At a Glance

In my previous analysis, I recommended a “Sell” position on Cytokinetics (NASDAQ:CYTK), a sentiment I largely maintain. The company faces heightened scrutiny with a declining revenue base, which fell from $89M to a meager $0.9M in Q2 2023. Aggressive R&D spending of $83.2M, largely funneled into cardiac myosin inhibition programs, juxtaposes a limited cash runway, thereby amplifying the imperative for robust clinical outcomes. Despite holding $592.6M in liquid assets, the company grapples with a monthly cash burn rate of approximately $40.7M, and a looming debt burden of $609.8M. While aficamten’s SEQUOIA-HCM Phase III trial progresses, Cytokinetics needs more than clinical efficacy to break through a competitive landscape entrenched by mavacamten’s first-mover advantage and Bristol Myers Squibb’s (BMY) marketing prowess. Investors should heed forthcoming data and potential strategic shifts closely, as they could serve as inflection points for the stock.

Q2 Earnings Report

To begin my analysis, looking at Cytokinetics’ most recent earnings report, there’s a notable plunge in revenue to $0.9M for Q2 2023 from $89M in Q2 2022, predominantly tied to the absence of deferred royalties on mavacamten. Research and development costs surged to $83.2M from $57.1M YoY, mainly allocated to their cardiac myosin inhibition programs. This spike suggests an aggressive investment into their pipeline, possibly aiming for a groundbreaking market entry. While General and Administrative expenses showed a marginal QoQ decrease to $39.7M, the YoY comparison showed an uptick to $89.4M, largely attributed to personnel and stock-based compensation. The company also revised its operating expense guidance to $390-$410M for 2023, in light of a recent Complete Response Letter from the FDA, indicating a recalibration of their strategic focus.

Cash Runway & Liquidity

Turning to Cytokinetics’ balance sheet, as of June 30, 2023, the company holds cash and cash equivalents of $68.6M, short-term investments of $497.1M, and long-term investments of $26.9M. This aggregates to $592.6M in highly liquid assets. Net cash used in operating activities over the last six months stands at $244.1M, translating to a monthly cash burn of approximately $40.7M. Given these numbers, the estimated cash runway would be about 14.6 months. It’s crucial to note that these estimates are based on past performance and may not reflect future financial conditions.

The company’s liquidity appears relatively strong, but the cash burn rate should not be ignored, especially when considering the term loan of $62.5M and convertible notes amounting to $547.3M on its liabilities sheet. These sizable debt obligations, totaling approximately $609.8M, add a layer of financial pressure that could necessitate additional financing, especially if there are any disruptions to the company’s cash inflow. Despite the healthy liquidity status, securing more financing might become a strategic imperative, given the current burn rate and debt profile. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

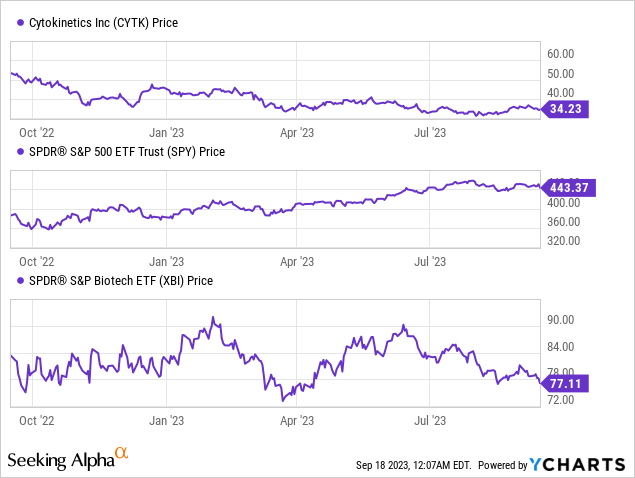

According to Seeking Alpha data, Cytokinetics sports a market capitalization of $3.29B with moderate levels of debt relative to its market cap, balanced somewhat by a decent cash reserve. The company is in a precarious developmental phase; revenue is projected to plunge through 2024 before rebounding significantly in 2025 to $173.85M. Analyst revenue projections suggest high volatility, making this a high-risk, high-reward situation. Stock performance has been lackluster, lagging behind the S&P 500 with a -37.2% return YoY.

Aficamten Navigates a Competitive HCM Landscape

Aficamten is on the cusp of a pivotal moment as it advances its SEQUOIA-HCM Phase III clinical trial, a significant study in the obstructive HCM space with 282 patients enrolled. As the company sharpens its commercial edge for potential market entry in the U.S. and Europe, it’s crucial to consider the competitive landscape, primarily shaped by mavacamten.

Mavacamten has shown robust clinical outcomes in symptom improvement and reduced LVOT gradient, thereby setting a high therapeutic bar for aficamten. Moreover, mavacamten benefits from being first-to-market and the marketing muscle of Bristol Myers Squibb. These factors accentuate two key challenges for aficamten:

-

First-Mover Advantage: Mavacamten’s first-to-market status allows it to set treatment paradigms, clinician expectations, and gain formulary positions, all of which could pose barriers to entry for aficamten.

-

Marketing Power: Bristol Myers Squibb has an established network and deep pockets for commercialization, which can sway physician prescribing habits and significantly impact market penetration.

Aficamten, therefore, has a steeper hill to climb. It needs to:

-

Demonstrate either superior or similar efficacy in key clinical endpoints, such as functional capacity and symptom relief.

-

Alleviate safety concerns like long-term LV systolic dysfunction, an issue highlighted in mavacamten’s trials.

-

Distinguish itself with unique attributes such as better drug-to-drug interaction profiles or more flexible dose titration, thereby offering a more compelling benefit-risk profile.

Strategically, the company is advancing on multiple fronts, from refining its go-to-market plans to initiating conversations with payers. Additionally, aficamten’s promise in nonobstructive HCM suggests a broader therapeutic scope, adding another layer to its potential value proposition.

My Analysis & Recommendation

In conclusion, Cytokinetics has made some commendable strides, especially in its cost-reduction efforts, effectively extending its financial runway. Although a 14.6-month runway appears manageable, the actual length is deceptively limited due to the significant debt burden of approximately $609.8M. Thus, I anticipate the firm may have to consider additional financing in the coming months, given the current cash burn rate and looming debt obligations. For investors, this should raise red flags as additional financing might dilute existing share value.

On the clinical front, aficamten’s progress in its SEQUOIA-HCM Phase III trial is noteworthy but must be contextualized within the broader competitive landscape. Mavacamten’s first-mover advantage, supported by the formidable marketing arm of Bristol Myers Squibb, puts aficamten in a position where it needs to do more than just match efficacy and safety – it needs to exceed. With Cytokinetics’ R&D outlay up by 45.7%, investors should be vigilant for fresh data that could substantiate this aggressive spend. If forthcoming results fail to surpass or meaningfully differentiate aficamten from mavacamten in key clinical parameters, this could serve as a tipping point.

Therefore, I maintain my “Sell” recommendation for Cytokinetics. The company’s liquidity position, although seemingly solid, belies a constrained financial runway, exacerbated by significant debt obligations. Furthermore, the high competitive barriers for aficamten-set mostly by mavacamten – require near-flawless execution in both clinical development and subsequent commercialization, a feat easier said than done.

In the coming weeks, investors should closely monitor the data release from the SEQUOIA-HCM Phase III trial, watch for signs of additional financing, and assess the firm’s evolving strategies to tackle mavacamten’s first-mover advantage. These will serve as critical barometers in determining whether Cytokinetics can successfully navigate the confluence of clinical and financial headwinds it currently faces.

Risks to Thesis

While I’ve recommended a “Sell” position on Cytokinetics, several factors could contradict my stance:

-

Efficacy Surprise: Aficamten could show superior efficacy to mavacamten in ongoing Phase III trials. The drug’s orphan and breakthrough designations hint at the FDA’s confidence, which could translate into swift regulatory approvals.

-

Strategic Partnerships: An unanticipated collaboration with a big pharma could offset resource constraints and financial pressures, giving Cytokinetics an upper hand in marketing and distribution.

-

Expanded Indication: Aficamten’s potential for non-obstructive HCM could widen its therapeutic scope, positively impacting revenue projections beyond my conservative estimates.

-

Market Underestimation: If mavacamten’s sales falter due to safety or tolerability issues, market dynamics could tilt favorably for aficamten.

-

Financial Restructuring: The firm might renegotiate its debt terms, extend the cash runway, or secure non-dilutive financing, thus mitigating financial risks more efficiently than anticipated.

-

Market Overreaction: The 37.2% one-year stock decline might be an overcorrection, offering a contrarian buying opportunity if fundamentals remain strong.

Read the full article here

Leave a Reply