For the most part, sharp rallies in tech stocks have cooled off dramatically since interest-rate fears escalated in September. Investors are now weighing the benefits of investing in unprofitable tech stocks against dumping cash in 5%+ risk-free yields, and in most cases, investing in growth stocks just doesn’t make sense right now.

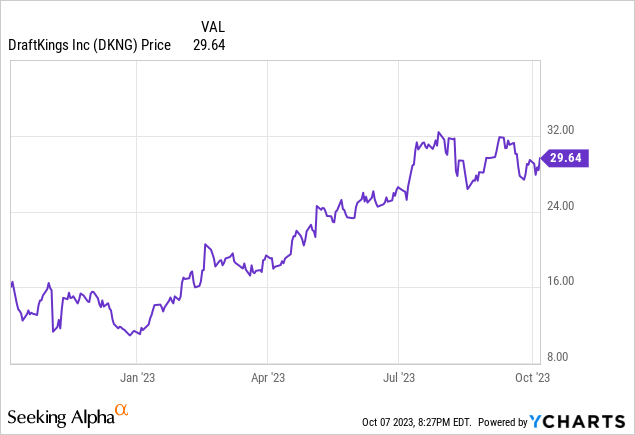

DraftKings (NASDAQ:DKNG), however, has defied this trend. The online sports betting giant has seen its share price nearly triple from the start of the year. Unlike many other tech rallies this year, however, DraftKings’ rally has been powered by substantial fundamental wins that more than justify the stock price ascent.

I’ve been consistently bullish on DraftKings for several years, but of course, with such a sharp rally and with DraftKings trading at multi-year highs, it’s prudent to revisit the bull case for this stock and ensure that it still merits a position in my portfolio. My conclusion: I’m still bullish on this name despite its bigger valuation.

Since my last note on DraftKings, a number of upside drivers have materialized. The company released very strong Q2 results that showcased, among other things, much stronger-than-expected customer engagement that led to a nearly doubling of revenue y/y. In addition, new states are taking off (the company recently launched sports betting in the state of Kentucky, home of the Kentucky Derby and Churchill Downs (CHDN) and a big gaming market) and the company is also moving faster on its integration of Golden Nugget Gaming to expand its market share in non-sports gambling as well. All this, meanwhile, has been additionally buoyed by substantial boosts in efficiency, as DraftKings hit adjusted EBITDA profitability for the first time.

Stay long here: there’s still plenty of upside left.

The long-term bull case for DraftKings

Here is a refresher on my bullish thesis on DraftKings:

- Still an open market to capture within the U.S. Today, DraftKings’ sports betting is live in only 44% of the U.S. population. Major states like California and Texas are still major holdouts. An additional 6% of the U.S. population is approved and in progress to go live, while the remaining states representing 24% of the U.S. population have some form of legalization legislation in the works.

- Superb velocity once legal. Given that it’s already a known national brand with fantasy sports operations live in most states, DraftKings isn’t starting from scratch every single time it launches in a new state. Data from recent state launches shows that sign-ups and betting activity immediately ramp from the time DraftKings launches.

- Variety of sports and formats leads to a broad market. DraftKings has something for everyone. Though anchored by big sports like football, DraftKings also has other sports, including golf, NASCAR, basketball, and MMA. DraftKings also has fantasy formats as well as direct online sports betting where legal, as well as offerings in casino gaming.

- Additional monetization opportunities beyond sports betting and fantasy sports. DraftKings has designs on diversifying itself beyond simply sports. Through acquisitions, the company is now a casino gaming operator, and its new marketplace business has tossed DraftKings into the high-growth arena of NFTs. DraftKings notes that recent NFT offerings have been over-subscribed.

- Just now turning the tide to focus on profitability. Driven by scale and word of mouth, DraftKings has reduced its customer acquisition costs by double digits year-over-year, allowing for more organic growth and helping the company notch adjusted EBITDA profitability for the first time in Q2 of 2023.

Valuation update

Of course, with DraftKings’ recent surge, the stock isn’t exactly as much of a bargain play as when it was collapsing last year. In spite of this, given the stock’s tremendous growth profile plus the fact that its profitability levels are still nascent, I think there’s plenty of upside left to go.

At current share prices near $30, DraftKings trades at a market cap of $13.75 billion. After we net off the $1.11 billion of cash and $1.25 billion of convertible debt on DraftKings’ most recent balance sheet, the company’s resulting enterprise value is $13.89 billion.

For next year FY24, meanwhile, Wall Street analysts are expecting DraftKings to generate $4.29 billion in revenue, representing 22% y/y growth. Now, there are a number of reasons why that estimate may be conservative. First, the company’s growth is topping 80%. Second, with only ~44% of the U.S. population having access to legal sports betting now and more than 30% either having additional approval or on the way to it, there is substantial room for greenfield user additions next year.

Still, taking DraftKings’ consensus estimates at face value, the stock trades at 3.2x EV/FY24 revenue. For a company that is expecting to hit a 12-15% adjusted EBITDA margin in Q4 of this year, I’d say this is still a reasonable multiple for a fast-growing stock that is just starting to see bottom-line leverage.

Q2 download

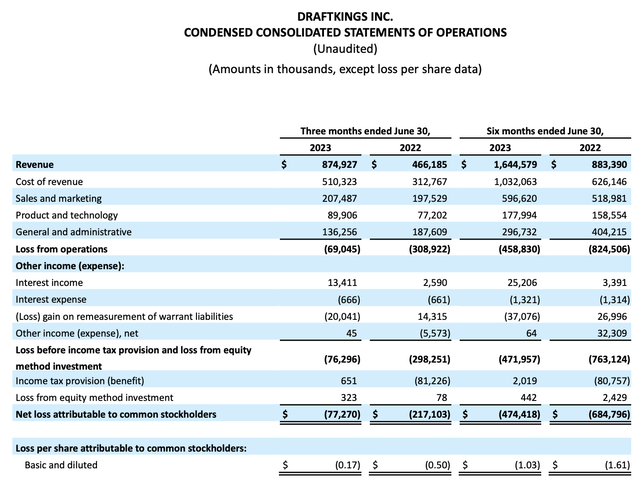

Let’s now go through DraftKings’ latest quarterly results in greater detail. The Q2 earnings summary is shown below:

DraftKings Q2 results (DraftKings Q2 earnings release)

DraftKings’ revenue grew 88% y/y to $847.9 million, substantially ahead of Wall Street’s expectations of $731.3 million (+57% y/y) and even accelerating ahead of Q1’s growth rate of 84% y/y. The company notes that engagement and retention trends have been outstanding, driven by continued optimization of the product: the company added same game parlay capabilities for baseball (MLB) which have seen strong activity. Note that the company has now rolled out similar capabilities across all of its sports, and Q2 results have not yet included the start of the NFL season.

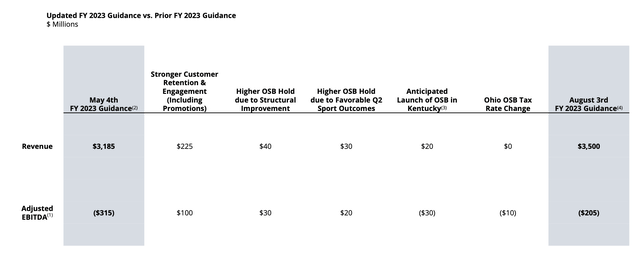

Higher customer engagement has led DraftKings to boost its full-year revenue outlook to $3.50 billion, now representing 56% full-year growth versus a prior view of just 42% y/y growth. With this substantial and unexpected boost in top line performance, it’s a small wonder that DraftKings’ stock has rallied post-earnings.

DraftKings guidance revision (DraftKings Q2 earnings release)

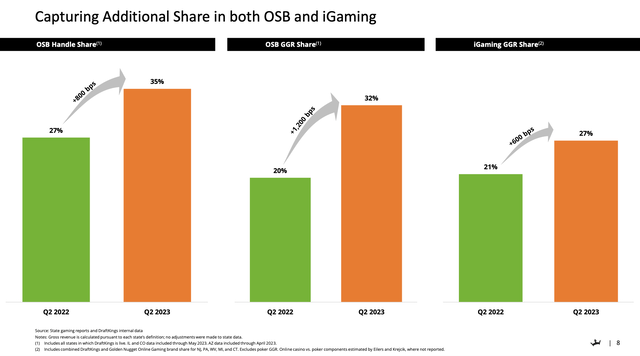

Unsurprisingly, DraftKings is also taking market share. The chart below shows that the company’s share of online sports betting handle has grown by 8 points to 35% of the market, while its secondary iGaming (online gambling) segment has grown to 27% market share as well.

DraftKings share gains (DraftKings Q2 earnings release)

Note that the strength of DraftKings’ top line also came alongside improved marketing efficiency. In the company’s Q2 shareholder letter, CEO Jason Robbins noted as follows:

Promotional Intensity continued to improve as expected. The combination of year-over-year improvement in our sportsbook hold percentage, more efficient promotional reinvestment and success with efficiency initiatives focused on our cost of goods sold resulted in an increase of more than 550 basis points year-over- year in our Adjusted Gross Margin for the quarter.”

As a result of this, DraftKings generated $73.0 million of adjusted EBITDA in the quarter at a 9% margin – versus a much deeper loss of -$118.1 million (a -25% margin) in the year-ago Q2. By Q4 of this year, DraftKings expects to generate a 12-15% adjusted EBITDA margin and has commented on expecting to achieve “meaningfully positive” adjusted EBITDA in FY24.

Key takeaways

With incredible fan engagement, superbly increased market share, marketing efficiencies, and bottom-line expansion coupled with aggressive top-line growth, there’s a lot to like about DraftKings even after its massive YTD rally. Stay long here and continue to ride the recent upside. I wouldn’t recommend adding more to your position above $30, however.

Read the full article here

Leave a Reply