With the monumental rise of Novo Nordisk (NVO), a once diversified Nordic ETF, the iShares MSCI Denmark ETF (BATS:EDEN) has become substantially a bet on the fortunes of one company. We don’t necessarily scoff at Novo Nordisk’s valuation, given that it at least provides a sink for their manufacturing investments. But there are general risks according to some commentators in terms of overextended growth expectations, possible competing drugs, and political risks. With PEs around 19x, and pressures outside of healthcare exposures on industrial spending as well, we don’t see a runaway reason to buy the ETF. Importantly, the heavy skew has us questioning the logic of using the ETF over just investing in components, particularly when expense ratios are high at 0.53%.

EDEN Breakdown

ETFs need to justify their existence by being useful from an idiosyncratic diversification point of view and by properly capturing a mandate. You pay a management expense, so there has to be some value; otherwise investors could just cheaply imitate the portfolio, even at limited scale.

EDEN doesn’t succeed much in this regard. Expense ratios are high at 0.53% despite Denmark not being an exotic stock market. Moreover, the heavy skew towards Novo Nordisk and other diabetes stocks limits idiosyncratic diversification, and also means that essentially the fortunes of the EDEN ETF rest on the massive healthcare market in the US and not on the economic idiosyncrasies of Denmark.

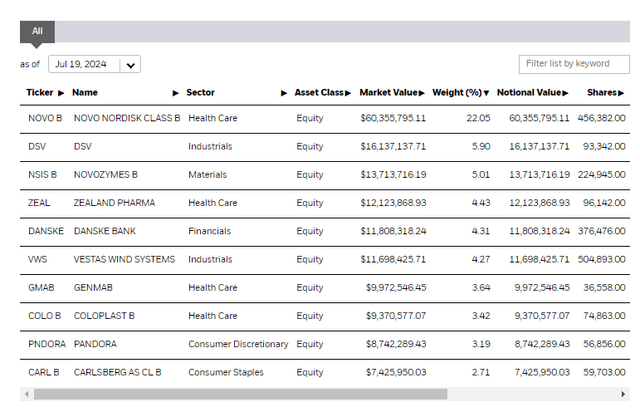

Top Holdings (iShares.com)

Healthcare is 41% of the ETF, with Novo alone at 22%, and even some of the other stocks in the healthcare allocation also have a diabetes angle.

The first thing to mention is political risks for NVO. The largest drugs are going to be subject to legislation within the Inflation Reduction Act. Novo’s obesity medications may be up there in popularity where they will become affected. While the benefits from legislation are conferred primarily onto Medicare enrollees, and Ozempic isn’t used mostly by seniors, there could still be an impact at some point after 2026 as the drug continues to grow in sales. On the insulin side, there has already been legislation to cap out-of-pocket expenses. In order to anticipate political fallout, Novo has capped the out-of-pocket expenses even for people who aren’t Medicare enrollees, where so far legislation has only explicitly addressed Medicare enrollees. Furthermore, regardless of the outcome of the presidential election, there is likely to be constant political will to try to address the high healthcare costs in America. Trump made headway with executive orders to limit prices of certain drugs in his tenure, and more has happened under Biden with the IRA. Pharma will be a target regardless, as healthcare costs remain outliers on the high side in the US. The differences in administration of the country should be quite marginal.

For Novo in particular, there is also concern around competition and valuation. There are 123 drugs under development right now for obesity. Some will be effective. There is huge incentive to attack Novo’s market share, as the market is massive. In terms of NPV of the Ozempic cash flows, Berenberg estimates have it at around $57 billion, based on peak sales in 2030 and then loss of exclusivity impacts after that. Ozempic sales were about $14 billion as of 2023. There is some sales deceleration as NVO courts insurers, so taking a crude approach ourselves, and valuing a no-growth stream of Ozempic sales at 50% margin and 20% effective tax, then declining around 66% at LoE before becoming a perpetuity in 2031, we get something like a $65 billion valuation of the stream at an 8% discount rate. That’s a relatively small part of the overall market cap of Novo, which is around $450 billion. It implies high expectations for other of Novo’s drugs coming out in the suite, like CagriSema, and a lot of success in other parts of the portfolio. We don’t want to get too into the weeds of NVO’s valuation in an ETF analysis, but we are not going to give the valuation the benefit of the doubt considering the extent of coverage of NVO.

For the industrial allocation, there are exposures like logistics, which are seeing some pressure on higher costs and slightly hampered volumes from Red Sea trade but also just lower activity in general. Industrial activity is generally under pressure in Europe, so that exposure does not contribute to a growth case or a higher multiple.

Financial exposures are also present, but rate increases haven’t been as extreme in Denmark, and incrementally they are likely to follow Europe in coming down. The outlook is alright but does not contribute to a growth case, with a lot of European retail financials trading below 10x PEs.

Bottom Line

In the end, the PE is 19x for an ETF whose major exposure is one of the most covered and popular companies in the world right now, with possibly one of the most famous drugs to ever come to market. NVO’s PE of 45x is clearly driving up the ETF’s multiple. There is some suggestion that the economic benefits may be too marginal of this one success to justify the valuation. At any rate, a stock as covered as NVO is simply more likely than not to be overextended. There are also exogenous political risks, and competitive risks that could disappoint NVO investors. The other major exposures are industrial, and European industry is under pressure, hence the space to reduce rates. ETFs like the iShares MSCI Israel ETF (EIS) has a much lower PE at around 12x, even though it has more high growth exposures like IT, but also healthcare, compared to EDEN. The case for EDEN is not that clear, and it’s not very useful for ETF investors due to the skew.

Read the full article here

Leave a Reply