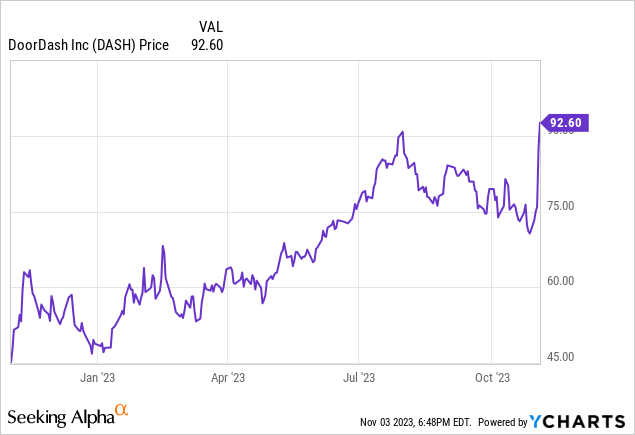

With interest rate fears (at least temporarily) quelling, investors have dared to be hopeful again. The past week has brought a substantial rally to growth stocks, which in some cases was also well-timed with very strong earnings releases.

DoorDash (NASDAQ:DASH), the takeout delivery app that competes alongside UberEats (UBER), Postmates, and GrubHub, showed incredibly strong execution in the third quarter, sparking a ~30% rally in its stock (which has added to a yearlong rally that has DoorDash up nearly 2x since the start of January).

I initiated bullish coverage on DoorDash in September when the stock was trading at ~$80 per share. Even now at its higher share price, considering the fundamental momentum that DoorDash has picked up in Q3, I remain quite bullish on the company and am content to hold onto it in my portfolio. Broadly speaking, I continue to be encouraged by how both DoorDash and Uber have held onto much stronger takeout demand in the post-pandemic period, and despite raising restaurant prices and fees (DoorDash’s net revenue margins, which can be thought of as its take rate, has increased over the past year which has been a major driver of revenue), customers seem to be unable to shake the habit of convenience.

Here, in my view, is the core bull thesis for DoorDash:

- Growth at scale. Despite hitting over $2 billion in quarterly revenue and over $15 billion in quarterly marketplace orders, DoorDash is still growing both top-line metrics in excess of 20% y/y, which is a strong signal that it is still underpenetrated in its market potential.

- Prominent brand and broad market coverage in U.S. restaurants – Though smaller than Uber Eats, DoorDash is broadly available nationwide and continues to grow. Through acquisitions, DoorDash also has operations overseas, giving it a massive TAM.

- Subscription program to drive recurring revenue and loyalty – The $10/month DashPass program offers free delivery fees and discounted pickup orders, encouraging not only a buildup of recurring revenue but also driving more frequent orders among DoorDash’s most ardent customer base.

- Growth via partnerships – DoorDash has inked a number of prominent partnerships with a variety of companies, including banks (a number of premium credit cards offer DashPass at a discount or free). It has also expanded its convenience/delivery business by opening its network to a wide array of retail chains.

- Favorable margin profile – Though its delivery business is at a smaller revenue scale than Uber’s, it has a favorable adjusted EBITDA margin profile.

- Cash rich – The company has more than $4 billion in net cash, unencumbered of debt, sitting on its balance sheet, providing for ample financial flexibility.

More to the last point above – I also think that it’s smart that DoorDash has wrapped up its share repurchase program ($750 million in stock repurchased since the start of the year, for which it was able to repurchase 12 million shares at an average price of $62.50 – a win relative to today’s share prices!). The ample liquidity on DoorDash’s books plus its growing FCF trend, however, allows plenty of firepower for another big repurchase program if shares did head south.

The bottom line here: in my view, DoorDash’s recent fundamental momentum more than justifies its recent stock rally. Hold on here for further gains, especially as DoorDash doesn’t seem to be seeing top-line deceleration anytime soon.

Q3 download

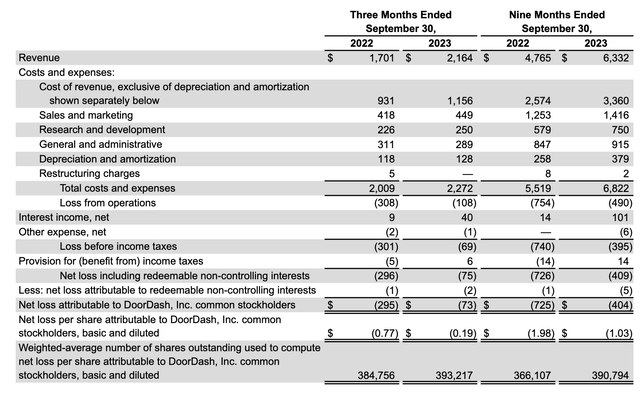

Let’s now go through DoorDash’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

DoorDash Q3 results (DoorDash Q3 earnings release)

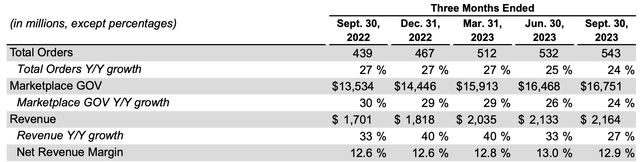

DoorDash’s revenue grew 27% y/y to $2.16 billion, handily beating Wall Street’s expectations of $2.09 billion (+23% y/y) by a four-point margin. Marketplace gross orders, meanwhile, grew 24% y/y to $16.8 billion, barely decelerating from Q2’s 26% y/y growth pace.

DoorDash marketplace trends (DoorDash Q3 earnings release)

Though the company does not report active users, it noted that customers grew at a double-digit pace in the quarter. It also reported higher membership for DashPass+, the $10/month membership program that allows members to save on both marketplace fees and delivery charges (one note here: many DashPass+ members are granted free memberships through a partnership with JPMorgan Chase (JPM) credit cards, so we can’t really tell if DashPass+ is really getting “full price” from growth in memberships or getting only partial renumeration from Chase).

Perhaps most encouraging of all: DoorDash also anecdotally noted that order frequency among existing members accelerated in Q3 relative to Q2, indicating deeper loyalty within the customer base and the growing habituality of takeout orders.

Management believes that order growth and increased frequency are due to the company’s expansion of marketplace offerings plus product improvements. Per CEO Tony Xu’s remarks on the Q3 earnings call:

In terms of the U.S. restaurant business or the marketplace in general, I mean, a few phenomenon are going on, but really it’s the result of product improvements we’ve made. Whether you look a quarter ago or a year ago, we’ve added selection to the platform on the restaurant side, and we’ve added a lot of selection on the non-restaurants front, literally going from 0 nearly 3 years ago to a multibillion-dollar business that’s at scale now growing fast and contributing quite significantly. And we have over 100,000 stores on the platform that are outside of restaurants. And when you look outside of restaurants and into the convenience or grocery or alcohol segments, almost half of new customers that come into the industry in the U.S. come to DoorDash first. And so that’s certainly adding in terms of the selection.

Second, we’ve continued to improve the quality of service, whether it’s our timeliness, our speed, our accuracy. Third, we’ve improved the affordability of the programs, both for our non-DashPass members as well as for our DashPass cohorts. And fourth, we’ve improved customer support all along the way.”

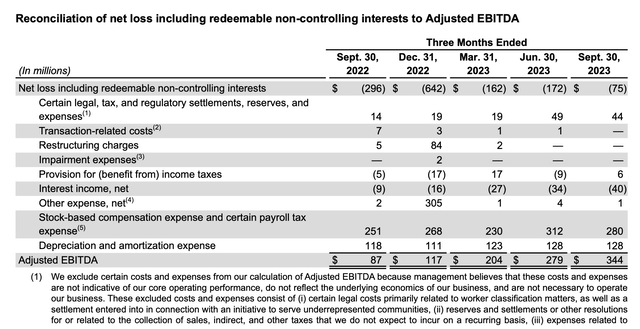

Higher order frequency, higher take rates, and economies of scale on opex have also allowed DoorDash to scale its profitability. Adjusted EBITDA nearly quadrupled y/y to $344 million, hitting a margin of 15.8%: more than ten points higher than a 5.1% margin in the year-ago Q3. It’s also a two-point sequential improvement from a 13.1% margin in Q2.

DoorDash adjusted EBITDA (DoorDash Q3 earnings release)

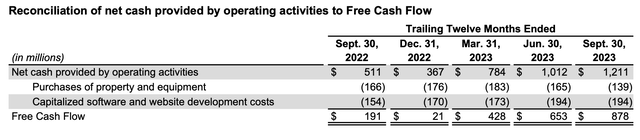

Similarly, the company is just starting to see tremendous leverage on free cash flow. Trailing twelve-month FCF is up to $878 million, versus the TTM period ending in the prior-year Q2 of just $191 million. We note that the company’s free cash flow over the past twelve months has more than covered its $750 million buyback program this year.

DoorDash FCF (DoorDash Q3 earnings release)

Key takeaways

With solid marketplace performance, continued expansion of DoorDash offerings and into categories like grocery/convenience, and sharp bottom-line increases, there’s a lot to like about DoorDash exiting the Q3 earnings season.

That being said, there are of course risks to the bull narrative here. Competition is the biggest one: Uber is undoubtedly much deeper-pocketed than DoorDash, and it can use its bundled membership plans (Uber One) to sway customers away from DoorDash. Valuation is another risk, if the market turns bearish again and insists on valuing tech companies based on bottom-line metrics. At current share prices near $93, DoorDash trades at a market cap of $36.4 billion and an enterprise value of $32.5 billion. On a revenue basis, DoorDash’s multiple of 3.3x EV/FY24 revenue against consensus expectations of $9.8 billion in revenue (+17% y/y) next year look reasonable, but in tighter market conditions the most pessimistic way to look at DoorDash’s valuation is against TTM cash flow, for which its multiple sits at ~37x FCF (or ~31x if projecting the same 17% growth forward on free cash flow).

With all this considered, however, I think there are more catalysts to the upside here that will continue to power DoorDash’s rally.

Read the full article here

Leave a Reply