Investment thesis

With signs of demand slowing down in Japan, China, and Europe, we believe Daikin’s (OTCPK:DKILF) shares look expensive on consensus PER FY3/2024 26.5x. Our major concerns are market share losses in Japan and the U.S., and the potential fall in China demand with the weakening real estate sector. We downgrade our prior Neutral rating to Sell.

Quick primer

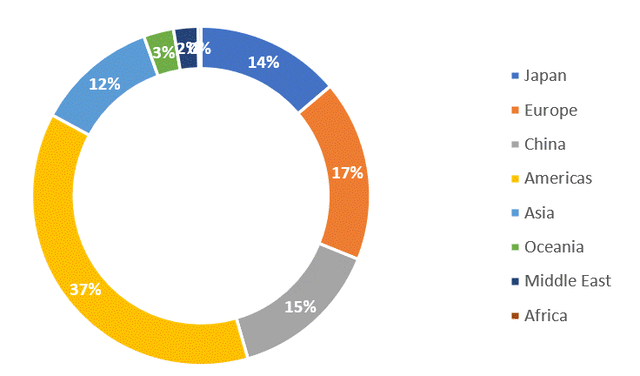

Daikin is the world’s largest manufacturer of air conditioners, with an approximate global market share of 12%, followed by peers Midea Group (000333), Gree Electric (000651), Trane Technologies (TT), and Carrier (CARR). In Q1 FY3/2024, overseas sales make up over 80% of the total, with the Americas (approximately 40%) being the largest followed by Europe (17%) and China (15%). It provides HVAC (heating, ventilation, and air conditioning) solutions for both residential and commercial properties, and its product strength is in ducted air conditioners (as opposed to ductless popular in US residential).

For the residential market, Daikin is viewed as a premium brand compared to peers such as Panasonic (OTCPK:PCRFY), Hisense (OTCPK:HISEF), Haier Smart Home (OTCPK:HRSHF), and Fujitsu (OTCPK:FJTSY).

According to the International Energy Agency (IEA), in 2050, air conditioner demand is projected to more than triple the current level due to the economic growth of emerging countries.

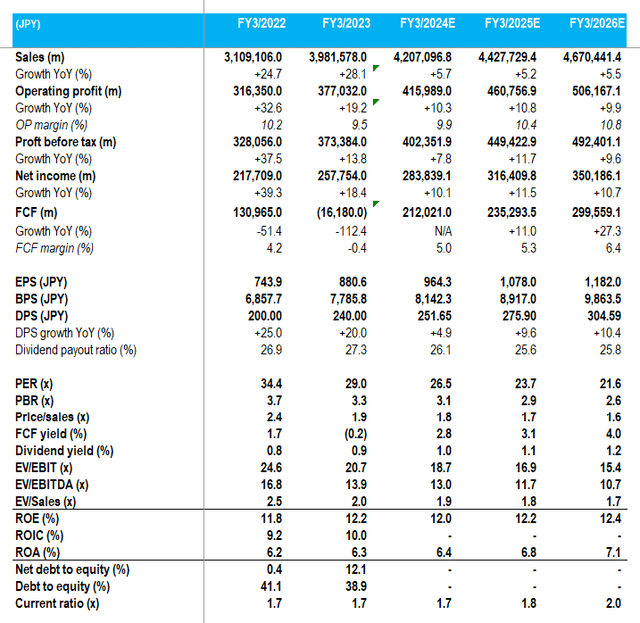

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

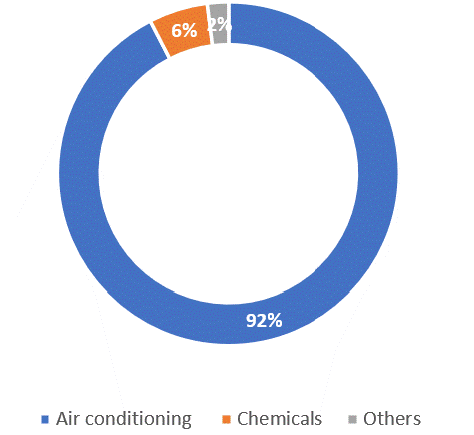

Sales split by segment – Q1 FY3/2024

Sales split by segment – Q1 FY3/2024 (Company)

Sales split by geography – Q1 FY3/2024

Sales split by geography – Q1 FY3/2024 (Company)

Assessing the outlook with China in mind

Despite booking record-high sales and earnings in Q1 FY3/2024, the company commented that a ‘severe business environment’ (Investor Presentation, -page 3, last paragraph) was expected in Q2 FY3/2024 and beyond. Trading was more sluggish than planned, and the company lost market share by approximately 5% (page 8) in Japan despite a very hot summer. Heat pump demand in Europe weakened due to changes in subsidies in Italy and France, and China demand slowed in June despite an initial bright start to the financial year.

Repeated comments by management about ‘weak residential demand’ are now in greater focus with the recent negative developments in the Chinese real estate market, with the share price movements in China Evergrande Group (OTC:EGRNF) and Country Garden (OTCPK:CTRYF) highlighting a real drop in consumer confidence. China has been a major growth engine for Daikin over the last 5 years.

We want to update our neutral view from November 2022, and assess the demand outlook per key regions and whether there are secular growth drivers for the business in the short to medium term.

Mixed picture per region, but mainly pointing to downside risk

Normally perceived as a premium brand in the air conditioner market, market share loss in Japan came as a negative surprise in Q1 FY3/2024; it would appear that residential demand is veering towards lower-priced alternatives in the face of rising power costs. In Europe, air conditioning-related demand was not strong with underlying sales growth of 5% YoY (excluding FX impact), with a fall in heat pump volume demand by 12% YoY. Daikin’s largest market is the Americas, where underlying sales grew 10% YoY driven by applied demand-related systems such as air handling units and chillers used in a commercial setting, but North American demand only grew by 2% YoY – this comes in contrast to relatively firm commercial demand experienced by Lennox (LII) in Q2 FY12/2023, as well as for Carrier’s recent results. It would appear that Daikin is also losing market share in its key market (page 9 of Investor Presentation).

China saw underlying sales increase by 19%, but this can be partly viewed as normalizing demand post-lockdown restrictions and not likely to be a sustainable trend. Whilst demand was originally expected to recover in H2 FY3/2024 when company guidance was announced, we believe that conditions have worsened with the authorities introducing measures to support the real estate market last week. Chinese consumers are feeling less prosperous given falling real estate prices, increasing unemployment amongst the younger demographic, and falling exports with July 2023 dropping a hefty 14.5% YoY. We expect to see a significant drop in China demand momentum in Q2 FY3/2024, casting doubt over FY company guidance despite the depreciating Japanese yen.

The impact of climate change and aging demographics

In the recent past, the simplistic investment case for Daikin had been the need for HVACs due to rising summer temperatures from climate change. There was also the environmental angle with the company’s heat pump technology, with excitement over rising adoption spearheaded in European countries. Now, we believe that investment priorities are shifting toward aging demographics, and the negative impact this will have on the real estate-related markets.

Although an environmental positive, the heat pump market remains driven primarily by the availability of subsidies and the price of natural gas. With subsidies being cut in certain European countries such as Italy and France, and the natural gas prices falling back since the invasion of Ukraine, European heat pump demand is currently waning. Whilst there may be a secular trend in its adoption, we do not see this as being a major kicker for the company; the company admits that there could be an ‘oversupply’ of heat pumps with competitors ramping up production (page 22 of Investor Presentation).

China’s economy has been dependent on a booming real estate sector fueled by population growth. The housing market created jobs and served as a place to store wealth for the growing middle class. The impact of an aging demographic is illustrated by the ex-growth Japanese market, and there is growing evidence of this now in China. With the Chinese population now in decline with a low static birth rate, there is limited demand for new housing and its related furnishings. Whilst property prices were rising, real estate was seen as a place to invest personal savings for capital gain. Now with falling prices and a lack of borrowing facilities by the banks, demand is weakening which is affecting banks, construction companies, and housing-related sectors such as white goods and consumer electronics. Real estate constituted around 30% of China’s GDP, making it the single biggest contributor to the world’s second-largest economy – sustained weakness here will be a major negative for Daikin.

Valuation

Consensus forecasts show stable single-digit sales growth into FY3/2024 and beyond, with an improvement in operating margins. Given the backdrop of a weak real estate market and low consumer confidence, we believe consensus numbers are too positive. Despite this, the shares are trading on PER FY3/2024 26.5x which does not denote a major undervaluation.

Upside Risks

With Daikin’s high exposure to overseas markets, a major depreciation of the Japanese yen will boost reported financials. Thematically, the shares could react to positive regulatory developments regarding heat pump technology adoption, although this story has been in the price for the last 2-3 years.

Conclusion

Daikin is a high-quality industrial company with a strong track record of growth over the last 10 years. However, the circumstances it faces in key geographic markets are highly challenging.

Downside risk comes from a major stall in demand in China and Europe due to persistent negative trends in real estate markets. Low global consumer confidence would postpone discretionary spending, which would impact higher-end purchases such as air conditioners. Earnings could weaken further, and prefer to invest in peers more directly exposed to the U.S. market where demand remains relatively firm such as Lennox and Carrier. We downgrade to a Sell rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply