Intro

CVB Financial (NASDAQ:CVBF) is a holding company of Citizens Business Bank, one of the best-performing community banks in California with assets over $16 billion. CVBF has some of the lowest funding costs in the industry which makes it particularly cost-competitive in its core commercial lending business.

If the bank manages to maintain this cost advantage in essentially a commodity industry, it will be able to continue growing and deliver attractive returns to shareholders. While CVBF has been written up several times on Seeking Alpha, none of the articles explicitly explained the origins of this most important advantage. We will address this.

We also look into the riskiness of the funding of CVBF. Silicon Valley Bank collapsed due to the volatile commercial deposits and poor investments, we want to investigate the deposit base and the Available-For-Sale investment securities of CVBF to see if it is also exposed to similar risks.

Our analysis has led us to believe that CVBF is a good-quality bank with a resilient balance sheet that currently trades at an attractive valuation.

Why is deposit cost important?

CVBF is primarily a commercial bank. Its business is to fund commercial real estate owners and developers. These customers usually take out large loans where interest payments are a significant cost item on their P&Ls. Most of these customers are willing to shop around to find the best rates to maximise their profits.

Commercial banking is primarily a mature industry where it is difficult to build out significant advantages against competitors, but given the large size of loans, even a 30-50 bps difference in the interest rate can make a tangible difference to the borrower. For example, on a $5 million loan, a 30bps advantage can save the borrower $15K per annum.

Lenders who can offer consistently lower-priced loans, will attract customers and gain market share in the market while generating an acceptable return on equity. We believe that CVBF could be in that position.

|

CVBF and industry peers |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Q2 2023 |

|

|

Interest Liabilities |

3,310 |

3,609 |

4,073 |

4,487 |

5,249 |

5,839 |

6,503 |

|

|

Cost, % |

0.25% |

0.35% |

0.54% |

0.32% |

0.12% |

0.16% |

1.83% |

|

|

Savings deposits |

2,337 |

2,656 |

3,048 |

3,530 |

4,249 |

4,866 |

4,186 |

|

|

Cost, % |

0.21% |

0.27% |

0.42% |

0.25% |

0.10% |

0.14% |

0.99% |

|

|

FHLB advances & other |

613 |

2,022 |

||||||

|

Cost, % |

0.38% |

3.76% |

||||||

|

Non-interest deposit |

3,856 |

4,449 |

5,177 |

6,281 |

7,817 |

8,839 |

7,823 |

|

|

Non-interest Share |

54% |

55% |

56% |

58% |

60% |

60% |

55% |

|

|

EWBC |

||||||||

|

Interest liabilities |

28,798 |

31,077 |

32,322 |

|||||

|

Cost, % |

0.76% |

0.28% |

0.85% |

|||||

|

Bank Of America |

||||||||

|

interest deposits |

1,077,515 |

1,170,251 |

1,234,688 |

|||||

|

Cost, % |

0.18 |

0.05 |

0.38 |

Financial filings of CVBF and peers CVBF had a consistently high share of non-interest-bearing deposits, on top of that, the interest-bearing liabilities were funded at an attractive rate as compared to several selected above-average banks.

Deposit cost and stability

CVBF has some of the highest ratios of non-interest-bearing deposits in the industry and also some of the lowest deposit costs. The bank focuses on everyday banking services for small and medium-sized businesses. These checking accounts of businesses are mainly used for transactional purposes and kept within CVBF for the extra services that the bank provides to its customers. Customers are obliged to keep part of their balances in non-interest-bearing accounts to receive the extra services for free. Most of the deposits are operating accounts, that businesses use to pay their day-to-day bills and receive payment from customers.

In the words of the management from the CVBF’s Q1 2023 conference call:

“… we bank operating companies. And those operating companies want the treasury management products and services, and they want the fraud prevention and they want to be able to do things. And the way we have structured those accounts, those customers — and just notwithstanding the fact that if you have any company of any size, they can’t operate with a $250,000 balance that is insured. We have access and have utilised, to a very small degree, the insured cash sweep. I think they just changed the name to inter-buy cash services, but same product.

And that’s something that is there, somebody is concerned about the safety. But quite candidly, it’s not really been about that, and they need to maintain higher balances in their non-interest-bearing to offset service charges to just operate their business. So we don’t give guidance on what we think that could be or where I think it could be. But just based on our model, I think that number can stay around the number that we’ve been at for the last few years.”

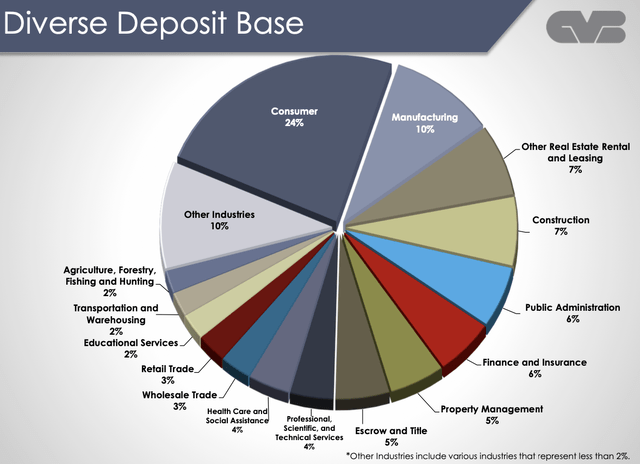

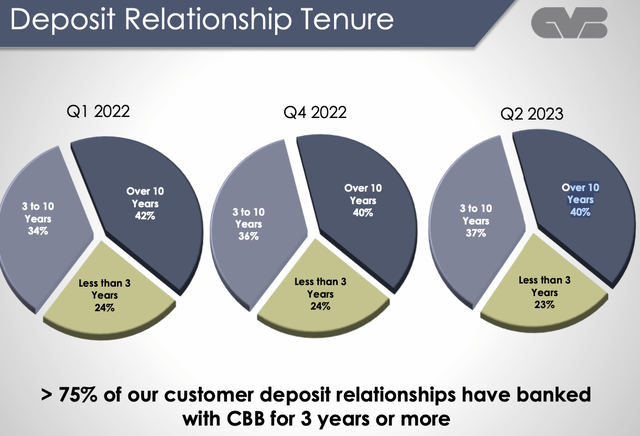

CVBF deposit base is also quite stable. Unlike Silicon Valley Bank it is not overly exposed to a single volatile sector. Most of the deposits originate from long-term banking relationships, 77% of deposits come from customers who have been with the bank for more than 3 years. CVBF does not employ any “flighty” brokered deposits and relies exclusively on core customer deposits.

Q2 2023 presentation

Q2 2023 presentation

In the words of the management from the CVBF’s Q1 2023 conference call:

“As deposits have become the primary focus of the banking industry, I would like to emphasize that Citizens Business Bank has and will continue to focus on financially strong, lower middle market businesses, providing these customers with both a high-touch relationship banking model and a wide array of products.

Our deposits are 100% relationship-based core deposits and customer repos. We had 0 broker deposits at the end of the first quarter. As you can see in our investor presentation, 77% of our deposits are business deposits and 23% are consumer, primarily the owners and employees of our business customers. The largest percentage of our deposits, 40%, are annualized business checking accounts, which represent customer operating accounts that generally utilize a full suite of treasury management products. Our customer deposit relationships represent a diverse set of industries. The industry with the largest concentration is manufacturing, which represents 9% of our deposits. This quarter, we included a graph in our investor presentation that shows our deposits by industry classification, highlighting each of the 14 industries that represent 2% or more of our deposits as of March 31, 2023.”

The only exception to this policy was the $1.5 billion drawdown of Federal Bank loans in Q1/Q2 of 2023. This liquidity infusion was warranted by the lack of confidence in the community banking sector after the Silicon Valley Bank collapse and is temporary.

Other balance sheet risks

The federal borrowing was a short-term tool and will have to be paid back or refinanced at the end of the term. The bank has the option to book the unrealised losses on AFS securities and pay down some of the obligations. The unrealised losses on AFS are already reflected in CVBF’s equity and capital ratios.

From the Q2 2023, quarterly report of CVBF:

“Borrowings as of June 30, 2023, consisted of $695 million from the Federal Reserve’s Bank Term Funding Program that were borrowed during the second quarter of 2023 at a rate of 4.7%. These borrowings can be prepaid without penalty and mature in May, 2024. FHLB advances will mature over the next two quarters, with the final maturity at the end of November 2023.

The Bank has $4.1 billion of secured and unused capacity with the FHLB, $1.3 billion of secured unused borrowing capacity at the Fed’s discount window or Bank Term Funding Program, more than $550 million of unpledged AFS securities that could be pledged at the discount window or the Fed’s Bank Term Funding Program.”

Once the existing FHLB facility runs out, CVBF will most likely refinance it with a new short-term facility, albeit at a higher rate of interest reflecting the current base rate.

The average duration of banks’ AFS securities has been about 5-5.5 years. These securities have incurred losses of $500 million as interest rates rose. CVBF might choose to sell some of them and take the tax losses or pledge them for new Federal funds.

CVBF now has about $2 billion of equity on assets of $16.5 billion. Tier 1 capital ratio is c14%. Overall, it would seem that so far the bank is in a good financial position.

Value overview

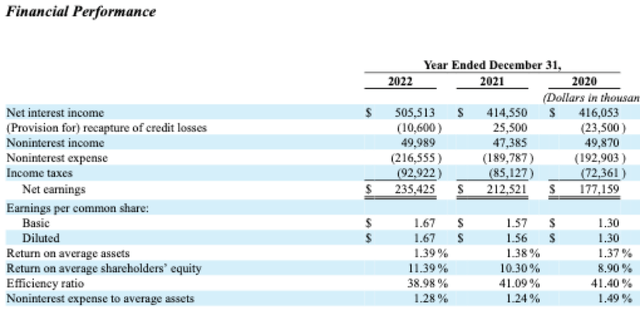

With an equity base of $2 billion, CVBF is generating a net income of c$230 million. With a Return on Equity of 11%+ and a competitive advantage in the cost of deposits, it is well positioned to grow its assets and equity at this attractive rate.

CVBF financial reports

Increasing base interest rates are making new bank loans more expensive while at the same time, the non-interest-bearing deposit base is keeping the interest costs of the bank low. Consequently, the net interest income of the bank is increasing. The effect is not immediate most of the older loans would have fixed interest rates for a certain period of time, but after a few years, they will be repriced if the interest rates stay at a higher level.

The bank will also expand its loan book because of the cost advantage discussed above. Over the next few years, we expect the bank to grow its asset base and the profit margins it generates on these assets, overall the earnings are highly likely to grow.

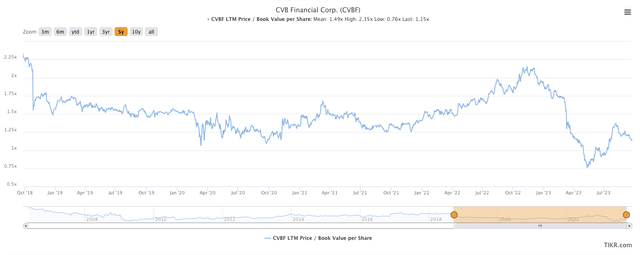

CVBF is currently trading at a PE of about 10x. This level of valuation is low for a business that is highly likely to grow.

On top of this, the bank is currently trading below its historic valuation multiple. The Price Book multiple of the bank currently stands at 1.15X as compared to the 5-year mean of 1.5x. A recovery to a historic valuation level would provide an extra return for shareholders.

tikr.com

Key Risks

The base interest rates have been raised really rapidly after an unprecedented period of ultra-low rates. A number of borrowers are feeling the impact of significantly higher rates while many more have locked in the low rates and are going to have to refinance at much higher rates in the quarters to come. The loan books of banks still look resilient, but problems might surface in the upcoming quarters. The economy is an important factor as a good business environment would drive corporate profits and help service higher debt costs.

Conclusions

CVBF is a cost leader in the commodity industry and for this reason, is likely to continue attracting new customers and growing its market share at an attractive profit margin and a good return on equity. The cost advantage of the business originates primarily because of the high ratio of non-interest-bearing deposits from a diverse set of core long-term customers. We believe this funding cost advantage is enduring and will continue benefiting the business.

Read the full article here

Leave a Reply