The Eaton Vance Floating-Rate Income Trust (NYSE:EFT) is a closed-end fund, or CEF, that income-hungry investors can employ in pursuit of their goals. As is the case with many leveraged loan funds, the Eaton Vance Floating-Rate Income Trust has a very attractive yield of 10.80% right now. Here is how that compares to some of this fund’s peers:

|

Fund Name |

Current Yield |

|

Eaton Vance Floating-Rate Income Trust |

10.80% |

|

Apollo Senior Floating Rate Fund (AFT) |

11.68% |

|

Pioneer Floating Rate Fund (PHD) |

11.51% |

|

BlackRock Floating Rate Income Strategies Fund (FRA) |

11.56% |

|

First Trust Senior Floating Rate Income Fund II (FCT) |

11.33% |

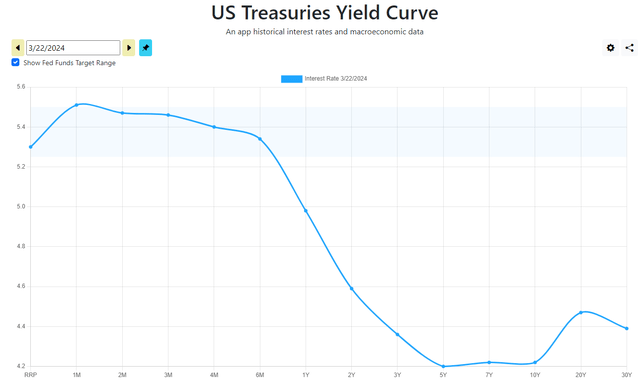

As we can immediately see, all of these funds boast double-digit yields right now, which is much higher than most investment-grade or junk bond funds possess today. The reason for this is that the yield curve in the United States has been inverted for quite some time now, with short-term yields being significantly higher than long-term yields. According to Axios, this has been the case for 628 straight days now. We can see this quite clearly by looking at the yields currently being offered by U.S. Treasury securities of different maturity dates:

USTreasuryYieldCurve.com

As we can see here, the longer term the U.S. Treasury security (with the notable exception of 20-year and 30-year securities), the lower the interest rate being demanded by the market. This is important for leveraged loan funds like the Eaton Vance Floating-Rate Income Trust because the yields provided by the securities in the fund are based on short-term interest rates, not long-term interest rates. Thus, in an inverted yield curve situation, these securities will have higher yields than traditional bond funds. The big question right now is how long the situation will persist and how long short-term interest rates will remain at today’s levels. After all, that directly impacts the ability of this fund to maintain its current yield. We will attempt to answer that question in this article.

As regular readers can likely remember, we previously discussed the Eaton Vance Floating-Rate Income Trust in late December of 2023. The market since that time has been curious, as bonds have generally woken up to the very real prospect that the market was too optimistic about the potential for interest rate cuts in 2024. As such, bonds have declined in price and yields have risen since the date that my previous article on this fund was published. The stock market, meanwhile, has been nothing short of euphoric.

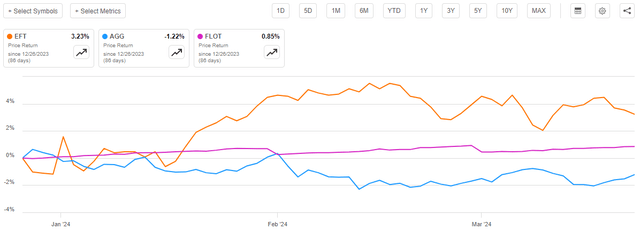

However, the Eaton Vance Floating-Rate Income Trust invests in debt securities, so the bond market’s performance should be more relevant as a point of comparison. Shares of this fund are up 3.23% since the date that the previous article was published. This is substantially better than the 1.22% decline of the Bloomberg U.S. Aggregate Bond Market (AGG) as well as the 0.85% gain of the Bloomberg US Floating Rate Note < 5 Yrs. Index (FLOT):

Seeking Alpha

Admittedly, this performance does not make a great deal of sense, especially if an investor expects interest rate cuts later this year. After all, the fund will almost certainly be forced to cut its distribution once the Federal Reserve reduces rates and we would think that the supposedly forward-looking market would sell off the shares of the fund in anticipation of such an event. Then again, as many other analysts have pointed out recently, many things about the market’s behavior right now do not make a great deal of sense.

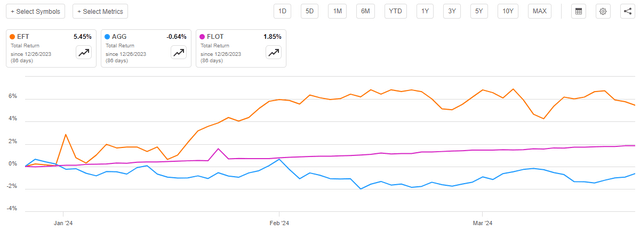

Investors in the Eaton Vance Floating-Rate Income Trust have actually done much better over the past three months than the above chart would indicate. This is because the fund uses the same business model as just about every other closed-end fund on the market. In short, it pays out most or all of its investment profits to its investors in the form of distributions. The basic goal is for the fund to keep its portfolio relatively stable over time while the investors get all of the money generated by the assets. This is one of the reasons why closed-end funds typically have much higher yields than just about anything else in the market.

As the distribution represents a real return to the fund’s shareholders, it also means that the investors do a lot better than the share price performance alone would suggest. This means that we should take the distributions paid by the fund into account as part of any discussion about its performance. When we do this, we see that investors in this fund have realized a 5.45% total return over the past three months. As was the case before, this is quite a bit better than either the traditional bond or the floating-rate note indices delivered:

Seeking Alpha

This is something that will almost certainly appeal to any investor, regardless of whether their primary objective is income or something else. After all, a 5.45% return over three months is 21.80% annualized, and that is a very attractive return no matter what asset class is being discussed. However, it is still uncertain whether or not the fund will be able to hold onto its recent gains as that could depend somewhat on the policy of the Federal Reserve over the next several months.

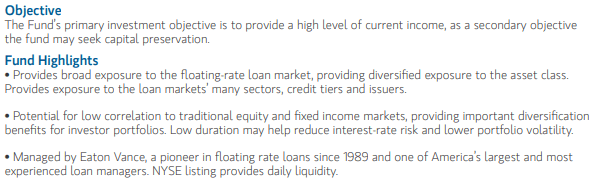

About The Fund

According to the fund’s website, the Eaton Vance Floating-Rate Income Trust has the primary objective of providing its investors with a very high level of current income. As is frequently the case with Eaton Vance funds, the website does not provide a description of how the fund will achieve this objective. The fact sheet is little better, as it simply states the following:

Fund Fact Sheet

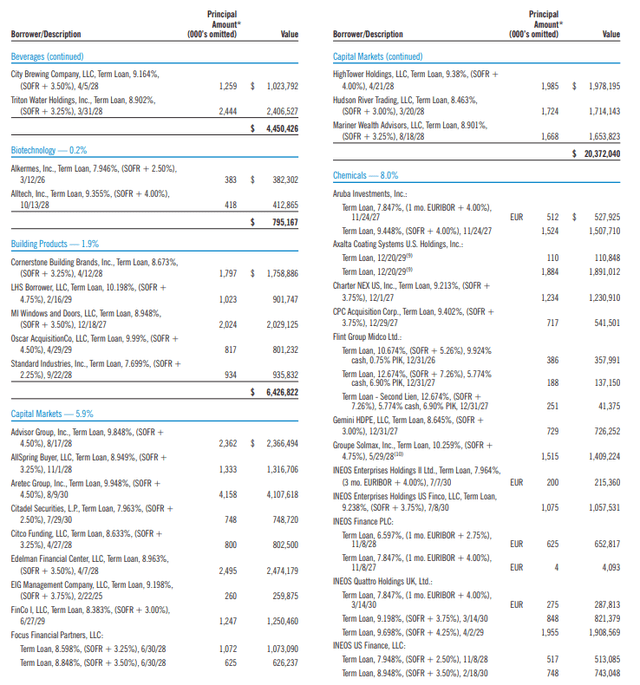

This is not as good of a description of the fund’s strategy as many other fund houses provide on their respective websites. In short, this fund invests its assets into a portfolio of floating-rate senior loans (“leveraged loans”) and borrows money to purchase more of these senior loans than would be possible solely through the use of its own equity capital. These loans tend to be floating-rate securities that pay a variable coupon that changes on a regular basis depending on movements in some short-term interest rate benchmark such as LIBOR or SOFR. Here is a selection of securities that the fund held at the time of its most recent semi-annual report including their interest rates:

Fund Semi-Annual Report

We can see here that the majority of those loans pay a coupon that is some spread over the secured overnight financing rate, also known as SOFR. This is a benchmark that has gradually been replacing LIBOR as a short-term interest-rate benchmark in the United States. The Federal Reserve publishes the official SOFR rate every day, and it stands at 5.31% on March 22, 2024 (the most recent data available as of the time of writing). Thus, a security that has a coupon of SOFR+3.25%, which is pretty common in the chart above, pays an 8.56% coupon today.

Thus, we can see that many of the assets held by the Eaton Vance Floating-Rate Income Trust have very attractive yields right now, and these yields are doubly attractive to anyone who has been active in the markets for many years and has become accustomed to the sub-5% yields offered by both investment-grade and even junk bonds over much of the past fifteen years or so.

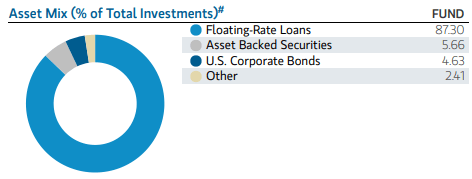

The fact sheet for the Eaton Vance Floating-Rate Income Trust states that 87.30% of the fund is invested in corporate loans. This leaves 12.70% of the portfolio to be invested in other things. In this case, those other things are mostly corporate bonds and asset-backed securities:

Fund Fact Sheet

Asset-backed securities can be a lot of different things, including credit card debt, student loans, car loans, or pretty much any sort of business or consumer debt that is not a mortgage. Banks frequently package up their loan receivables and sell them off to the capital markets as asset-backed securities in order to free up capital. American Express (AXP), for example, was quite active at doing this with credit card receivables prior to the 2008 financial crisis.

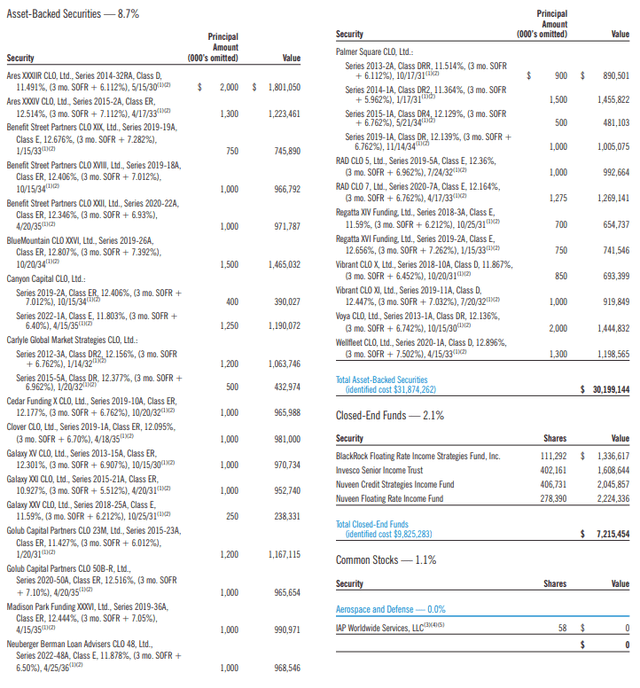

Unfortunately, asset-backed securities can be either floating-rate or fixed-rate securities. It depends somewhat on what exactly is backing them. At first glance, the presence of these securities may reduce the appeal of this fund for those who are seeking to exploit the high short-term rates in the market. Fortunately, it appears that all of these securities are floating-rate collateralized loan obligations:

Fund Semi-Annual Report

The above chart comes from the fund’s semi-annual report, which is a bit older than the fact sheet. This is why it states that 8.7% of the fund’s assets are invested in asset-backed securities instead of the 5.66% that the fact sheet claims. It appears that this fund has reduced its exposure to these securities in the time period that passed between the release of its semi-annual report and the release of the fact sheet. The important takeaway here is that the Eaton Vance Floating-Rate Income Trust appears to be only investing in asset-backed securities that carry a variable interest rate just like the senior loans. This is exactly what we want to see with this fund.

Overall, it appears that the only fixed-rate assets in this fund are the corporate bonds and possibly whatever that 2.41% allocation to “Other” consists of. It is possible that the other allocation consists of other floating-rate funds, as it did at the time of the semi-annual report, or common stocks, or something else entirely. As such, it is possible that 5% to 7% of this fund is invested in non-floating rate securities. Thus, it might not be a perfect floating-rate fund but admittedly the 5% to 7% allocation is so small that we probably do not need to worry too much about it. The Eaton Vance Floating-Rate Income Trust’s portfolio looks pretty decent as a way to diversify a portfolio away from traditional stocks and bonds, which is something that many investors could want as these securities do tend to perform very differently than traditional assets in response to interest rate movements.

I discussed the differing performance of floating-rate securities in some of my previous articles on the Eaton Vance Floating-Rate Income Trust. In particular, these securities tend to be remarkably stable in terms of price regardless of macroeconomic conditions or interest rate movements. One reason for this is that they are debt securities and are therefore theoretically less risky than common stocks. After all, common stocks supposedly move with the operating performance of the issuing company, and operating performance typically declines during recessionary periods and economic panics. However, a company must make the payments on its debt regardless of whether the economy is booming or depressed. The variable interest rate paid by these securities ensures that they are always delivering a yield that is competitive with the prevailing market interest rate, so their price does not fluctuate to any great degree when interest rates change either. These factors combine to provide a return profile that is not particularly correlated with either common stocks or traditional bonds, exactly as the fund’s fact sheet states.

The Fund And Interest Rate Trajectory

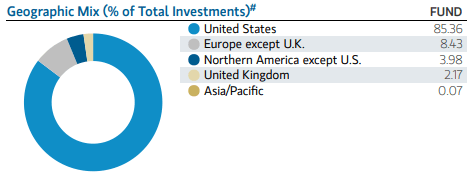

As mentioned earlier in this article, the interest rate that is paid by floating-rate securities declines when the policy rate declines. As the Eaton Vance Floating-Rate Income Trust invests almost exclusively in American securities, the Federal Reserve’s interest rate policy is going to be the most important determinant of the income that the fund earns from the securities in its portfolio. This chart details the fund’s current exposure by nation:

Fund Fact Sheet

As we can see, the United States accounts for 85.36% of the fund’s assets. As all of these securities are denominated in U.S. dollars, the coupon rate paid by these securities will exhibit a very strong positive correlation to the federal funds rate. That does, however, still leave 14.64% of the fund’s assets invested in non-American securities. These could be impacted by the policy rate decisions of other central banks around the world, but the European Central Bank is probably the most important of these. This central bank has stated its desire to reduce interest rates this year. However, as Reuters points out:

The world’s biggest central banks are on the starting line of reversing a record string of interest rate hikes but the way down for borrowing costs will look very different from the way up.

There will be no floodgates or fireworks. Instead, banks on opposite sides of the Atlantic are likely to move in the smallest increments with periodic pauses, fearing that ultra-low unemployment could rekindle inflation rates still above their targets.

The eventual bottom for interest rates is also set to be far higher than the historic lows of the last decade and mega-shifts in the structure of the economy could put borrowing costs on a higher path for years to come.

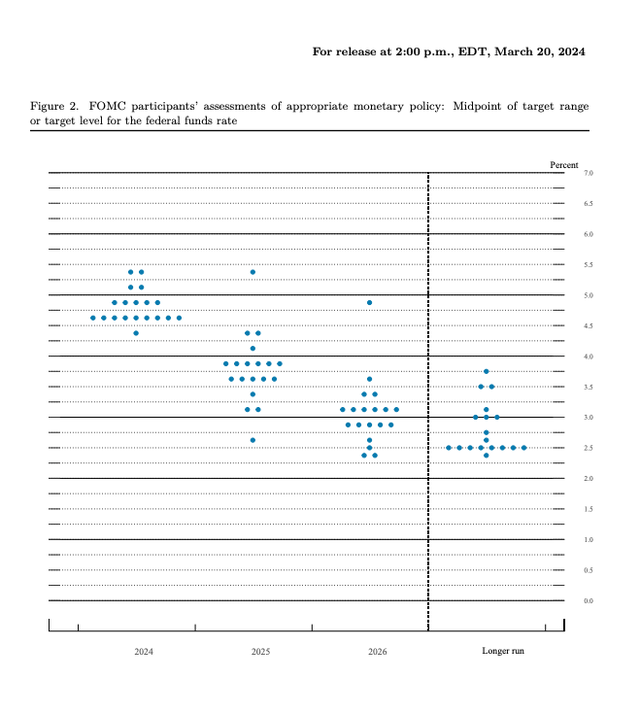

This is in line with statements made by the Federal Reserve last week. The dot plot that was released by the American central bank essentially stated that ultra-low interest rates are unlikely to ever return. The dot plot showed that policymakers are increasingly willing to keep interest rates high on a permanent basis, which will almost certainly be necessary to keep inflation in check given the Congressional Budget Office’s long-term projections of very high Federal government deficits going forward.

With that said, the markets are currently expecting the Federal Reserve, the European Central Bank, and the Bank of England to cut interest rates three times this year for a total of 75 basis points each. The European Central Bank has already stated its desire to implement the first of its cuts in June, but some analysts believe that it will wait if the Federal Reserve of Bank of England does not cut their respective rates. Any cut from the European Central Bank will reduce the interest income that the Eaton Vance Floating-Rate Income Trust receives from its European securities so investors in this fund should not completely ignore developments coming out of Europe.

However, the most important factor determining the fund’s income going forward is the monetary policy of the Federal Reserve. After all, we have already seen that the majority of the fund’s income comes from U.S. dollar-denominated securities. Following its meeting last week, the Federal Reserve provided guidance that it would reduce the benchmark federal funds rate three times this year:

BankRate/Data from FOMC

However, it appears that its confidence in its ability to actually implement 75-basis points of cuts has wavered. In particular, only one official believes that more than three cuts will be possible in 2024. That is far fewer than we saw following previous meetings. We also see that two members of the Federal Open Market Committee are projecting no cuts at all, and a large proportion are actually predicting fewer than three cuts. There are nine officials projecting zero to two cuts and nine officials projecting three cuts in 2024. This, combined with the fact that some of the more dovish members of the committee have reduced their projections from four or more cuts down to three suggests that there is a growing amount of doubt surrounding the Federal Reserve’s ability to reduce rates to any significant degree.

There are also some political issues that might need to be considered as well, given that 2024 is a presidential election year. Peter Tchir at Academy Securities released a report yesterday that stated:

How the election campaign will affect Fed policy remains to be seen, but in a world where every decision is held under a magnifying glass and is examined for political motivations, it will be difficult to convince many people that their actions are apolitical. I think this is really going to hamstring what they can do in September and November, so a cut in June with maybe a “pre-emptive” cut in July makes sense, but I am not expecting more than that without the economy taking a big hit.

The Federal Reserve claims that it is apolitical, but the political considerations should not be completely ignored. The Federal Reserve Chairman is appointed by the President of the United States, so Chairman Powell could find himself out of a job if the Federal Reserve alters monetary policy in a way that angers the candidate who ends up winning the election. This might mean that the self-interested move is to avoid any changes to monetary policy until after the election. As Peter Tchir correctly points out, that would reduce the ability of the Federal Reserve to actually cut interest rates three times in 2024.

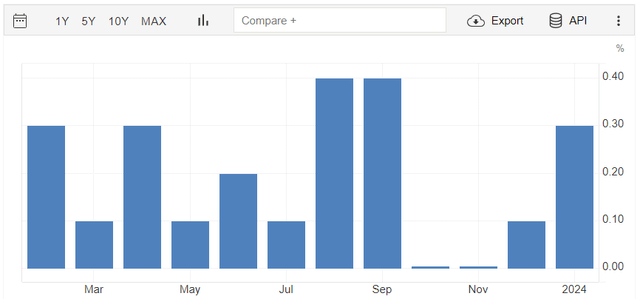

Finally, we have the pervasive specter of inflation, which was the factor that caused the Federal Reserve to raise interest rates as rapidly as it did in 2022 and 2023. The prevailing narrative is that inflation has been cooling, which would be supportive of an interest rate reduction. However, the data does not support that narrative. The measure that the Federal Reserve uses to measure inflation is the personal consumption expenditures index, not the consumer price index. Here is the month-over-month change in the personal consumption expenditures index over the past year:

Trading Economics

The index increased by 0.1% in November, 0.2% in December, and 0.4% in January. That therefore points to inflation getting worse, not improving. If the Federal Reserve’s goal with its monetary policy is to reduce inflation, this suggests that the appropriate move is to shock the market by raising interest rates at its next meeting. There is, in fact, a growing number of analysts and economists who have been coming out over the past month or two pointing this out.

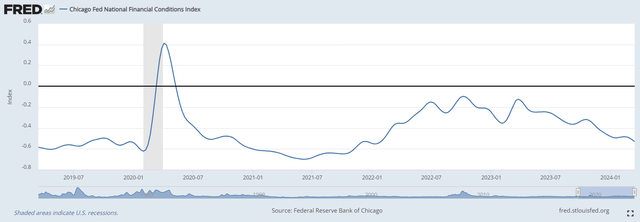

The problem for the Federal Reserve may be financial conditions right now. This chart shows the Chicago Fed’s National Financial Conditions Index over the past five years:

Federal Reserve Bank of St. Louis

As of right now, this index sits at -0.5356. That indicates that financial conditions are currently looser than they have been on average since 1971. The last time that financial conditions were this loose was the third week of January 2022. In other words, financial conditions are currently about the same as they were before the Federal Reserve even started its monetary tightening policy.

In short, it is very difficult to see how the Federal Reserve can reduce interest rates three times this year unless it is either willing to accept a much higher level of inflation heading into the presidential election or a massive recession hits within the next few weeks. I highly doubt that the economy will collapse in the near term and there will be a lot of political outcry if the Federal Reserve reignites inflation right before the election. Thus, there could be some reasons to doubt the current narrative surrounding interest rates.

With that said the Federal Reserve might decide to cut due to a problem arising in the banking system or something similar. However, that still poses the risk of reigniting inflation.

If the Federal Reserve does fail to cut interest rates three times in the next nine months, it will probably not be particularly good for either stocks or bonds. The Eaton Vance Floating-Rate Income Trust could therefore provide something of a hedge since higher rates benefit its income and distributions, so it will probably hold up better than either type of traditional security.

Leverage

As is the case with most closed-end funds, the Eaton Vance Floating-Rate Income Trust employs leverage as a means of boosting the effective yield that it earns from the securities in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase floating-rate debt securities. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, so this will usually be the case. Unfortunately, this strategy is not as effective at boosting yields today as it once was. This is because the difference between the yield of the purchased securities and the interest rate of the borrowed money is a lot less than it was when interest rates were at 0%.

The use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund does not employ too much leverage since this would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

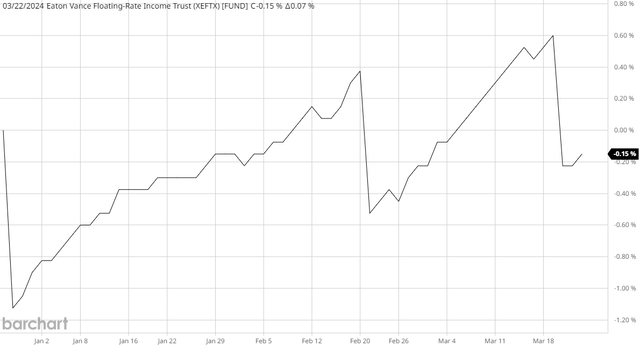

As of the time of writing, the Eaton Vance Floating-Rate Income Trust has leveraged assets comprising 36.45% of its portfolio. This is relatively in line with the 36.21% leverage ratio that the fund had the last time that we discussed it. This makes a great deal of sense considering the overall stability that floating-rate securities typically exhibit over time. This stability reflects itself in the fund’s portfolio. This chart shows the fund’s net asset value per share over the past three months since we last discussed this fund:

Barchart

As we can see here, the fund’s portfolio has been remarkably stable, as it declined 0.15% since the last time that we discussed it. This is obviously far different from the fund’s share price performance, which we will discuss later in this article. However, the important thing here is that the fund’s net asset value declines whenever it pays out its distribution and then rebuilds as coupon payments come in. The iShares Floating Rate Bond ETF exhibits exactly the same characteristics, and this is generally what we would expect from a floating-rate fund.

The fact that this fund’s portfolio tends to stay fairly stable in terms of price means that its leverage should not change all that much over time. After all, if the portfolio stays the same size, then the fund’s leverage as a percentage of it will also stay the same unless the fund increases or decreases its borrowings.

This fund’s leverage is a bit above the one-third of assets level that we would ordinarily like to see, but it is probably okay. The biggest problem with a leveraged portfolio is that the leverage tends to amplify price movements in the fund’s assets. In this case, there is very little volatility in terms of asset prices so the risk of using leverage is greatly reduced. Overall, this fund’s leverage should not be worth worrying about.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Eaton Vance Floating-Rate Income Trust has the primary objective of providing its investors with a very high level of current income. In pursuance of this goal, the fund invests its assets into a portfolio of floating-rate debt securities that deliver essentially all of their total investment returns in the form of direct payments to their owners. In this case, that owner is the fund, which receives these payments on behalf of its investors. The fund even borrows money to allow it to purchase more securities than it would otherwise be able to if it were to rely only on its own equity capital. This boosts the income that the fund earns because it is able to pocket the difference between what it receives from the purchased securities and what it has to pay on the borrowed money.

The fund collects all of the money that it receives and then pays it out to its shareholders, net of its expenses. As we saw earlier in this article, many of the securities that are held by this fund have fairly high current yields so we might expect this to result in the fund’s shares having a very high yield.

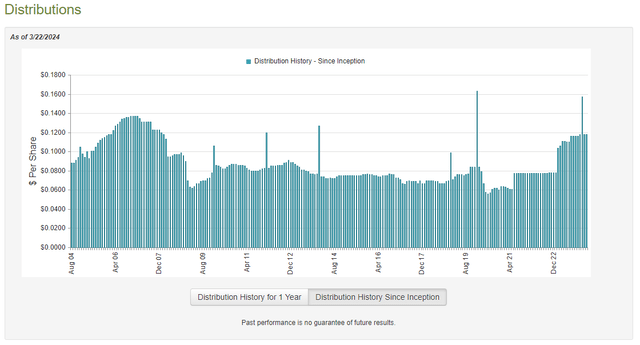

This is indeed the case, as the Eaton Vance Floating-Rate Income Trust currently pays a monthly distribution of $0.1180 per share ($1.4160 per share annually), which gives it a 10.80% yield at the current share price. As we saw earlier in this article, this yield is quite reasonable compared to many of its peers, but it is far from being the highest available yield in the sector. In addition, this fund has not been particularly consistent with respect to its distributions over the years. As we can see here, this fund has raised and lowered its distribution numerous times over its existence:

CEFConnect

This is something that will almost certainly prove to be a turn-off for those investors who are seeking a safe and consistent income with which to pay their expenses or finance their lifestyles. However, it is not at all surprising that a floating-rate fund would have such variation in its distribution over time. After all, the fund’s income is pretty much exclusively coupon payments that it receives from the debt securities in its portfolio. The fund will vary its distributions based on the income that it receives, so its distributions are largely dependent on interest rates. In some ways, this fund can be thought of as a very high-yielding money market fund.

It is still important to investigate the fund’s finances, however. The last thing that we want is for the fund to be paying out more than it can actually afford and destroying its net asset value in the process. The destruction of net asset value is not sustainable over any sort of extended period, after all.

Fortunately, we have a relatively recent document that we can consult for the purposes of our analysis. As of the time of writing, the most recent financial report for the Eaton Vance Floating-Rate Income Trust corresponds to the six-month period that ended on November 30, 2023. A link to this report was provided earlier in this article. This is a more recent report than the one that was available to us the last time that we discussed this fund, which is nice to see. After all, this report will include information about the fund’s performance during the second half of 2023, which was a very volatile period for both the stock and bond markets. The summer months were characterized by rising yields and falling asset prices as the Federal Reserve raised rates in July and dashed hopes of a near-term pivot in interest rates.

Meanwhile, November witnessed investors becoming excited about the prospect of interest rate cuts and they bid up the price of most assets in an attempt to secure income-producing securities before the Federal Reserve began easing. As already mentioned though, interest rate movements and macroeconomic concerns do not ordinarily have a significant impact on floating-rate securities, so this fund was probably not affected too much by these things. The financial report will still tell us how well it did though, and its income in particular could be important for determining how sustainable the distribution is likely to be.

For the six-month period, the Eaton Vance Floating-Rate Income Trust received $827,795 in dividends along with $28,596,500 in interest from the assets in its portfolio. The fund had no income from any other source, so its total investment income was $29,424,295 over the period. The fund paid its expenses out of this amount, which left it with $20,116,675 available for the shareholders. This was more than sufficient to cover the $19,560,395 that the fund paid out in distributions during the period. This is a very good sign, as it suggests that the fund is simply paying out its net investment income.

We saw the same thing during the full-year period that ended on May 31, 2023. During that period, the Eaton Vance Floating-Rate Income Trust had a net investment income of $33,572,147 and distributed a total of $30,661,298 to its shareholders.

Thus, this fund is simply paying out its net investment income, which should mean that the distribution is sustainable as long as the fund’s income remains near today’s levels. Thus, it will probably have to reduce it later this year if the Federal Reserve does reduce interest rates but it is sustainable as long as rates interest remain at today’s level, which will almost certainly be the case for the next few months.

Valuation

As of March 22, 2024 (the most recent date for which data is currently available), the Eaton Vance Floating-Rate Income Trust has a net asset value of $13.32 per share but the shares currently trade at $13.14 each. This gives the fund’s shares a 1.35% discount on net asset value at the current price. That is a more attractive price than the 0.83% discount that the shares have averaged over the past month, so the current entry point appears to be reasonable.

Conclusion

In conclusion, the Eaton Vance Floating-Rate Income Trust is a solid choice for those investors who are desiring income right now. The fund’s distribution depends heavily on interest rates remaining at their current level, which may or may not be the case. The economic data suggests that interest rate cuts should not be on the table right now as any monetary easing could cause inflation to become a very big problem once again.

However, the Federal Reserve’s current statements make it sound as though the bank is committed to interest rate cuts regardless of the risks. Any interest rate cuts would be detrimental to Eaton Vance Floating-Rate Income Trust’s ability to generate income and maintain its distribution.

For the moment, I am going to maintain the “hold” rating on Eaton Vance Floating-Rate Income Trust. It is probably a good idea to have some exposure to floating-rate securities as a hedge against the possibility of no rate cuts in 2024. I would recommend pairing this fund with something that will benefit from inflation, as that will almost certainly be the result if the Federal Reserve does actually cut rates.

Read the full article here

Leave a Reply