The Credit Suisse High Yield Bond Fund (NYSE:DHY) is a little-followed closed-end fund that investors can use to generate a high level of income from the assets in their portfolios. This is evidenced by the fund’s current 9.79% yield, which is quite a bit higher than most other things in the market today. Indeed, it is substantially higher than the yield of any of the domestic fixed-income indices, which is not exactly atypical for a closed-end fund. The fund’s performance has not been particularly bad either, as it has significantly outperformed the Bloomberg U.S. Aggregate Bond Index (AGG) over the past year, although it has lagged behind the domestic junk bond index (HYG):

Seeking Alpha

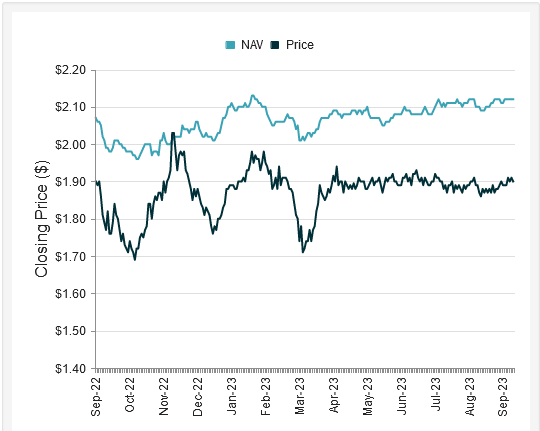

The fund has had somewhat more volatility than either of the indices though, which is also not surprising. We might blame this on the fact that this is a fund offered by Credit Suisse Asset Management, which was part of the Swiss banking giant before it failed alongside a few large domestic regional banks. Credit Suisse was merged into UBS (UBS) and the fund’s management transitioned to an entity affiliated with UBS. The fact that this fund’s share price declined right around the time that this event happened reinforces that statement. However, that did not really impact the fund’s portfolio, and in fact, the portfolio itself has been considerably outperforming the shares in the market:

CEF Connect

This makes a good argument that an income-focused value investor might want to consider purchasing up the fund’s shares today assuming that the distribution can be sustained going forward. Let us have a closer look at this fund and its financial performance and determine if this could be a reasonable way to generate a high level of income today.

About The Fund

According to the fund’s website, the Credit Suisse High Yield Bond Fund seeks to achieve an attractive return for its investors. Specifically, the webpage states:

The High Yield team seeks to deliver attractive returns from U.S. high yield bond markets to investors. The platform offers access to a deep team of credit professionals, including sector analysts covering over 1,000 corporate issues. The strategy aims to maximize total return from monetizing macroeconomic themes and exploiting sector and issuer performance and rating dispersion. The team’s proprietary credit ratings, trend outlook and spread volatility evaluation drive a disciplined portfolio construction process that has powered outperformance in the high yield bond asset class.

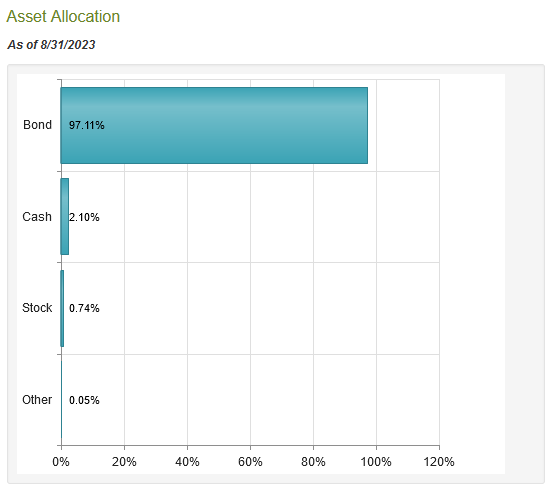

Once we strip away the marketing jargon from that strategy description and objective, we see that the Credit Suisse High Yield Bond Fund is a junk bond fund that attempts to provide an attractive level of total return for its investors. As such, we might expect that the fund’s portfolio will consist heavily of bonds and similar debt securities. This is certainly the case, as 97.11% of the fund’s assets are invested in bonds. The fund also maintains relatively small allocations to cash and common stock:

CEF Connect

The cash allocation is almost certainly for two purposes:

- Paying the distribution

- Providing liquidity in the event of an opportunity for investment

The first of these makes a great deal of sense. Basically, the fund keeps the coupon payments that it receives from the bonds in cash rather than deploying them immediately. This ensures that it is not forced to sell an asset to pay the distribution. The second makes a certain amount of sense too, as the fund would logically want to keep some money available to purchase an asset when a good opportunity presents itself. The common stock position is a little more confusing, but many closed-end bond funds maintain a small common stock position due to the fact that common stock has much more potential for capital gains than bonds. In this case, though, the common stock position is so small that it hardly matters in the grand scheme of things.

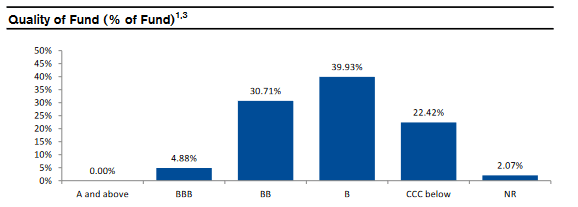

As mentioned, both in the name of the fund and its own description of the strategy, the fund invests primarily in the U.S. high-yield debt market. This refers specifically to the market of speculative-grade securities, which are colloquially known as “junk bonds.” We can see this quite clearly by looking at the credit ratings of the securities that comprise the fund’s portfolio. Here is the high-level summary that is provided by the fact sheet:

Fund Fact Sheet

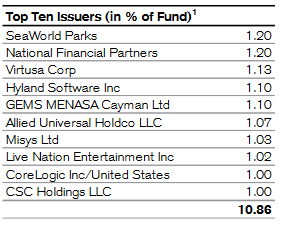

An investment-grade bond is anything rated BBB or higher by one of the major rating agencies. As we can clearly see, the fund only has 4.88% of its assets invested in such securities. The remainder of the fund’s assets are entirely invested in junk bonds. That is something that could be concerning to more risk-averse investors considering the high default risk that accompanies these securities. However, the fact that the fund is currently invested in securities from 222 issuers should alleviate the risks somewhat. After all, that ensures that each individual issuer only accounts for a very small percentage of the portfolio. In fact, right now the issuer whose securities comprise the largest percentage of the fund’s assets is SeaWorld Parks at 1.20% of the total:

Fund Fact Sheet

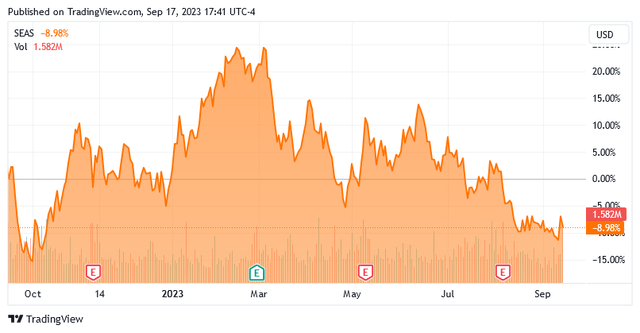

SeaWorld Parks (SEAS) has been at the center of controversy for quite some time, mostly from animal rights activists. Regardless of your opinion of their complaints, there could be some reason for concern about the company. After all, the business has been suffering from declining visitor numbers for a while. For its part, the company is blaming lousy weather and a lack of international visitors. It is also possible that this reduction is also being driven by consumers becoming increasingly financially strapped. I have discussed this in numerous recent articles and blog posts, such as this one. The stock price has been suffering too, as SeaWorld Entertainment shares are down 8.98% over the past year:

Seeking Alpha

SeaWorld Entertainment’s operating cash flows have been holding up reasonably well though, which should ensure that the company can continue to make its bond payments. However, SeaWorld Entertainment still only accounts for 1.20% of the portfolio. That is not nearly enough to have any real impact on the portfolio in aggregate. The same applies to every other company in the portfolio. Indeed, it would take something akin to a wave of defaults occurring all at once to really result in problems for investors here. If that were to happen, it is a pretty safe bet that the economy and the United States as a whole have far bigger problems than just a few investors losing some money.

Interest Rate Concerns

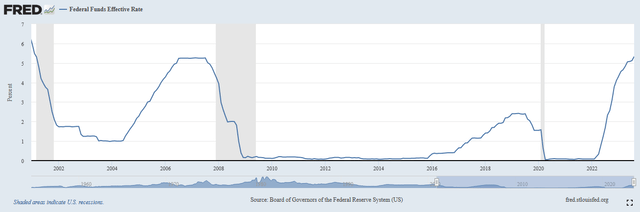

The real risk for investors here is interest rates. This is because bond prices typically decline when interest rates rise. This is the reason for the bond market’s decline over the past year. As mentioned in the introduction, the Bloomberg U.S. Aggregate Bond Index is down 3.45% over the past year. It is somewhat surprising that it has not declined more than this. As of the time of writing, the effective federal funds rate is at the highest level that has been seen since early 2001:

Federal Reserve Bank of St. Louis

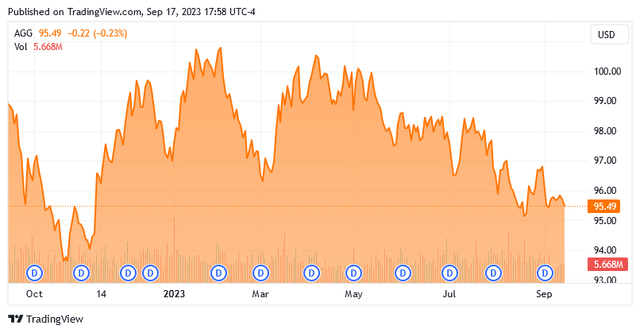

Curiously though, the Bloomberg U.S. Aggregate Bond Index is not at a level that reflects this. As we can see here, the index is actually higher than it was back in December:

Seeking Alpha

The only explanation for this is that the market expects that the Federal Reserve will cut rates in the near future. This conclusion is reinforced by the fact that both the five-year and the ten-year Treasury issues are at lower yields than the near-term securities:

|

Treasury Security |

Current Yield |

|

6-Mo. |

5.517% |

|

12-Mo. |

5.435% |

|

2-Yr. |

5.037% |

|

5-Yr. |

4.465% |

|

10-Yr. |

4.336% |

Nobody in their right mind would lock up their money for five years or ten years at these rates right now unless they expected rate cuts. After all, if the market believed Chairman Powell’s statements about “higher for longer,” then it would make more sense to simply stick your money in a money market fund or some sort of floating-rate security than a ten-year Treasury at 4.336%. The fact that the one-year Treasury is trading at a lower yield than the six-month Treasury indicates that the market thinks that the rate cuts will come in the very near term.

I think that there is a huge risk that the market is wrong here. After all, the Federal Reserve continues to state that it is committed to its 2% inflation rate target. Inflation has begun to trend up, including core inflation. This breaks the trend that analysts and economists were cheering over the first half of this year. If the Federal Reserve does indeed remain committed to keeping rates at today’s level, or even higher, until inflation comes down, then it could cause bond prices to fall significantly. That would have an adverse effect on the price of the Credit Suisse High Yield Bond Fund.

Performance Analysis

Perhaps surprisingly, junk bonds have held up surprisingly well in the rising rate environment. Over the past year, the Markit iBoxx Liquid High Yield Index (HYG) has outperformed the Bloomberg U.S. Aggregate Bond Index, by quite a lot:

Seeking Alpha

This is very confusing when we consider that junk bonds are issued by companies with much weaker balance sheets than investment-grade companies. As such, they should be more impacted by rising rates than investment-grade companies because an increase in interest expenses will strain their limited cash flow and push these companies into financial distress much more rapidly than an investment-grade company. Indeed, Fitch expects junk bond defaults to rise over the course of this year.

As the Credit Suisse High Yield Bond Fund invests nearly exclusively in high-yield issues, that index is a better point of comparison for it than the aggregate bond index. Unfortunately, the fund has underperformed the index on a share price basis over the past year:

Seeking Alpha

We can see that this fund was much more volatile than the index. As mentioned in the introduction, one reason for this was undoubtedly the problems that Credit Suisse had, which ultimately led to its takeover by UBS. However, that does not really affect the fund besides the need for it to switch managers. The fund’s leverage may have played a role too, which we will discuss later.

The fund has a significantly higher yield than the index, however. This is important because distributions are every bit as important for determining the performance of an investment as its price action in the market. It is more important that we look at total return than price performance. In this respect, the Credit Suisse High Yield Bond Fund does incredibly well. It actually managed to beat the index over the past twelve months:

Seeking Alpha

This performance difference becomes even more pronounced when we look at longer periods of time. The performance difference between the fund and the index is very substantial over the past ten years:

Seeking Alpha

There is no time period of one year or longer over which the Credit Suisse fund underperforms the index on a total return basis. Thus, any long-term investor would have been better off purchasing the Credit Suisse High Yield Bond Fund than purchasing the junk bond index.

It is important to keep in mind that past performance is no guarantee of future results. However, it does appear that anyone who is interested in acquiring a position in a junk bond fund would be better off with this fund than with an index fund. The big concern here is that junk bonds in general may be overvalued right now, for the reasons that we already discussed. As such, it may be a good idea to be cautious right now.

Leverage

As just mentioned, the Credit Suisse High Yield Bond Fund employs leverage as a method of boosting its effective yield and total return. I explained how this works in a previous article:

In short, the fund borrows money and then uses that borrowed money to purchase bonds or other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund needs to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the levered assets of the Credit Suisse High Yield Bond Fund comprise 31.37% of its assets, so it satisfies that one-third requirement that was just specified. As such, the risk-reward tradeoff appears to be reasonable here. We should not need to worry too much about the risks that are associated with the fund’s leverage.

Distribution Analysis

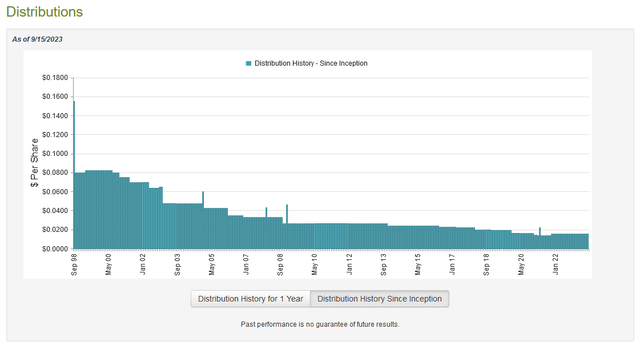

As mentioned earlier in this article, the Credit Suisse High Yield Bond Fund seeks to achieve a high level of return for its investors. In order to achieve this objective, the fund invests its assets into a portfolio of junk bonds. These bonds deliver the overwhelming majority of their total investment return in the form of direct payments made to the investors. Due to their risks, these securities tend to have incredibly high yields. The fund then applies a layer of leverage to boost the effective yield of the portfolio. The fund collects these payments and distributes them to the shareholders, net of expenses. As such, we can expect that it will have a very high yield itself. That is certainly the case, as the fund currently pays a monthly distribution of $0.0155 per share ($0.186 per share annually), which gives it a 9.79% yield at the current share price. Unfortunately, the fund’s distributions have not been particularly consistent over the years:

CEF Connect

As we can clearly see, the fund’s distribution has generally been declining since the late 1990s, although the fund did increase it in November 2021. This is, interestingly, one of the few fixed-income closed-end funds that has not cut its distribution over the past twelve months in response to the Federal Reserve’s switch to a quantitative tightening policy. Indeed, the fund has kept its distribution stable.

Despite the recent consistency, the fund’s long-term history means that this fund will probably not appeal to those investors who are seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. However, it is important to keep in mind that anyone purchasing the fund’s shares today will receive the current distribution at the current yield. They will not be negatively impacted by events that occurred in the past. As such, the most important thing right now is the fund’s ability to sustain its distribution at the current level. Let us investigate this.

Fortunately, we have a fairly recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. This document should give us a good idea of how well the fund was able to take advantage of the strong market for bonds in the first few months of this year to generate some trading profits. In addition, it should give us an idea of how well it weathered the weakness in November and December of 2022.

During the six-month period that ended on April 30, 2023, the Credit Suisse High Yield Bond Fund received $12,785,891 in interest along with $31,073 of securities lending income. These two combined sources of income gave the fund a total investment income of $12,816,964 during the six-month period. The fund paid its expenses out of this amount, which left it with $8,767,315 available for shareholders. Unfortunately, this was not enough to cover the $9,626,777 that the fund actually paid out during the period, although it did manage to get pretty close. Nevertheless, the fund still failed to fully cover its distribution with net investment income. This is concerning as we generally like a fixed-income fund to fully finance its distribution out of net investment income.

With that said, the fund may have been able to obtain money through other means that can be distributed to investors. For example, it might have had some profits from exploiting fluctuations in bond prices. The fund actually had mixed success at this task. It reported net realized losses of $14,047,981 but these were more than offset by net unrealized gains of $24,316,327 during the period. In total, the fund’s net assets went up by $9,408,884 over the six-month period. This is a good sign as the fund did manage to pay for its distribution, even though net unrealized gains are not necessarily permanent. When we consider how strong the junk bond market is right now, the fund has probably managed to continue to deliver a reasonably strong performance, so we probably do not need to worry about a distribution cut, at least for a while.

Valuation

As of September 14, 2023 (the most recent date for which data is currently available), the Credit Suisse High Yield Bond Fund has a net asset value of $2.12 per share but the shares currently trade for $1.8845 each. This gives the fund’s shares an 11.11% discount on net asset value. This is a very large discount, which is in line with the 11.32% discount that the shares have had on average over the past month. Thus, the current price looks very reasonable.

Conclusion

In conclusion, the Credit Suisse High Yield Bond Fund appears to be a very solid and well-diversified junk bond fund. While investing in junk bonds may be somewhat concerning to some investors, this fund appears to be managing the risks well and should be relatively insulated against individual issuer defaults. The big risk here is that junk bonds in general look to be very overpriced when considering the likely trajectory of interest rates and the economy. As such, more risk-averse investors might want to avoid anything related to junk bonds, including this fund. However, for an investor that can stomach the risk, this fund historically has outperformed the junk bond index and might be a decent way to play the sector long-term.

Read the full article here

Leave a Reply