Investment Thesis

CVS Health (NYSE:CVS) is a retail pharmacy chain in the United States that has expanded into healthcare services and insurance. With about 85% of the US population living within 10 miles of a CVS, there is a significant opportunity to expand into healthcare services and internal referrals from pharmacy benefits.

With headwinds diminishing and giving way to advantageous demographic changes, our investment thesis is bolstered. With major acquisitions now complete, CVS can focus on the broader health services shift and deleveraging. The overarching objective is to create accretive double-digit earnings growth by growing recession-resistant health services. The combination of the pullback in price, coupled with anticipated growth, makes CVS a compelling recession-resistant dividend stock.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $8.65 X 16.2 = $140.13

Presently, CVS trades on a significant discount to the healthcare sector, at a forward P/E of 8.1x, compared to the sector at 18.4x. However, given that CVS is involved in retail, PBM, and HMO businesses, we felt a combination of those industry multiples of is appropriate.

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

0.3 |

0.3 |

0.3 |

|

Price-to-Earnings |

8.2 |

8.2 |

7.4 |

Healthcare Benefits and Pharmacy

CVS Operates 3 segments: Health Services, Pharmacy, and Healthcare Benefits.

Healthcare benefits are primarily operated through Aetna, providing employer-paid health benefits, Managed Medicaid, and Medicare Advantage plans. The benefits segment expanded its ACA (Affordable Care Act) exchange offerings to 12 states and enrolled 1 million new members. Total membership increased 4.9% year over year. There are utilization increases in 2023, expected to wean off by 2H24. This increase has been largely seen across the healthcare sector due to pent-up elective procedure demand. CVS has had an increase of the MBR (Medical Benefits Ratio) to 86.2%, a 350bps increase year over year. This means that for every $100 in premium income, $86.20 went to providing claims.

|

Membership (Millions) |

% Change Year Over Year |

|

|

Government (Managed Medicaid, Medicare Advantage) |

7.5 |

0.6% |

|

Commercial |

18.1 |

6.8% |

You can read more about the tailwinds in the healthcare sector in our comprehensive article about it here. In short, a demographic change is underway, providing recession-resistant tailwinds for healthcare as a sector.

The pharmacy segment saw same-store sales growth, including retail, of 11% and a 1.1% increase in filled prescriptions. The reduction in uptake of COVID-19 vaccines and a reduction in the severity of cold and flu season has decreased operating income by 17.4% year over year. A particular tailwind for the pharmacy segment is the uptake of over-the-counter self-care products. This care area represents a total addressable market of almost $500 billion. Through its digital platform, CVS has grown OTC wellness offerings by 65% year over year.

Health Services

Health services saw strong growth in both patient volumes and total revenue, driven by acquisitions. CVS closed the purchase of Oak Street Health and Signify Health. The transaction was settled for $10.6 billion and $8 billion, respectively.

Oak Street is a payor-agnostic primary healthcare provider with 600 clinicians across 21 states. Oak Street is expected to add $2 billion to EBITDA by FY26. Oak Street increased its facility count by 23% year over year, which helped it grow patient volumes by 35% and revenue by 43% year over year. CVS estimates that 50-60 additional locations, or 24% growth in facility count, will be completed in 2024 to continue this pattern of growth.

Signify Health is a technology-based healthcare provider with 10,000 clinicians in 50 states who provide remote and in-home care visits. CVS believes that it will provide a new vector for growth, thanks to an aging population who have more complicated care needs. Signify estimates that around 30% of the patients they encounter do not actively have a primary care physician. With the CVS integration, conversion of that 30% to Oak Street is an opportunity. Already, Signify has increased the volume of in-home evaluations by 16% year over year and grown its revenue 19% year over year.

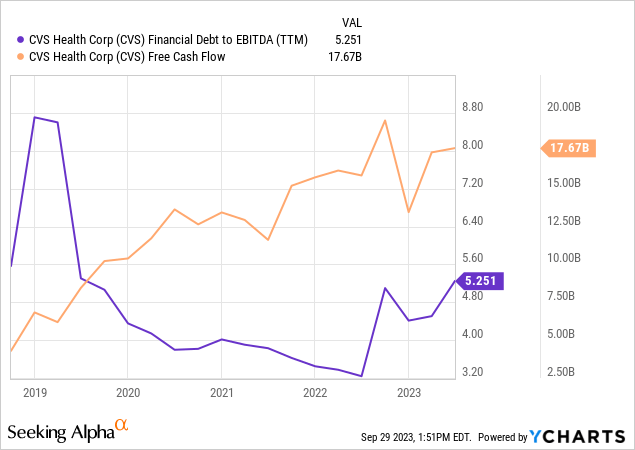

While these two acquisitions substantially increased CVS’s debt load, they potentially could drive strong revenue growth. According to the CFO, Shawn Guertin, the M&A deal flow in the future will be substantially smaller and likely not occur in the short term. The focus will shift toward delivering and realizing the existing asset’s growth potential.

Risk

CVS reported a 17.7% year-over-year increase in interest expenses in 2Q23. This was primarily due to the acquisition of Signify Health and Oak Street. The weighted average interest rate on the books is 5.56%, and the debt-to-EBITDA has risen sharply to 5.3x. While we believe the additional EBITDA provided by Oak Street will aid deleveraging, it will take until FY26 until the synergies are realized. Being saddled with debt payments could delay the growth timeline for CVS’s health business.

YCharts

As previously mentioned, CVS’ benefits segment saw significant increases in utilization, with premium utilization going up to 86.2%. While CVS does expect this ratio to go back down to the 82% range it was during and before COVID, the aging demographics could potentially lead to higher average utilization that is not fully offset by increases in Medicate payments as the Federal Debt Crisis limits available funds. Though, this is more of a broad market risk to our thesis that would apply to any healthcare stock.

By federal law, health insurance providers are forbidden from realizing profits from MBRs under 80% and must provide rebates.

Outlook

Despite the slowdown in COVID-19 vaccination uptake, CVS grew revenue by 10.3% year over year in 2Q23. While EBITDA fell by 15.9%, we expect a recovery by 2H24 as utilization returns to normal levels, acquisition-related costs are reduced, and the savings program concludes.

In 2Q23, CVS took a $500 million charge related to “cost optimization.” This program, implemented in 2Q23, is estimated to be completed by the end of the year. This program is comprised of a strategic review of assets and employee-related costs. CVS guidance states that this $500 million charge will lead to between $700-800 million in G&A savings. Currently, CVS spends approximately $38.8 billion on SG&A.

CVS pays out a 3.5% yield. Currently, CVS has $14.5 billion in share repurchases authorized. In 2Q23, it repurchased $2 billion. We expect this number to increase as M&A is reduced. CVS has strong free cash generation of $18 billion per year, giving it ample room to accomplish deleveraging while maintaining the dividend.

In conclusion, CVS has continued its operational shift away from being a traditional retail pharmacy. Though there are some short-term challenges, including a higher-than-expected MBR and a temporary dip in operating income, the long-term outlook remains optimistic. As CVS begins to realize the broader tailwinds from demographic changes and its acquisitions, it has the potential to grow into a diversified healthcare powerhouse.

Read the full article here

Leave a Reply