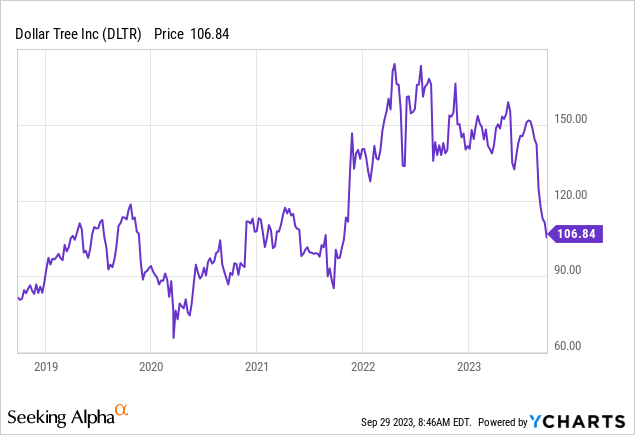

Dollar Tree (NASDAQ:DLTR) has just experienced a monster sell-off, amounting to -35% in size for a price decline during late summer. Shares are now trading at a fairly attractive overall valuation, with price sitting at the same level as 2019. In terms of growth at a reasonable price [GARP-style investing], DLTR is moving to front of the class, especially if new shoppers appear during a recession.

YCharts – Dollar Tree, Weekly Price Change, 5 Years

Even more intriguing to me as an investor is the clientele shopping this retailer, and their reasons for showing up in large numbers. While Target (TGT), Walmart (WMT), and to a degree Dollar General (DG) offer general merchandise to the masses, Dollar Tree is considered more of a discount “variety” store, offering items (usually in smaller proportions per packaging) at yet lower prices, often with a specific buyer-type in mind.

For starters, constantly changing seasonal decor for your house at minimal cost does draw in crowds of homemakers. My unscientific personal headcount at stores visited consistently runs around 65% to 75% women of all paying customers. What you may not know or fully appreciate is Dollar Tree has become a crafter destination for inexpensive repurposing supplies.

The main excuses for me to walk in a Dollar Tree (outside of following my wife) are its extensive selection of cheap Hallmark greeting cards and small-portion candies for movie night at home. Sometimes I will stock up on the greeting cards, buying 10 or 20 at a time, for future occasions. Most shoppers visit stores looking for specific items, everything from balloons inflated with helium for a graduation or birthday party, to food and toiletries on the cheap for cost-conscious consumers.

Items were almost entirely priced at $1 or less before November 2021, hence the company name. Labor shortages and shipping issues caused by the pandemic forced a reworking of price points for consumers. Today you can still get greeting cards at a $1 price (occasionally 2 for $1). Other items range from $1.25 to $3 and even $5 in each store, with various pricing depending on your location in the country.

The chain earns income with a low variable-cost business model. Smaller stores in strip mall locations (with fixed rents and minor utility bills) are important, but a major profit driver is limited labor needs. My local stores are usually manned by just one or two workers at a time.

The Backdoor Crafting Story

In terms of customer loyalty, Dollar Tree has a meaningful share of repeat business, much higher than the typical retailer, in my estimation. However, the club warehouse Costco (COST) may have the most fanatical return customer pull.

Why do I say this? Because a massive number of customers drive to stores to buy cheap input items for building and designing personalized arts and crafts for their homes. Different retailers carry the same or similar product, but Dollar Tree is almost always the least expensive seller.

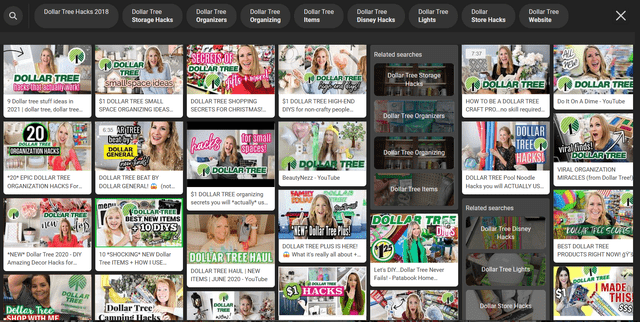

How do these customers find out about new niche products and supplies? Essentially, YouTube channels [hosted by Alphabet/Google (GOOG) (GOOGL) computers] and social media platforms catering to the crafting community highlight new items all the time. If you make a search engine query for Dollar Tree crafting, literally thousands of videos will pop up, mostly posted over the last 2-3 years. And, new videos are uploaded daily for viewing.

Bing Search – Dollar Tree Crafting Videos, September 28th, 2023

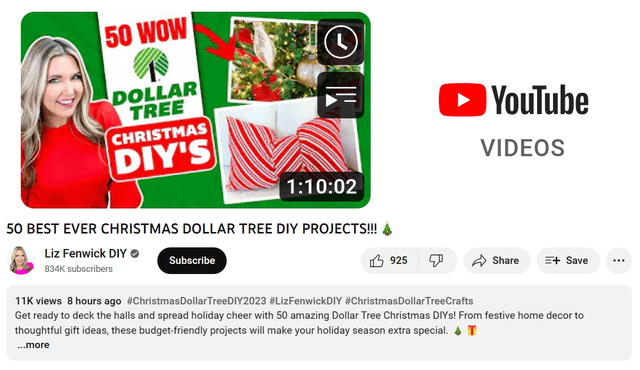

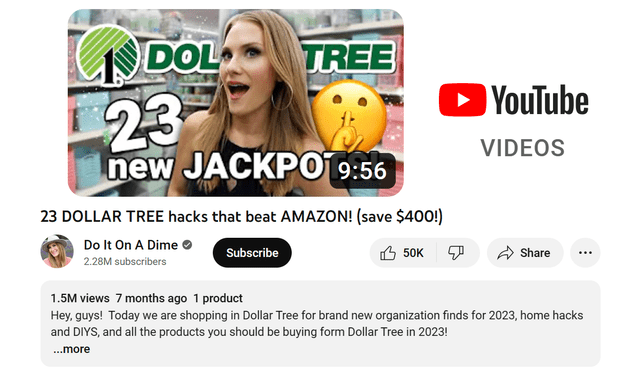

Some of my wife’s favorite YouTube creators focus on reformulated crafting ideas, hacks for your home on the cheap, and shopping deals of the day as a source of distraction from everyday life. You could even say shopping at this discounted goods chain is a stress reliever and a type of therapy for hundreds of thousands of Americans. This is not a rare pastime just for my wife. More than a few video blog producers have subscribers (followers) in the hundreds of thousands to millions. Many of their video posts achieve millions of views over the course of 6-12 months. Two examples include Liz Fenwick DIY and Kathryn Snearly‘s Do It On A Dime.

YouTube – Liz Fenwick DIY Channel

YouTube – Do It On A Dime Channel

Quickly Improving Valuation

So, if its long-term customer base is loyal, while a recession forces consumers to search for cheaper alternatives, millions of individuals for foot traffic will end up walking through Dollar Tree store doors over the next year (some new and some regular shoppers).

Consequently, the dramatic share price decline this summer could be opening a wonderful multi-year opportunity to scoop up shares in your portfolio. The valuation backdrop is absolutely getting more interesting for me.

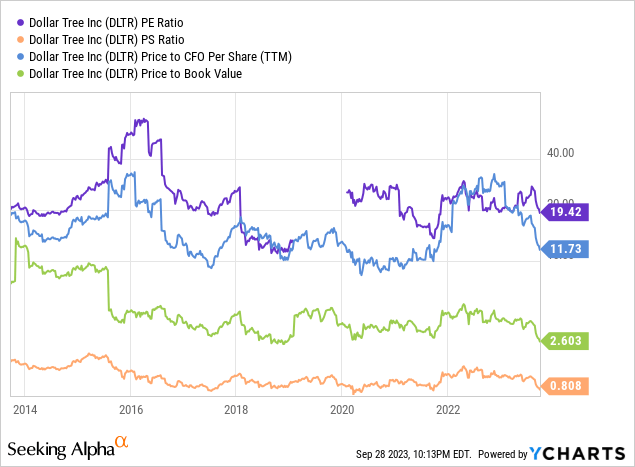

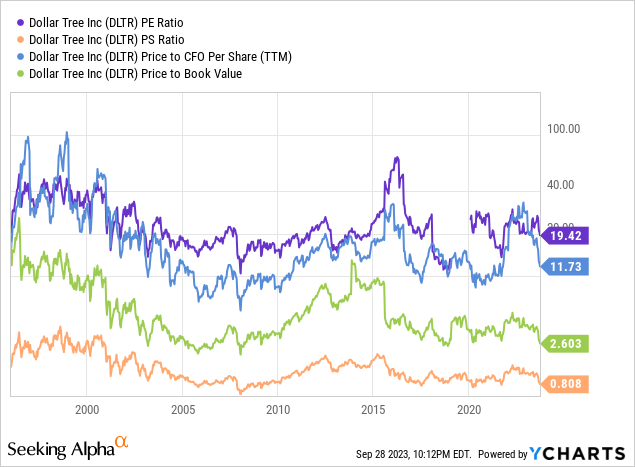

On price to trailing earnings, sales, cash flow, and earnings, the company is nearing the low levels of the 2020 pandemic panic outlined during March-April of that year (in combination equally weighted for my basic fundamental comparison stats). You have to go all the way back to 2010 to find a cheaper setup.

YCharts – Dollar Tree, Basic Fundamental Valuation Stats, 10 Years

YCharts – Dollar Tree, Basic Fundamental Valuation Stats, Since 1996

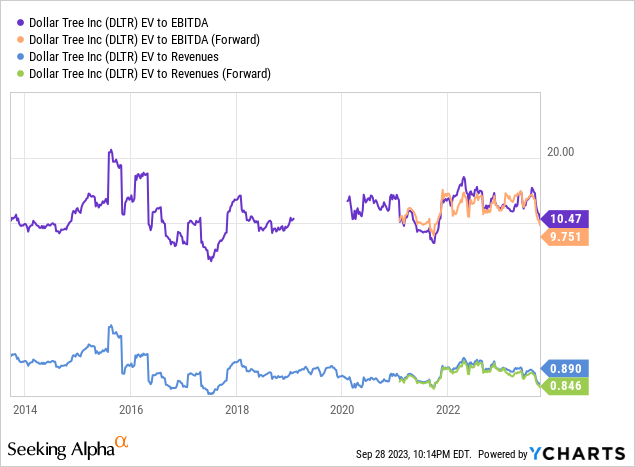

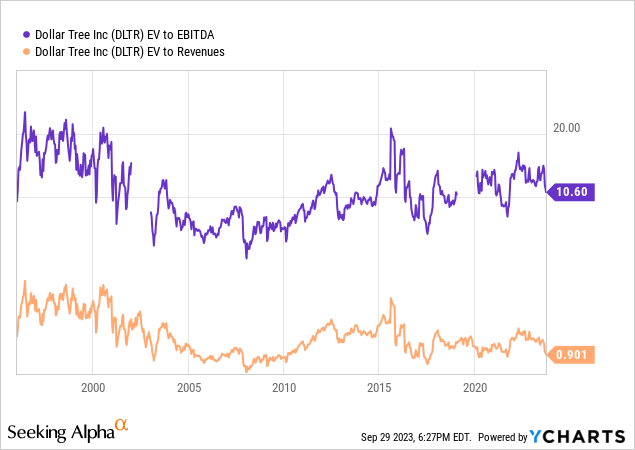

When we include changing balance sheet debt and cash levels, the enterprise valuation on EBITDA and revenues is arguing Dollar Tree is likewise drifting into the buy territory. In terms of 10-year averages, the EV to EBITDA valuation is roughly a 20% discount to the median average, while EV to sales is a good 30% discount.

YCharts – Dollar Tree, Enterprise Valuation Stats, 10 Years

YCharts – Dollar Tree, Enterprise Valuation Stats, 10 Years

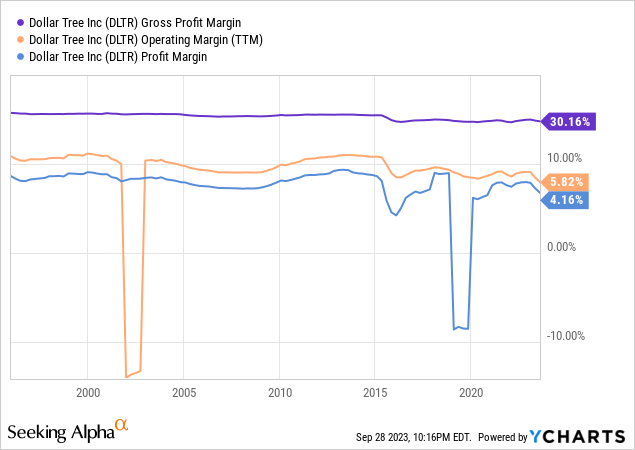

What about margins? The bad news is profit margins overall have drifted a tad lower since 2014 (including gross, operating, and final GAAP margins). The good news is labor wage pressures should cool next year in a recession, potentially helping margins, especially if we assume sales hold up or possibly continue growing.

YCharts – Dollar Tree, Profit Margins, Since 1996

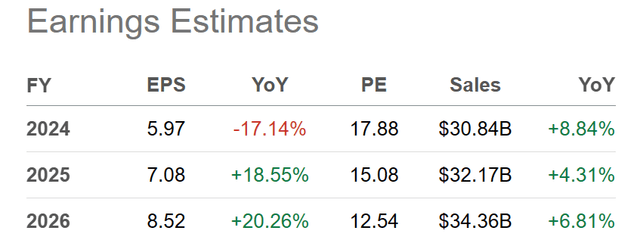

One last valuation idea to ponder is Dollar Tree earnings per share are projected to grow nicely between 2023 and 2025 (FY 2024-26 ending in January). Wall Street is forecasting a return to income growth next year, after 2023’s bump in the road, caused by a combination of higher costs for diesel and shipping product to stores, increased labor wages including adding to employee counts, higher utility expenses from the abnormally warm summer, and a decision to spend extra capital on store improvements. Despite stronger-than-expected sales trends, Wall Street has punished the stock for a slight guidance drop in EPS of just a few pennies for this fiscal year. If income beats are next, will the share price recover all of its losses over the next 12 months?

Seeking Alpha Table – Dollar Tree, Analyst Projections for 2023-25 EPS and Sales, Made September 28th, 2023

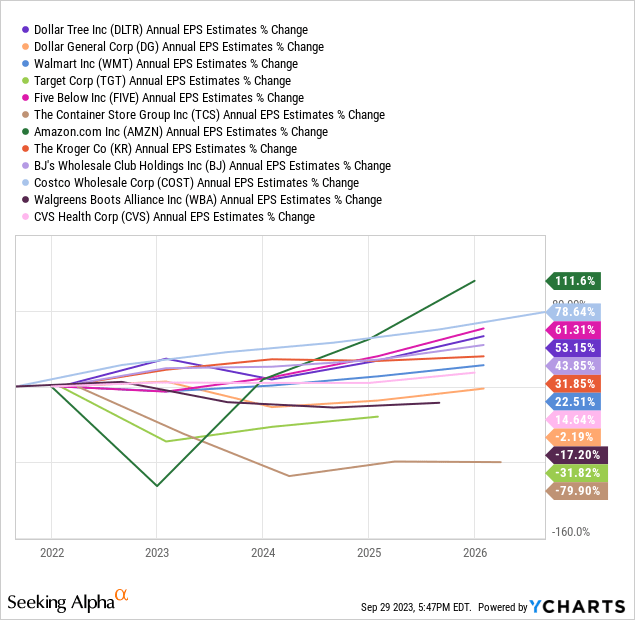

Believe or not, expected EPS growth measured from last year into 2026 trails only Costco, Amazon (AMZN) and perhaps Five Below (FIVE). Amazon is not exactly relatable as a competitor and peer, with limited physical locations and an increased focus on computer-cloud divisions. However, for reference as a national retailer, I thought I would include the name. Other major national retail peers to compare/contrast include Dollar General, Walmart, Target, The Container Store (TCS), Kroger (KR), BJ’s Warehouse (BJ), Walgreens (WBA), and CVS Health (CVS). Granted none of them has an exact competitor business model design.

YCharts – Major U.S. Retailers, Analyst Projected EPS Growth 2022-25, Made September 29th, 2023

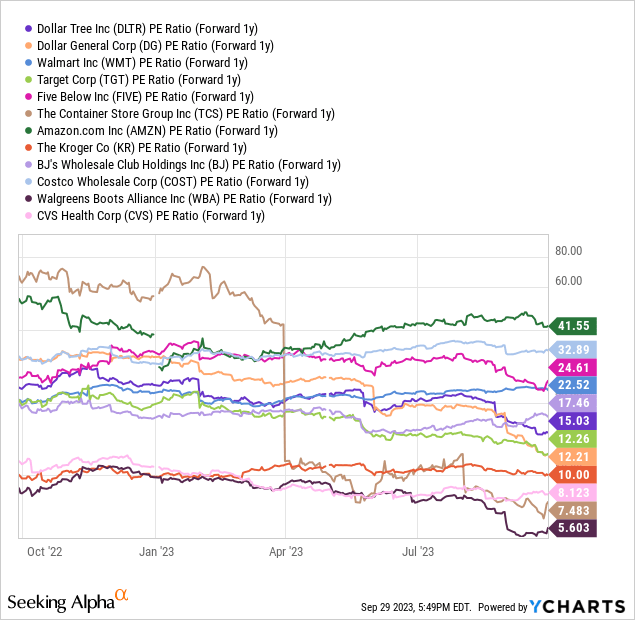

All things considered, you would guess DLTR’s forward P/E ratio would be near the S&P 500 forward average of 20x. So, Dollar Tree’s 15x multiple is relatively attractive. And, when you factor in a number of national retail chain leaders with less growth potential are priced at higher P/E ratios, its attractiveness increases. Then contemplate above-average growth is available at half the P/Es of Amazon and Costco, while still a huge discount to Five Below.

YCharts – Major U.S. Retailers, Price to Analyst Forward Projected Earnings, Made September 29th, 2023

In the end, a forward P/E of 15x translates into an earnings yield of approximately 6.6%, which exceeds the current 5.45% 1-year Treasury dividend rate. I have explained investing in companies with earnings yields less than risk-free Treasury rates makes no mathematical sense going into a recession (where corporate income levels may decline). At a minimum, Dollar Tree surpasses this self-imposed investor threshold.

Technical Trading Thoughts

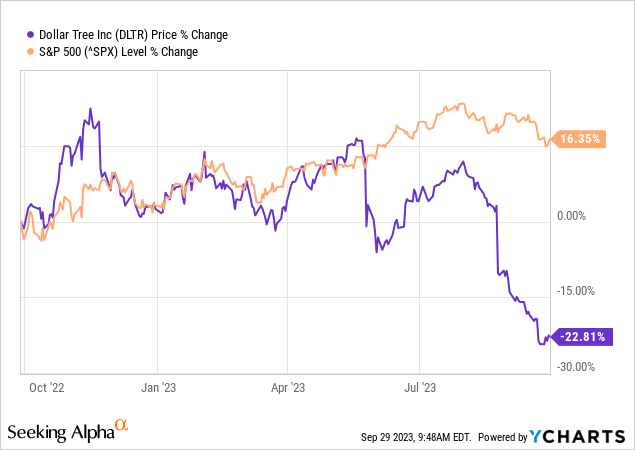

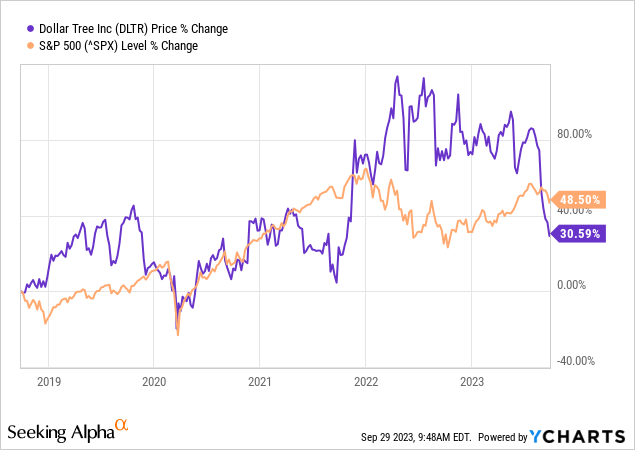

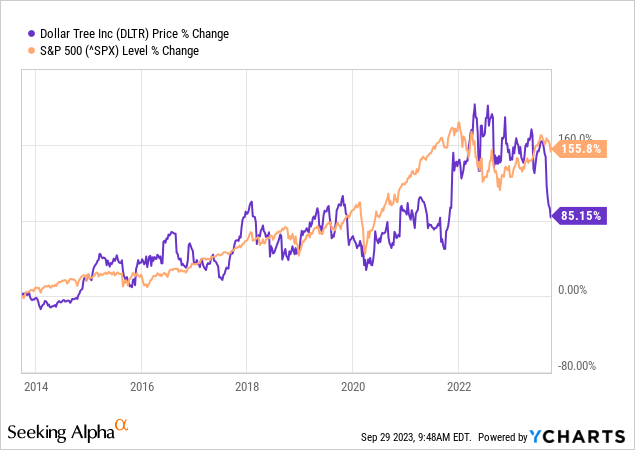

Over longer periods of time, Dollar Tree has done a terrific job of mimicking the S&P 500 for price gains (with slight outperformance the rule until July). Historically over the last decade, oversized DLTR price drops have proven great buying points. Will this latest hiccup bring solid gains again next year?

YCharts – Dollar Tree vs. S&P 500, Price Change, 1 Year

YCharts – Dollar Tree vs. S&P 500, Price Change, 5 Years

YCharts – Dollar Tree vs. S&P 500, Price Change, 10 Years

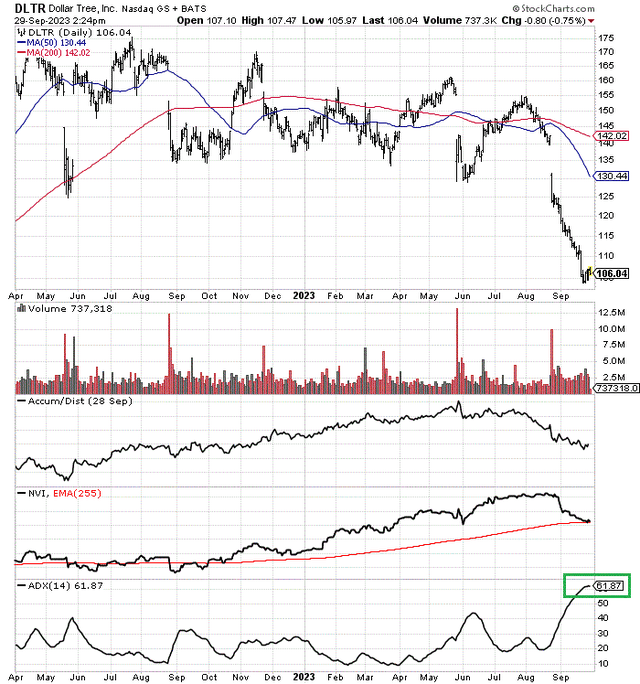

Another positive technical note is the stock has reached its most “oversold” level ever (since Dollar Tree started public trading in 1995), as measured by the 14-day Average Directional Index indicator. The 61 score yesterday is boxed in green below. For contrarians hunting for a possible blue-chip reversal setup, DLTR is worthy of your research time.

StockCharts.com – Dollar Tree, 18 Months of Price & Volume Changes, Author Reference Point

Final Thoughts

I consider myself a well-trained husband, after several decades of marriage. I am constantly reminded by my wife – she is never wrong. So, this will be her stock pick, which I agree has sound upside potential for long-term investors hunting for a blue-chip retailer itself in the bargain bin.

I am particularly curious how Dollar Tree will survive the next recession (which could begin shortly). It is entirely possible, sales and EPS will hold up better than even Walmart, the typical trade-down retailer of choice during past economic downturns since the 1970s. Crafting demand may actually increase, all a function of stress-reducing trips for those inclined to find a temporary escape from life. DLTR’s lower-priced items could also see a bump higher in demand from shoppers needing to cut household living expenses. And, labor wage pressures for company workers may slide into a smarter balance for management on any macroeconomic downturn in America.

Analyst estimates appear to be suggesting Dollar Tree will remain an above-average grower in the retail sector over the next 2-3 years, another plus for investors.

On the balance sheet front, tangible book value is sitting at a company-record $18 per share, and net debt is about the same as 2020. Unfortunately, this stock does not pay a dividend. Instead, all cash flow and earnings are plowed back into the business to fund growth (and perhaps pay down debt in the near future). I give the company a “B” grade for balance sheet strength, much higher than the average retailer.

Lastly, an oversold stock condition may have opened a smart buy entry situation, with a reversion-to-the-mean upmove toward a more typical valuation the next material trend in the share quote during 2024.

What could go wrong with my bullish thesis? Two clear and present danger risks jump out to me. One is the Fed has overshot its tightening of credit conditions in late 2023, which could send U.S. equities dramatically lower in coming months, as liquidity in the financial markets disappears. I place the odds of this playing out in the 20% to 30% range (actually quite high). Second, a severe economic downturn may also affect traffic and sales results at Dollar Tree because of its large size. A deep or prolonged recession in 2024-25 would almost surely keep the stock quote trading between $80 and $120 next year. $80 would approach the lowest “trailing” valuation on fundamentals in this stock’s trading history (given flat to slightly higher operating results), similar to the Great Recession setup of late 2008 to early 2009. I place the odds of such playing out in the 10% to 20% range.

However, I would view a major price dump into the new year as a stronger buy proposition. To offset some of the risks explained above, I think it prudent to purchase a starter position now in the low $100s, then add on additional weakness if it appears during October-November. That way you won’t miss out on any immediate price rebound. This is my personal plan for trading Dollar Tree. And, yes, my wife is on the hook for this one. I rate the stock a Buy.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here

Leave a Reply