Datadog, Inc. (NASDAQ:DDOG) has been marked as a survivor. Even as the company continues to report decelerating revenue growth amidst a tough macro environment, Wall Street has stood by its side, assigning a premium valuation that is clearly implying a strong rebound in growth rates moving forward. However, in spite of the generative AI thesis having already played out for several quarters, the fact that DDOG has not seen a material benefit and is even still projecting further deceleration should be a cause for concern.

While DDOG deserves high marks for having a strong product portfolio while generating substantial free cash flow, the current valuation demands expectations that I fear cannot be matched. I recommend investors to avoid this name until the risk-reward proposition improves.

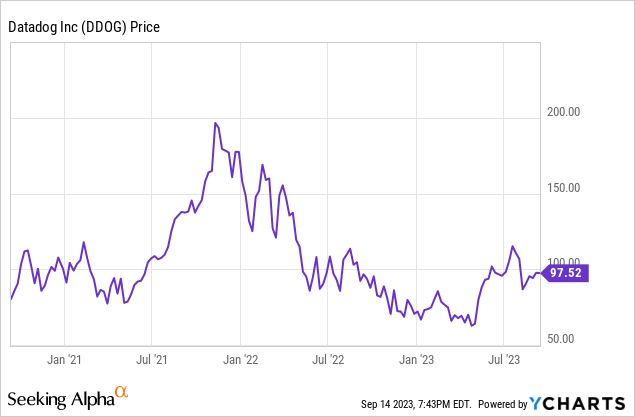

DDOG Stock Price

DDOG has rebounded sharply from the lows and, for the most part, has held on to these gains – in spite of the underlying business seeing persistent headwinds.

I last covered DDOG in June, where I lamented selling the stock too early amidst AI tailwinds. One quarter later, I’m less certain that I was wrong in my original assessment, and suspect that the stock has run too far, too fast.

DDOG Stock Key Metrics

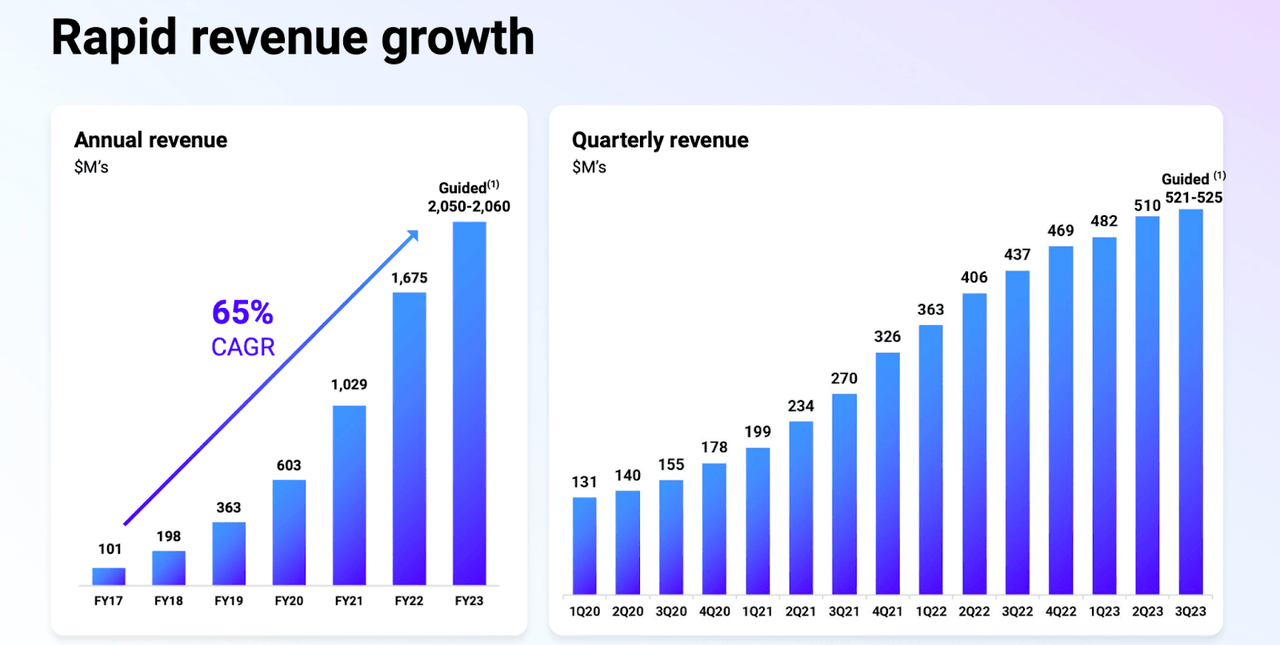

In its most recent quarter, DDOG delivered $510 million in revenue, ahead of guidance for $502 million.

2023 Q2 Presentation

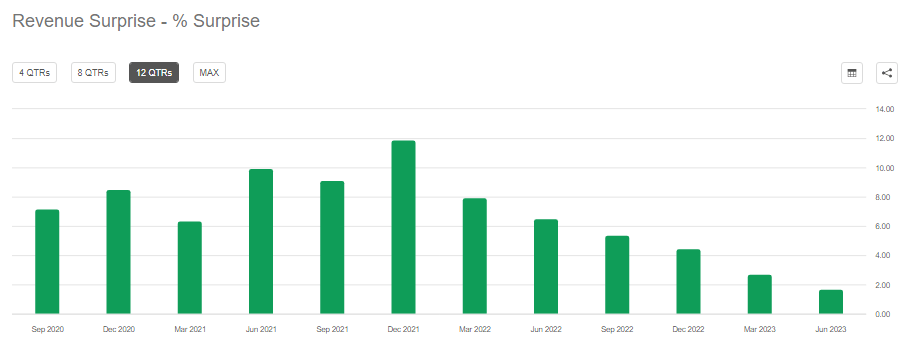

We can see below that the magnitude of consensus beats to revenue have declined sequentially for 6 straight quarters.

Seeking Alpha

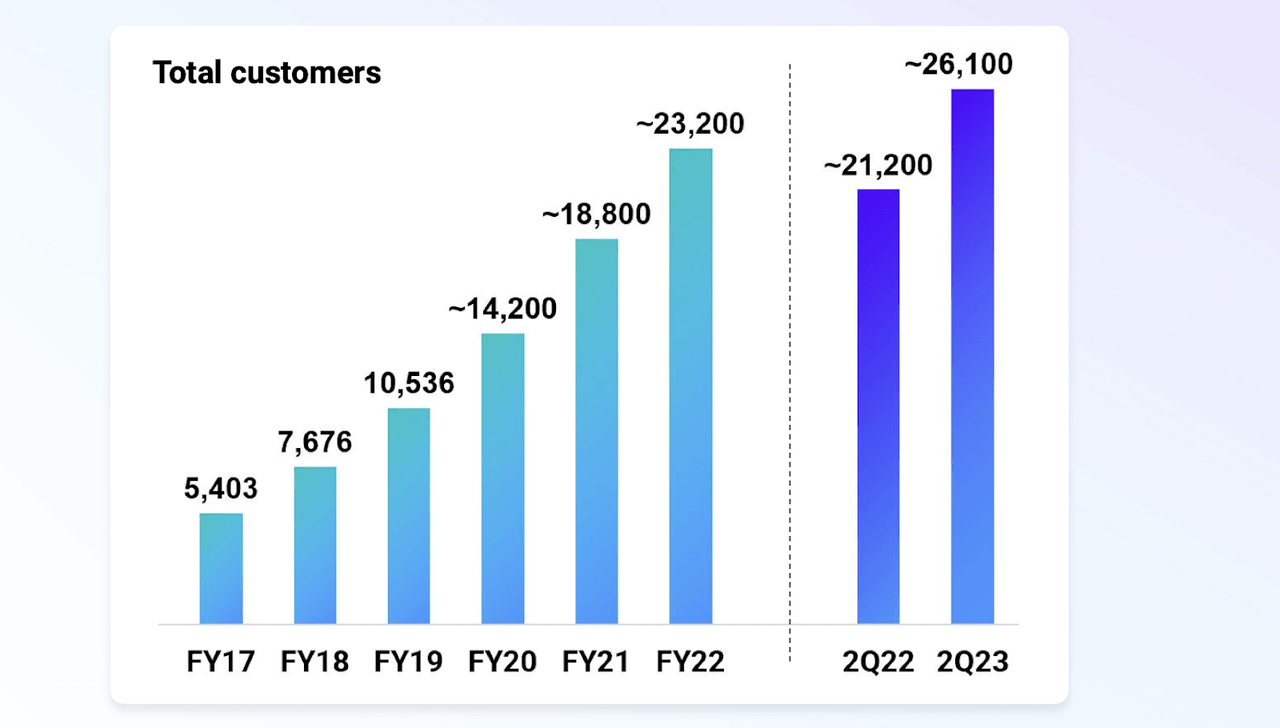

DDOG has been able to sustain customer growth, which is no longer a certainty in this macro environment as many enterprises have been hesitant to increase non-discretionary IT spending.

2023 Q2 Presentation

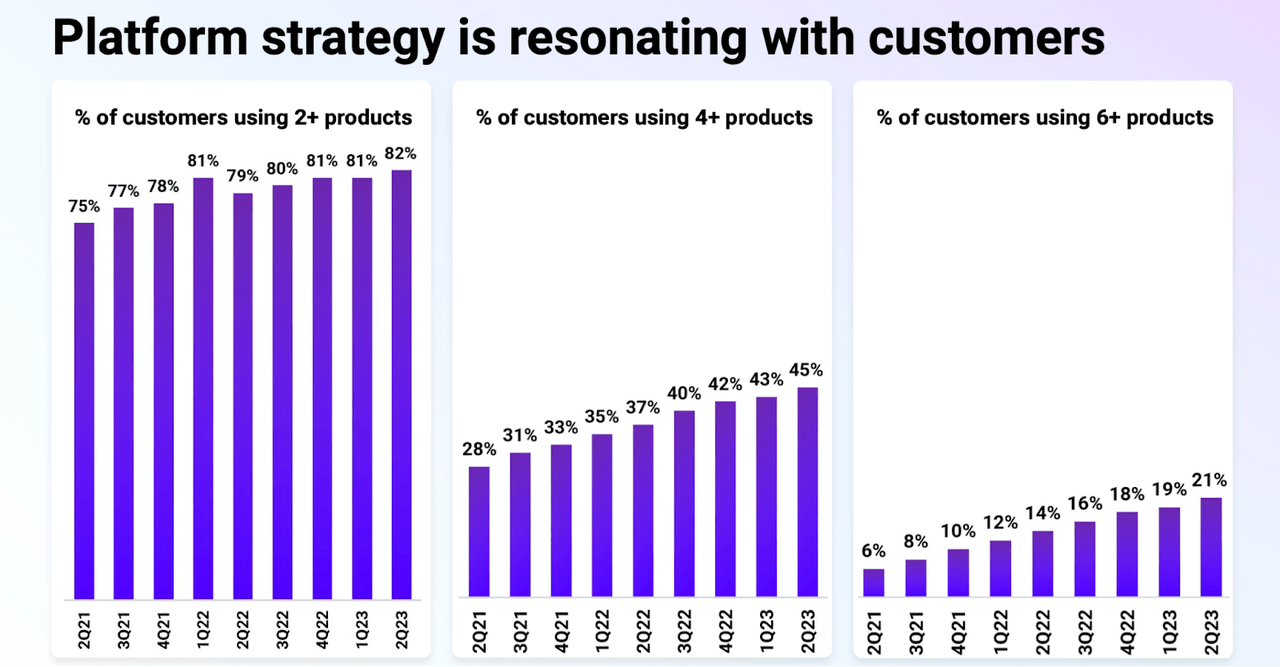

DDOG delivered a dollar-based net retention rate in excess of 120%, continuing its ability to cross-sell new products to existing customers. Like tech peers with deep product portfolios, DDOG has benefitted from the “flight to safety” witnessed in enterprise spending as customers have proven less adventurous in terms of working with smaller vendors in this macro environment.

2023 Q2 Presentation

Due to winning some large contracts, DDOG reported billings growth of $520 million, up 31% YoY, with current remaining performance obligations (“RPOs”) growing 30% as well. The company generated $106.5 million in non-GAAP operating income, representing a 21% margin and a sizable beat to guidance for $86 million. Non-GAAP net income was even higher at $125.3 million due to the company earning considerable interest from its cash hoard. DDOG ended the quarter with $2.2 billion in cash versus $740 million in debt, representing a strong net cash balance sheet.

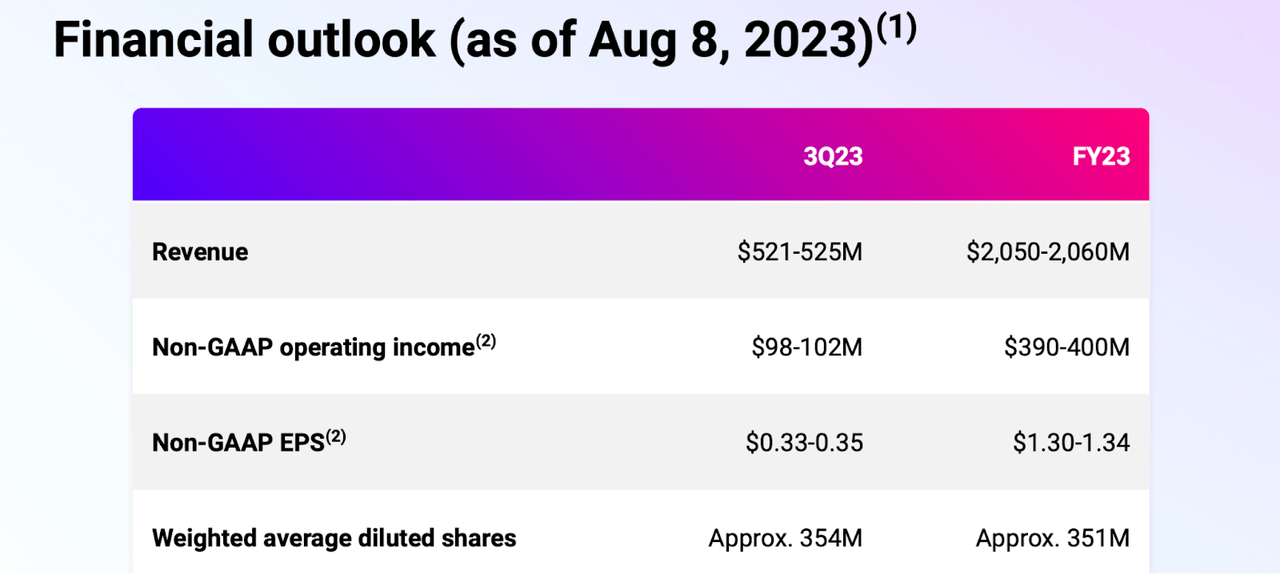

Looking ahead, management is guiding for up to 20% revenue growth in the third quarter to $525 million. Full-year guidance of $2.060 billion in revenue implies $543 million in fourth quarter revenue, or just 15.8% growth. If investors were hoping for the strong print on current RPOs to forecast an acceleration in growth, those hopes will have to wait.

2023 Q2 Presentation

On the conference call, management stated that they are “seeing signs” that cloud optimization headwinds were easing. But in the same call, management also noted that they expect headwinds to continue and to cause their net retention rate to dip below 120% in the third quarter. Based on management’s guidance for the upcoming quarters, it is reasonable to conclude that cloud optimization headwinds appear firmly intact.

Is DDOG Stock A Buy, Sell, Or Hold?

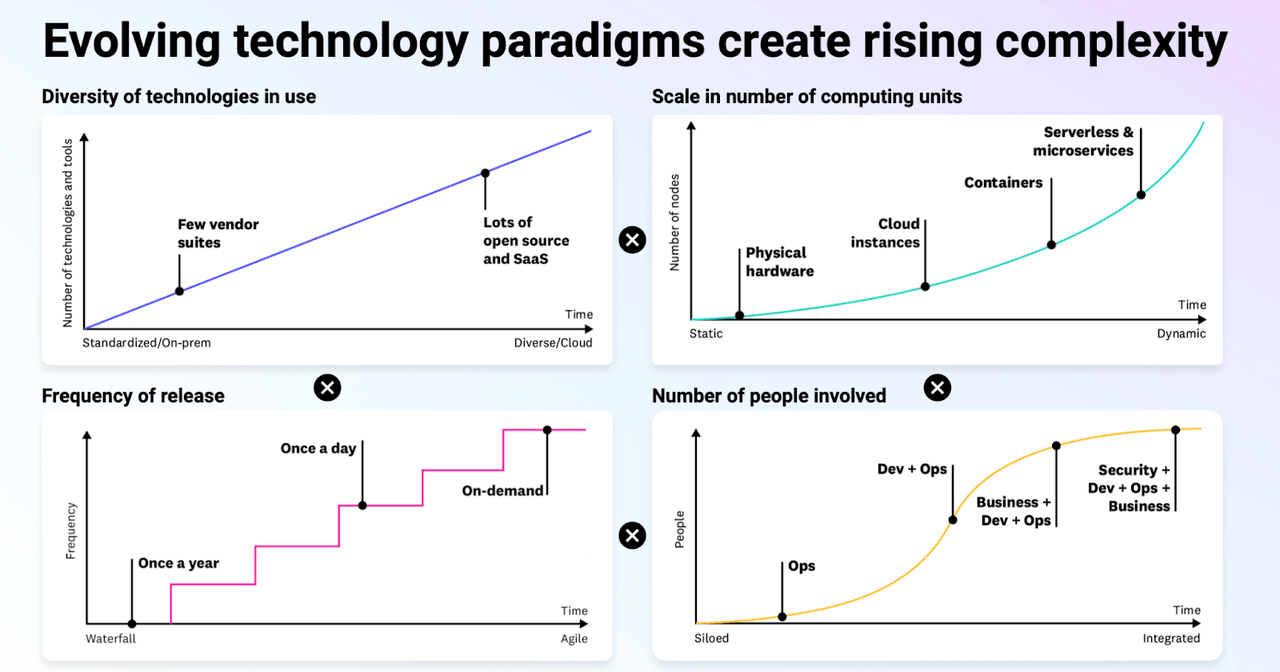

DDOG offers observability solutions that enable customers to optimally manage their data. With data rising incessantly and from various sources, managing data is no easy task.

2023 Q2 Presentation

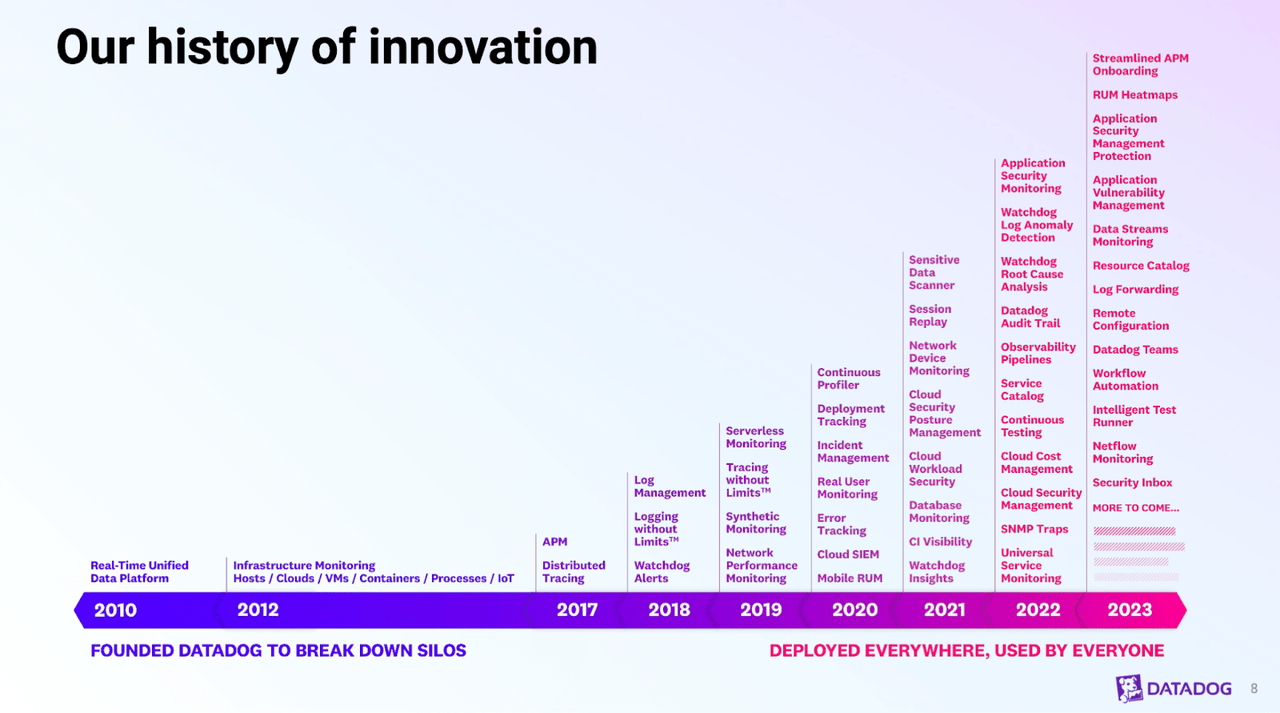

DDOG is a clear innovator in the space, and that history of innovation may suggest that the company can pivot to expanding its use cases to include generative AI.

2023 Q2 Presentation

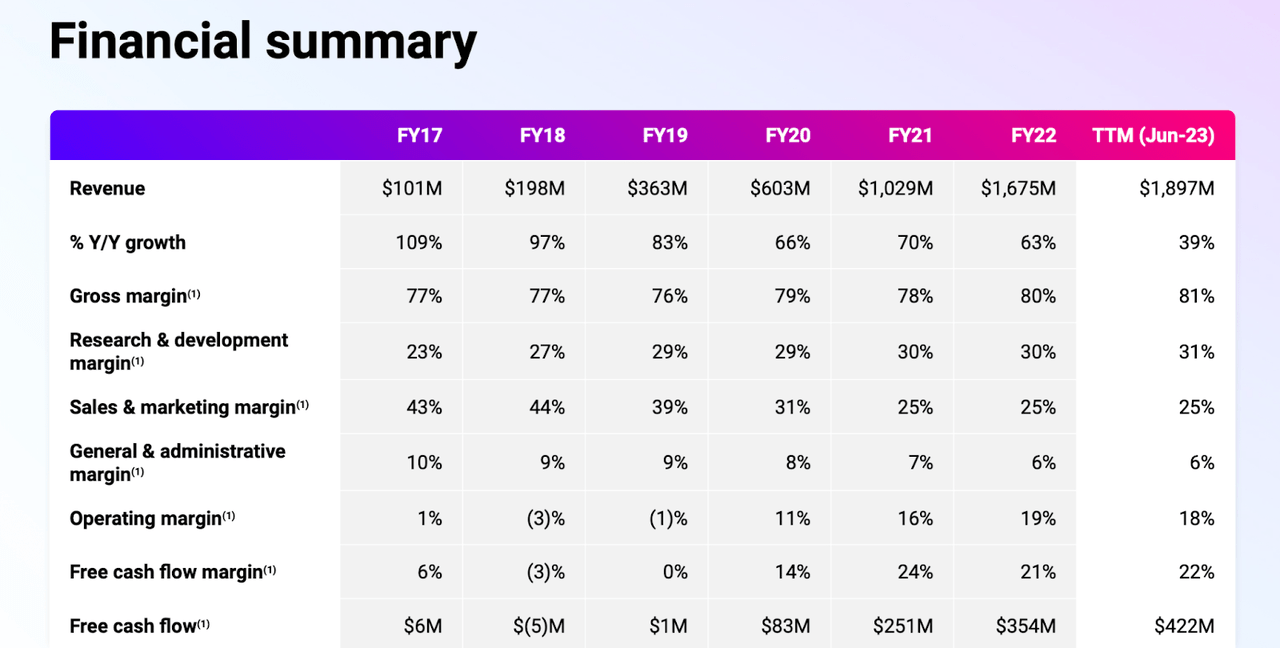

DDOG has a history of sustaining incredible revenue growth while generating solid cash flow margins.

2023 Q2 Presentation

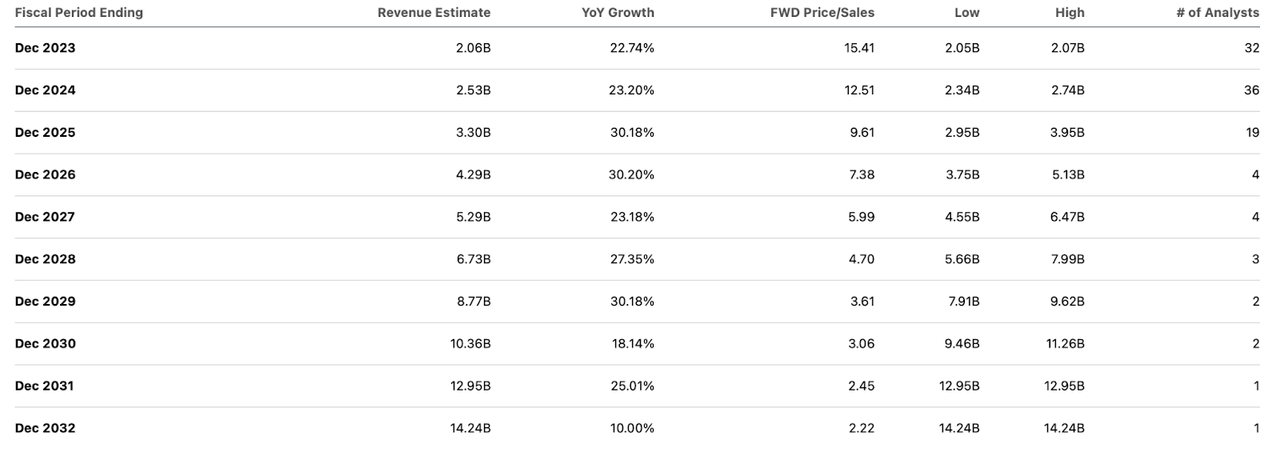

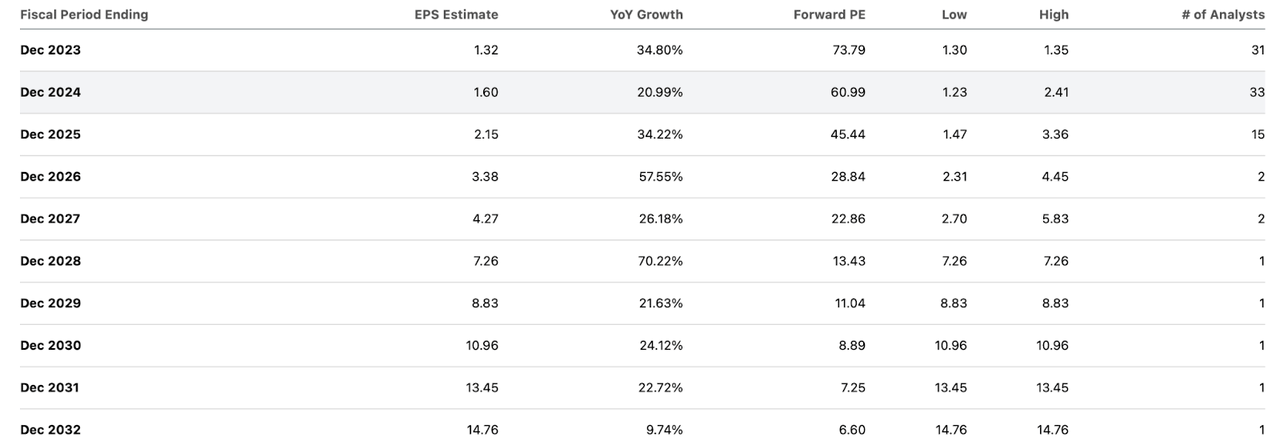

It appears that the strong historic financial results have helped the stock retain a premium valuation. As of recent trading, DDOG traded hands at around 15x sales. That’s an expensive multiple even if we use consensus estimates for 23% revenue growth in 2024, but I fear that actual growth rates may be closer to the 15% exit growth rate this year.

Seeking Alpha

On an earnings basis, DDOG does not begin to look cheap until many years later. Clearly, many years of growth are already priced into the stock.

Seeking Alpha

Now I illustrate why the stock is so expensive. Let’s assume that DDOG can achieve consensus estimates through 2029 and exit with a 15% revenue growth rate. Assuming 30% long-term net margins and a 1.5x price to earnings growth ratio (PEG ratio), DDOG might trade at 6.75x sales at the end of 2029, implying a stock price of $183 per share, implying around 11% potential annual upside over the next 6.2 years. But with the company projecting just 15% growth in the fourth quarter this year, one must wonder if consensus estimates are too aggressive, as they imply a return to 30% growth on a sustained basis. If growth instead only recovers to around 20%, then DDOG might trade at around 9x sales, implying that the stock might be dead money for a couple of years.

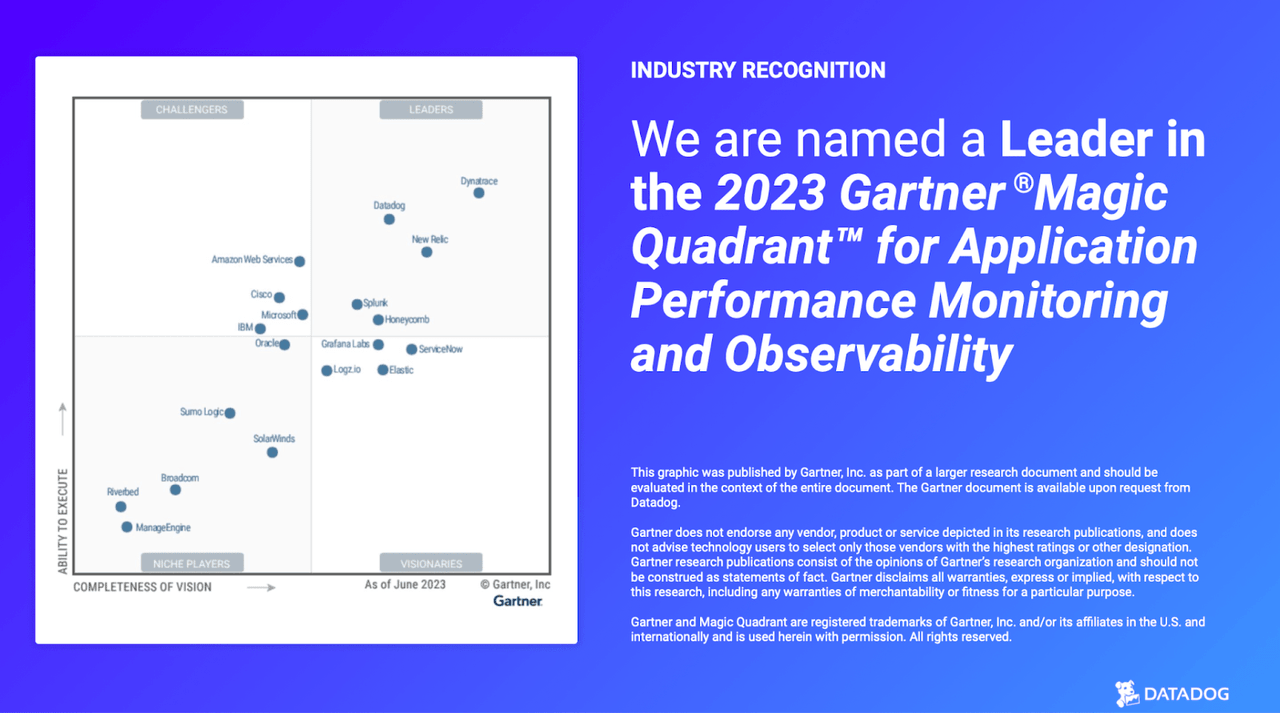

I should note that DDOG operates in a highly competitive field.

2023 Q2 Presentation

It is unclear how generative AI may change the competitive landscape, but DDOG investors should be concerned that close competitor Dynatrace (DT) is guiding for stronger sustained growth. It is possible that generative AI eventually helps DDOG accelerate its growth rates, but that is arguably incorporated in the aggressive consensus estimates.

Given that Datadog, Inc. is offering just modest potential upside assuming it can hit bullish consensus estimates, while offering considerable downside if it performs in line with projected guidance, the stock is offering a poor risk-reward from here. I recommend investors to avoid the stock as the high valuation has more than offset the high quality of the underlying business.

Read the full article here

Leave a Reply