Co-authored with Treading Softly.

There’s a famous parable that was told of a man who attempted to plant seeds and cultivate them. He scattered them on all sorts of different kinds of ground. Some seeds were successful initially but then failed. While some seeds were successful and bore abundance, there were some areas that proved to be completely unsuitable for the seeds. You see, those seeds needed a specific set of circumstances to succeed, and even in other circumstances, they could succeed for a period of time before they failed.

If we can understand this when it comes to life, we should be able to understand this when it comes to a market. Not every holding you have in your portfolio will thrive in every set of market conditions. This doesn’t mean that you should not hold any of that type of holding in your portfolio on a regular basis, but it means you should have a portfolio that is designed to thrive in various situations, with some sections of your portfolio thriving and others not. The goal for a professional income investor is to have a portfolio that provides great income, regardless of market or economic conditions, and that requires that some of your portfolio may struggle when others are thriving.

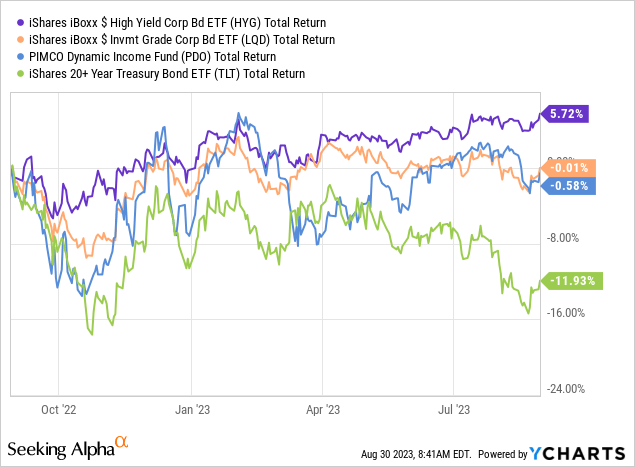

For example, the carnage in the bond markets continues. U.S. Treasury rates are hitting multi-decade highs, and total returns for U.S. Treasuries are negative year-to-date. Over the past year, it has been the lowest-risk debt that has seen the greatest decline. The reason is that this decline is purely driven by rising interest rates, not by a rise in credit losses. The higher-yielding debt is, the better its returns over the past year.

On a total return basis, PIMCO Dynamic Income Opportunities Fund (PDO), yielding 12.2%, has ended roughly flat, with all of its returns coming through dividends.

PIMCO is an active manager in the bond sector, and with many of its funds, it focuses on sections of the bond markets that are out of favor. Back during the Great Financial Crisis, PIMCO did the unthinkable – it was backing up the truck on non-agency mortgage-backed securities – assets that “everybody knew” were “toxic.” It was a move that, in hindsight, was brilliant.

Today, everybody knows that commercial mortgage-backed securities are toxic. Ask your aunt, uncle, fishing buddy, or folks at the weekly poker game, and they will tell you that commercial real estate is a disaster waiting to happen. You know, the same folks who were telling you 20 years ago to get into flipping houses because “real estate only goes up” and were counting their crypto millions as they mortgaged their house to buy Bitcoin at the bargain price of $60k. They might not know what a CMBS is, but they know it is bad.

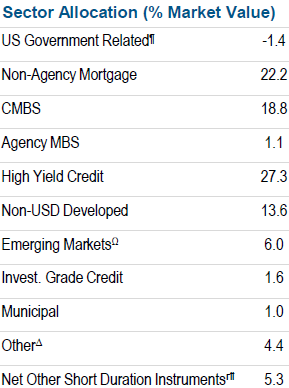

Once again, PIMCO is doing the unthinkable – with PDO, PIMCO has been building a large position in CMBS. Now up to 18.8% of assets. Source.

PDO Fund Card

In its quarterly commentary, management wrote:

“We expect to continue to focus on non-agency MBS and other high quality global structured products that offer attractive valuations and strong defensive qualities, as was demonstrated by their overall resilience during the pandemic-induced market shock in 2020. Specifically, we are constructive on non-agency MBS as it remains supported by a strong U.S. housing market and underlying credit support. We continue to be selective within CMBS, relying on PIMCO’s capabilities to underwrite properties and the credit worthiness of the underlying tenants.”

Residential and commercial mortgages have seen their prices hit hard by a combination of rising interest rates and negative sentiment. You don’t have to look far to hear how horrible commercial real estate is. Yet PIMCO understands that where there is maximum fear, there is maximum potential. Furthermore, commercial mortgages are very property-centric investments. A mortgage isn’t secured by all the property in the universe; it is secured by a specific property. A private equity company defaulting on an office building in San Francisco has absolutely no bearing on whether a borrower in Charleston is going to default on their building.

PIMCO is betting that it is capable of digging a bit deeper and coming to a better conclusion of which properties are an attractive risk/reward than the general market, which is just selling everything commercial real estate. As a longtime holder of PIMCO funds, I have a lot of confidence in their ability to navigate this market.

Interest rates won’t be high forever, mortgages won’t be out of favor forever, and the bond market will recover. This is why I’ve continued adding to my PIMCO funds. PDO is one of PIMCO’s younger funds, and it typically does not trade at a large premium because it is a term fund that will be redeemed at NAV in January 2033 (subject to an extension of up to 18 months by Board vote). This feature limits the likelihood that the shares will trade substantially above NAV, something that we have seen become quite common with some other PIMCO funds.

We don’t expect a special dividend this year, but with a regular dividend yielding in the double-digits, I am happy to add more shares and wait for the bond markets to recover.

Conclusion

In life, there are seasons. You’ll have a season of life when you were a child growing up, and then there are seasons when your children are growing up. Maybe a time when many of your friends are getting married for the first time, and unfortunately, a season may come when many of your loved ones pass away. These seasons don’t last forever. How you live your life in those seasons may be vastly different than how you live your life in other seasons, yet it’s all still your life.

Likewise, your portfolio will have sections that will thrive in certain seasons and struggle in other seasons. But it’s all your portfolio, and you don’t just hack half of your portfolio, just like you wouldn’t cut off your arm when your friends start getting married. Instead, you embrace the current season, find opportunities, and thrive.

With PDO, we can benefit from the carnage we are seeing in the bond market by buying shares of this fund, which specializes in buying heavily discounted or near-bankrupt bonds. We can leverage the management team of PIMCO to enjoy strong income now, and when interest rates start to fall and we enter a new season in the market, enjoy large capital gains as we ride it back upwards.

When it comes to retirement, you want to be able to enjoy great income while someone else does all of the work. That’s exactly what you can do with this fund. Someone else manages it and takes care of the trades and the monitoring while you kick back and relax.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here

Leave a Reply