Devon Energy Corporation (NYSE:DVN) is scheduled to report its third-quarter or FQ3 earnings release on November 7 (post-market) as investors assessed its recent downward volatility. I last updated DVN holders in early August, urging them to consider buying DVN’s accumulation phase as DVN was no longer assessed to be overvalued.

However, the stock of the leading energy E&P play has disappointed, as sellers have rejected further buying advances since then. A further breakdown in DVN price action has occurred, resulting in the re-test of its $44 critical support level, behooving caution.

While a bear trap (false downside breakdown) remains a distinct possibility, I’m more skeptical about its outperformance moving ahead against its sector (XLE) peers. Accordingly, XLE/DVN has moved into a significant uptrend bias, normalizing its underperformance since it bottomed out resoundingly in late 2022.

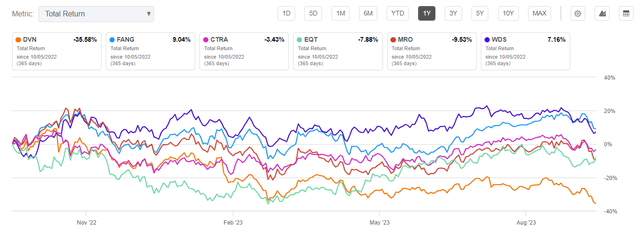

DVN 1Y total return Vs. peers (%) (Seeking Alpha)

DVN’s underperformance isn’t limited to its XLE peers but also relative to its E&P peers, as highlighted by Seeking Alpha in the peers’ comparison analysis above. Accordingly, DVN’s total return over the past year has lagged markedly, registering nearly -36%. However, DVN has performed relatively well over a 10Y basis, posting a 10Y total return CAGR of about 6.8%.

Therefore, I believe investors sitting on significant gains on DVN have likely rotated out into less expensive and higher-conviction E&P plays, notwithstanding Devon’s high-quality Delaware basin acreage and cash flow generation.

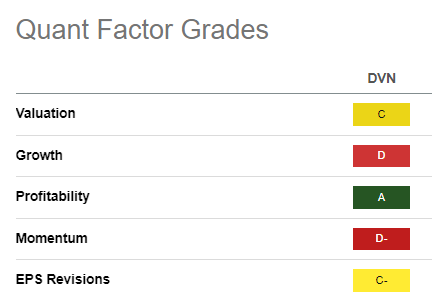

DVN Quant Grades (Seeking Alpha)

After outperforming its sector peers in 2022, a period of relative underperformance and growth normalization shouldn’t surprise holders. Devon Energy is still expected to post robust profitability, as seen by its best-in-class “A” profitability grade.

However, earnings outperformance has proved challenging as energy markets normalized, as DVN received a “C-” earnings revisions grade from Seeking Alpha Quant.

Notably, DVN failed to participate in the recent resurgence in the energy market, which saw crude oil prices (CL1:COM) (CO1:COM) lifted to highs last seen in November 2022 before a steep pullback this week. In addition, natural gas (NG1:COM) prices have also surged, reaching levels last seen in late January 2023. Despite that, DVN buyers didn’t return, allowing sellers to digest its gains further, breaking down below its technically important $44 support zone.

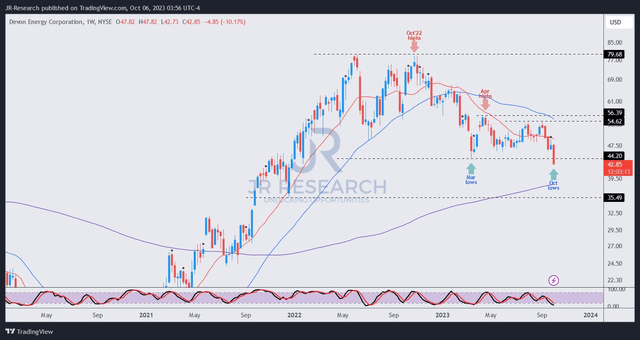

DVN price chart (weekly) (TradingView)

As seen above, DVN buyers need to hold the $44 level to validate DVN’s recovery from its lows since March 2023. While a bear trap potential remains possible after the technical selling subsides, I believe the risk/reward looks less attractive.

With a valuation grade of “C,” DVN still isn’t in the deep value zone that could attract value-conscious investors to return despite its highly profitable business model.

If buyers don’t return and hold the $44 level firmly, I anticipate that DVN’s medium-term downtrend bias will reassert itself, suggesting a fall toward the $35 level is possible. It might bottom out close to the 200-week moving average or MA (purple line), attracting long-term buyers to return more aggressively.

Takeaway

Devon Energy is a leading oil and gas producer with high-quality and low-cost assets predicated on its market leadership in the Delaware Basin. Its multi-basin portfolio has helped Devon Energy post remarkable results in 2022. However, DVN has failed to participate in the recent surge in underlying energy prices, continuing its relative underperformance against its sector and E&P peers over the past year.

While I believe that DVN is no longer overvalued, sellers remain in control and could exert further downside pressure if buyers fail to hold the $44 level with a bear trap reversal.

As such, although I’m not bearish on DVN, I believe caution is necessary as we await more clarity on DVN’s market action.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply