It’s been a rough three month stretch for the restaurant industry group, which has slid 18% from its July highs, massively underperforming the S&P-500 (SPY)’s 8% drop. This violent decline in the AdvisorShares Restaurant ETF (EATZ) can be attributed to worries about Ozempic (NVO) affecting dining habits which remains to be seen, but the primary reason for the decline is the deceleration we’ve seen in industry-wide traffic, which has fallen off a cliff after barely treading water for most of the year. And unfortunately for Dine Brands (NYSE:DIN) investors, the stock has continued to underperform, suffering a ~50% drawdown from its 2021 highs and a ~24% drawdown since its July peak. In this update, we’ll dig into Q2 results, the outlook for Q3 and Q4, and whether the stock is approaching a low-risk buy zone after two years of underperformance.

IHOP Menu – Company Presentation

Q2 Results

Dine Brands released its Q2 results in Aug, reporting a deceleration in comparable sales trends, with Applebee’s down 1% year-over-year (Q1 2023: +6.1%), and IHOP up just 2.1% (Q1 2023: 8.7%) during a period of easy comparisons because of lapping Omicron. And while IHOP’s sales help up better with the help of menu innovation (Eggs Benedict, Crepes), the overall performance was below my expectations with another decline in traffic from Applebee’s despite leaning in heavy to promotions which could weigh on restaurant margins. Meanwhile, although the company noted that average weekly sales were above pre-pandemic levels at $54,000+ at Applebee’s, this is to be expected given menu pricing. Besides, the percentage of mix from off-premise (23%) is higher than pre-pandemic, which could be margin-dilutive given that restaurants will typically miss out on higher-margin drinks in a to-go setting.

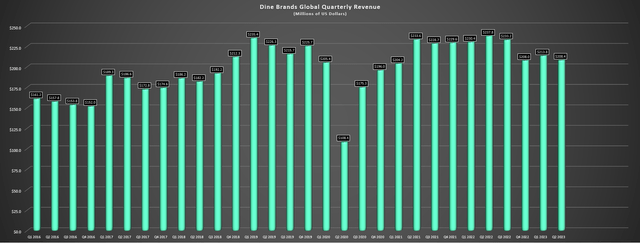

Dine Brands Quarterly Revenue – Company Filings, Author’s Chart

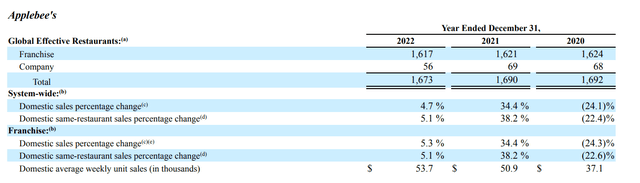

As for revenue, Dine Brands revenue slid by 12% year-over-year to $208.4 million, with this figure being a little noisy because of the re-franchising of 69 Applebee’s restaurants. The result was that total franchise revenues increased to $177.9 million vs. $168.3 million (including $3.6 million from the Fuzzy’s acquisition), but company-restaurant sales slid to $0.5 million vs. $39.5 million in the year-ago period. And from a net income standpoint, we saw a sharp decline to $18.2 million (Q2 2022: $24.0 million), primarily related to higher G&A and interest expense, with additional impact from the loss on extinguishment of debt and a loss on disposal of assets (IHOP Flip’d). As for adjusted earnings per share, it increased from $1.82 vs. $1.65, helped by a lower share count related to continued share buybacks. And on development, the company ended the period with fewer Applebee’s restaurants (1,661 vs. 1,673), offset by an increase in IHOP restaurants to 1,790 (Q2 2022: 1,764).

Adding to the disappointing news, investors saw Applebee’s previous outlook of 10-20 fewer restaurants in 2023 increased to 25-35 fewer restaurants this year. This mostly offset any net unit growth at IHOP and resulting in a lower store count than pre-COVID-19 levels despite the acquisition of fast-casual Mexican chain, Fuzzy’s Taco Shop. Meanwhile, its pancakes to go concept (Flip’d) was a flop, to say the least, taking one potential growth pillar away from the company’s plan to accelerate unit growth at its one growing concept, IHOP. On a positive note, Dine Brands shared it has landed a 20 restaurant development agreement with an existing IHOP franchisee for Fuzzy’s, which would translate to decent growth for this new brand under its umbrella.

Appleebee’s Store Count (2020-2022) – Company Filings

Overall, these results were quite disappointing, and the company shared that competition is leaning into promotions which could erode some of Applebee’s relative value that it strives to offer to ensure it can win guests. However, this commentary is even more alarming given that casual dining traffic has not improved and looks to have worsened in Q3, suggesting we could see even more promotions in the back half of the year that could impact Dine’s upcoming Q3 and further out Q4 results. And while the company noted that it has outperformed in past recessions at Applebee’s due to the value it offers to its guests, this playbook may not work as well after three years of unprecedented commodity inflation and sticky mid single digit wage inflation from a margin standpoint, potentially explaining why we’re seeing higher closures of underperforming restaurants and weak development metrics.

Industry Wide Trends

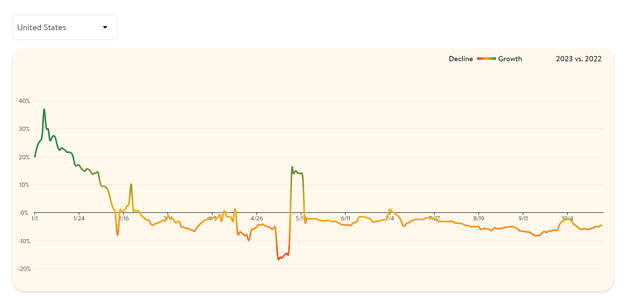

The Q2 results for Dine Brands were not inspiring (especially at Applebee’s), but a look at industry-wide traffic adds more reason for concern to a model that appears to be reaching to bring in traffic at any price (2 for $25 entrees, upgraded to including steak for a limited time). This is because if we look at the chart below, seated diners’ growth has continued to worsen on a year-over-year basis for restaurants in the United States. Meanwhile, October is off to an even worse start, suggesting little reprieve. However, perhaps the worst news is that quick-service restaurant traffic has fallen off a cliff as well, down sharply in August and September and plunging even further in October to mid single-digit traffic declines. Meanwhile, Darden (DRI) noted on its most recent call (fiscal Q1 2024) that it seeing some potential early signs of check management. Taken together, this suggests that consumers might finally be starting to feel the pinch, which is not ideal for a name like Dine Brands that is already struggling to grow traffic despite leaning into heavily on value and promotions.

Recent promotions at Applebee’s include free boneless wings appetizer for to-go purchases of $40+ on Halloween, all you can eat boneless wings (dine-in) at $12.99, limited-time 2 for $25.00 with steak entrees, and Dollaritas ($1 margaritas), plus $5.00 all you can eat pancakes at IHOP.

Seated Diners Growth – OpenTable

Given the traffic declines the industry is experiencing, it’s certainly possible that we could see even heavier promotional activity in the back half of the year, making it difficult to be optimistic about Dine Brands upcoming Q3 (November 1st) and Q4 results set to be reported early next year. This is because it’s hard for the company to lean in on promotions more than it already is, its relative value proposition may be less strong, and it’s possible that some consumers in the $50,000 household income bucket (roughly half of Dine Brands’ guests) may be dropping frequency at casual dining altogether with tighter wallets and menu prices that have soared over the past few years. And when things are tight to the point that consumers are tapped out, quick-service with the lowest average check might be the only option outside of dropping frequency and skipping a visit altogether.

To summarize, while it was difficult to be bullish about Dine Brands in early Q3 with traffic already rolling over which is why I took a small loss on the stock from my purchase at $56.00 for a small loss, it’s even more difficult to be optimistic with traffic worsening. And while it might be worth ignoring this difficult backdrop if the stock was priced at distressed levels, this is not the case currently, with Applebee’s still trading at over 18x EV/FCF and just shy of 10x EV/EBITDA. Let’s take a closer look below:

Valuation

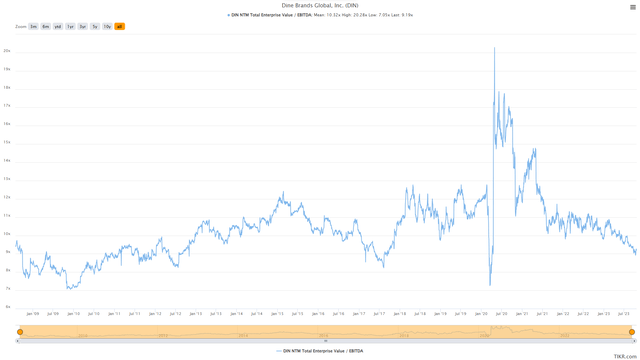

Based on ~15.6 million shares and a share price of $51.00, Dine Brands trades at a market cap of ~$800 million and an enterprise value of ~$2.25 billion. This leaves the stock trading at ~9.0x FY2024 EV/EBITDA estimates, making it one of the cheaper casual dining names in the market today. In fact, this leaves the stock at a discount to its historical multiple of ~10.3x. However, while this might be a very attractive valuation for a concept with growth, Dine Brands has struggled to grow, with its total restaurant count actually down from FY2020 levels despite the acquisition of Fuzzy’s Taco Shop. So, while I think that some franchised brands that are enjoying explosive growth like Wingstop (WING) can easily justify a multiple of 25.0x EV/EBITDA or higher, I don’t think this is the case for Applebee’s and the flop at Flip’d certainly doesn’t help which was previously expected to provide some incremental growth.

Dine Brands – EV/EBITDA Multiple – TIKR.com

Using what I believe to be a more conservative multiple of 8.5x EV/EBITDA for a low growth franchisor with a spotty track record like Dine Brands, FY2024 EBITDA estimates of $250 million and ~15.1 million shares, I see a fair value for the stock of $48.00. This suggests that while the stock may be down substantially from its highs, there isn’t any margin of safety in place yet, at least using more conservative multiples. So, while Dine Brands’ stock may be down over 50% from its highs and could put together a decent bounce if its Q3 results come in better than expected, I continue to see far more attractive bets elsewhere in the market. Plus, I prefer having a minimum 20% discount to fair value to justify starting new positions in franchisors (and ideally closer to 30% for low-growth and lower capitalization names), and even applying a 20% discount, Dine Brands would need to decline below $38.40 to offer a meaningful margin of safety for investment.

Summary

Dine Brands lowered its development outlook for Applebee’s in Q2 and while the company may have grown net units at IHOP, it’s been a disappointing year overall with the Flip’d shutdown, which was initially discussed as a big part of accelerating unit growth at IHOP. Meanwhile, although DIN has moved to a ~100% franchisor model, its comp sales results left much to be desired with negative same-store sales at Applebee’s and low single-digit comp sales growth at IHOP. And if these results were what can be delivered in a soft quarter for industry-wide traffic, things could get worse in Q3/Q4, with there being clear evidence of traffic falling off a cliff in multiple restaurant segments (casual dining and fast food). So, while DIN may be more reasonably valued, I don’t see any clear path to a re-rating for the stock given the difficult macro environment, hence I think the better trade is waiting for a deeper correction to provide a margin of safety or focusing on better positioned names.

Read the full article here

Leave a Reply