I’ve maintained throughout 2023 that we’re in a big bull market and that investors should want exposure to growth to maximize returns. That’s worked pretty well this year, as the Nasdaq is up better than 40%, while value-oriented indices – like for dividend stocks – are up much less. That’s what happens during raging bull markets, which is what we’ve seen in 2023.

It is my belief that the current bout of selling that started in July – and has the likelihood of extending through at least part of this month – is just the pause that refreshes. That means that you still want to be exposed to growth for the last part of the year, and not value-oriented sectors like dividend stocks.

Speaking of dividend stocks, in this article, we’ll take a look at iShares Core Dividend Growth ETF, better known as DGRO. It’s an exchange-traded product that is made up of hundreds of high-quality dividend stocks, and while there’s a time and a place for such a product, the end of 2023 is not that time and place.

What is DGRO?

Let’s start with what DGRO is to get grounded on why I’m not a fan at the moment. To be clear, DGRO is a terrific example of a dividend exchange-traded product, so my beef is not with the construction of it or its execution against its goals. I’m simply making the case that this is the wrong place to be, so whether it’s an excellent product or not doesn’t really make any difference in this case.

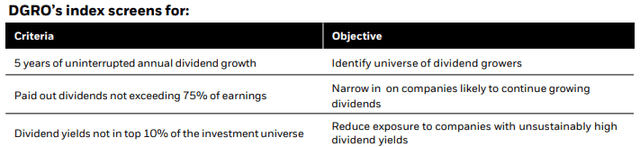

Fund website

You can see in the screening criteria that DGRO seeks out only the best of the best in terms of sustainable dividend growth. The fund highlights sustainable payouts, a history of strong dividend growth, and avoiding those stocks with unreasonably high yields. When combined, these criteria leave only the best dividend stocks, so again, for a dividend fund, DGRO is hitting all the marks.

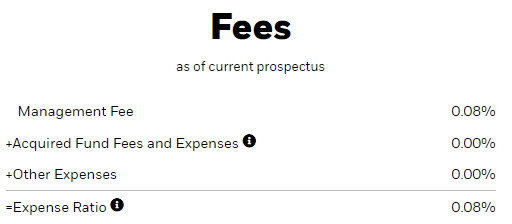

Fund website

That includes cost, which is rock-bottom at just eight basis points annually. It’s almost free, which the fund manager can offer because it has tens of billions of dollars in assets. It’s a great example of a dividend stock fund, full stop.

Let’s now turn our attention to sector exposure, because this really hammers home why you don’t want funds like DGRO during bull markets.

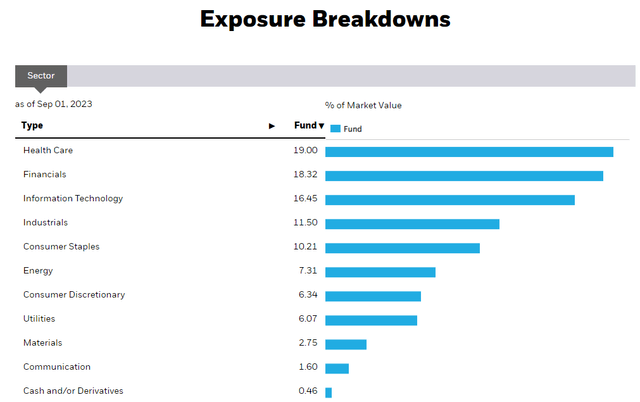

Fund website

The top two sectors – healthcare and financials – as well as the fourth and fifth sectors are all defensive in nature. In other words, during bear markets and consolidations, sectors like staples, industrials, financials, and healthcare tend to outperform. These are sectors with generally lower growth rates, generally less economic sensitivity, and of course, dividends. During weak markets, these are exactly where you want to be. The reason is because sectors like communication, consumer discretionary, and technology tend to suffer more than others during these weak periods.

The flip side of that is during bull markets, communication, technology, and consumer discretionary outperform, which is what has happened in 2023.

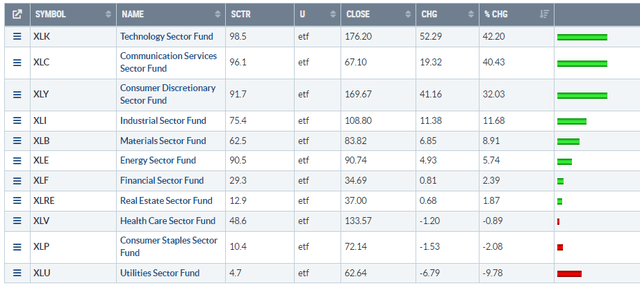

StockCharts

Look at the leaderboard for this year from a sector perspective; the biggest exposure areas for DGRO – with the exception of technology – litter the bottom of this list. Why would you want to own the bottom of the leaderboard? The point of all of this is that I think this bull market is far from done, so I’m not sure the 2024 leaderboard will look much different than this, barring some sort of unforeseen shock. That means DGRO is set to underperform even more than it already has. It’s not too late to get your allocation right for this bull market.

There is one caveat from a technical perspective, which we’ll take a look at now.

Bullish seasonality

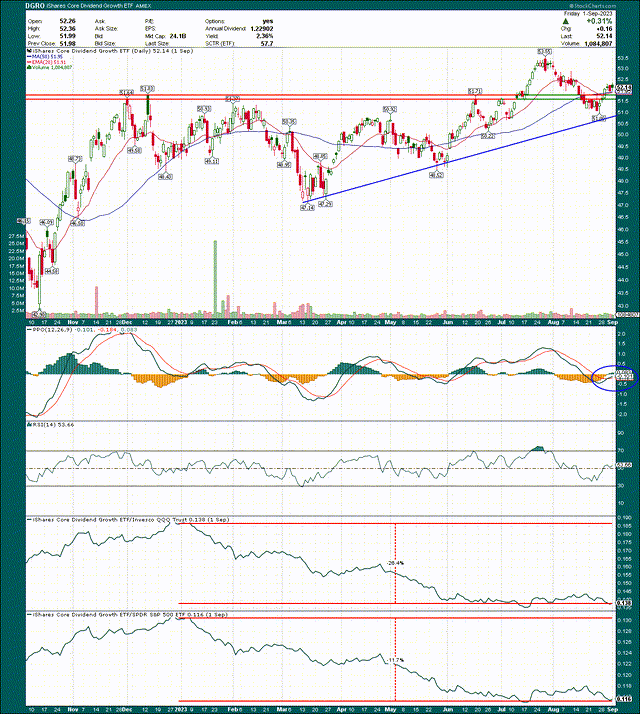

Let’s have a look at the chart, which shows some bullishness heading into September, which we all know is a very weak month for stocks in general.

StockCharts

I drew in an ascending triangle that began late last year and saw DGRO recently break out higher. There was a slight breakdown in the past couple of weeks, but you can see DGRO bounced right back above the breakout level of $51 and change. It’s back above the moving averages as well, so there’s some cause for optimism here. The PPO, which is my preferred momentum gauge, looks great as well as it bounces off the centerline.

In the bottom two panels, we see the massive underperformance of DGRO against both the S&P 500 and the Nasdaq 100. That’s what we want to avoid as a 2% yield is useless when you underperform by 20% or 30%.

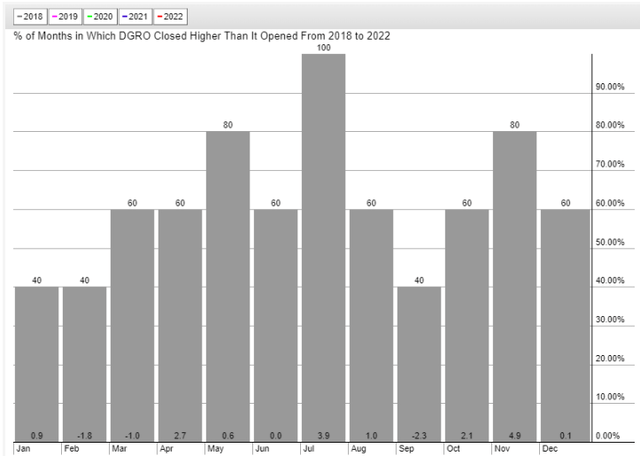

One final technical note here before we move on to risk-free rates, and that’s seasonality. I mentioned September is weak for stocks, and that’s true even for DGRO.

StockCharts

The past five years have seen only two Septembers end higher and have averaged an annualized decline of 2.3%. That’s obviously not a disaster, but October and November are much better at a combined +7% annualized return. In other words, September doesn’t look amazing, but DGRO is likely to end the year higher than it is now. That’s true of all major indices, however, and I still think you’re better off elsewhere and more exposed to growth.

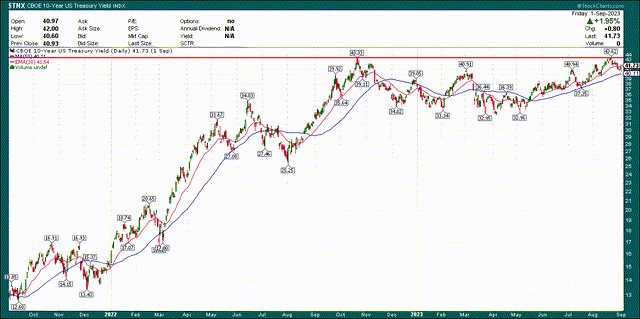

There Is Now (an) Alternative

One last point that I think is pretty major here is that for many, many years, risk-free rates were extremely low, meaning the value of dividend stocks was relatively higher. Now, we’re looking at investors being able to allocate their capital into treasuries for 4%+ yields, tax-free and risk-free. DGRO yields 2.4% and carries with it the inherent risk and taxation of equities. The old There Is No Alternative, or TINA, is out the window with dividend stocks. Now, I see it as There is Now (an) Alternative. Investors can get twice the yield (roughly) with no taxes and essentially no risk.

StockCharts

The one caveat is that the yield is very near its highs. What happens in the next few weeks will be critical in terms of whether we get a breakout higher, or whether we get a double top. It’s mixed right now in terms of the technical view, so I’m not willing to take a position on this one at the moment. But the point is unless we see a huge breakdown in yields, treasuries will still be much more attractive from a yield perspective than dividend stocks. For the 10-year pictured above, there’s a gap of roughly 170 basis points between it and DGRO’s yield, excluding the taxation and risk factors that also point to treasuries being the better buy for income.

The bottom line

With that in mind, as well as the sector allocation of DGRO, I don’t think this is the place your money should be. I know there are die-hard dividend investors that will ignore every piece of evidence here and hold funds like DGRO, and that’s fine. However, the point around underperforming by 10% or 20% or 30% is real, and the 2% yield is no consolation, as far as I’m concerned.

For that reason, if you own DGRO, it’s not too late to get out and allocate for the bull market that isn’t yet done. When signs the bull market is ending appear, you can reallocate to DGRO, but for now, you want to be elsewhere. I’m putting a sell on DGRO, not because I think it will fall in absolute terms (because I don’t), but because on a relative basis, returns are going to continue to be negative against virtually any benchmark you can throw at it.

Read the full article here

Leave a Reply