“Feelings. Nothing more than feeeelings,” the aptly named “Feelings” song by Morris Albert croons.

In case you don’t know what I’m talking about, here’s how the lyrics continue from there:

“Trying to forget my feelings of love

Teardrops

Rolling down on my face

Trying to forget my feelings of love.

Feelings

For all my life I’ll feel it

I wish I’d never met you, girl

You’ll never come again.”

There’s more to it than that, but you get the gist.

It’s not a peppy kind of song.

The lyrics are a relatable (though perhaps insipid) expression of a common battle: trying to downplay an emotion because that emotion is just too overwhelming.

But is that really the best way to handle how you feel?

Psychologists would doubtlessly say no.

And I can’t help but agree.

Before you accuse me of promoting some state of whiny indulgence, I’m not.

I don’t believe in letting emotions dictate decisions.

If I did, I’d still be sitting in a parking lot, staring brokenly at a diminished shopping center I used to own.

Instead, I’ve very much moved on from there.

I’ve got my new business now scouring the stock market for promising portfolio picks.

In some ways, recommending REITs and other dividend-paying stocks is a definite switch from my commercial real estate development days.

Then again, I’m still evaluating property potentials and crunching numbers.

So, really, I have to say, the biggest change I had to make was to my mindset.

“How Does That Make You Feel?”

Like I stated above, feelings are real.

In which case, it’s foolish to pretend otherwise.

Do a Google search on “why emotions matter,” and you might find a book by Tristen K. Collins with that title.

For the record, this is not an endorsement; I know nothing about the actual work.

But I do like its description, which reads:

“For some, emotions are overwhelming and all-important. For others, they are bothersome and irrational. No matter where you fall on the emotional spectrum, one thing is for sure: God designed you as an emotional being.”

Don’t believe in God?

Like I said, I’m not promoting the book. But the fact is we all do have feelings regardless of how we interpret the world. Even sociopaths want to feel something, after all.

Fortunately for us, these:

“… emotions have purpose, and they’re worth handling with curiosity, respect, and wisdom. What might it look like for you to have a healthy relationship with emotions? Could you learn to discern them and use them wisely?”

The book apparently covers:

- “How emotions work as signals on your body’s internal dashboard

- Why emotions are valuable (even when they are unpleasant)

- What to do when your emotions don’t match the situation

- Helpful tools and habits to cultivate emotional health over the long-term

- The ins and outs of shame, fear, anger, sadness, jealousy, and happiness.”

I bring all this up because it very much applies to investing.

When you learn how to control your emotions, you learn how to make more money.

If I had recognized that back before the housing market crash of ’08, I would have been much better off.

But I let the glamour of success run my business and personal spending alike.

Those feelings felt great… right until they didn’t anymore.

(A Moderate Amount of) Greed Is Good

Quite a while ago, my colleague Chuck Carnevale wrote an article on this very topic: how emotions determine market price.

But only in the short run.

I plan to quote it much more extensively in a follow-up article titled “Earnings Determine Market Price in the Long Run.” But for now, here’s a very relevant passage:

“… although the correlations between earnings and price are extremely profound long-term, there will be occasions when investors will see a short-term separation between earnings and price over or under.

“These are times when emotions such as fear or greed or hype or hysteria take hold, and investors throw caution to the wind and behave irrationally.”

Sounds familiar, doesn’t it?

“My thesis on the importance of earnings does not deny this. Instead, it recognizes this and uses this recognition as an opportunity to make intelligent (not perfect) buy, sell, or hold investing decisions, thereby aiding the investor in avoiding obvious mistakes.”

I completely agree with Chuck’s assessment.

And so does every successful investor I know of.

To quote Michael Douglas’ Gordon Gekko in Wall Street, “Greed is good!”… to a certain extent. The desire (i.e., emotion) to make money can push us to take calculated chances that really pay off.

If we didn’t care at all about making money, most of us who aren’t jack-of-all-trades would starve to death pretty quickly. Then again, allowing our greed to go unchecked leaves us in the lurch too.

Or take fear. A controlled amount keeps you safe; an unfettered amount can cost you quite a bit.

The emotional intelligence that recognizes the dividing line between those two positions is an edge you really want to have. It allows you to better avoid what needs to be avoided and to pounce on assets that more than pay off.

Medical Properties Trust (MPW)

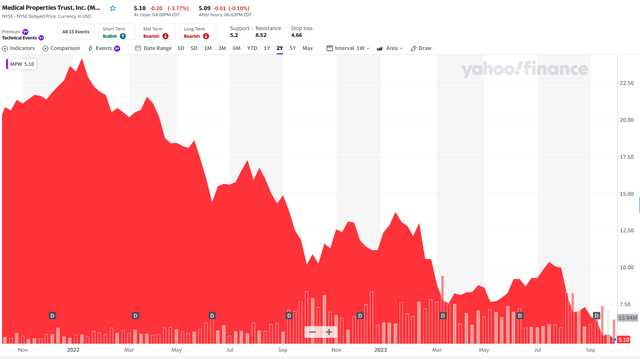

Does this chart below spark fear or greed?

Yahoo Finance

As you can see, MPW shares have declined by over 74% in the last two years – from around $24.00 to $5.10 per share.

Unfortunately, I participated in the greed as I’ve accumulated shares in that period that has resulted in paper loss of ~40%.

I don’t want to bore you with the details as my last article was less than thirty days ago (read it here) and the battlefield was split fairly even with bulls and bears (just under 1,000 comments).

In the article, I explained that MPW’s payout ratio (based on AFFO per share) was 96.67% and “I would not be surprised at all to see a dividend cut in the near future”.

Fast forward to now…

MPW has announced a dividend cut of around 50%, from $.29 per share to $.15 per share with a targeted initial payout ratio of less than 60% of AFFO.

The annualized run rate is now $.60 per share.

Shares are down over 27% since the dividend cut announcement – so much for pricing in a dividend cut.

It’s clear that many investors have bailed on MPW, as the lack of management trust continues to linger. A few days ago, the CEO posted a video on the MPW website hoping to improve communications with investors.

(Better late than never)

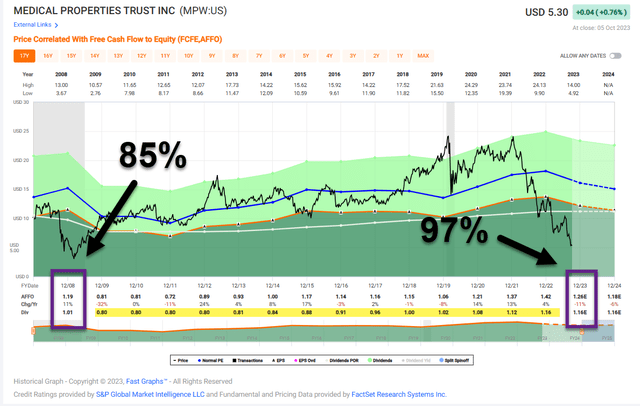

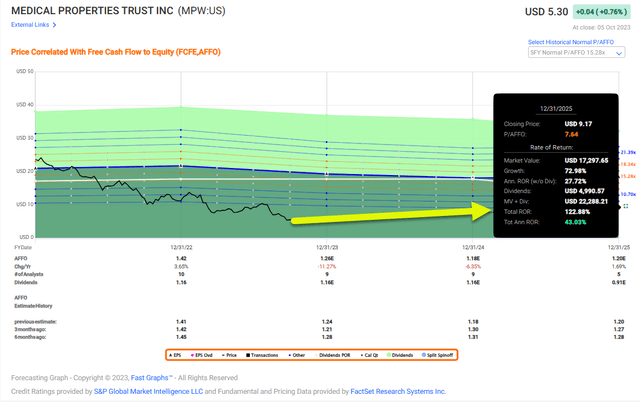

Fast Graphs

As seen above, MPW cut its dividend in 2008 – during the Great Recession – from $1.01 to $.80 per share and did not grow the dividend from 2009 to 2013.

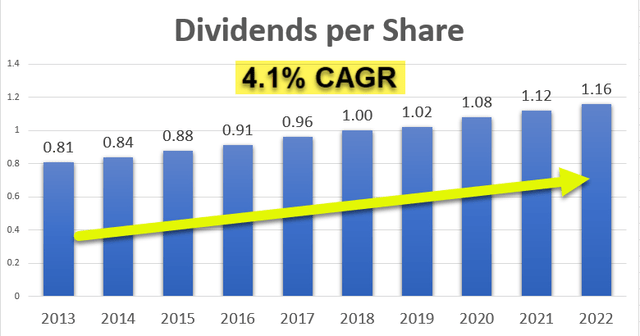

When the company began to grow its dividend in 2013 through 2022, it did so by around 4.1% per year.

iREIT®

We noticed the elevated payout ratio in 2023 at which time we downgraded shares to a spec buy.

In hindsight, we should have downgraded to a SELL recognizing the probability of a dividend cut.

Furthermore, MPW’s sub investment grade balance sheet was a concern that we pointed out in previous articles.

So here we are today, with MPW shares trading at $5.30 with a P/AFFO of 4.1x. Now that the dividend cut is in the record books, the payout ratio is a much healthier 48%.

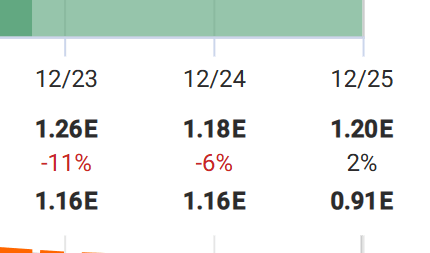

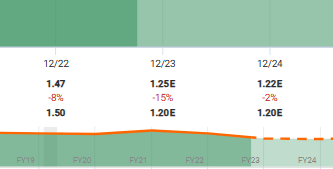

AFFO per share

FAST Graphs

However, earnings are not moving in the right direction, as analysts forecast -11% growth in 2023 and -6% in 2024.

Even out to 2025, analysts are forecasting modest growth of just 2% (5 analysts in the 2025 pool).

As I mentioned before, emotions determine market price in the short run, and the title of my next article explains, “earnings determine market price in the long run” will be the reason I decide to buy, sell, or hold.

Given the current and future growth forecast for the company, catalysts will need to unfold allowing the company to return to historical valuation levels (10-year average of 12x). These catalysts include:

1) Monetizing the Prospect managed care business

2) Audited financials by Steward

3) Continued diversification

4) Improving the balance sheet (dividend cut helps)

5) Improve investor relations (video is a good step forward)

Now the good thing is that we maintained a Spec Buy which means we have been underweight the name. However, given the muted growth over the next year or two, we don’t anticipate a full recovery for some time.

However, as cheap as shares are now, a return to 7x would result in 40% annual returns.

FAST Graphs

Gladstone Commercial (GOOD)

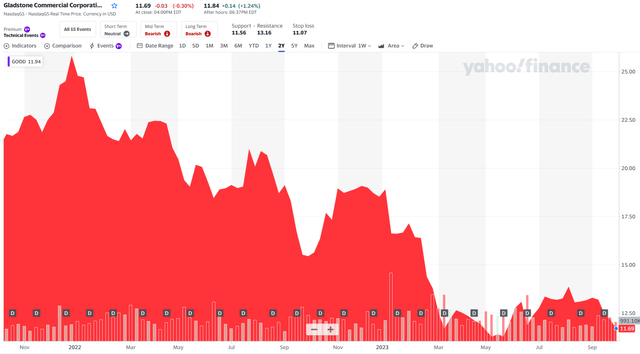

Does this chart below spark fear or greed?

Yahoo Finance

As you can see, GOOD shares have declined by over 48% in the last two years – from around $25.77 to $11.69 per share.

Fortunately, I was on the right side of this trade.

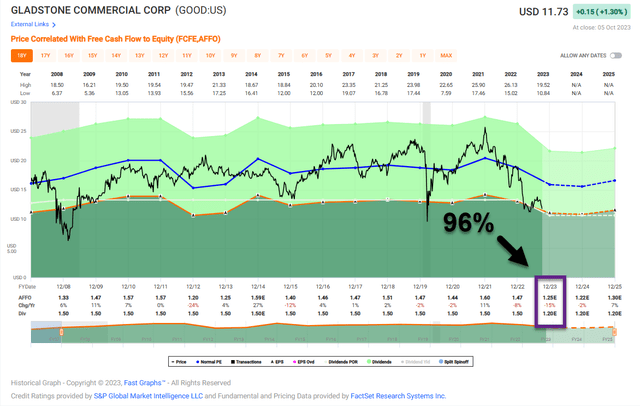

In December 2022 I wrote an article explaining,

“This earnings profile is flat as a pancake. Why would you invest in any company that’s not growing?

In 2021, I pointed out the dangerous payout ratio:

“Even more concerning is the fact that GOOD’s payout ratio is strikingly dangerous: 104% in 2021 and 111% based on analyst AFFO per share estimates.”

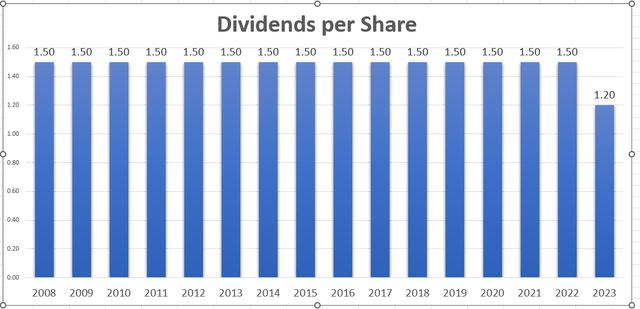

In February 2023, GOOD cut its dividend from $.13 per share to $.10 per share, 20% haircut ($1.20 per share), and the payout ratio is stall alarmingly high at 96%:

FAST Graphs

What do you think is wrong with this picture?

iREIT®

You guessed it…

Zero dividend growth!

Once more, analysts forecast negative earnings (AFFO per share) growth in 2023 and 2024:

FAST Graphs

Which means the company is teetering on another dividend cut.

The 10.2% dividend yield is tempting…

But it’s a “sucker yield”…

W. P. Carey (WPC)

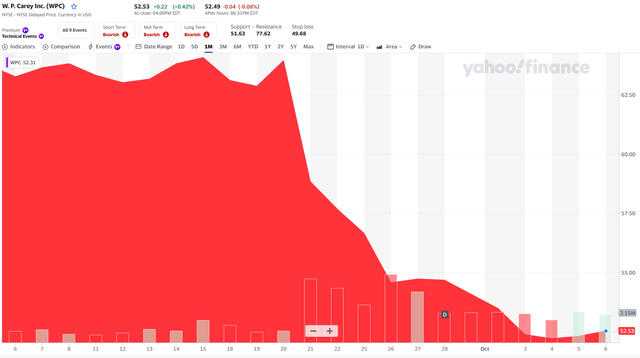

Does this chart below spark fear or greed?

Yahoo Finance

Most know what happened a few days ago when WPC decided to “throw away a 24-year dividend growth streak, just one year shy of becoming a dividend champion (and eventually an official dividend aristocrat)”.

As I pointed out in an article (with over 739 comments) “the market reacted with fury and rage at the announcement that the company would exit its office properties, slash its dividend (likely 20%) and reset the payout ratio to between 70% to 75%.”

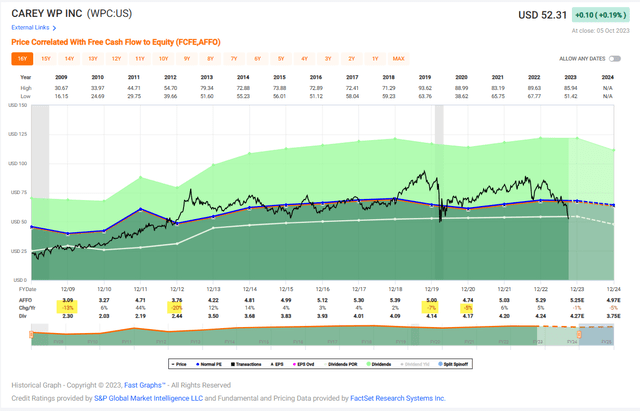

Assessing WPC through the rear-view mirror, we can see fairly healthy fundamentals, which is why we gave the company a fairly decent quality rating.

Earnings growth was spotty – negative 4 out of 10 years – but the underlying business model appeared to be sound (net lease properties).

FAST Graphs

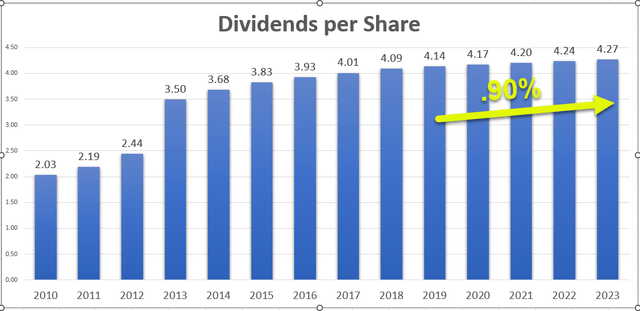

Carefully dissecting the dividend growth over the least 5 years we can see that the company generated modest (sub 1%) growth of .90% CAGR.

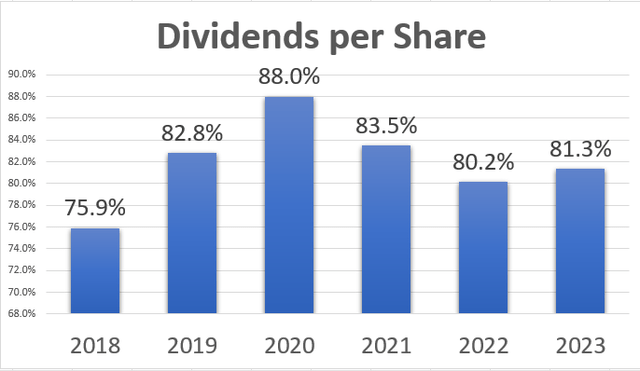

iREIT®

Once again, in hindsight, it’s easy to see that WPC’s payout ratio was higher than most peers, and especially at risk, given the high office exposure.

iREIT®

I think the dividend cut caught many people (including me) off guard, and of course the market reaction was quite fearful.

Earnings Determine Market Price (In The Long Run)

Now, I hope you enjoyed reading this article, Emotions Determine Market Price (In The Short Run), in which I detailed 3 REITs that have cut their dividends.

Stay tuned for my next article titled Earnings Determine Market Price (In The Long Run).

Special shout out to my friend and owner of FAST Graphs, Chuck Carnevale, whose mentorship provided me with inspiration to write this article and the next one in the series.

Finally, yesterday I published an update on Hannon Armstrong (HASI), another beaten-down REITs (soon to covert to C-Corp). I did not include HASI here because I owe to members to soak it in first.

As always, thank you for the opportunity to be of service.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here

Leave a Reply