Investment Thesis

In continuing with our coverage for Dufry (OTCPK:DUFRY), we had assigned a buy rating to the stock for a play on long term passenger growth driven by robust travel demand, particularly from China, along with relative undervaluation compared to pre-pandemic levels. We also are constructive as the overhang with regards to AENA concession behind as Dufry won all its tendered bids in Spain and having further expanded the floor space by 30%. We see a good entry point for the investors to capture in on a passenger recovery, cross selling opportunities post Autogrill acquisition and significant undervaluation compared to its pre-pandemic levels.

Strong H1 Performance

Dufry reported a strong 31.5% organic sales growth YoY in H1 2023 (up 3.4% vs 2019 levels) benefitting from COVID-19 recovery and pent up demand. The strong sales growth was driven by 28.8% LFL growth along with 2.7% growth from net new shops. It grew 22.6% YoY for Q2 2023 with sales up in mid-single digits compared to 2019 levels. Gross margin also came in strong at 64.4%, up 70 bps YoY, as rising demand limited promotion. Core EBITDA margin expanded by 70 bps YoY to 8.6%, ahead of consensus estimates, driven by improving sales and strong gross margins. H1 Free cash flow conversion was a strong 34% given Dufry’s increasing focus on efficient capex spending and some phasing impact.

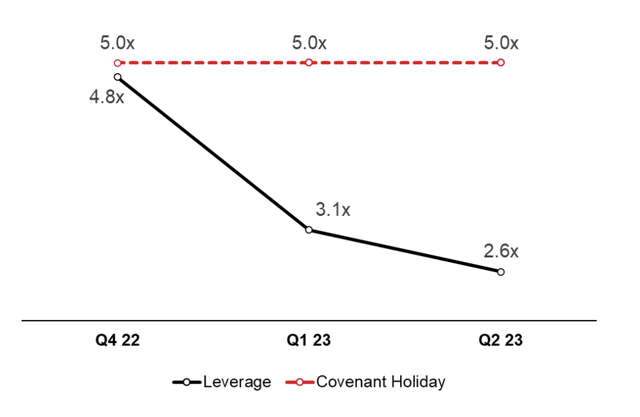

Balance sheet position continues to improve as it ended with total liquidity of CHF 2.8 bn including cash and cash equivalents of over CHF 1.0 bn. Net debt position continues to improve at CHF 2.8 bn, lowest since 2015 despite Autogrill acquisition with leverage position continue to improve at Net Debt/ EBITDA of 2.6x.

Company Presentation

Management continue to be cautious on H2 2023 and reiterated its full year sales guidance expected organic sales to grow 15% YoY. This implies little growth over H2 2022 compared to 31.5% growth in H1 despite July organic sales being robust and up 17% YoY (4.7% above 2019 levels). It expects an EBITDA margin of 8.3-8.4% compared to 8.0% earlier implying some deterioration in margins during H2. This also appears to be against the historicals during 2016-2019 period where H2 margin has been higher by almost 300 bps on an average compared to H1 primarily due to increase in personnel costs or integration costs, but if the sales recovery is better, there could be some surprise on margins front as well. It also expects FCF conversion to mid-20% ahead of the estimates, as it expects to be more efficient on capex, which will be increasingly viewed positively given the investor’s increasing focus on cash generation. Management also reconfirmed the synergies of CHF 85 mn with the full run rate synergies to be delivered a year earlier than expected previously and integration costs down to CHF 50 mn vs CHF 100 mn.

Travel Recovery Underway

According to Civil Aviation Administration of China, number of Chinese outbound travellers reached ~49% of 2019 levels which implies we are still halfway through recovery. In July, China’s air passenger traffic reached a record high of 62.4 mn passengers while China still faces issues due to property market meltdown and rising unemployment. However, Chinese saved significantly during the COVID-19 pandemic with total household deposits totalling 132 trillion yuan (US$18.3 trillion), an increase of 12 trillion yuan in H1, highest increase in a decade which would enable them to spend for travel and shopping. It grew by almost 41 trillion yuan in last 2.5 years (US$5.68 trillion). Also, according to National Immigration Administration, authorities issued over 10 million ordinary passports at 68% of the same period in 2019 reflecting continued pent up demand for travellers. We believe there would be a significant impending recovery on the cards, particularly within China which can provide a significant fillip to Dufry’s growth prospects.

Valuation

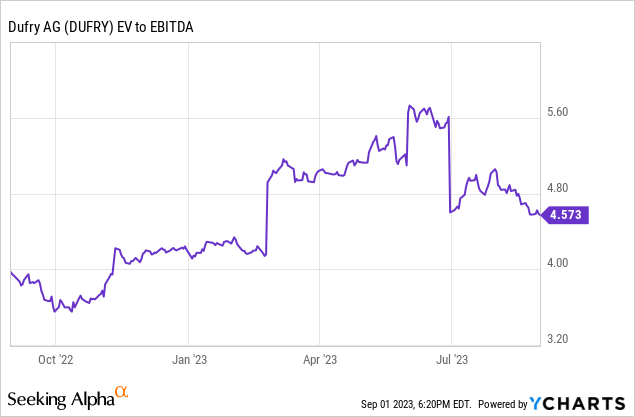

Dufry still trades cheap at just 4.6x trailing EV/ EBITDA, lower than 9x EV/ EBITDA compared to its pre-pandemic average. We assign a 30% discount to the pre-pandemic levels (9.0x average in pre pandemic) to factor in the ongoing macro risks implying a 6.3x EV/ EBITDA and assign a target price of $6.0.

Risks to Rating

Risks to rating include

1) Decrease in retail spends due to continued and prolonged economic uncertainties

2) Autogrill cost synergies is expected to be realized in 2024. Any delay in realizing the synergies could significantly impact the operations

3) Passenger recovery can further weaken, particularly in China, as a result of rising unemployment and a slump in housing market which can put a dent on Dufry’s recovery

4) High capital spending due to Autogrill integration or otherwise can lead to the company missing its cash conversion targets

Final Takeaways

We continue to believe that Dufry is a perfect play on passenger growth and rising retail spends. It has posted robust results on travel demand recovery, which is still underway and only at half-way mark in China (Chinese being the largest travellers globally). We believe the closing of its Autogrill acquisition along with its winning of the Aena concession are major positives and can further enhance and consolidate its position within travel retail. We reiterate Buy assigning a target price of $6.0.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply