Devon Energy Corporation (NYSE:DVN) showcased a strong growth trajectory, marked by a significant increase in net earnings in Q3 2023. This impressive performance stems from a disciplined operating strategy and sound financial management, highlighted by a notable increase in free cash flow and effective debt reduction. This piece provides an analysis of Devon Energy’s financial health from Q3 2023 earnings and includes a technical stock price analysis for potential investment opportunities. The assessment indicates that the stock price is currently undergoing consolidation at a significant support zone, indicating the formation of a strong base.

Strategic Financial Growth in Q3 2023

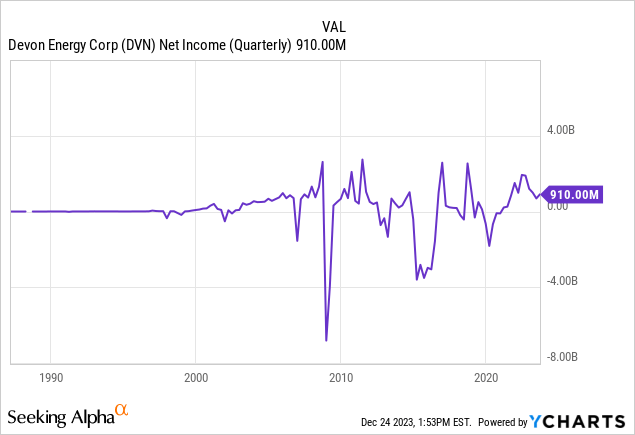

Devon Energy’s Q3 2023 earnings report reveals a strong growth path driven by a disciplined operating strategy, as highlighted by CEO Rick Muncrief. The quarter was marked by a notable financial improvement, with net earnings reaching $910 million, translating to $1.42 per diluted share. The core earnings reached $1.1 billion, or $1.65 per diluted share, a remarkable 40% increase from the previous quarter. This financial strength is further reflected in the company’s operating cash flow, which totaled $1.7 billion.

A standout feature of the quarter was the remarkable increase in free cash flow, which saw a significant jump, more than doubling from the previous quarter to reach $843 million. This was achieved with a capital reinvestment rate of 52% of cash flow. Devon’s financial prudence is evident in its debt management strategies; the company retired $242 million in outstanding debt and simultaneously boosted its cash reserves by $273 million, bringing the total cash to $761 million. These maneuvers have reduced the company’s outstanding debt to $6.2 billion, bringing the net debt-to-EBITDAX ratio to 0.7 times.

Regarding capital distribution, Devon Energy’s solid performance in the third quarter facilitated a substantial dividend hike for its shareholders. The company declared a fixed-plus-variable dividend of $0.77 per share, marking a 57% hike from the second quarter. Additionally, through its $3.0 billion share repurchase program, Devon has significantly returned capital to shareholders, repurchasing about 40 million shares for $2.1 billion, indicating a potential 9% reduction in outstanding share count.

Operationally, the quarter was active with 24 drilling rigs and 5 completion crews, leading to 81 gross operated wells going online. Production robustly grew despite a 12% reduction in capital spending compared to the previous quarter, primarily due to scaled-back activities in the Delaware Basin. The company recorded an average production of 665,000 oil-equivalent barrels daily, an 8% year-over-year increase. The Delaware Basin remained a key driver of this performance, contributing 66% of the total output. Notably, 59 gross operated wells in this basin achieved an average 30-day production rate of 3,000 Boe per day, highlighting a more than 20% improvement in well productivity. The quarter also saw an 18% quarter-over-quarter expansion in field-level cash margins to $34.73 per Boe, aided by low production costs of $12.37 per Boe and favorable commodity prices.

I believe Devon Energy’s Q3 2023 has been a financial and operational success. The company’s strategic decisions in managing capital, debt, and shareholder returns have positioned it as a resilient and growth-oriented player in the energy sector. With its efficient operational activities and increased production, Devon Energy is a robust example of sound corporate management and financial health in a dynamic industry in my view.

Exploring the Long-Term Technical Trends

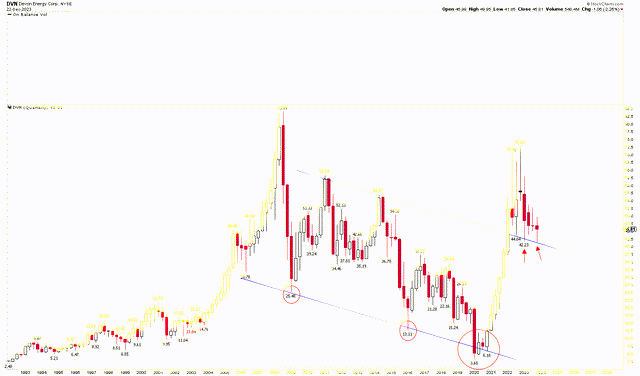

Devon Energy’s quarterly chart displays a strongly bullish trend characterized by steady increases in its stock price. This trend is evident from the company’s stock price history, which hit a low of $3.60 in 2020 and then witnessed a considerable rise. The chart, with its solid quarterly candlestick patterns, vividly shows this ascending trajectory, culminating in the stock reaching a high of $72.68 in October 2022.

The price drop in 2020 was primarily influenced by the global downturn in the energy sector due to the COVID-19 pandemic, which significantly reduced demand for oil and gas. This downturn was exacerbated by an oversupply in the global oil market, further depressing prices. However, the strong rally in the stock price to $72.68 by October 2022 was attributed to a confluence of factors. Firstly, the gradual easing of pandemic-related restrictions led to a rebound in global economic activities, thereby increasing energy demand. Secondly, Devon Energy’s strategic decisions, including mergers and acquisitions, notably its merger with WPX Energy, significantly enhanced its production capabilities and operational efficiencies. Additionally, the company’s commitment to capital discipline and shareholder-friendly policies, such as implementing a “fixed plus variable” dividend strategy, was crucial in attracting investor interest. This recovery was also part of a broader resurgence in the energy sector, buoyed by rising oil prices amidst global supply concerns and geopolitical tensions.

DVN Quarterly Chart (StockCharts.com)

The impressive surge in the stock price in 2021 breached the blue channel and signaled a robust bullish pattern on the long-term charts. Following its peak at $72.68 in October 2022, the stock underwent a correction, descending to the support level of the blue channel. At this support, the quarterly candles displayed extended wicks, indicative of strong bullish sentiment in this support area. These lengthy shadows on the candles suggest a potential rebound from these levels.

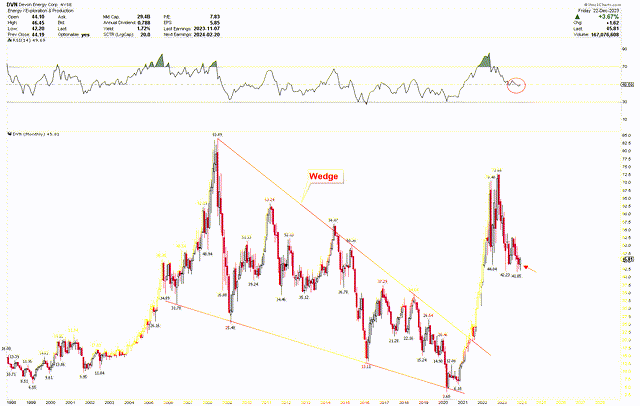

Delving deeper into the bullish momentum, the monthly chart below reveals a wedge pattern that developed from 2008 to 2020. This pattern was decisively breached in 2021, leading to a vigorous price rally. The breakout from this wedge points to a target of $83.89, representing the all-time high for Devon Energy. Such price behavior suggests that the robust rally starting from the 2020 low is likely not over and is anticipated to extend further, potentially reaching new record highs. Additionally, the RSI has stabilized around the mid-level of 50, consolidating in this area. This consolidation further reinforces the bullish outlook prevalent in the market.

DVN Monthly Chart (StockCharts.com)

Key Action for Investors

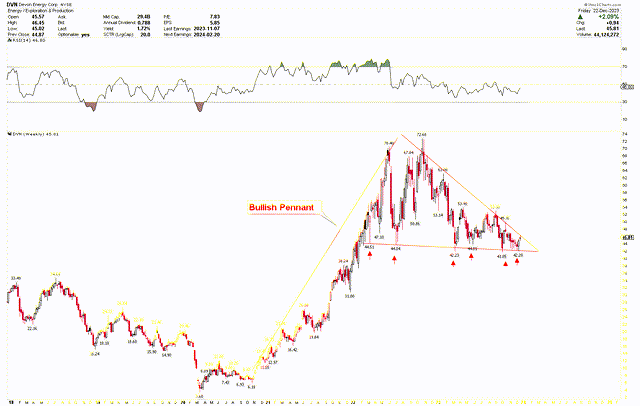

Based on the above analysis, the stock price of Devon Energy is exhibiting a long-term bullish trend, with recent consolidations underscoring robust support levels. Interestingly, the weekly chart reveals a pronounced bullish momentum, evident in the formation of a bullish pennant. The pennant’s flagpole extends from the 2020 low at $3.60 to the October 2022 peak of $72.68, indicating significant growth. The price appears to culminate within this bullish pennant, suggesting that a breakout could trigger a substantial rally. To confirm an upward break from this pattern, a weekly close above $53 is necessary.

Investors may consider buying Devon Energy shares at the present level, anticipating a potential robust rally ahead.

DVN Weekly Chart (StockCharts.com)

Market Risk

A primary risk for Devon Energy is the volatility of oil and gas prices. Many factors, including geopolitical events, global supply and demand dynamics, and macroeconomic trends, influence these prices. While Devon Energy has shown a strong growth trajectory and operational efficiency, its profitability remains significantly exposed to fluctuations in commodity prices. The energy market’s inherent volatility, exacerbated by ongoing geopolitical tensions and the global transition towards renewable energy sources, could impact Devon Energy’s revenue and earnings. The stock price is presently positioned within a bullish pennant formation, and a decline below the $40 mark would signal an increased likelihood of further downward movement.

Devon Energy also faces substantial regulatory and environmental risks. The global shift towards greener energy sources and the tightening of environmental regulations could pose challenges for the company. The increasing focus on reducing carbon emissions and transitioning to sustainable energy sources may lead to stricter fossil fuel extraction and usage regulations. This could result in increased operational costs, potential fines, or the need for significant investment in cleaner technologies. Moreover, environmental risks such as spills or accidents could have financial implications and damage the company’s reputation.

Devon Energy’s operational risks include those associated with exploration and production activities. The technical challenges and uncertainties in drilling and maintaining wells can impact production volumes and costs. Additionally, as a player in a global market, Devon Energy faces geopolitical risks. Political instability in oil-rich regions can disrupt supply chains and affect global oil prices. The company’s ability to navigate these risks effectively will be critical in maintaining its growth and financial stability.

Bottom Line

Devon Energy has demonstrated a remarkable growth trajectory in Q3 2023, underpinned by significant increases in net earnings and a disciplined approach to operations and financial management. The company’s strategic focus has yielded a substantial rise in free cash flow and a commendable reduction in debt, positioning it as a resilient and forward-looking entity in the energy sector. The robust operational performance, as evidenced by increased production and effective cost management, combined with wise financial strategies, such as prudent capital reinvestment and shareholder-friendly policies, have been key to this success. Devon’s ability to sustain and grow dividends, alongside a significant share repurchase program, signals a strong commitment to shareholder value.

Technically, the stock price of Devon Energy exhibits a long-term bullish trend, supported by a consolidation phase at significant support levels. The analysis of historical price movements and chart patterns indicates potential for continued upward momentum, with the stock showing signs of forming a base for future growth. The formation of a bullish pennant pattern suggests a higher likelihood of a solid bottom being established, potentially leading to a robust rally from these levels. Investors may consider buying the stock at its current price in anticipation of a significant upward movement.

Read the full article here

Leave a Reply