Investment Thesis

Dropbox (NASDAQ:DBX) is a company competing against some of the most financially robust businesses in history, the so-called ‘FAAMG’ giants. Furthermore, it operates with a business model that makes it challenging to distinguish itself from its peers, despite its efforts to pivot towards a B2B-focused model through interesting acquisitions.

In this article, I will share my perspective on Dropbox and discuss some data that suggests a less optimistic outlook for the company’s future.

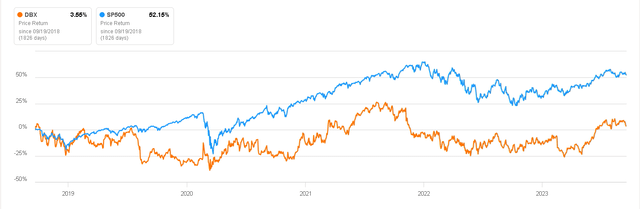

Dropbox Performance vs S&P500 (Seeking Alpha)

Business Overview

Dropbox is a cloud-based file storage and file sharing service that allows users to store files and data in the cloud and access them from various devices with an internet connection. Users can upload files to Dropbox’s servers and share them with others.

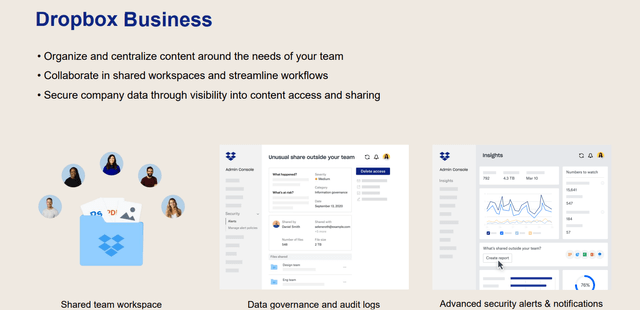

Although it initially started as solely a cloud storage platform, the company has been attempting to enter the workplace teams market through Dropbox Business. This move makes sense because a B2B business typically has more predictable revenue than one that attempts to offer its platform to individuals.

Dropbox

To enhance its appeal to businesses, Dropbox has strategically acquired companies, expanding its portfolio of solutions. For instance, in January 2019, Dropbox acquired the e-signature company HelloSign, now known as Dropbox Sign. With this integration, users can send files to be signed (or sign documents themselves) without leaving Dropbox.

In March 2021, Dropbox announced the acquisition of DocSend, a platform similar to WeTransfer but with a stronger focus on the business environment. Like WeTransfer, it allows users to upload documents they wish to share, send recipients a download link, and receive real-time feedback from users who have downloaded the files. The most recent acquisition, in December 2022, involved FormSwift, a cloud-based solution designed to assist businesses in editing, sharing, and printing personalized legal documents using pre-built templates.

As evident from these acquisitions, each addition enhances the platform’s completeness and functionality for enterprise environments. This strategic approach helps Dropbox differentiate itself from its competitors, as it competes in a market with formidable players.

Competition is Fierce

Dropbox faced strong competition in the cloud storage and file sharing space, with some of its primary competitors including:

- Google Drive: A service provided by Google, tightly integrated with other Google Workspace applications like Google Docs, Sheets, and Slides, making it a popular choice for collaborative work.

- Microsoft OneDrive: Microsoft’s cloud storage service, often seamlessly integrated with Windows operating systems and Microsoft Office applications.

- Apple iCloud: Apple’s cloud storage and synchronization service, deeply integrated into the Apple ecosystem, including iOS, macOS, and various Apple apps.

- Amazon Drive: Offering cloud storage services and part of Amazon Web Services (AWS), frequently used for personal storage and often linked with Amazon Prime memberships.

Imagine having to compete with all the FAAMGs except for ‘F.’ Although, knowing how sharp Zuckerberg is, it might not be long before Meta also tries to enter the market. The key challenge here isn’t just the size of the competitors, but rather their seamless integration with widely adopted products.

For instance, a user with an Apple device, representing 30% of the market share, enjoys direct access to iCloud. Similarly, a company relying on Gmail, used by 22% of the population, benefits from perfect integration with Google Drive. Moreover, Android users often have this platform as their default storage solution. The same applies to Microsoft, Amazon, and others.

The challenge for Dropbox lies in competing against storage services that can offer storage for free while generating revenue from other products, such as Apple’s iPhones or Microsoft’s software licenses. In Dropbox’s case, selling subscriptions is its primary source of revenue, and there’s no alternative if they cannot secure subscriptions.

If we look at the bright side, Dropbox is singularly dedicated to this niche. Consequently, it can channel all its analysis and resources into optimizing its platform with highly valuable resources for its customers. In contrast, for the AAMG giants, cloud storage is just one of many features within their extensive product menus. I don’t know if this is enough to maintain its market share, but it’s something worth noting about DBX’s current position.

Key Ratios

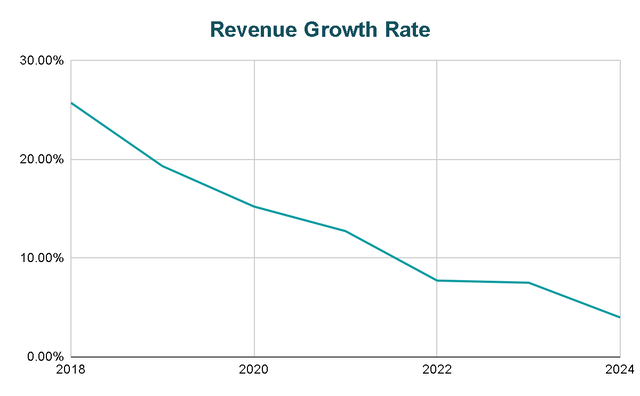

As could be seen, the outlook is not encouraging and this is being reflected in the growth rate of revenue in recent years and analysts expectations for next two years. It grows less every year, and a growth rate of only 7% is currently expected for this year.

Author’s Representation

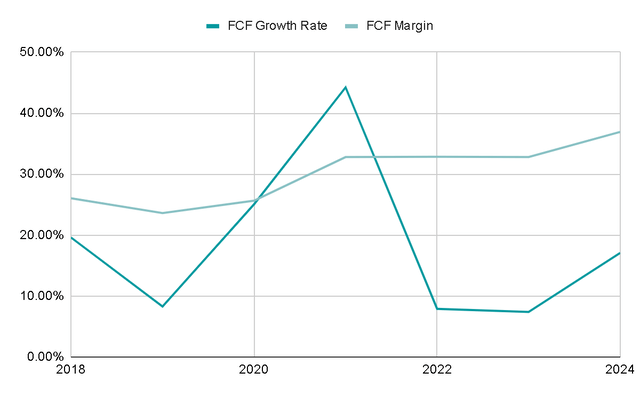

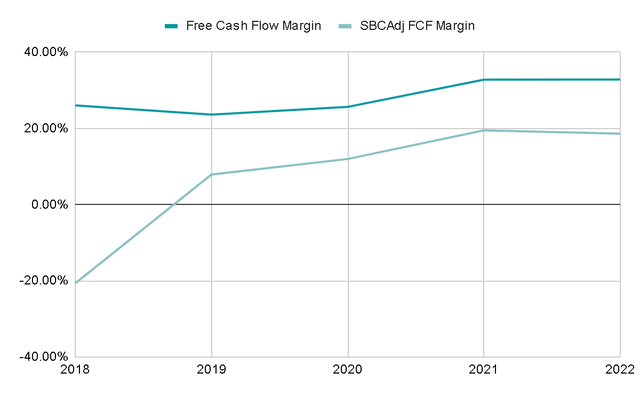

The growth rate of Free Cash Flow is not different from that of revenues and during FY2022 it grew 7%, similar to what is expected for FY2023. The positive thing is that it represents a 33% margin with respect to revenues.

Author’s Representation

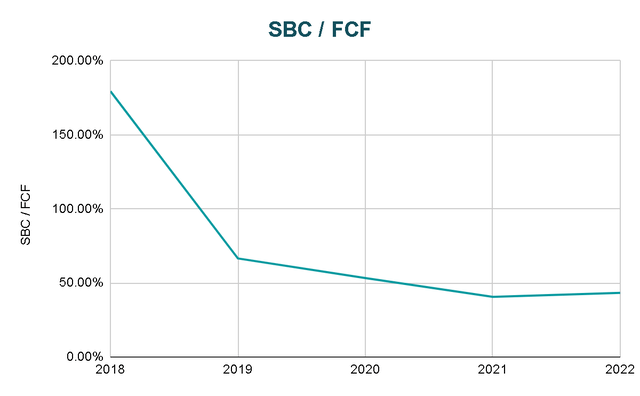

However, it’s important to note that Stock-Based Compensation (SBC) accounts for a substantial 43% of Free Cash Flow. This is a significant figure, and it’s advisable to deduct it from the Free Cash Flow, since it doesn’t represent an actual cash inflow. SBC is primarily a means of attracting talent without the necessity of cash payments. If Dropbox were to cease issuing shares as part of employee compensation, it would have two options:

- Lose those employees.

- Pay them with cash.

Neither of the two seems positive, so the most common thing is that SBC levels are usually maintained in the medium and long term.

Author’s Representation

With this adjustment, the Free Cash Flow margin for FY2022 would decrease from 33% to 19%. In other words, the company doesn’t generate as much cash as it might initially appear.

Author’s Representation

Valuation

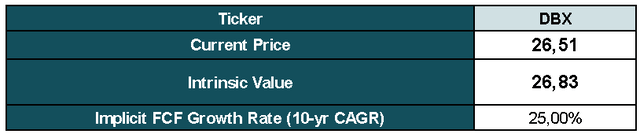

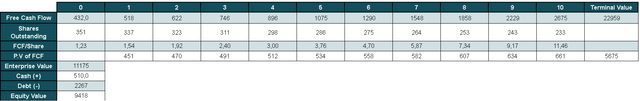

I’m of the opinion that even the worst companies have value, and if this intrinsic value is higher than the current price, it can be a good investment. To estimate Dropbox’s value, I am going to perform a Reverse DCF, which will help us determine the implied growth rate in the current share price. Here are the data I’ve incorporated into my DCF model:

- Shares Outstanding: 363M.

- Cash: $232M.

- Total Debt: $2267M.

- FY2022 SBC Adjusted Free Cash Flow: $432M.

- Expected Return: 15%.

- Terminal Growth Rate: 3%

- Share Reduction: 4% annually according to the trend of recent years.

With these assumptions, Dropbox’s Free Cash Flow would need to grow at a rate of 25% annually to achieve a 15% return, which appears highly unlikely. I believe that a realistic growth rate, given the current conditions, would be around 10% annually. With this growth rate factored in from the current price, we could anticipate a return of approximately 9% to 10% on our investment. This represents a somewhat modest return considering the associated risk.

Reverse DCF Results (Author’s Representation) Reverse DCF Model (Author’s Representation)

Final Thoughts

Dropbox’s competitive position seems to be highly compromised, and its future growth prospects are uncertain. Despite these challenges, the current valuation doesn’t encourage us to take the risk of investing in a potentially struggling company. Therefore, it may not be worthwhile to look for a turnaround situation in case the company manages to find its niche within this market and establish itself.

As a result, I would give it a ‘sell‘ rating. However, I’m interested in closely monitoring this story because there are some indications that suggest Dropbox may be moving towards a better business model through recent acquisitions.

Read the full article here

Leave a Reply