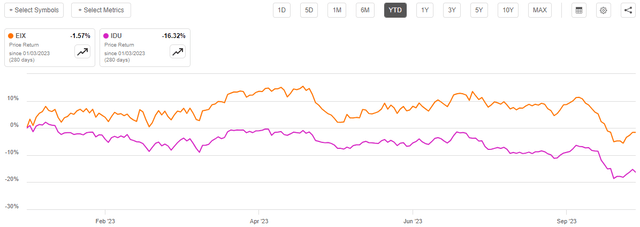

Edison International (NYSE:EIX) is a regulated electric utility that primarily serves Southern California, although it has operations in other areas. The utility sector in general has long been a favorite among risk-averse investors who are seeking a respectable level of income and insulation against economic shocks. Edison International is not a slouch in this area, as the company’s stock yields 4.66% at the current price. Unfortunately, Edison International has not been performing particularly well in the market lately, as the stock price is down 1.57% year-to-date compared to a 13.97% gain in the S&P 500 Index (SP500):

Seeking Alpha

This is not especially surprising, however. Utility companies in general tend to have remarkably stable cash flows, low growth rates, and high yields so many investors tend to think of them as a substitute for bonds in a portfolio. In late July, the market came to the conclusion that the current high-interest rate environment will likely be with us for some time, and it began pushing yields up and the price of both bonds and utilities down. Fortunately, Edison International has held up much better than most utilities. The stock’s 1.57% year-to-date decline is a lot better than the 16.32% decline of the U.S. Utility Index (IDU):

Seeking Alpha

Despite the annoyance that stock price declines have on our portfolios and the frustration that comes with losing money, they can sometimes be beneficial as they provide an opportunity to initiate or start a position at a lower price. We all like to buy things at a discount, especially when those things help us make money. As such, Edison International’s valuation looks more attractive than it did back in July when we last discussed this company. When we consider that this company will probably be highly resistant to the turbulent economy that could be coming down the pike, there may be some reasons to buy it today. Let us investigate it further.

About Edison International

As mentioned in the introduction, Edison International is a regulated electric utility that primarily serves the highly populated area of Southern California:

Edison International

This is one of the most populated areas of the nation as it includes the giant cities and surrounding counties of Los Angeles, San Bernadino, and Santa Barbara. As such, Edison International is one of the largest utilities in the United States despite not having the same geographic reach as some other companies in the sector. The company served approximately fifteen million customers at the close of the second quarter of 2023. However, as I have pointed out in various previous articles on electric utilities, the fact that a company has a larger customer base than its peers does not change its basic characteristics.

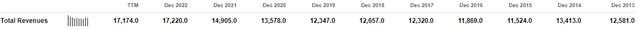

In this case, the characteristic that we are most interested in is the fact that the company enjoys remarkably stable revenues over time. This chart shows Edison International’s annual revenue during each of the past ten years:

Seeking Alpha

As we can see, while the company’s revenues did grow significantly over the period, they were not really very volatile. Rather, the company’s revenues generally grew at a slow but steady pace over the ten-year period. The sole exception to this was in 2022, at which time the company’s revenues experienced a significant jump. However, many electric utilities reported similar jumps in revenue:

|

Company |

FY 2022 Revenue |

FY 2021 Revenue |

|

DTE Energy (DTE) |

$19,228.0 |

$14,964.0 |

|

Eversource Energy (ES) |

$12,289.3 |

$9,863.1 |

|

FirstEnergy Corporation (FE) |

$12,268.0 |

$10,943.0 |

|

American Electric Power (AEP) |

$19,639.5 |

$16,792.0 |

(all figures in millions of U.S. dollars)

The primary reason for this was the incredibly high rate of inflation that dominated the economy over the course of 2022. It pushed up the costs of operations for many of these utilities and they were forced to increase their prices to compensate. That should be pretty self-explanatory when we consider how many news headlines were in the mainstream media discussing how escalating electric prices were crushing many financially vulnerable households. Revenues are not inflation-adjusted so they will naturally increase when electric bills go up.

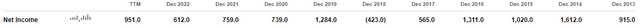

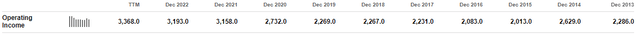

Of course, as investors, we are more concerned about profits than we are with revenues. After all, if a company’s expenses go up faster than its revenue, then its profits go down and it does not really help us. Unfortunately, Edison International’s profits do tend to be much more volatile than its revenue, as we can see in this chart that covers the same time period as the revenue chart above:

Seeking Alpha

For the most part, we do still see some stability, but not nearly to the same degree as revenue. Disturbingly though, we do not actually see any growth here. As can be clearly seen, Edison International’s net income in 2013 was higher than its revenue in 2020, 2021, or 2022. However, we see a very different story when we look at operating income, which gives us a better idea of how well the company was able to convert its revenue into profits through its basic operations:

Seeking Alpha

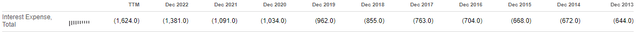

We certainly see much more stability and gradual growth than we saw by looking at the company’s net income over the period. One reason for this is that items that are not directly related to the company’s basic operations are included in net income but not operating income. For example, Edison International’s interest expenses have been steadily increasing over time:

Seeking Alpha

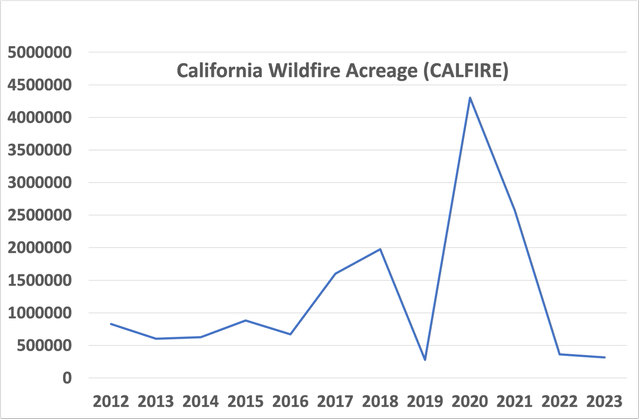

The company also points out that things such as wildfire claims have a negative impact on its bottom line. This necessity of dealing with wildfire claims is just one of the things that we have to put up with if we are investing in a utility in California. Fortunately, and perhaps surprisingly, the California Department of Forestry and Fire Protection points out that 2023 saw the lowest level of wildfire damage in California over the past decade:

Cliff Mass Weather Blog/Data from CALFIRE

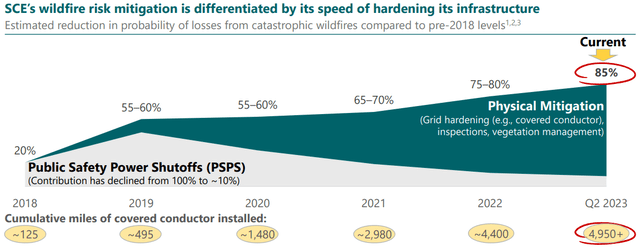

However, there is no real evidence of a sustainable trend here, so we could see the low level of fire destruction in 2023 reverse itself in 2024. As such, there is still very much a risk that Edison International’s results could be negatively impacted by wildfire claims in future quarters. For its part, the company has been hardening its infrastructure by deploying covered conductors along its transmission lines. We discussed this in previous articles on the company. As of the second quarter of 2023, Edison International believes that it has reduced the risks of its infrastructure sparking a wildfire by 85% compared to pre-2018 levels:

Edison International

As such, the company should be at a lower risk of losses than it has been in previous years. However, this is still something that we have to put up with when it comes to investing in Californian utility companies.

The important thing for us to notice for our purposes today is that Edison International’s revenues appear to be resistant to economic shocks. If we take another look at the company’s revenues, we can clearly see that the company’s revenues and operating incomes were completely unaffected by the coronavirus outbreak in 2020. Indeed, its operating numbers continue generally with the same growth trend that had been going on for many years, and it does not even appear that anything out of the ordinary happened during that year. This is despite the fact that California had some of the strictest COVID-19 lockdowns in the United States. This stability is characteristic of most utilities, and I explained why in a previous article on one of the company’s peers:

The reason for this overall financial stability should be fairly obvious. Edison International provides a product that is generally considered to be a necessity for our modern way of life. After all, nearly everybody has an electric service to their homes and businesses. In fact, the presence of electric service is generally considered to be a requirement under habitability laws in just about every location in the United States. The overwhelming majority of people cannot possibly imagine life without electric and the conveniences that it enables so they will usually prioritize paying their electric bills over discretionary expenses during periods in which money gets tight.

There are signs that money may be getting tight for an increasing number of consumers. For example, consumer credit card spending declined in September for the fifth straight month. Germany’s Mercedes-Benz (OTCPK:MBGAF) reported a decline in S-Class sales during the third quarter, which points to a slowdown even among wealthy consumers. Finally, Goldman Sachs and Bank of America recently conducted a survey that revealed that 84% of Chief Executive Officers among America’s largest companies expect a recession in 2024. Recessions have a way of becoming a self-fulfilling prophecy, as when this percentage of consumers and businesses expect one, they take actions that ultimately have the effect of causing it. Fortunately, Edison International should be mostly immune to a recession, as it seems unlikely that people will stop paying their electric bills. Thus, the company could be a decent place for investors to hide out until economic conditions improve.

Growth Prospects

Naturally, as investors, we are unlikely to be satisfied with mere stability. We like any company in which we are invested to grow and prosper with the passage of time. Fortunately, Edison International is well-positioned to accomplish this. As I pointed out in my previous article on the company, it is unlikely to accomplish this through growing its customer base as California’s population is currently declining. However, the company should still be able to expand its rate base and grow its earnings that way. I explained the concept of rate base in my previous article on this company:

The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows the company to positively adjust the prices that it charges its customers in order to earn that specified rate of return.

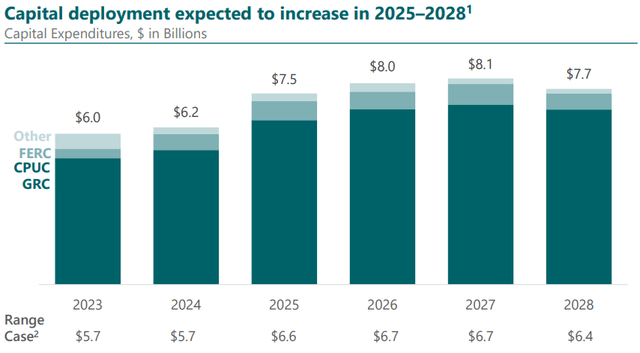

The usual way through which a utility will expand its rate base is by investing money into upgrading, modernizing, and possibly expanding its utility-grade infrastructure. Edison International is planning to do exactly this as the company has unveiled a plan to spend $43.5 billion over the 2023 to 2028 period on improving its infrastructure:

Edison International

This should have the effect of growing the company’s rate base at an 8% compound annual growth rate over the six-year period. That is a very reasonable growth rate, although the company is unlikely to grow its earnings per share at such a high rate. This is because the company will need to finance these capital expenditures via the issuance of both equity and debt. In the case of debt, the company will need to pay interest, and in today’s high interest-rate environment, that will be a drag on its earnings. In the case of common equity, the newly issued shares will increase the number of shares across which the company’s earnings will be distributed and thus dilute some of the earnings growth. However, Edison International still expects that it will be able to grow its earnings per share at a 5% to 7% rate over the 2023 to 2028 period through rate base expansion.

When we combine the company’s expected earnings per share growth with its current dividend yield of 4.66%, Edison International should be able to deliver a 10% to 11.5% total average annual return over the period. That is a very respectable growth rate and is certainly attractive in today’s economic climate.

Valuation

According to Zacks Investment Research, Edison International will grow its earnings per share at a 3.69% rate over the next three to five years. This is less than the 5% to 7% rate that the company predicts that it can achieve through its rate base expansion program, but there is little reason to doubt the Zacks estimate either. This is especially true because of the strong possibility that interest rates will remain at today’s elevated level for longer than management expects and that will drag on the company’s earnings.

Edison International has a price-to-earnings growth ratio of 3.63 using the Zacks estimate of its earnings per share growth. Here is how that compares to the company’s peers:

|

Company |

PEG Ratio |

|

Edison International |

3.63 |

|

CMS Energy (CMS) |

2.21 |

|

CenterPoint Energy (CNP) |

2.45 |

|

DTE Energy |

2.61 |

|

PG&E Corporation (PCG) |

5.20 |

|

Eversource Energy |

2.68 |

|

FirstEnergy Corporation |

N/A |

|

American Electric Power |

2.51 |

As we can see here, with the exception of PG&E Corporation, Edison International appears to be very expensive relative to its peers. However, this is assuming that the Zacks estimate of 3.69% earnings per share growth is accurate. If the company manages to achieve the 7% growth that management expects on the high end, the company’s price-to-earnings growth ratio comes in at 1.92 at the current stock price. That seems to be excessively low relative to its peers, so it seems unlikely that the company will actually achieve such growth. The market seems to think that its growth will be closer to the low- to mid-single-digits. However, that is still better than the negative growth rate that we might see some consumer discretionary companies deliver in the face of declining consumer spending and a recession.

Conclusion

In conclusion, Edison International is one of the largest electric utilities in the United States as it serves the highly populated Southern California region. The fact that the company operates in California might be a turn-off for some investors, as wildfire costs and various government mandates have weighed on utilities operating in this state for quite some time.

However, Edison International still manages to achieve relatively steady growth regardless of conditions in the broader economy. This resilience might be quite appealing considering that the current economic climate is not exactly the strongest one that we have seen recently and there are signs that consumers may be cutting back on luxuries. Edison International should be able to weather such an environment just fine, though.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply