Introduction

It’s time to talk about aerospace, an industry that accounts for roughly a fifth of my entire net worth.

On September 8, I wrote an article titled “My New Investment – Why I’m Betting Big On GE Aerospace.” As the title gives away, I explained why I made GE Aerospace (GE) my fifth investment in the aerospace & defense industry.

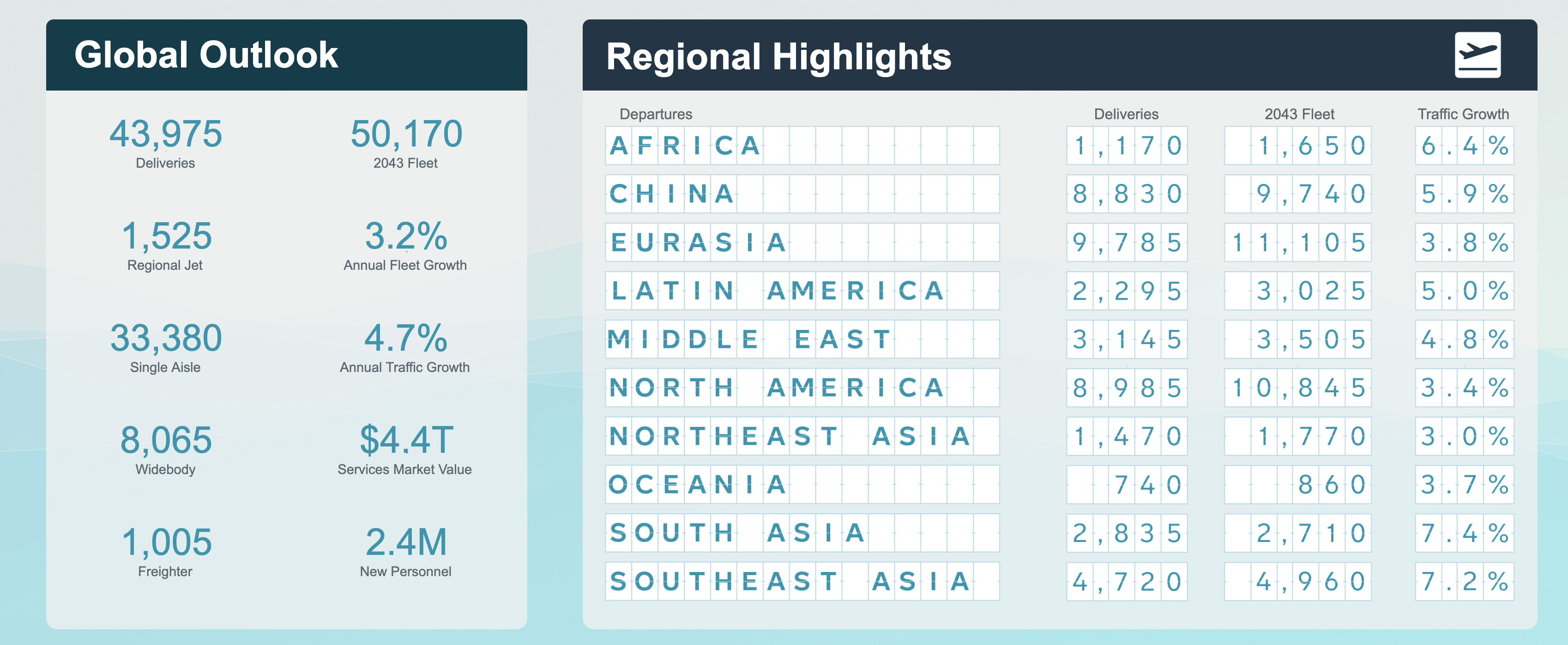

I am bringing this up because I spent the first part of that article explaining why (commercial) aerospace has been doing so well and why I expect this to last. This included the table below, which is based on expectations from The Boeing Company (NYSE:BA) (NEOE:BA:CA), the star of this article.

Through 2042, the aerospace giant expects annual traffic to grow by 4.7%, potentially causing the global fleet to grow by 3.2% per year. Moreover, while emerging markets like Africa, China, Latin America, and South (east) Asia are expected to see outperforming growth, even mature markets like Eurasia and North America are expected to see strong traffic growth.

Boeing

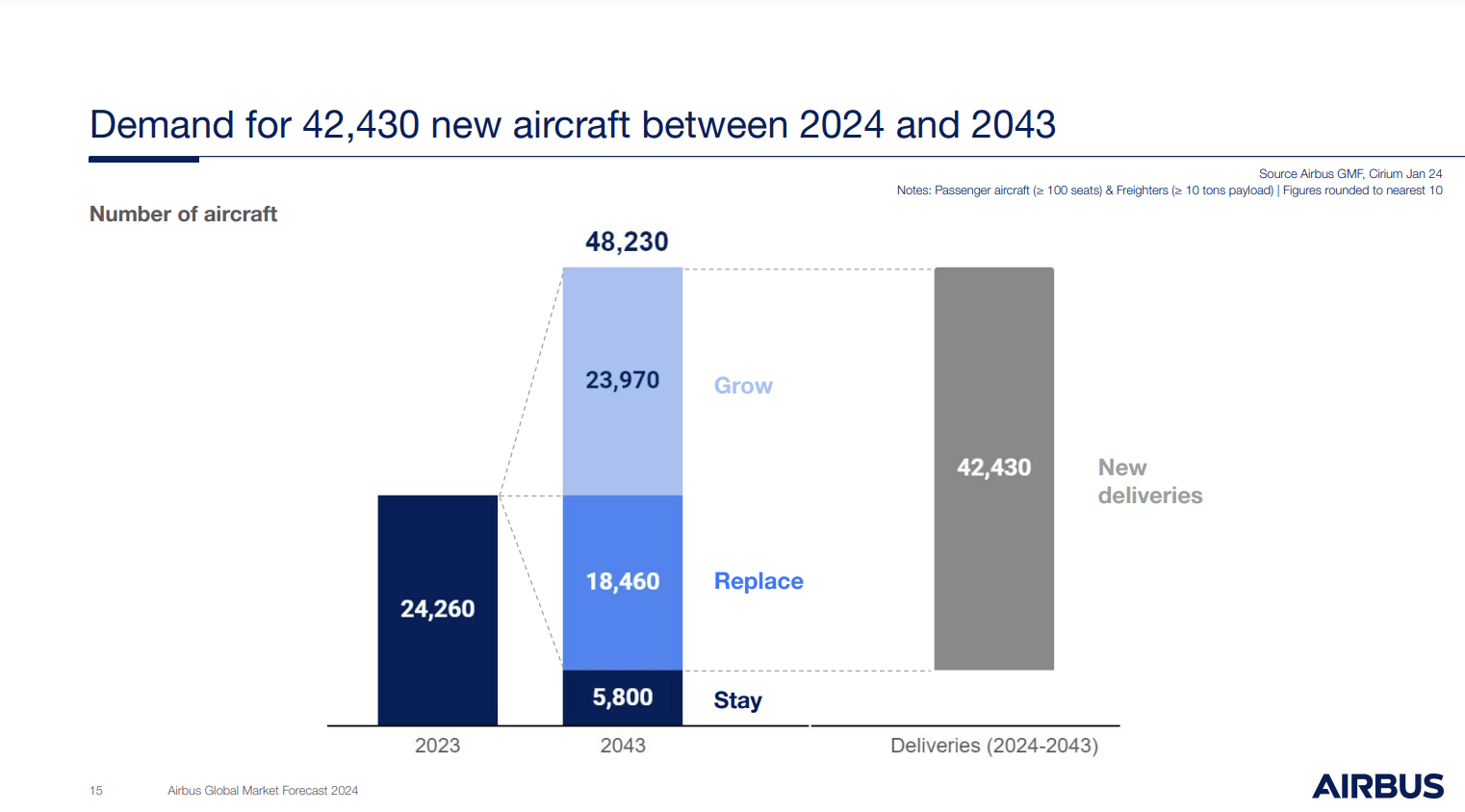

Airbus (OTCPK:EADSF) agrees with these numbers, as it expects more than 42 thousand new aircraft deliveries during this timeframe – roughly 50% of which are expected to be additions to fleets instead of replacement models.

Fewer than 6 thousand units of the current global fleet of 24,260 (as of 2023) are expected to be in service by 2043.

Airbus

Even if the actual numbers in 2044 are slightly below the forecast, it is very clear that the world will need a lot of new aircraft.

As one can imagine, this is great news for companies producing aircraft. Right now, that market is dominated by Airbus and Boeing. Essentially, these two companies own the entire market of commercial aircraft (long haul and short haul, excluding smaller regional planes).

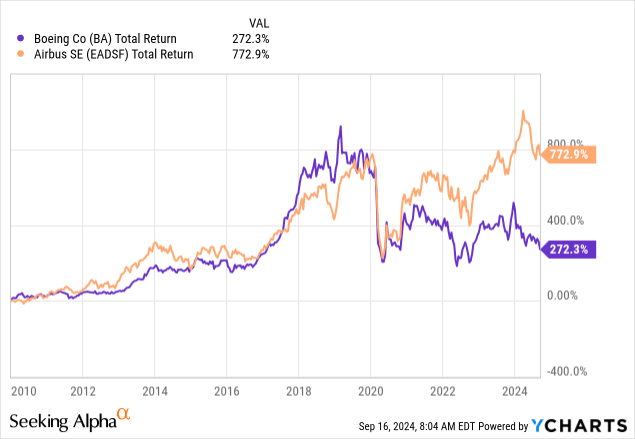

Between January 2010 and early 2020, both Boeing and Airbus returned roughly 800% (including dividends) on the stock market, which is an absolutely stunning number, as it turned every $1,000 into $8,000.

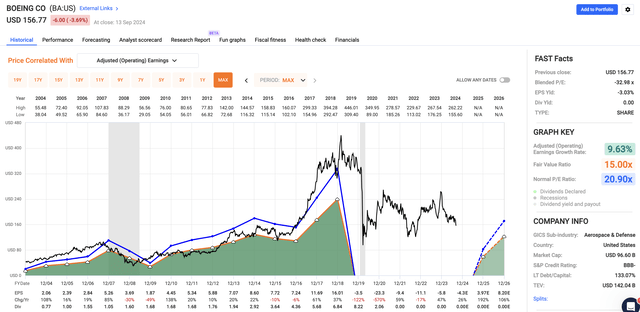

Unfortunately, the pandemic wasn’t the only headwind facing Boeing and Airbus. As the chart above shows, Boeing has lost its way since then. It is now trading where it traded roughly ten years ago, making the past ten years a lost decade – despite strong secular growth tailwinds!

Needless to say, we don’t have to go over this again. Since 2019, countless articles have been written on Boeing’s many issues, including its 737 MAX problems, delays in its 777X program, and general quality issues.

My most recent article on the company was written on June 27, when I went with the title “Boeing: Despite Serious Issues: I Am Maintaining My Strong Buy Rating.” Since then, shares have fallen by 14%, pressured by a number of developments that we’ll discuss in this article:

- A new labor strike.

- Warnings from rating agencies.

Moreover, since then, the company has reported its 2Q24 earnings and presented at the Morgan Stanley Laguna Conference on September 13.

In other words, there’s a lot of new food for thought, as I will use this article to reassess the risk/reward of what is now an airplane producer with a sub-$100 billion market cap.

In general, I believe being aware of what’s going on at Boeing is important for everyone with aerospace exposure, as it’s one of the biggest customers of every major supplier on the market.

So, let’s dive into the details!

About Strikes & Credit Risks

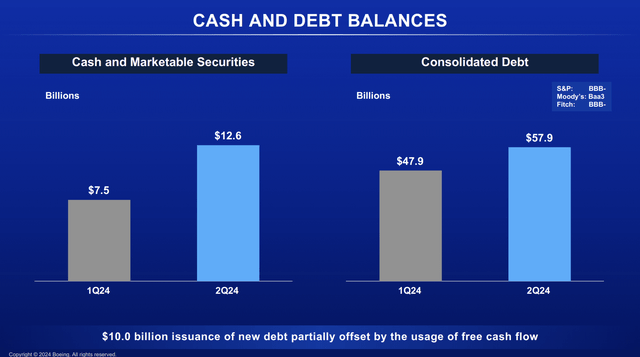

On September 12, Moody’s placed Boeing on review for a credit rating downgrade. This comes at a time when the giant is reducing debt, looking to improve its operations and win back confidence from investors and customers.

Bloomberg

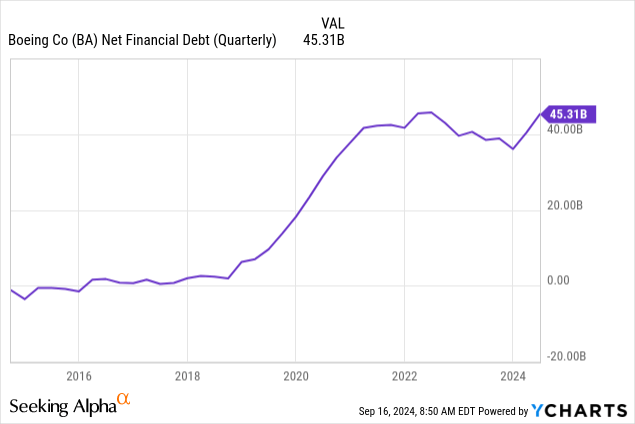

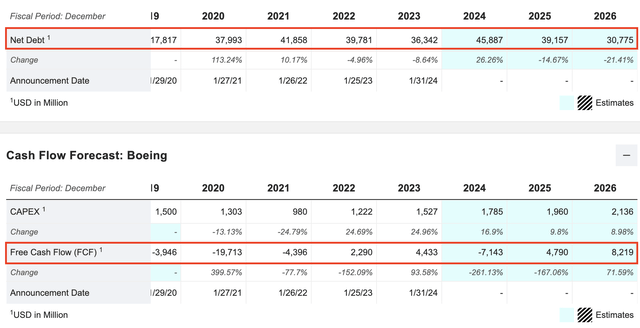

Needless to say, a credit rating cut is bad news, as it is a clear signal that risks are rising. This often translates to higher borrowing costs to compensate investors for these risks. It has more than $45 billion in net debt, most of which has been accumulated once the 737 MAX problems started. Before that, it had almost zero net debt.

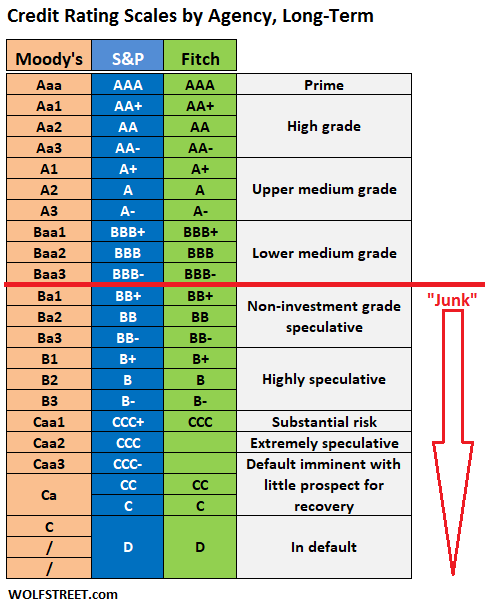

This is made worse by the fact that Moody’s currently has a Baa3 rating on Boeing debt. A credit rating cut would push the rating to Ba1, which is a non-investment grade rating.

Wolf Street

Even worse than that is the fact that Bloomberg notes that Boeing has $4 billion of maturing debt in 2025, followed by $8 billion in 2026.

If S&P Global (BBB- rating) lowers Boeing’s debt rating as well, it will have to leave the investment-grade index, which eliminates a lot of potential debt investors.

Hence, in order to avoid the strike, Boeing has offered to increase the pay increase for its workers from 12% to 25% and build the next commercial jet in Washington State, the heart of its global operations.

Although I believe Boeing will reach a deal soon (they may have reached one by the time you’re reading this), Reuters also reports that Boeing has underestimated the cost-of-living pressures on its employees and somewhat poor pay agreements in prior years.

How Bad Is It?

During the most recent Morgan Stanley Laguna Conference, Boeing was asked a very important question with regard to the brief debt discussion we just had.

Below, I’m quoting both a critical question regarding Boeing’s debt load and the answer Brian West, CFO of Boeing, gave. I also added emphasis.

Kristine Liwag

Brian, on the balance sheet, debt remains elevated and free cash flow continues to shift to the right. Is there a possibility that the company may need to raise debt or equity by year-end or early 2025?

Brian West

So we remain committed to manage the balance sheet prudently. We’ve got two objectives. First of all, we want to prioritize the investment grade credit rating; and secondly, we want to allow the factory in the supply chain to stabilize. Now that last objective just got harder based on last night. So we are perfectly comfortable to supplement our liquidity position to support these two objectives. And we’re constantly evaluating our capital structure and liquidity levels to ensure that we could satisfy our debt maturities over the next 18 months while keeping confidence in our credit rating as investment grade. So over time, I’m confident that the business performance is going to catch up with the capital structure, and it’s going to reflect an investment-grade credit profile, right? And we will take any necessary actions between now and then to make sure we accomplish those two objectives. – Morgan Stanley Laguna Conference

Essentially, what Boeing is saying is rather straightforward. The company has a focus on balance sheet stability and an “obligation” to spend money on innovation and production. Without spending, it cannot grow, which is needed to support the balance sheet on a long-term basis.

Let me show you what this means.

Right now, the company has roughly $45 billion in net debt. That sounds like a lot (it is). However, net debt always needs to be put into context. A large company can take much more debt than a smaller company.

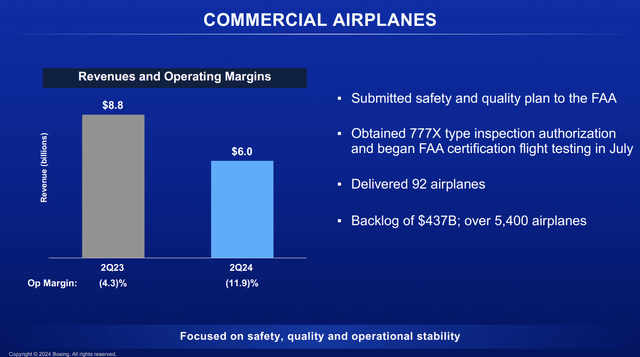

The Boeing Company

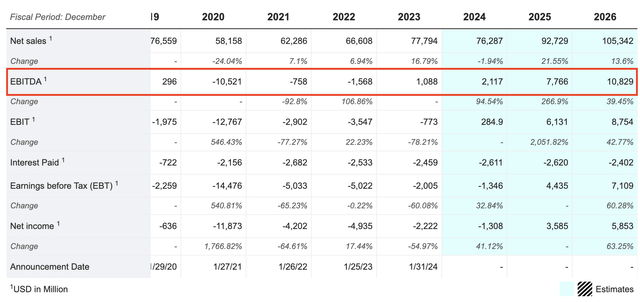

Using analyst expectations, this year, Boeing is expected to generate $2.1 billion in EBITDA. This would translate to a net leverage ratio of 21x ($45/$2.1). That’s a number that screams “bankruptcy.”

However, its EBITDA is only low because of operating struggles. Next year, analysts expect EBITDA to rise to $7.8 billion, potentially followed by a surge to $10.8 billion in 2026.

MarketScreener

Moreover, the company is expected to increase free cash flow to $4.8 billion in 2025 and $8.2 billion in 2026. This could cause a net debt decline to $31 billion by 2026.

Putting everything together, the company could work its way to a sub-3x leverage ratio by 2026, which is a healthy number.

MarketScreener

S&P Global seems to share my view, as the company commented on a longer-term outlook when it assigned a credit rating to the company’s new senior notes in April of this year.

Our ‘BBB-‘ issuer credit rating and negative outlook on Boeing are unchanged. We expect the company’s credit measures will be weak for the rating through next year. We anticipate that while the acquisition of Spirit would result in weaker financial measures, they would remain within our tolerance for the rating, inclusive of a negative outlook. – S&P Global (emphasis added)

Needless to say, new disruptions – including strikes – could delay this recovery and potentially force the company to take on more expensive debt or benefit from recovering free cash flow much later than expected.

There’s Good News

To me, the biggest bull case is that Boeing is still a business that benefits from super high demand and operations that can become highly profitable if the right steps are taken.

For example, during the Morgan Stanley conference, the Virginia-based giant noted that it has enough backlog to keep its workers busy for the next 7-8 years.

As of 2Q24, it has a backlog of roughly 5,400 commercial planes, with a monetary value of almost $440 billion. When adding $59 billion in defense backlog, it has a total backlog of roughly half a trillion dollars.

The Boeing Company

These planes will have to be built, regardless of Boeing’s financial situation. That is also why suppliers like GE Aerospace, RTX Corp. (RTX), and TransDigm (TDG) have been doing so well on the stock market.

Moreover, during the conference, Boeing noted that once it overcomes current production challenges and ramps up to higher production rates, cash margins for the 737 MAX and 787 programs will approach or exceed pre-pandemic levels.

While the strike is damaging its recovery, the company’s progress was going smoothly, which should allow the giant to pick up where it left off after reaching a deal with its workers.

So the health of the production system was going in the right direction. And my expectation is we’ll pick right back up where we left off, but I don’t know when. Deliveries in August were similar to July. And I will tell is I think it was — I think there was a third consecutive month of having deliveries in the 30s, another indication of momentum. – Morgan Stanley Laguna Conference

I also like the planned takeover of Spirit AeroSystems (SPR), as it’s an all-stock deal that should allow the company to get much better control of the supply chain of major programs like the 737, 787, and 777X – without further stressing its balance sheet.

The company is also focusing on its defense business. While defense demand is very strong due to elevated global tensions, it has operating issues. For example, it is challenging to increase F-15 production numbers while winding down the F/A-18 program. It also struggles with fixed-price programs that are being impacted by more expensive development costs. This includes the T-7 and MQ-25 programs.

The Boeing Company

In 2Q24 alone, the company took a $1 billion loss on certain fixed-price development contracts, lowering the operating margin to negative 15.2%.

The good news is that 60% of the defense portfolio is stable. On a longer-term basis, Boeing will de-risk the remaining 40% by better-controlling costs and more favorable contract structures.

Valuation

There’s more good news, as analysts have barely adjusted their long-term expectations. Using the FactSet data in the chart below, analysts expect 2026 EPS of $8.20, down from $8.36 when I wrote my June article.

FAST Graphs

Next year, EPS is expected to be roughly $4, which would make it the first profitable year since 2018.

Applying a 30x multiple to its 2026 numbers (as I expect the strong recovery to last), we get a fair stock price target of roughly $250, 60% above the current price. In June, I gave a wide price target range of $260 to $300.

The consensus price target is $213.

However, while I will stick to a Strong Buy rating to reflect its potential, BA is still a highly volatile recovery play, which makes it unsuitable for conservative investors.

Personally, decided to buy suppliers instead of Boeing.

Needless to say, I’m rooting for the company and believe that the right steps could unlock a lot of value in the years ahead.

Takeaway

Boeing is still one of the key players in aerospace, and despite its current challenges, I see long-term potential.

While the company is facing headwinds with debt concerns, strikes, and production issues, its massive backlog and growing demand for aircraft provide a strong foundation for recovery.

Moreover, although Boeing’s balance sheet is under pressure, the expected improvement in cash flow over the next few years gives me confidence that the company can weather the storm.

However, given the volatility, I’m focusing on suppliers for now, while keeping a close eye on Boeing’s progress as it works to stabilize operations and capitalize on future growth.

Pros & Cons

Pros:

- Massive Backlog: Boeing has a backlog of 5,400 planes worth nearly $500 billion. This provides steady future demand.

- Recovery Potential: As production ramps up, cash flow and margins are expected to improve significantly by 2026.

- Industry Leader: Boeing dominates commercial aerospace alongside Airbus, giving it a strong market position.

- Defense: Boeing has a significant defense footprint, a market with strong secular growth.

Cons:

- Debt Burden: With $45 billion in net debt, any further disruptions could lead to more expensive financing.

- Strikes & Operational Struggles: Labor strikes and production delays threaten its recovery timeline.

- Volatility: Boeing remains a high-risk stock, making it less suitable for conservative investors.

Read the full article here

Leave a Reply