Energias de Portugal (OTCPK:EDPFY) is one of our perennial favourites in the utilities and renewable space. Multiples still look good for their assets, which continues to support the asset rotation methodology. Selling prices are still alright for electricity, and speculative factors are driving increases in forward prices. Moreover, they are increasing their hold on EDP Brasil by buying out the minority interests, which is lifting costs of capital but also growing well-indexed and resilient businesses. Finally, they are generally doing a good job of growing assets. But we think it might be time for EDP to start thinking about deleveraging and playing the role of cash cow, possibly starting to think about growing its dividend.

9M Breakdown

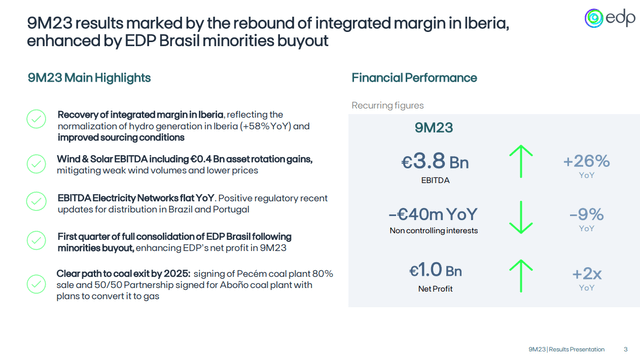

Highlight (Q3 Pres)

The high level results already paint a pretty good picture. Broadly, they are up on base effects, as last year was terribly dry in Iberia and affected hydropower which is recovering sharply. Electricity prices are somewhat down, being the first offset, but forward prices are looking good, possibly as markets worry about a colder winter and the energy needs associated with that this year. Wind was lower due to less wind resources, and networks was also slightly down due to some electricity grid debt and slightly higher OPEX.

EDP also has a decent amount of CCGT, which operates on spark spreads that require gas as input to create electricity. Gas price deflation has dramatically reduced YoY due to the hoarding and speculation of 2022, which has improved CCGT margin.

CCGT Exposure (Key Data Q3)

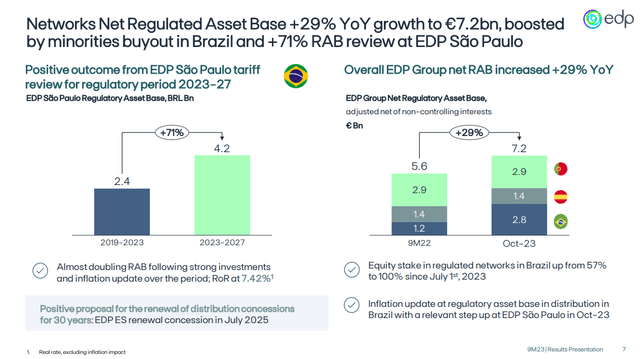

Within networks there was still growth driven by the Brazilian business thanks to large increases in the regulated asset base. Keep in mind that the rate of compensation on that base also rises in line with long-term bond rates, so the business continues to be indexed in terms of revenues to be hedged from inflation and also higher cost of capital. Also, EDP has bought out the minority interests in EDP Brasil. Since that’s where the more vigorous return profile is, where the company is able to focus its debt needs in lower rate markets, we see this as a good investment, although it has raised net debt and financing costs with it. These businesses are highly stable, and we believe consolidating it will help with the deleveraging profile.

RAB Growth Brazil (Q3 Pres)

Net Debt Change (Q3 Pres)

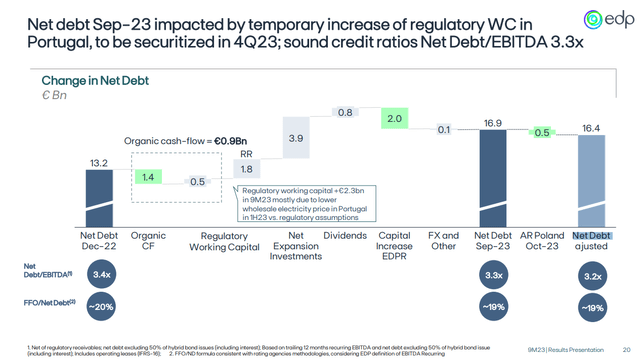

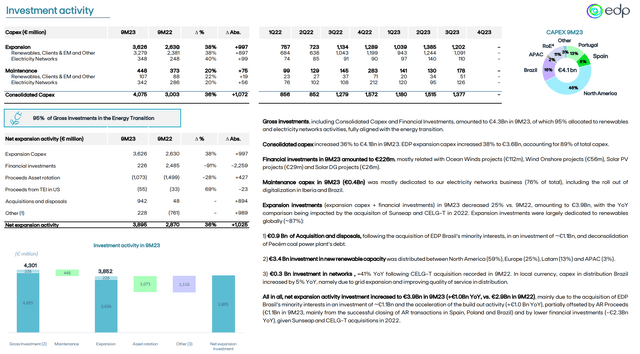

Talking about investment activity in general, renewable investments into generation assets continue to grow the generation business as well. General investment ramped up on account of a 33% decline in disposals from the asset rotation model as well as the decision to buy the rest of EDP Brasil this year.

Investments (Key Data Q3)

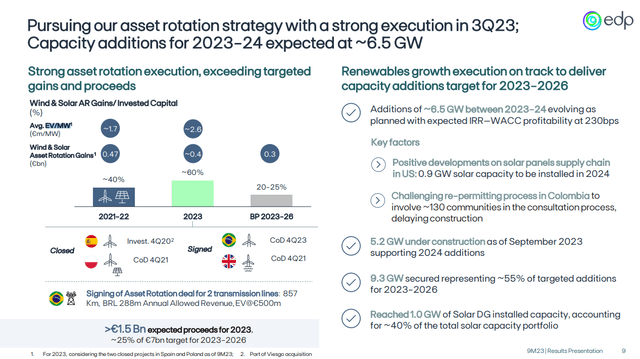

The asset rotation declines show that dealmaking activity might be slowing, although the multiples being paid for EDP’s assets continue to grow, so the private market environment for these assets continues to look good.

Disposal Multiple (Q3 Pres)

Bottom Line

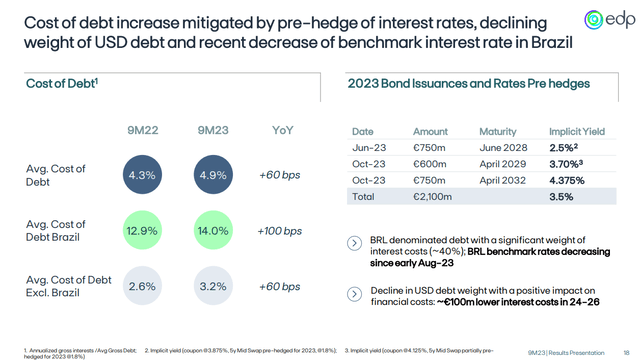

The main negative this quarter is the cost of debt increases on account of accelerated investment and decelerated disposals. The new debt has averaged up debt costs which grew by 60 bps, which is quite a lot.

Debt cost (Q3 Pres)

Leverage is 3x ND/EBITDA which means those higher costs of capital, even if low relative to other companies, will actually sting. It’s quite the incremental step.

In general, EDP has been an asset rotation play that has also paid a stable, but not growing, dividend. The markets have penalised it for this. In the past, when the funding environment was better, we actually welcomed the model, but now we think that it’s wise for EDP to recognise that the markets probably want to see more deleveraging, rather than increasing debt as it has been doing for years, and perhaps grow the scope for the dividend too. The lower activity in the asset rotation activity may be the catalyst to force EDP to change its strategy a bit which might allow it to be received more favourably than peers.

It’s tough to find a great comp for EDP, because other companies in Europe don’t tend to have such large hydropower investments, and then also large network concessions. EDP is quite unique in that regard. There may be comps in South America but the environment is too different there to make a genuine comparison. However, comparing the EDP valuation to other European renewable picks like ERG SpA, which is more focused on wind and a bit on solar, the ERG multiple is not far from being 50% higher than EDP.

We’ve always thought there was a case for the stock, although it’s not been a place to hide lately in a higher cost of capital environment, even though the networks business is naturally hedged to that.

While not a screaming buy, because we still think that close to 7x EV/EBITDA in the current environment seems fair in an absolute sense, and while still decent, the asset rotation model may lose some velocity as multiples must come down on higher long-term cost of capital expectations, it remains on the watchlist as a curiosity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply