Summary

Readers may find my previous coverage via this link. My previous rating was a buy as I believed Endava (NYSE:DAVA) is well positioned in a high-growth area that I believe has long-term healthy end-demand due to positive secular tailwinds driving growth in digital transformation. I am reiterating my buy rating for DAVA as there is an upcoming catalyst that will drive the stock up in 2H24. Importantly, DAVA’s structural growth seems to remain intact. That said, I am not recommending investors increase their stake in DAVA until 2H24, as there is uncertainty in near-term growth and margin.

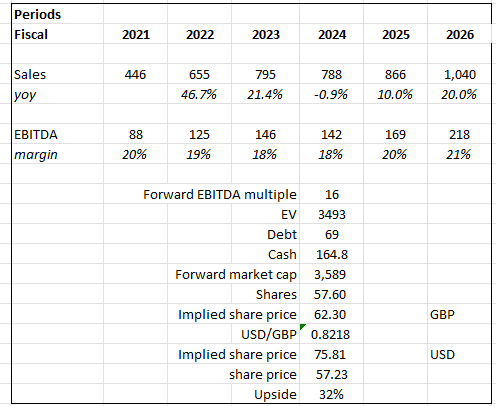

Financials / Valuation

DAVA’s revenue for the fourth quarter of FY23 was £189.8 million, an increase of 5.2% year over year but a decrease of 6.8% quarter over quarter. Growth was boosted by 370 basis points due to M&A activity, indicating that organic revenue growth was 1.5%. However, at £188.5 million, performance was above expectations. While DAVA’s annual growth was satisfactory, the company’s sequential revenue decline across all industries and regions is cause for concern. DAVA’s earnings per share came in at £0.57, which was £0.12 higher than expected.

Based on author’s own math

Based on my updated view of the business, I am tapering my growth expectations to be more conservative. I now expect growth to only recover to FY23 levels in FY26. Similarly, I am expecting margin to expand at a much lower path given that FY24 might be another year of muted growth (management guidance) and margin expansion (1H24 could be negative due to the weak growth, offset by improvements in 2H24). Instead of my previous 26% target, I tapered to a more conservative target of 21% by 2026. My 21% target was anchored against DAVA FY21 20% EBIDA margin performance, which I expect DAVA to exceed as revenue growth recovers and a high incremental margin kicks in. Due to the uncertainties in the near-term growth prospects, I expect valuation multiples to stay at this level in the near term.

Comments

Sequential results show that DAVA still has some work to do. A strong acceleration in growth in 4Q24 is implied by management’s FY24 guidance, which I believe will be the catalyst that re-rates the stock higher and proves my earlier hypothesis that the slowdown is not structural. What’s more, management guidance did not account for its clients’ CY2024 budget cycles, suggesting a degree of upside depending on the outcome of recessionary pressures in the United States, the United Kingdom, and Europe.

In retrospect, I’m beginning to see more indicators that DAVA’s solutions are still gaining traction and that the recent slowdown in growth is cyclical rather than fundamental. Demand can be inferred from DAVA’s booming performance in the rest of the world, which increased 177% year over year and now accounts for around 8% of company revenue. Importantly, once the economy improves, DAVA should be able to duplicate this success in the United States, the United Kingdom, and Europe. Management mentioned on the call that they had completed three acquisitions in APAC during FY23 and that the region now had over 1,000 employees, up from less than 50 in FY22. Keep in mind that DAVA’s employees are its most valuable resource and that they are the ones who are put to use in assisting with the implementation of transformation strategies at the customer level. As such, with more employees in the team now, it is able to drive more growth.

DAVA

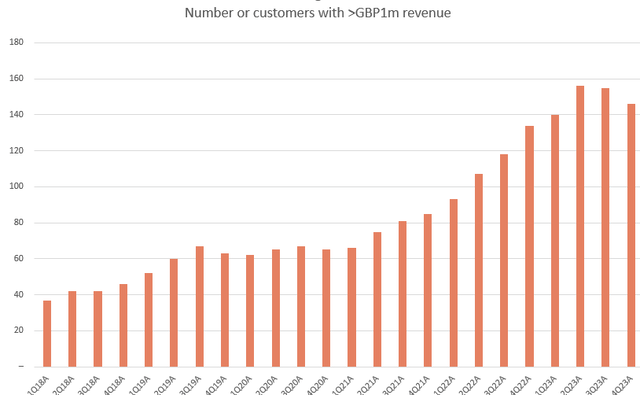

Another noteworthy indication of demand is that DAVA experienced a consistent expansion in its client base generating revenue exceeding £1 million. This growth is evident from the increase in the number of clients from 134 in 4Q22 to 146 in 2Q23. Additionally, DAVA observed a 13.7% year-on-year rise in average spend from its top 10 clients, reaching £6.6 million. I hold a positive outlook regarding the anticipated expansion in the upcoming fiscal year of 2024, with a particular emphasis on the second half of the year. This perspective is supported by management’s indication of a high-teen double-digit growth trajectory towards the conclusion of FY24, driven by the recognition of project revenue.

We expect to return to high-teens growth by Q4 FY ’24. As concerns to profitability, adjusted PBT should be subdued compared to the most recent quarter in FY ’23 as we maintain a bench in readiness for the recovery we are seeing develop in H1 and build through H2. Source: 4Q23 earnings

While DAVA stock has performed well since my last writeup in early July, rising by about 11% since then, and underlying structural demand is not impaired, I would like to take this opportunity to highlight that DAVA stock may be rangebound in the near-term (at least for 1H24). In the short term, DAVA’s continued revenue decline in North America is a cause for concern. The region was quick to pull back on spending in early March out of fear of a potential recession, and this was noted by the company. In addition, the United Kingdom’s continued mixed results with revenue growth of 0.1% indicate that the country will remain under duress throughout FY24, with no improvement in sight until the fourth quarter of that year. Clients remain cautious, particularly in banking, financial services, and private equity portfolio companies, which has led to increased competition for short-term work. I think the market is worried about the effect that weak revenue performance will have on profits in the near future. Lower utilization rates could have an adverse effect on DAVA’s profit margins in the near future. The good news is that the company’s management only plans to moderately increase headcount in 1H24, as the business will boost utilization and not anticipate a significant increase in hiring until demand turns in 2H24.

There are encouraging signs and obvious catalysts that should lead to a stock re-rating. Despite my continued faith in DAVA’s long-term potential (and my buy rating), I would advise caution when considering further investment in the stock in the near term (1H24).

Risk & conclusion

Endava operates and manages substantial delivery centers in prominent digital engineering locations, including Eastern Europe and Latin America. The heightened level of competition for talent may have adverse effects on Endava’s capacity to recruit and retain the supplementary workforce required for expansion. The company additionally generates a significant portion of its revenue from clients in the financial services industry, particularly within the payments and insurance sectors. The potential decline in technology investment within Endava’s primary industries may have an adverse effect on its overall growth trajectory. Finally, the expansive international presence of the company exposes Endava to various significant foreign currencies. Endava’s financial performance may be negatively impacted by adverse fluctuations in currency exchange rates, potentially affecting both its revenue and profitability.

I maintain my buy rating for DAVA, as the company’s structural growth prospects appear intact, and an upcoming catalyst is expected to boost the stock in the second half of 2024. Despite this positive outlook, I advise caution in increasing investments in DAVA until the second half of the year, as near-term growth and margin uncertainties persist. While DAVA’s structural demand remains intact, there are near-term challenges, including revenue decline in North America and mixed results in the United Kingdom. Caution is advised due to potential impacts on profit margins in the short term.

Read the full article here

Leave a Reply