Denali Therapeutics Inc. (NASDAQ:DNLI) is a clinical-stage biotech developing neurodegenerative disease therapies. The company’s main value driver is its brain delivery platform, which uses a biomarker-driven drug development approach. DNLI’s proprietary Transport Vehicle [TV] technology overcomes the typical limitations of delivering medications across the blood-brain barrier [BBB]. This way, DNLI can provide the brain with therapeutic molecules for conditions like MPS II, Alzheimer’s, Parkinson’s, and other neurodegenerative illnesses. This is a valuable IP that uniquely positions DNLI in neurodegenerative applications. I believe DNLI has enough resources to eventually reach a potential FDA approval on at least one of its drug candidates. Thus, I deem it a good DCA “buy” for investors who understand the inherent biotech risks.

Biotech Delivery Platform: Business Overview

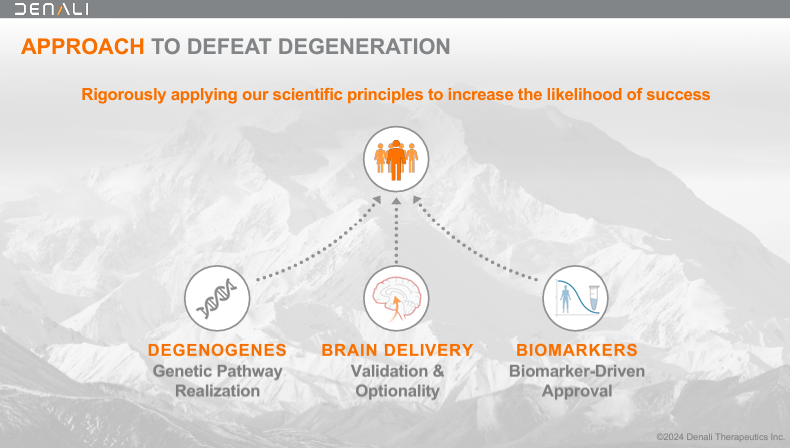

Denali Therapeutics Inc., founded in 2015, is a biotechnology company based in South San Francisco, California. DNLI develops therapies for neurodegenerative conditions using a threefold strategy: 1) brain delivery, 2) leveraging genetic pathway potential, and 3) biomarker-driven drug development. DNLI concentrates on genetic pathways in chronic neurodegenerative conditions to develop targeted molecular therapies. The company accomplishes this through its proprietary TV platform.

Source: Corporate Presentation. August 2024.

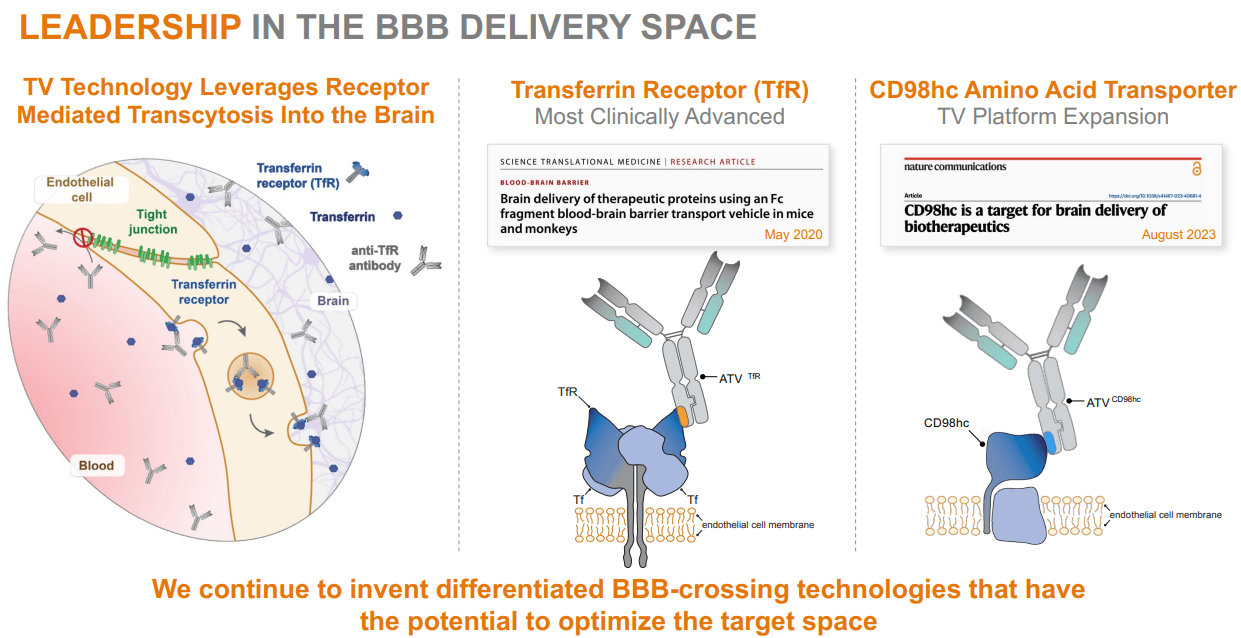

Therefore, DNLI’s brain delivery strategy uses its TV platform through intravenous administration. This delivers large therapeutic molecules, such as antibodies, enzymes, and oligonucleotides, across the Blood-Brain Barrier [BBB]. The BBB is a protective barrier that blocks most substances from entering the brain. DNLI’s TV technology facilitates the transport of various therapeutic molecules, including enzymes, antibodies, and oligonucleotides, across the BBB for therapeutic effects on neurodegenerative diseases. Its Fc domain molecules then bind to specific transport receptors on the BBB and move from the bloodstream into the brain.

Source: Corporate Presentation. August 2024.

The unique aspect of DNLI is that it can take its engineered molecules across the BBB, distributing them effectively into the brain. This way, DNLI can target key disease pathways, including lysosomal functions, glial biology, and cellular homeostasis. Moreover, DNLI uses biomarkers in its early research, patient selection, and dosage decisions. Biomarkers are key because they help categorize patients into phenotypes, ensuring optimal patient populations for trials. This way, DNLI maximizes its chances of meeting clinical endpoints, which is vital for obtaining regulatory approval.

Leading Product Candidates

One of DNLI’s leading drug candidates is DNL343 for ALS. It’s worth highlighting that the ALS market is projected to reach $1.3 billion by 2029, mostly due to earlier diagnosis and intervention. ALS is a progressive neurodegenerative condition affecting motor neurons, leading to muscle weakness and paralysis. Currently, there are six approved treatments for ALS, the most recent being Biogen’s (BIIB) Qalsody, which costs $14,230 per dose. Nevertheless, DNLI’s DNL343 is a promising small molecule that activates eIF2B. This activation regulates cellular protein synthesis, which reduces cellular stress and slows down motor neuron death in ALS.

In theory, DNLI could carve out a niche in ALS. Its action mechanism differs from Biogen’s Qalsody, which targets the SOD1 gene rather than eIF2B. DNLI estimates that DNL343 for ALS could reach peak sales of $1 billion to $5 billion, but I’m somewhat skeptical. First, the ALS market doesn’t appear as big, nor is DNL343 the only available treatment. For instance, AbbVie’s (ABBV) ABBV-CLS-7262 also targets elF2B, and it’s a much better-capitalized competitor.

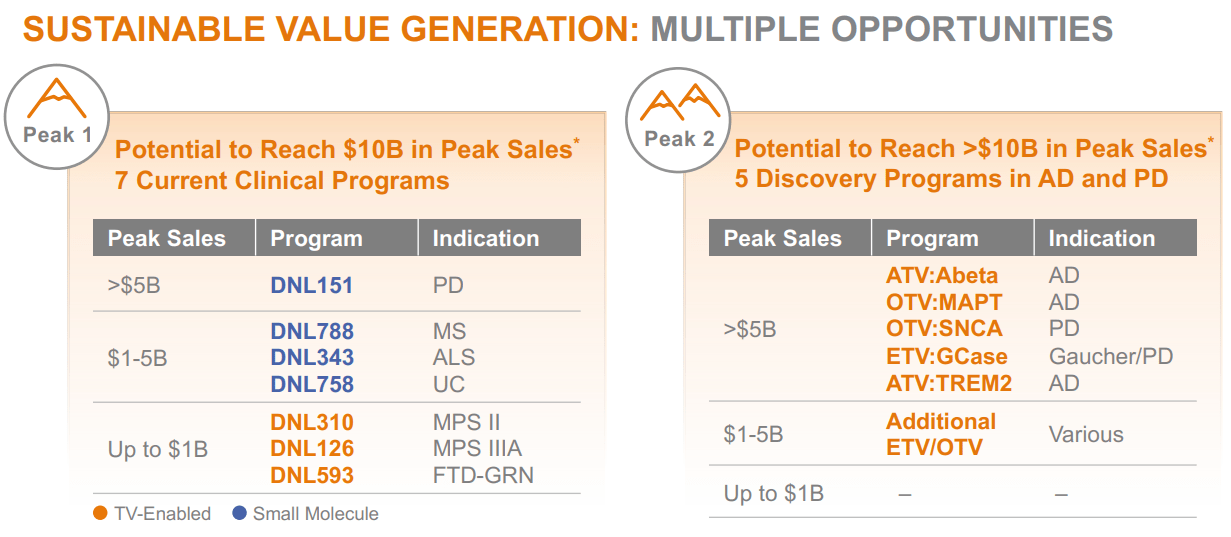

Source: Corporate Presentation. August 2024.

However, in August 2024, DNLI’s corporate presentation highlighted that DNL343 isn’t its only promising drug candidate. Its clinical-stage drug portfolio also has DNL151 for Parkinson’s Disease [PD], which is estimated to have potential peak sales of over $5 billion, contingent on being successfully developed and commercialized. Likewise, DNL788 targets multiple sclerosis [MS], with forecasted peak sales at about $1 billion to $5 billion. Finally, DNL310 for MPS II, DNL126 for MPS IIIA, and DNL593 for FTD-GRN could each generate up to $1 billion in sales.

Value Driver: Transport Technologies

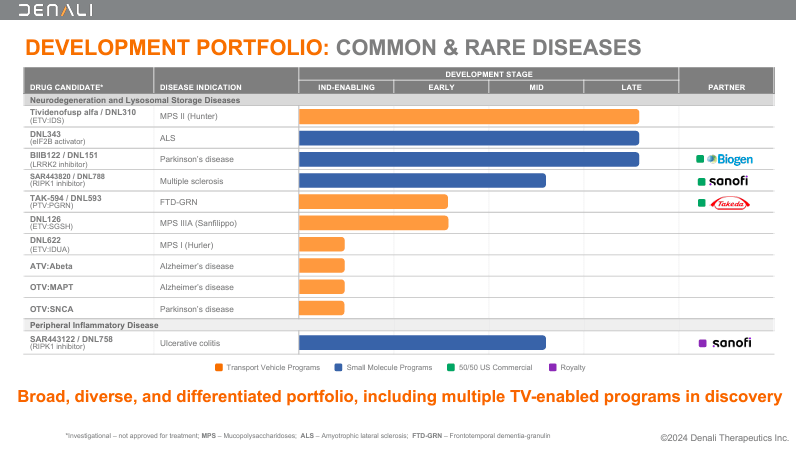

Nevertheless, the common theme among these drug candidates is that they leverage DNLI’s transport technologies. In fact, DNLI has secured partnerships using its proprietary platform. For instance, SAR443820, or DNL788, is in mid-stage clinical development in collaboration with Sanofi. DNL788 acts as a Receptor-Interacting Protein Kinase 1 (RIPK1) inhibitor, which addresses inflammatory and neurodegenerative conditions like MS. MS is a chronic autoimmune disease that causes neurological damage as the immune system attacks the myelin sheath of nerves. By inhibiting RIPK1, DNL788 reduces inflammation and protects nerve cells, halting MS progression.

Source: Corporate Presentation. August 2024.

Similarly, DNLI’s Peripheral Inflammatory Disease program includes SAR443122 or DNL758. DNL758 is also a RIPK1 inhibitor developed with Sanofi that targets the inflammatory processes in UC. UC is a chronic bowel disease that causes inflammation and ulcers in the colon and rectum. Thus, DNL758 attempts to reduce the damage caused by UC. Likewise, DNL151 was developed with Biogen as a Leucine-Rich Repeat Kinase 2 (LRRK2) inhibitor. DNL151 is indicated for PD because it inhibits the LRRK2 protein linked to dopamine neuron degeneration.

DNLI’s proprietary platform also works for rare genetic diseases. For instance, DNL126 is an early-stage drug for Mucopolysaccharidosis IIIA (MPS IIIA), also known as Sanfilippo syndrome type A. Here, DNLI uses its Enzyme Transport Vehicle [ETV] technology to deliver the deficient enzyme N-sulfoglucosamine sulfohydrolase [SGSH] directly to the brain. On the other hand, DNL593 targets Frontotemporal Dementia [FTD] by increasing progranulin levels, slowing disease progression. DNL593 uses the company’s Protein Transport Vehicle [PTV] technology to deliver therapeutic proteins across the BBB. Likewise, DNLI has other variations of its transport technology, such as DNL622, which targets beta-amyloid (Abeta) proteins responsible for plaque formation in AD patients. DNL622 targets beta-amyloid proteins linked to plaque formation in AD. DNL622 is also potentially useful because it targets alpha-synuclein in AD and PD.

Fairly Valued: Valuation Analysis

From a valuation perspective, DNLI trades at a $3.3 billion valuation, making it a mid-sized biotech in its sector. Its balance sheet shows $74.7 million in cash and equivalents and $821.4 million in short-term investments. This totals $896.0 million in available short-term liquidity with no financial debt and only $115.5 million in total liabilities. Its book value stands at $1.4 billion, implying a P/B multiple of 2.4, which aligns with its sector’s median P/B of 2.4.

Moreover, I estimate DNLI’s latest quarterly cash burn at $96.0 million, calculated by adding its CFOs and Net CAPEX. This indicates a relatively healthy cash runway of 2.3 years. It’s worth mentioning that Q2 2024 wasn’t an outlier quarter, and DNLI has been consistently burning its cash at a similar rate for the past several quarters. Evidently, DNLI seems to be aggressively investing in pushing forward its research.

Source: Corporate Presentation. August 2024.

In my view, DNLI’s advanced transport technologies are flexible, enabling application across a wide range of potential indications. This flexibility opens the door to partnerships and potential revenues from royalties or milestone payments. While the technology is promising, drug approvals are still a year or more away, even under the most optimistic assumptions. Thus, DNLI is indeed racing against the clock, but I lean bullish on the stock due to its reasonable valuation and uniquely disruptive TV platform.

Investment Caveats: Risk Analysis

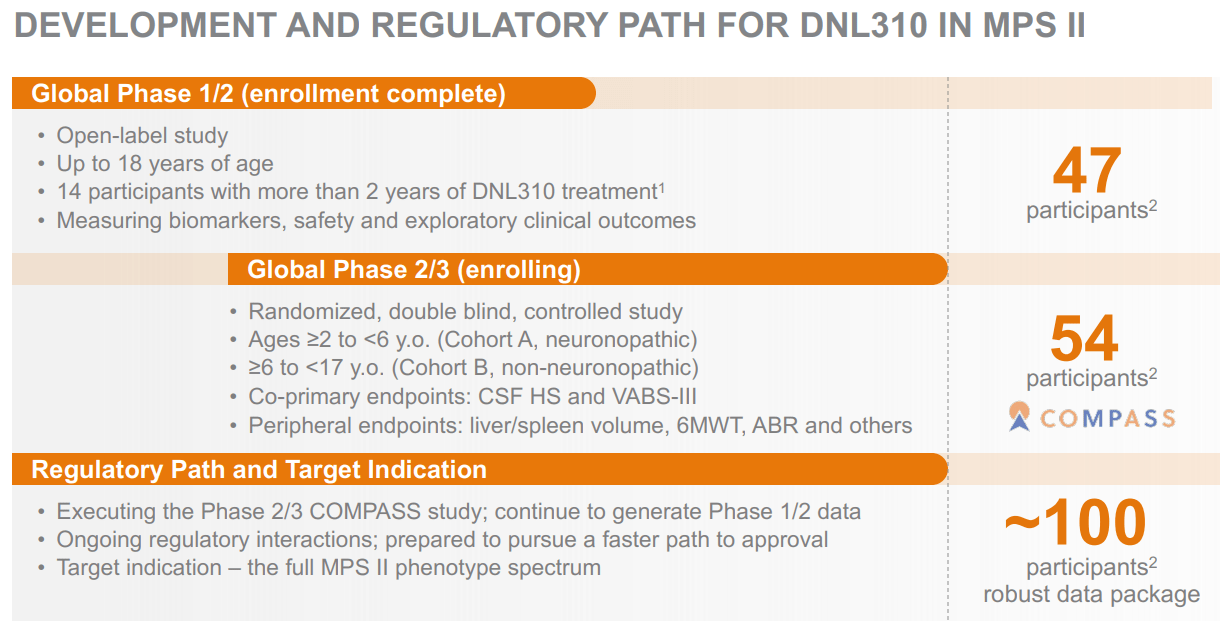

I think DNLI’s investment thesis mostly hinges on its platform’s potential. If the company fails to convince regulators that it’s safe and effective, essentially all of its IP would suffer. Moreover, even if one of its drug candidates reaches approval, it would still face considerable competition. For example, DNL310 for MPS II is one of DNLI’s leading drug candidates due to its promising initial data. Also, DNL310 has a relatively solid competitive profile, as the standard MPS II enzyme replacement therapies don’t cross the BBB.

However, REGENXBIO (RGNX) has an adeno-associated virus [AAV] vector in clinical trials, which could compete with DNL310. I believe DNL310’s prospects are probably superior, but the point is that it’s unlikely it would become the new standard of care immediately. Unfortunately, we can’t dismiss the fact that clinical-stage biotech is often a game against time, such as cash reserves running out. At the same time, DNLI’s platform is clearly applicable across several possible CNS indications.

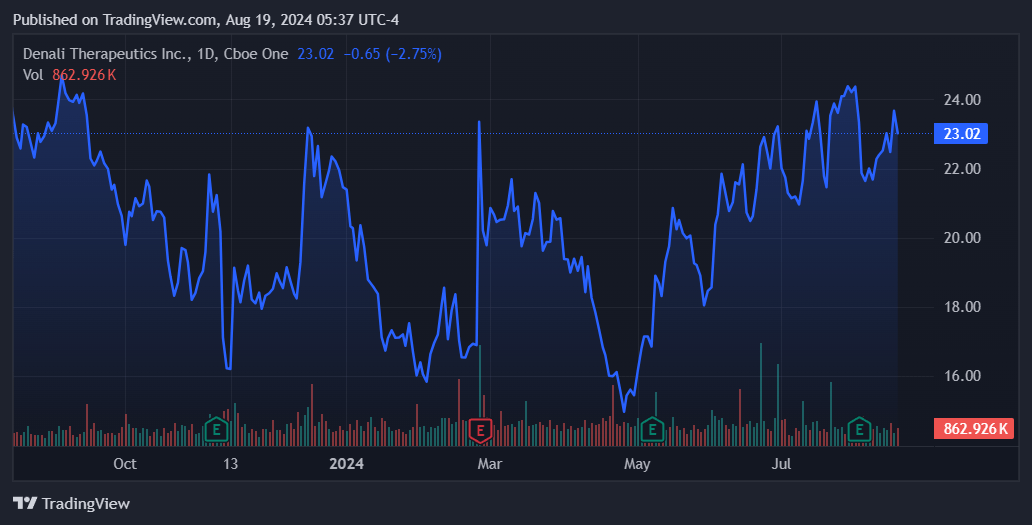

Source: TradingView.

This makes pricing DNLI tricky because, on one side, there’s a potentially disruptive biotechnology platform with wide-ranging applications. On the other hand, there are still no product sales, and the cash burn remains relatively high. Nevertheless, I lean towards a bullish rating due to its unique technology platform, especially after its $500 million raise, corroborating institutional investors’ belief in its technology. With such enormous backing, DNLI has enough resources to prove its research on at least one of its several promising drug candidates. I believe a single drug approval would derisk DNLI considerably, as it would also validate its platform as a whole.

DCA Buy: Conclusion

Overall, DNLI is mostly a bet on its promising TV platform. However, DNLI is not a short-term bet, and I think there will likely be many pullbacks until it has an approved drug. So, I wouldn’t advise buying your entire position at once. Instead, I suggest a measured DCA strategy for DNLI. Over time, I believe its research will deliver, but investors must be prepared for a bumpy ride, mainly due to its relatively high cash burn. Thus, a DCA approach will give investors a stake in its upside potential without overcommitting to a stock that might trade sideways until it gets a clear path to approval on one of its several drug candidates. However, once DNLI obtains approval for one of them, it can completely change its risk profile and validate its technology. Since I think DNLI has enough resources to do this, I believe it’s fair to rate it a good DCA “buy” for investors who understand the inherent biotech risks.

Read the full article here

Leave a Reply