Last time I wrote about Digital Realty Trust (NYSE:DLR) was back in May at $102 per share. I issued a BUY rating because the stock could provide a double-digit return from the dividend and FFO growth alone, with no need for multiple expansion.

Since the original article, the stock has returned about 15% and now trades at $117 per share. Additional earnings have also been released and the REIT (VNQ) sector overall has dropped by about 10%. Today I’d like to provide an update to my thesis.

Digital Realty Trust

DLR is a data center REIT which owns about 300 properties located mostly in North America (55%) and Europe (25%) with smaller exposure to other parts of the world (Asia and LATAM).

The company runs a business of leasing server capacity to major tech firms. The largest portion of tenants comes from Cloud (39%), followed by IT, Content, Financial, Network, and Enterprise all around 10-12%. Because these are primarily large firms, over 50% of tenants are investment grade companies, many of which are publicly traded. There is, however, slight concentration risk as 50% of revenues comes from just 20 tenants and the largest tenant accounts for over 10% of revenues.

Because most of DLR’s tenants are reputable companies, there’s low collection risk. Moreover, because the REIT operates in a capital-intensive and low-margin business, it’s quite unlikely that high-margin tech companies would want to build their own data center infrastructure and leave DLR. It makes sense for them to lease the server capacity and focus on their high value-add operations. This means that occupancy is likely to stay relatively high.

But there’s also a downside to the sector. Firstly, the upside for data centers is quite limited. This is because they’re in the middle of the supply chain between two high-margin players – the chipmakers on one side and tech software companies on the other side. As a result, DLR operates in a low-margin business. And the thing is that it also gets stuck with paying the entire maintenance CAPEX bill, which in case of data centers, is quite high.

A famous short-seller Jim Chanos even has a short thesis on the sector for this very reason. However, from what I’ve seen in the financial statements, I think his estimates of maintenance CAPEX of up to 150% of annual depreciation are vastly inflated.

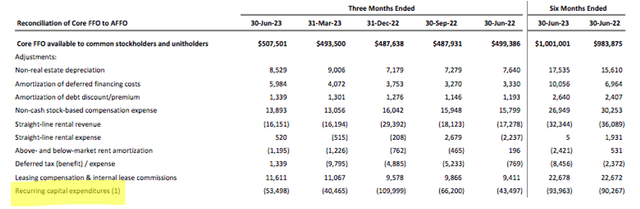

During the most recent quarter, reported maintenance CAPEX, which is called recurring capital expenditure below amounted to about 10% of Core FFO and about 13% of total depreciation and amortization. This is somewhat down from higher levels in Q3 and Q4 2022, but still less than 10 times what Jim Chanos estimates.

DLR Supplement

Nonetheless, one should take maintenance CAPEX seriously to air on the side of caution assume a higher percentage than what’s reported by management. To take this into consideration, I will lower the growth estimates that management guides towards.

Recent Results

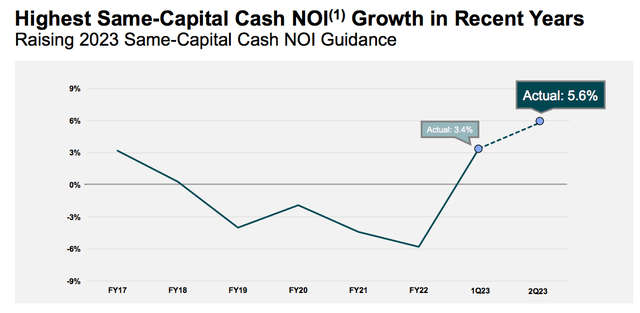

I find recent results quite reassuring as the REIT has seen the highest same-store cash NOI in many years of 5.6% YoY, driven by very high rent spreads on renegotiated leases of 14.6% (6.9% on a cash basis). I consider high rent spreads the best indication of demand for space and in the case of DLR it suggests that tenants have no intention of leaving the REIT.

DLR Presentation

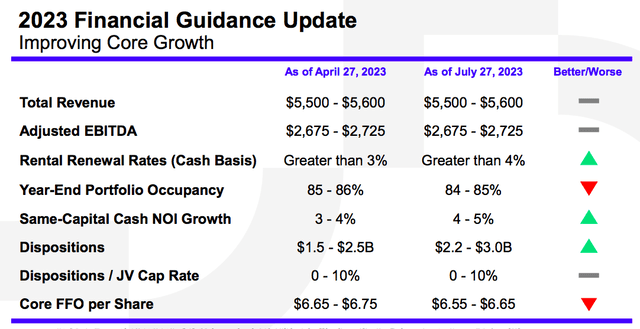

As a result of strong NOI growth, management has increased their full-year rent growth guidance from 3% to 4%. But they have also decreased their target occupancy by one percentage point, causing a slight 10-cent drop in the expected per share FFO. Currently, guidance calls for 2023 FFO of $6.55-6.65 per share, which would represent about 3% YoY growth. Beyond this year, consensus calls for 6% annual FFO growth in 2024 and 2025, but to stay conservative and leave more of a buffer for maintenance CAPEX, I will assume flat FFO until 2025.

DLR Presentation

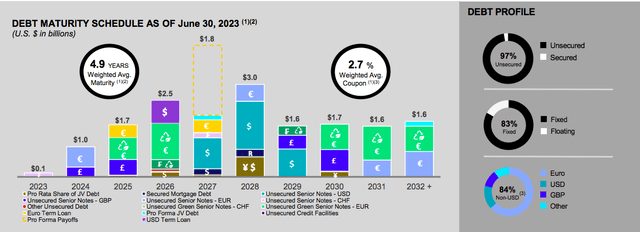

On the balance sheet side of things, DLR is doing quite well too. It has a BBB rating, a reasonable net debt/EBITDA of 6.3x, and a low average cost of debt of 2.7%.

Notably, the portion of fixed rate stands at just 6% if adjusted for the proceeds from recent forward equity sales agreements which will be used to repay the credit line. With a relatively low debt maturity next year, DLR’s interest rate risk should be well manageable.

DLR Presentation

Valuation

Assuming that management delivers on their FFO forecast, the stock trades at a forward P/FFO of 17.7x, which is actually slightly above the historical average of 16.7x. Assuming zero FFO growth for the foreseeable future implies a price target near today’s price or slightly below.

Of course, investors will also get a dividend that yields 4.1% and is well covered and therefore likely to continue.

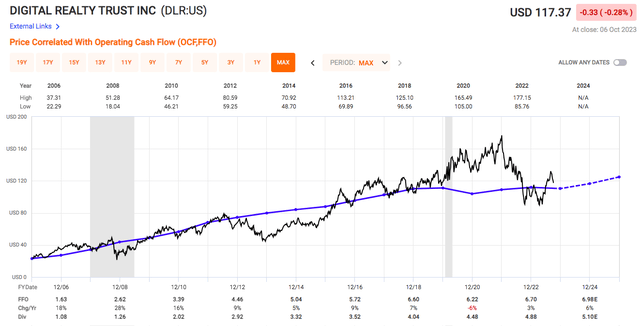

FAST Graphs

But the dividend alone isn’t enough to invest in the company. It all comes down to how conservative you want to be. Taking management’s numbers at value could easily add 5-6% per year to our return as their FFO grows, but if we use this to create a maintenance CAPEX reserve instead, the investment becomes uninteresting. Having earned 15% on the investment already, I’m inclined to take my profits and downgrade the stock to a HOLD here.

Read the full article here

Leave a Reply