Commodities, as represented by the S&P GSCI, rose over 4% in September and 16% in Q3 2023. This highlighted the potential diversification qualities of this asset class, as equities and fixed income both fell during the month.

Commodities’ low correlations to other asset classes can provide a cushion when other higher-allocated asset classes drop during risk-off scenarios as was seen last month.

Adding commodities to a strategy tends to dampen overall portfolio risk and drawdowns over time. Historically, during periods of great macroeconomic shifts like we are experiencing now, a diversified portfolio has tended to perform better than more highly concentrated ones.

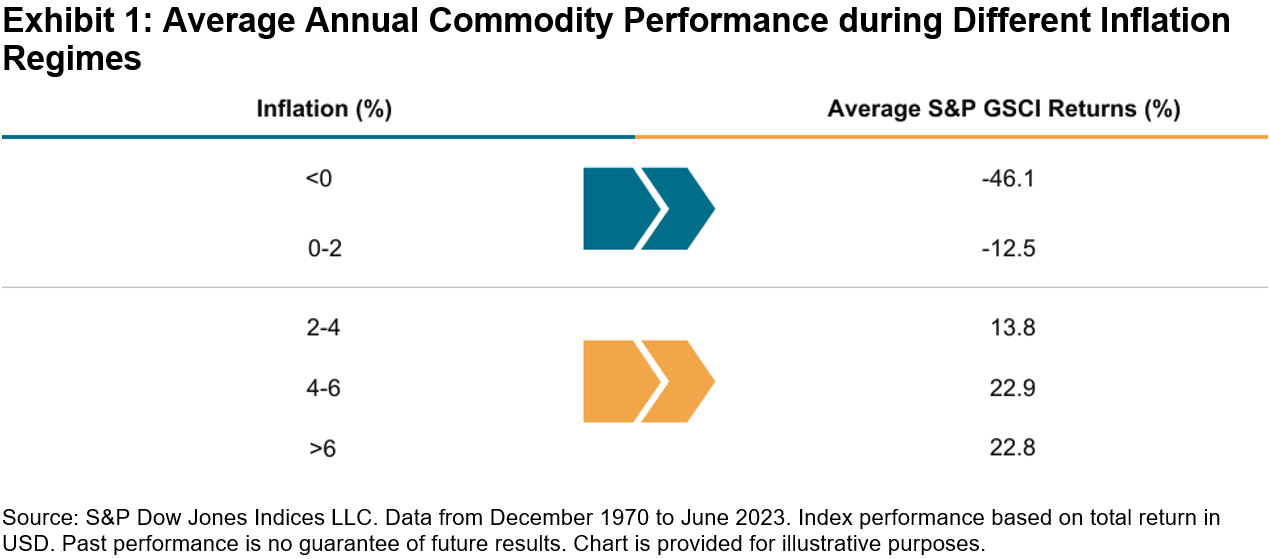

During periods of high and sticky inflation readings, commodities have provided a hedge when other asset classes tend to drop from higher input costs.

The main contributors to the outsized performance last month were the energy commodities. Supply cuts from Saudi Arabia and Russia were the strongest catalysts as demand persisted globally.

The headline S&P GSCI currently has a weight in energy commodities of over 60% due to its construction as a world production-weighted index.

Market participants replicating it as an inflation hedge witnessed higher returns recently in comparison to other comparable commodity indices, which tend to be more equally weighted.

Energy commodities tend to have the highest inflation beta or sensitivity to changes in inflation over time. Other commodities used in petroleum products such as sugar also rose by 5%, with its heavy use in ethanol in South America.

The S&P GSCI Industrial Metals rose 3.51% in the third quarter, with the five metals’ prices continuing to bounce back from tough first half 2023 performances.

Expectations for China’s economy to accelerate were never met, but stimulus measures are slowly being introduced. China tends to be the biggest contributor to metal demand and this has the potential to still be the case during the energy transition.

The International Energy Agency (IEA) updated its Net Zero Roadmap in September, when it said electricity is poised to emerge as the new oil of the global energy system.

Metal demand will likely pick up over time due to the use of certain industrial, precious and rare earth metals increasing by many times more across a wide span of clean energy technologies.

The S&P GSCI Agriculture fell 4.35% and the S&P GSCI Precious Metals fell 3.76% in the third quarter. Both sectors, along with most commodities, were hit by the headwind of a rising U.S. dollar.

For the agriculture commodities, lower soybean usage and surprisingly larger wheat production figures were reported in the latest USDA quarterly stocks report.

Within the precious metals, gold and silver both fell as real rates continued to rise.

Gold tends to be inversely correlated to real rates but this hasn’t been the case for most of 2023. Recent heavy central bank bullion buying may have been the reason for gold’s resilience so far in 2023.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply