Company Overview:

Elevance (NYSE:ELV) is the leading health insurer providing over 48 million medical benefits to customers in the U.S. The company is the single provider of Blue Cross Blue Shield (BCBS) having exclusive licenses in 14 states and owns the Anthem and Wellpoint brands. Within these BCBS states, Elevance insurers 1 out of every 3 people. The company operates in 3 segments: Health Benefits, Carelon, and Corporate & Other. The health benefits segment can be broken into commercial and government customers. Government makes up roughly 55% of FY22 revenue and commercial makes up roughly 20% of FY22 revenue. ELV’s Carelon segment is broken into Carelon Services and CarelonRx. Carelon Services provides care delivery, care management services, and data & analytic solutions. CarelonRx is ELV’s primary benefit manager business which has grown to 21% of FY22 revenue since inception in FY19.

Investment Thesis:

Elevance and other PBM providers (CI, UNH, CVS, HUM) have experienced massive volatility over the past few months. With CVS’s loss of California and legislation cracking down on PBMs, the industry is viewed with significant pessimism. Taking these near-term risks into account, we believe the strength of growth will outpace UnitedHealth over the next 5 years. Utilizing its leading market share in BCBS states, the company has significant pricing power which can generate superior compounding growth. Additionally, the company’s early development of its Carelon segment may drive double-digit growth over the next 5 years. With pessimism hitting a high, we believe that Elevance’s valuation is attractive for the companies consistent double-digit EPS growth.

Scale Advantages & Strong Economic Moat

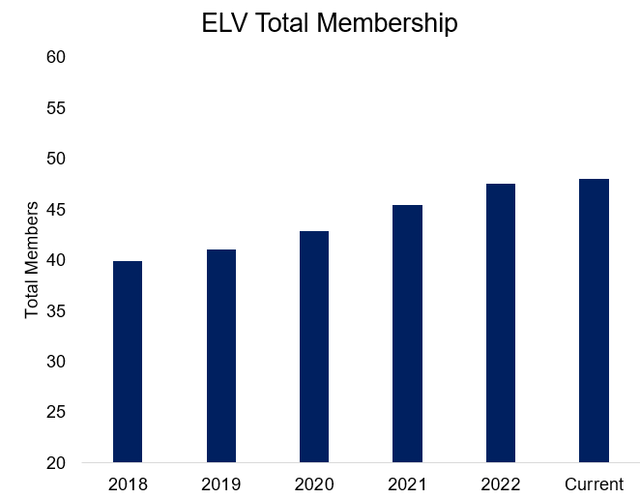

ELV Membership Growth (Elevance)

Unlike UNH, ELV is focused on the company’s 14 licensed states. Within these states, 1 out of 3 people are insured by ELV. The scale of the customer base in these states gives ELV extreme pricing power. The company has leading positions in commercial and Medicaid while building momentum within Medicare Advantage (MA). MA is a significant growth driver for ELV, with it driving higher margins and strong member growth. ELV has lagged behind its peers in growth within this area but has had stronger results recently. Additionally, Elevance has had consistent membership growth and began implementing strategies used by top competitors of acquiring smaller firms thus instantly growing its membership. Due to consistent membership growth and the continuation of the recent success of MA, Elevance should experience excellent growth.

Synergistic Carelon Segment

ELV has strong growth opportunities in its Carelon segment and value-based care spending. The growth can be broken into 3 parts: PBM growth through CarelonRx, the acquisition of BioPlus increasing the overall offering of ELV, and Carelon Services driving lower cost and higher quality care.

- CarelonRx has become a significant part of ELV having only started in FY19. The PBM manages 17M members with slightly over 50% of revenue attributed to non-Elevance members. The effectiveness of CarelonRx can be attributed to strong growth in non-Elevance members. As CarelonRx continues to gain traction with ELV members, it should experience double-digit growth. Currently, CarelonRx is the 6th largest PBM with 308 million scripts and 4.6% market share. With the addition of BioPlus, CarelonRx will expand its offering capabilities and become a competitive PBM offering. Compared to competitors, Elevance took a different approach to developing its PBM business. CarelonRx was built internally compared to M&A-built PBM business like UNH and CVS. Competitors may face challenges with synchronizing systems and tougher data integration. The internal creation of CarelonRx and the focus on whole-person care can allow advancements to be more efficient and quicker than competitors.

- BioPlus is a vital source for CarelonRx’s growth. As BioPlus expands, its services can be handled in-house by CarelonRx. Another synergistic area of growth for BioPlus is that CarelonRx can participate in the upside of increased biosimilar uptake. BioPlus has room for improvement as it needs to expand into more complex diseases so it can provide full coverage to CarelonRx. As BioPlus expands with CarelonRx, it can begin to take advantage of the 25% – 30% addressable market.

- Carelon Services offers services including care delivery, care management, and data & analytic solutions. Carelon Services is viewed as low-cost and high-quality care through a focus on serving and understanding patients. It serves both Elevance members as well as over 80 third-party payors. Carelon Services takes a different approach towards healthcare services owning care delivery assets on a targeted basis rather than a broad delivery basis. Management believes it gives them an advantage because it will be more capital-efficient. Carelon Services is projected to grow at upper teens to low twenties with high-single-digit margins. A core component is the growth in their behavior health segment where they have had success in crisis solutions and mental health programs. Utilizing the different segments of Carelon Services can lower overall costs and increase visibility into ELV’s customer base.

Vendor Consolidation

With the addition of Carelon and BioPlus, ELV can become a single carrier for its commercial clients. Management noted that 23 of its largest vendors have consolidated their vendors down to ELV. Becoming a one-stop-shop, Elevance can effectively compete with CVS and UNH. The continuation of ELV’s value-based care will drive employers to ELV’s offerings and drive further growth. The consolidation gives ELV more insight into whole-person care, which the company can leverage to decrease costs. Additionally, cross-selling synergies will increase overall margins and further drive EPS growth.

Superior Capital Allocation Strategy

Due to the nature of ELV business model, it generates significant FCF of $6 billion in FY22. Management has excelled at reinvesting this capital and returning it to shareholders. Looking ahead, Management will return value to shareholders by investing 30% of capital into share repurchases, and 20% of capital into dividends. The remaining capital will be attributed to organic and inorganic investments. With the successful acquisition of BioPlus, the company could begin to look for a smaller specialty pharmacy or PBM to integrate with its current Carelon system. M&A investment in these areas will drive growth and continue to diversify its revenue stream.

Differences From UnitedHealth Group (UNH)

Commercial Exposure & BCBS affiliation

Elevance’s Blue Cross Blue Shield affiliation is a substantial differentiating factor from UNH. The affiliation offers an industry-leading cost structure, a dominant commercial position, and access to leading discounts. Elevance has an established commercial advantage within their licensed blue states which gives Elevance the ability to offer employers a broader network and better discounts than competitors in the space. Insuring 1/3 of people in licensed states gives the company greater negotiating leverage than competitors. With the addition of CarelonRx and Carelon services, the company can offer value-based care to its commercial customers driving further growth and benefiting from employer consolidation. The company has seen success with consolidation, as 23 of its largest vendor consolidated their vendors to a single carrier (Elevance) within the last few years. With the consolidation due to value-based care, the company will be a leader within the commercial segment and will drive synergies with its Carelon segment.

Early Stage Growth

Unlike UNH, Elevance is in the early stages of growth for its Carelon segment. The segment has grown exponentially since its inception in FY19. The segment generated $41B in FY22 representing nearly 25% of total revenue. Management is expecting a low-double-digit CAGR until 2027 and expects 30% of operating income to be attributed to Carelon. Additionally, Elevance acquired BioPlus in February to join the specialty pharmacy space. BioPlus has around 4% market share with an additional 25-20% addressable market. The synergies from this acquisition can generate double-digit growth as Elevance migrates from CVS’s Caremark. Carelon services will also drive value from top and bottom-line growth. As the company leverages its data & analytic solutions, it can increase margins by another 200bps by 2027.

Risks

The upcoming election could reduce company sentiment thus lowering valuation. During elections, the main topic is drug regulation and free-for-all healthcare. While free-for-all healthcare is unlikely to happen anytime soon, there is always an idea that might be detrimental to Elevance’s success. During these times, the company and other MCOs are put in a bad light and their sentiments worsen. This could drive the valuation down (typically 1 std. deviation from peak to trough during elections).

Regulation of PBMs and additional initiatives provide significant headwinds. Within the MCO space, regulation is always a risk. Currently, the regulation is surrounding PBMs and lower drug prices. This is a significant risk for CarelonRx. However, studies show that PBMs lower drug prices and benefit the consumer will likely trump the potential for regulation.

Near-term cost headwinds could result in underperforming estimates. Elevance is experiencing macroeconomic factors that are adversely affecting its MLR. Not only are costs increasing, but redeterminations from Medicaid could put additional pressure on MLR. If these headwinds were worse than management had expected, the company could face significant EPS underperformance and valuation deterioration.

Redeterminations of Medicaid could result in member loss. In 2020, the government rolled out the Families First Coronavirus Response Act (FFCRA), which drove significant growth in Medicaid since states were required to pause the eligibility redetermination process. They have since returned to normal and states (starting in April) have 14 months to resume the redeterminations. It is estimated that a 24% decline in Medicaid will happen due to the redeterminations. During this period, ELV could experience member loss from its Medicaid business. However, redeterminations could potentially be a positive for the company. ELV could generate strong commercial growth from the redeterminations and potential growth overall during the process.

Valuation

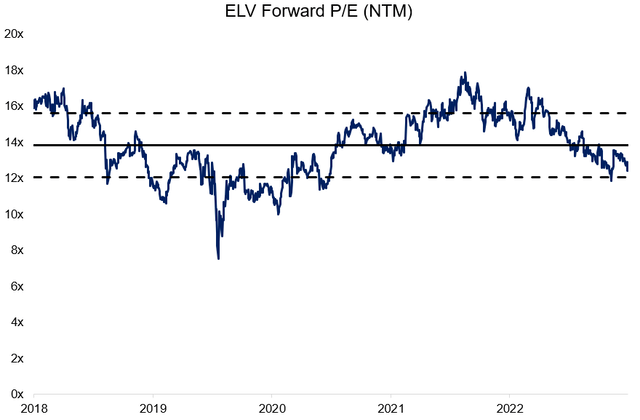

5-Year NTM P/E (Bloomberg)

After a recent sell-off (down 14% YTD and 6% over the past month), ELV looks extremely attractive historically and compared to its largest competitor. Currently, ELV trades at 15.2x the FY22 adj. EPS, 13.2x the FY23 adj. EPS, and 11.7x the FY24 adj. EPS. Compared to its competitors’ average, ELV trades at a premium. However, ELV has a substantially higher growth rate than both CI and CVS justifying its premium valuation. Compared to a competitor with similar growth rates, ELV is trading at a significant discount. UNH has a similar growth rate in the low-double-digits but trades at a valuation 19x FY23 adj. EPS. UNH deserves a premium valuation as its revenue is more diverse, it’s more geographically diverse, and it has better management and better capital allocation. Nevertheless, the premium between these two companies seems egregious and ELV should be trading at higher levels. Historically, UNH trades at a valuation of 3x greater than ELV and therefore if ELV were to trade at that level it would be at $504.5 showing a 15.8% upside. Moreover, If ELV traded in line with its historical average LTM P/E of 13.5x, the company would trade at $551.8 or a 25% upside.

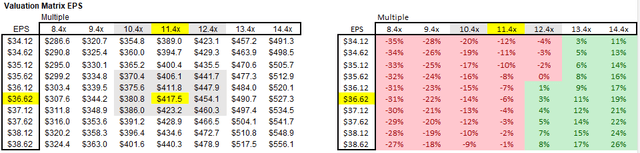

Valuation Matrix (Analyst Estimates)

Bull Case: ELV delivers mid-double-digit EPS growth which is the high end of its 5-year estimates. The company expanded its margins in health benefits by 150bps and expands the operating margins of Carelon by 200bps. Additionally, Carelon grew at upper-teens CAGR and generates over 30% operating margins. Additionally, macroeconomic conditions become less harmful on MLR and Medicare Advantage is a driving force for newer customers. With this in mind, ELV could generate close to $43.07 in EPS in the 2025 timeframe. This target is slightly higher than the consensus of $42.17 for 2025. The higher growth and successful execution of Carelon will justify a higher valuation than current levels. Apply a forward multiple of 15.5x (slightly higher than historical averages but well below the 18.5x peak in October) on the $43.07 would be roughly a $667.60 target or a 53.6% upside.

Base Case: ELV delivers low-double-digit EPS growth which is the low-end of management’s 5-year estimates. The company expanded its margins in health benefits and expanded its Carelon margins. Additionally, Carelon grew at mid-teens CAGR and generates over 25% of operating margins. The macroeconomic conditions proved to be more resilient than management anticipated with the MLR coming in higher than expected. Obesity drugs hinder the commercial segment’s margins and depress EPS. ELV could generate close to $40.84 in EPS in the 2025 timeframe. This is substantially less than the consensus of $42.17. Assuming the valuation of the company remains stable, the company would trade at a 13.5x multiple (slightly below historical averages). Applying the 13.5x forward multiple on the $40.84 would be roughly a $551.30 target or 25% upside.

Bear Case: ELV delivers well below management estimates growing at an 8% CAGR. The company struggled to expand margins in its health benefits due to significantly higher than expected MLR. Carelon struggled to hit the growth target of mid-teens CAGR and grew at HSD or LDD. The macroeconomic conditions proved to be more of a hindrance than anticipated and obesity drugs became more apparent in the commercial segment. Additionally, the company struggled to gain Medicare Advantage customers which created a headwind for top-line growth. ELV could generate close to $36.62 in EPS in the 2025 timeframe. Due to the lower growth, the company would trade at a lower multiple than current averages. Apply a 11.5x forward multiple (lowest multiple in the past 5 years excluding COVID) on the $36.62 would be roughly a $421.10 target or a 3% downside.

EBITDA: Assuming the consensus EBITDA target for 2025 and taking the current forward EV/EBITDA multiple (well below historical averages) would result in a price target of $508.10 or a 17% upside.

Conclusion

With extreme pessimism surrounding MCOs, we believe that Elevance is trading at an attractive valuation for the company’s long-term growth potential. Elevance has significant scale advantages with its resilient customer base in licensed states. Elevance can leverage this scale to improve pricing and drive growth in Medicare Advantage. Moreover, Synergies between Carelon services, CarelonRx, and BioPlus will drive material savings, top-line growth, and higher profitability for Elevance. The company efficiently generates substantial FCF which it returns to shareholders and generates stellar organic and inorganic growth.

Read the full article here

Leave a Reply