Investment Thesis Remains Speculative In The Near Term

Dollar General Corporation (NYSE:DG) is a stock that requires no introduction, with the discount retailer providing “a broad selection of merchandise, including consumable items, seasonal items, home products, and apparel” at everyday low prices (typically $10 or less).

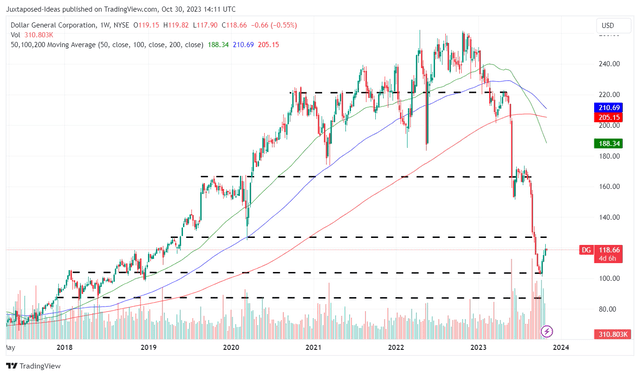

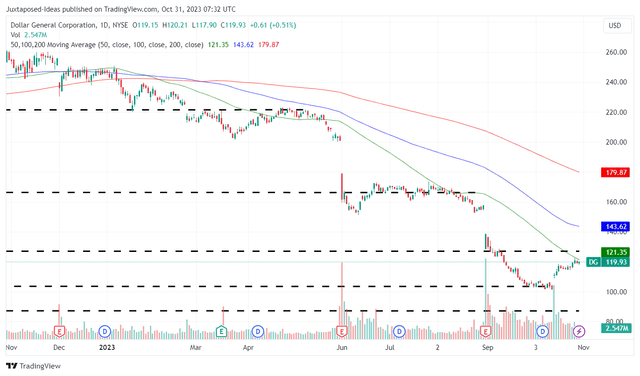

DG 5Y Stock Price

TradingView

DG has also greatly benefitted from the COVID-19 pandemic, with the resultant housing boom and stimulus checks directly contributing to its expanded top/bottom lines and inflated stock valuations/prices.

However, thanks to the Fed’s sustained rate hike, it appears that the retailer’s fortunes have reversed drastically, with things normalizing to pre-pandemic levels.

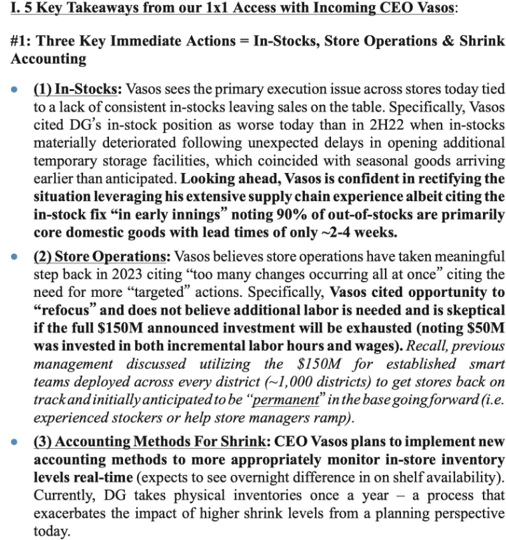

Incoming CEO’s Three Key Focus

X

For now, while Mr. Market and investors may cheer the return of DG’s previous CEO, investors may want to temper their near-term expectations, since its reversal may take longer than a few quarters, due to the uncertain macroeconomic outlook.

This is mostly attributed to the tightening discretionary spending of the retailer’s core consumer group, with a household income of between $35K and $75K, attributed to the elevated interest rate environment, higher inflationary pressures, and ultimately, the restart of the federal student loans from October 2023 onwards.

With the Fed expecting a normalized economy only by 2026, it appears that DG may face further uncertainties as the headwinds persist over the next two years.

While investors may be rest assured of its slow-but-sure reversal as the previous CEO attempts to right the ship in the correct direction, we believe that things may get moderately worse before it gets better.

As a result of this transitionary period, the DG stock is only suitable for investors with higher risk appetite and long-term investing trajectory. Rome was not (re)built in a day. Patience may be prudent here.

In addition, it appears that DG suffers from a similar inventory headwind as with many other retailers, with the management reporting a bloated FQ2’23 inventory level of $7.53B (+2.7% QoQ/ +8.6% YoY), compared to FY2019 levels of $4.67B (+14.1% YoY).

While the management has been able to record a stable gross margin of 31.1% (-0.5 points QoQ/ -1.2 YoY), compared to FY2019 levels of 30.6% (+0.1 points YoY), we concur with market analysts here that the discount retailer may face a similar situation as that of Target Corporation (TGT) in FQ2’22, where the latter took drastic actions to reduce excess inventory through price markdowns.

US Retailers’ Shrinkage Issues

Yahoo!

DG also expects “approximately $100M of additional shrink headwind since last quarter’s call,” similar to many other retailers, with the management already lowering their FY2023 adjusted EPS guidance to $7.70 (-27.9% YoY) at the midpoint, or the equivalent of “a YoY decline of -34% to -22%.”

Investors may want to note that this is the second time that the management has lowered its FY2023 adjusted EPS guidance, down from the previous FQ1’23 guidance of “an approximate -8% decline to flat” and FQ4’22 guidance of “YoY growth in the range of +4% to +6%.”

With DG also missing the consensus estimates for the past four consecutive quarters, it is unsurprising that the stock has also drastically lost nearly half of its value since May 2023.

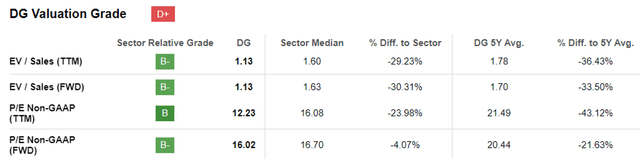

DG Valuation

Seeking Alpha

For now, DG’s FWD P/E valuation of 16.02x seems moderated compared to its 5Y mean of 20.44x, though finally nearing the sector median of 16.70x.

Then again, we believe that the stock has only normalized to its 3Y pre-pandemic mean of 17.24x, down from the hyper-pandemic peak of 24.43x.

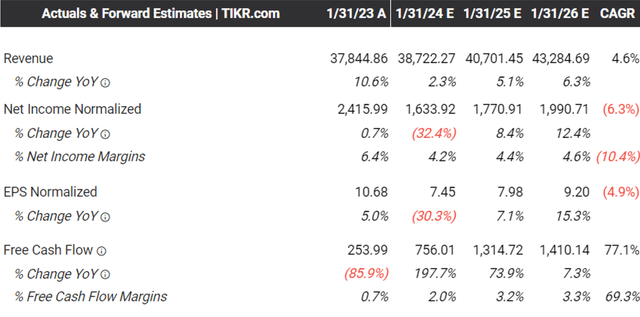

The Consensus Forward Estimates

Tikr Terminal

We suppose part of the pessimism is also attributed to the underwhelming consensus forward estimates, with DG expected to report a top and bottom line CAGR of +4.6% and -4.9% through FY2025.

This is compared to its pre-pandemic CAGR of +8.1%/ +14.4% and hyper-pandemic CAGR of +10.9%/ +16.6%, respectively. Due to the uncertain outlook, it appears that DG’s performance may be temporarily impacted.

However, we believe that the DG stock is finally trading near its fair value of $123.35, based on the management’s lowered FY2023 adjusted EPS guidance of $7.70 at the midpoint and its FWD P/E valuation of 16.02x.

Based on the consensus FY2025 adjusted EPS estimates of $9.20, there appears to be an excellent upside potential of +23.5% to our long-term price target of $147.38 as well.

So, Is DG Stock A Buy, Sell, or Hold?

DG 1Y Stock Price

TradingView

The DG stock appears to have found bullish support at its critical support levels of $105s, offering interested investors an improved margin of safety.

Thanks to the deep pullback, the stock now offers an expanded forward dividend yield of 1.98% as well, compared to its 4Y average of 0.87%, though still lower than the sector median of 2.88%.

We believe that its income investment thesis remains somewhat safe, based on its 1Y Dividend Coverage Ratio of 3.17x and FWD Dividend Per Share Growth of 10.77%, compared to the sector median of 2.00x and 4.39%, respectively.

As a result of its dual-pronged prospects through capital appreciation and dividend incomes, we are cautiously rating the DG stock as a Buy. Then again, there is no specific entry point to this rating, since it depends on investors’ dollar cost averages and risk appetite.

Bottom-fishing investors may also want to monitor the stock movement for a little longer before adding once the critical support level of $105s proves robust in the near term, since it may fail to break out of its upcoming resistance level of $125s.

Read the full article here

Leave a Reply