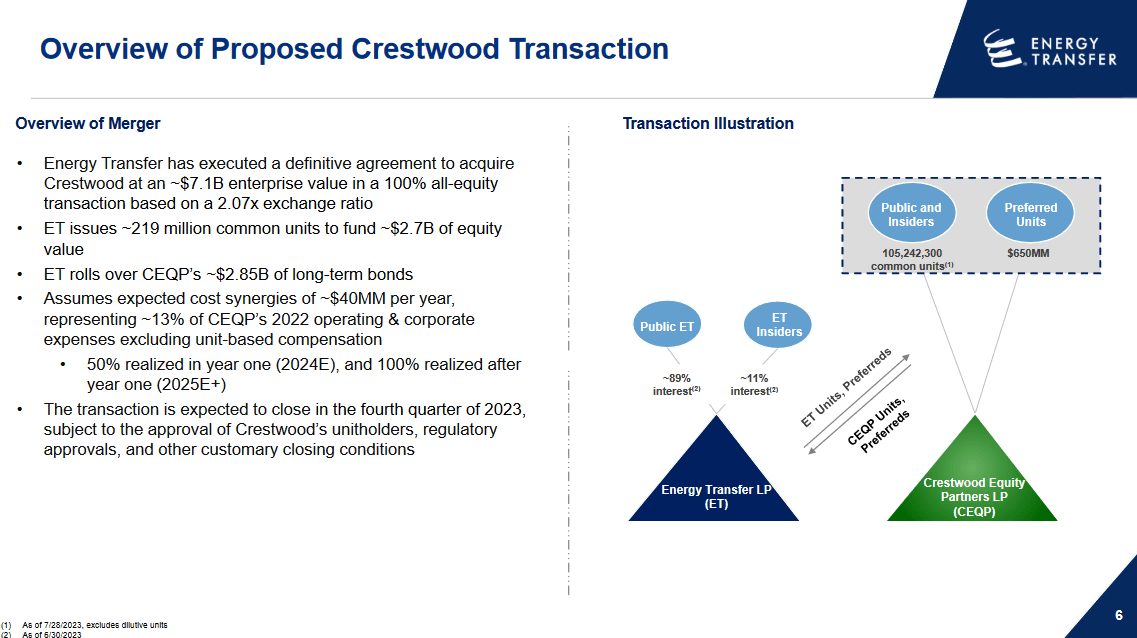

Crestwood (Investor Presentation)

As for the coming expansion of the business, I think that it will come from acquiring more companies. The latest one is around Crestwood, with a deal valued at $7.1 billion. The cash for ET is only $330 million right now so they will have to take on a significant amount of debt to fund this transaction. It is a bet that natural gas prices will continue to improve and once the debt they take on now matures, EBITDA will be high enough to cover it. For the long term, I agree that natural gas prices will appreciate. For a more stable financial position though I would have preferred a higher cash position before making a transaction like this.

Dividend Evaluation

One of the main appeals of ET is the dividend. The company has a history of paying out a very high yield, which right now is above 9%.

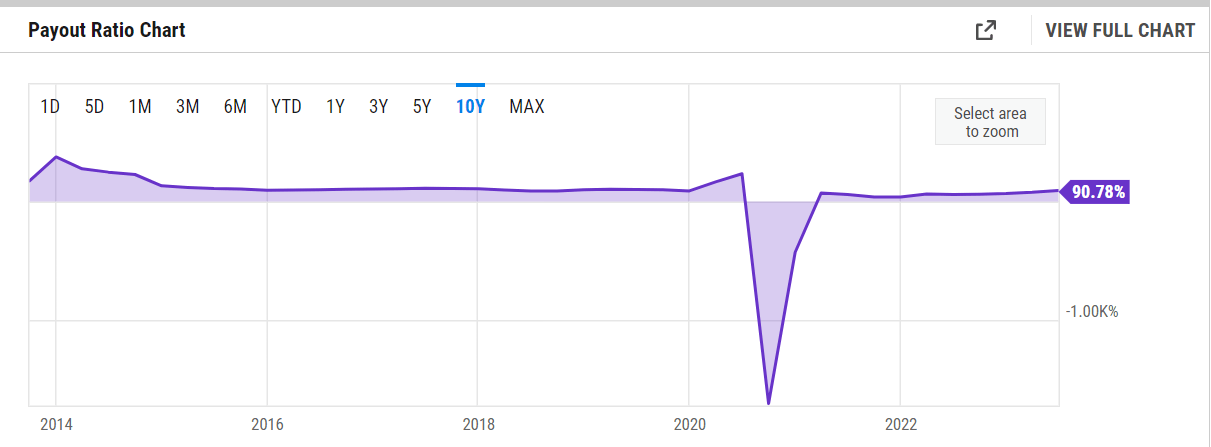

Payout Ratio (Ycharts)

The payout ratio for ET has historically been very very high. Right now sitting at over 90%. Since we know that the earnings of the business are quite tied to the commodity prices, betting on a higher dividend is betting on higher commodity prices as well. What I am slightly worried about is the potential lack of increases in the coming years for ET. Natural gas prices have been cut heavily from the highs in 2022, and it seems like there will be a slow climb upward.

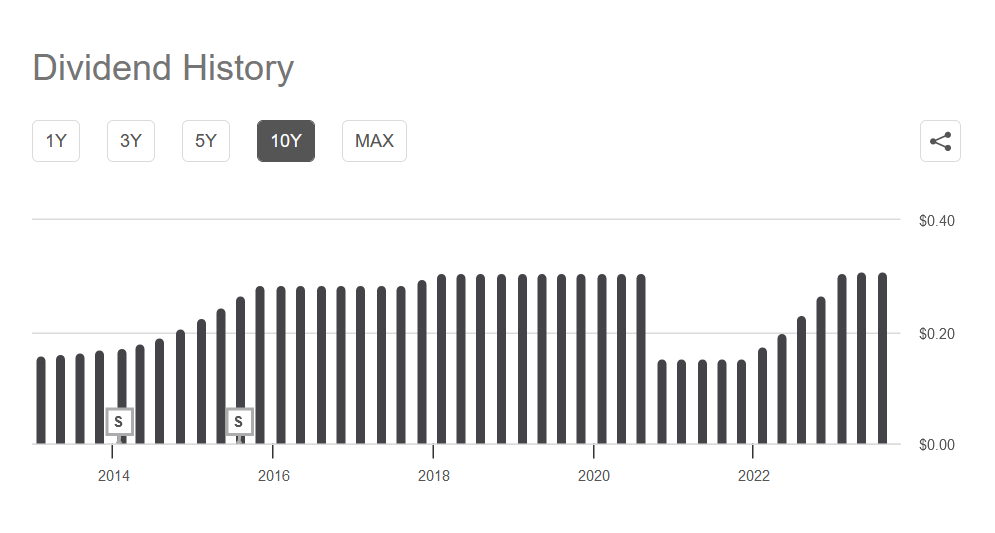

Dividend History (Seeking Alpha)

When the commodity prices collapsed in 2020 the dividend for ET was cut. Looking back it was a good move as the company would have been unable to pay out the nearly $3 billion in dividends with an FCF of under $200 million and negative net income. What I think this highlights though is the susceptibility that the dividends have to commodity price volatility. Oil prices have heavily appreciated in the last few months and sit above $90. If global production starts to increase again prices may decrease and ET could potentially see stagnating EPS growth.

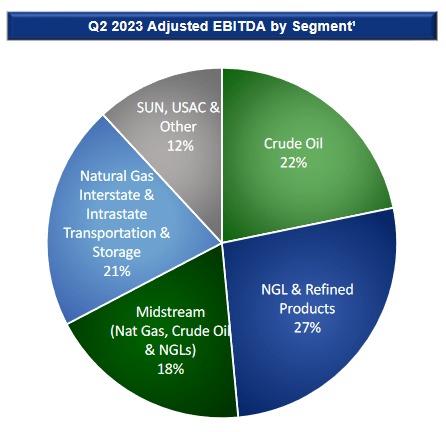

EBITDA Mix (Investor Presentation)

Between 2013 and 2018 the dividend increased from $0.16 to 0.31 every quarter, a nearly 100% increase. A majority of the EBITDA for ET is from natural gas and during the 2013 – 2018 period prices for it declined. But the net incomes for ET rapidly increased during this period, which has come from the pipeline expansion, as gross property, plants & equipment more than doubled. Where my thesis around the dividend coming under fire originates is that ET is no longer in the same position to grow as rapidly as before, and that will result in lackluster growth I think. I don’t think ET can double their asset base in the next 5 years, that would just result in too much debt and leverage. If you are looking for a 5% terminal dividend raise I don’t think ET can provide that for the next decade. This is why I would argue ET is rather a hold right now, and potentially a buy when the earnings discount is good enough. If you get a p/e discount of 15% you would have in my opinion sufficient immediate usage potential to make ET a good buy. But when it trades in line with the sector that upside disappears.

Risk/Reward

Apart from the vulnerability to interest-rate shifts, another pivotal aspect of ET’s financial stability hinges on its consistent capacity to fulfill its debt commitments. Ensuring the company’s ability to make timely and dependable debt repayments is of paramount importance to maintain solvency and overall financial health.

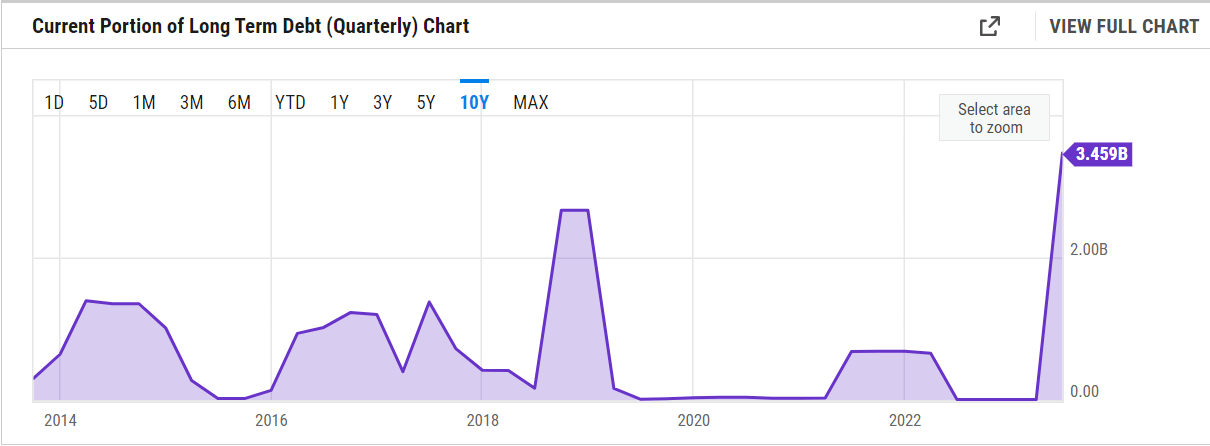

Current Debt (Ycharts)

Looking above we have the current debt obligations of the company and as it’s visible, it has spiked a lot in the last few quarters alone. ET has a large debt position at $44 billion right now. The spik of current obligations I don’t think will be the first. In 2018 the company started building up its debt position again and reached over $51 billion in total. About 5 years onwards and some of the debts are starting to mature. I think that investors should be worried about the potential of lower divine increases going forward to meet these obligations.

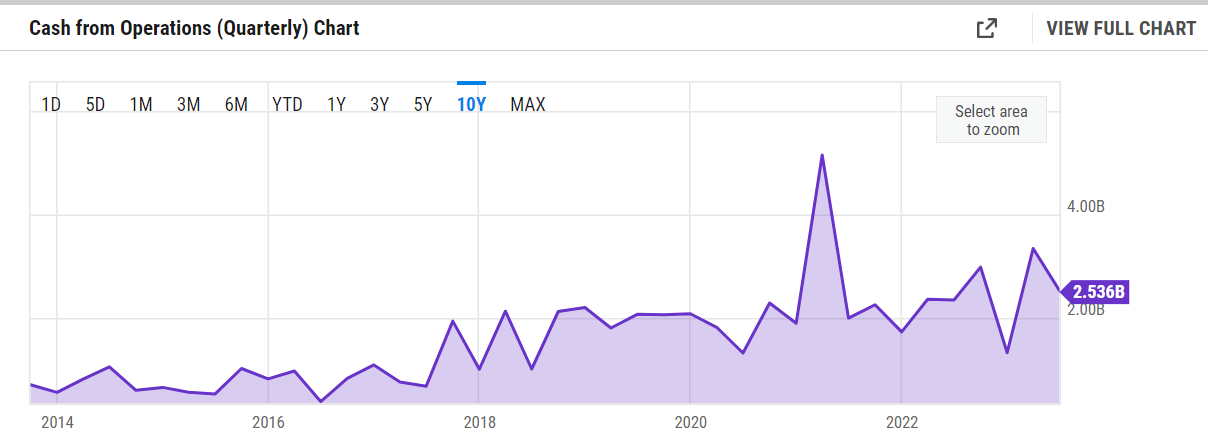

Cash From Operations (Ycharts)

The cash from operations has been climbing very well over the years and is capable of covering a significant amount of the current debts the company has. However, I think that there may be a consolidation for the dividend of the company. If ET doesn’t raise the dividend in the remaining part of 2023 I think that the share price will come under pressure and be forced downwards. The last time the company announced a raise to the dividend it was only 0.8% higher. Natural gas prices have come down heavily since last year and I think they could rise to go into winter, but investors should be prepared for some potentially lackluster dividend raises if prices don’t appreciate quickly.

Key Notes

ET is a fantastic business that has historically rapidly increased the asset base and therefore also the total EBITDA. This has over the year resulted in a strong dividend as the payout ratio is currently over 90%. But seeing as the earnings are tied to commodity prices, the dividend that investors could get can face some volatility potentially. To hedge against this ET is continuing to expand its network through transactions like acquiring Crestwood. This is an effort to raise the distributable cash flows and deliver a satisfying yield for investors. I find that the dividend increases won’t be as high as most may hope for. I think ET is a hold now, but potentially a buy if the earnings discount becomes great enough.

Read the full article here

Leave a Reply