Written by Nick Ackerman, co-produced by Stanford Chemist.

Calamos Strategic Total Return Fund (NASDAQ:CSQ) has performed quite well since our last update earlier at the start of 2024. The fund provides investors exposure to a diversified pool of primarily equity positions but also has a sleeve of convertible and high-yield securities. The fund is leveraged, and given that the broader market has done well through 2024, it is too much of a surprise seeing that CSQ has performed a touch better on a total return basis.

CSQ Performance Since Prior Update (Seeking Alpha)

Even with a bit of volatility lately, CSQ continues to trade at only a narrow discount. A shallow discount for this fund isn’t unusual in the last five years or so, but it does mean that we should still be patient before adding too aggressively. Instead, continuing to hold seems like an appropriate plan or making small additions through a dollar-cost average approach could also be the way to go.

CSQ Basics

- 1-Year Z-score: -0.41

- Discount: -2.28%

- Distribution Yield: 7.76%

- Expense Ratio: 1.57%

- Leverage: 30.56%

- Managed Assets: $3.874 billion

- Structure: Perpetual

CSQ’s objective is to seek “total return through a combination of capital appreciation and current income.” They attempt to achieve this simply by; “investing in a diversified portfolio of equities, convertible securities and high yield corporate bonds.”

The fund has the ability to invest where they think the best opportunities might be. That is part of the appeal of active management: the flexibility to adapt to different situations. However, it should be noted that the fund will have “at least 50% in equity securities.”

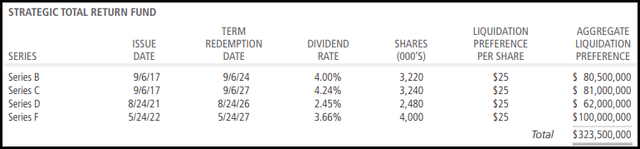

This is a leveraged fund, and when including those leverage expenses, the fund’s total expense ratio comes to 4.09%. As rates rose, the fund’s expense ratio climbed quite materially. It had been 2.50% at the end of October 31, 2022. Fortunately, some of this leverage is through preferred issuances, which come with fixed-rate dividends. Those have helped keep leverage costs somewhat in check.

CSQ Preferred Leverage (Calamos)

However, that still left the fund exposed to floating rates based on OBFR plus 0.80% for the larger part of its leverage pie. At the end of fiscal 2023, the fund had $801 million borrowed, but they have more recently pushed this to $860.5 million as we’ve seen the market rise during this period. As underlying assets appreciate, the leverage ratio naturally declines and allows more room to add further borrowings. Under their latest credit agreement, they can borrow up to $1.13 billion.

Performance – Stubbornly Narrow Discount

This fund provides decent diversification but thanks to a strong tilt toward the top holdings tilting toward an S&P 500 Index-esque exposure, the fund has done incredibly well. The fund holds almost all of the Mag 7 names as top holdings, excluding Tesla (TSLA), which most accept as having been kicked out of the club.

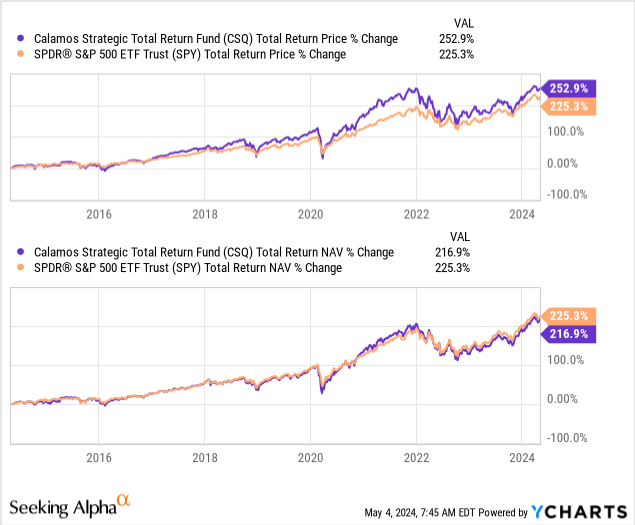

The S&P 500 Index, as measured by (SPY) may not be the most appropriate benchmark for CSQ since the fund carries meaningful sleeves of convertibles and high-yield bonds, but the performance has been competitive nonetheless. The chart below shows us over the last ten years comparing CSQ and SPY, where CSQ actually outperformed on a total share price basis. The fund slightly lagged on a total NAV return basis.

Ycharts

In looking at the annualized results for CSQ, we of course see some solid results as well:

CSQ Annualized Performance (Calamos)

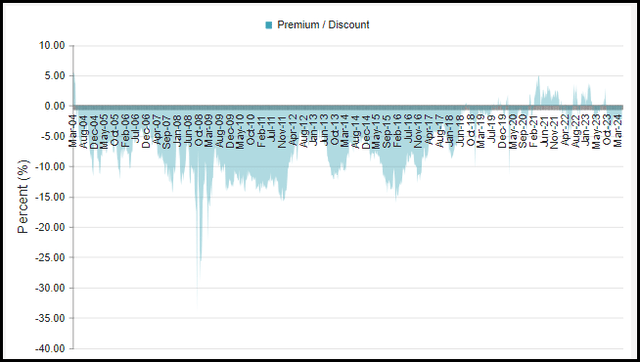

With all that being said, the fund’s discount remains narrow as it has been flirting with a premium since around 2018, leaving this fund at a ‘Hold’ again today. Past performance is solid, but that doesn’t mean we should ignore valuation – as I believe personally that’s a better much better gauge of determining if something is worthwhile buying today or not.

What is quite peculiar is that this fund had historically traded at around a 5-10% discount for most of its life. It was only around 2018 that this started to change, and even despite discounts in the whole CEF space widening out to historically wide levels in 2022/2023, CSQ did not experience that happening. They were able to buck that trend and continue flirting with a premium. Over the last five years, the fund’s average discount comes to a shallow -0.40%.

CSQ Discount/Premium History (CEFConnect)

In addition to considering a CEF’s discount/premium, another consideration is that if we had a more serious market correction, that could also present a time to consider buying more aggressively. I don’t think the latest dip in the market is really presenting the most opportunity. With some more volatility, such as a correction in the broader market, we could even see this fund’s valuation get shaken up a bit more.

Distribution – Looking Steady

The fund pays a monthly distribution that currently works to a rate of 7.76%; based on the NAV, it comes out to a similar 7.58%, given we only have a small discount.

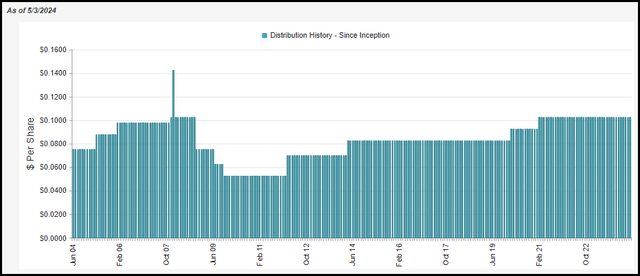

CSQ Distribution History (CEFConnect)

In our last update, I had noted that the current distribution looks quite sustainable as it is at a reasonable NAV rate at this time. In fact, thanks to some appreciation since that last update, the NAV rate has moved a bit lower.

With that, there isn’t too much to update on this front. If one believes the market can continue to perform well, then CSQ should be able to continue supporting its distribution. If one thinks the market is going to sink and stay down for an extended period of time, then CSQ’s distribution could struggle as well.

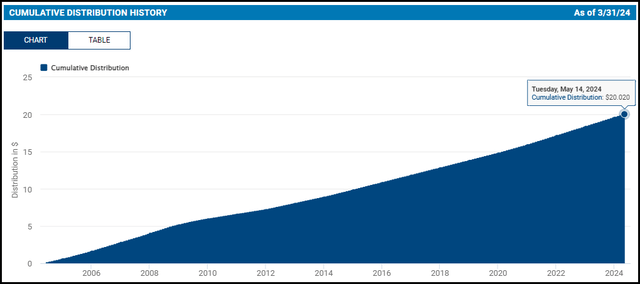

On one last note: The fund has passed over $20 worth of cumulative distributions since its inception. That is quite notable, as this fund launched with around a $15 NAV, and the current NAV is higher now than at its inception. Admittedly, after the Global Financial Crisis, it did take the fund a long time to recover to this level. Still, this is quite an impressive feat nonetheless.

CSQ Cumulative Distributions (Calamos)

CSQ’s Portfolio

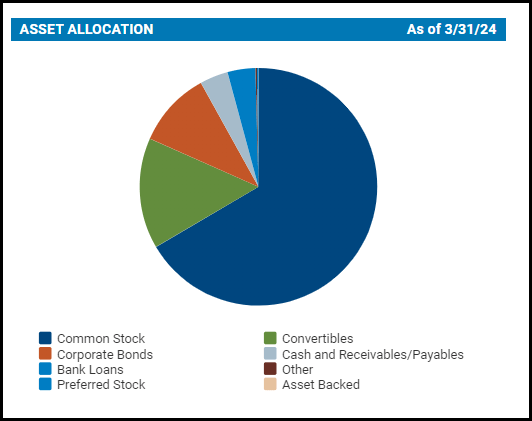

Consistent with the fund’s strategy, the portfolio remains tilted with a heavy emphasis on equity securities. That accounts for 66.57%, with convertibles at 15.08%, corporate bonds at 10.30% and the remainder in various other smaller sleeves.

CSQ Asset Allocation (Calamos)

We haven’t seen a material change since the last time we gave the fund a look, and that was looking at the breakdown as of the end of November 2023. The fund’s turnover rate came to 29% last fiscal year and 24% in FY 2022, so they aren’t the most active, but they have still made some changes over the years.

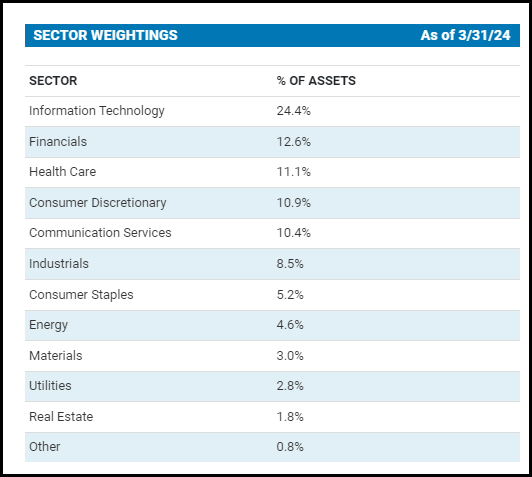

Similar to the fund’s overall asset allocation, we also see that the sector allocations haven’t shifted too dramatically either.

Information technology is the largest sector, at 24.4%, up from 23.6% previously. That is also significantly higher than the second sector weighting, financials, at 12.6%. Financials previously were the third largest sector, at a weighting of 12%, and consumer discretionary came in at 12.3%.

At the same time, the S&P 500 Index itself has seen the tech sector start to comprise around 30% these days. So, if anything, CSQ is looking more diversified in terms of sector allocation.

CSQ Sector Weighting (Calamos)

Some consumer discretionary exposure slipping in terms of the portfolio weighting overall could be at least partially related to TSLA. As we noted at the top, we don’t see TSLA as a top-ten holding, but it was previously.

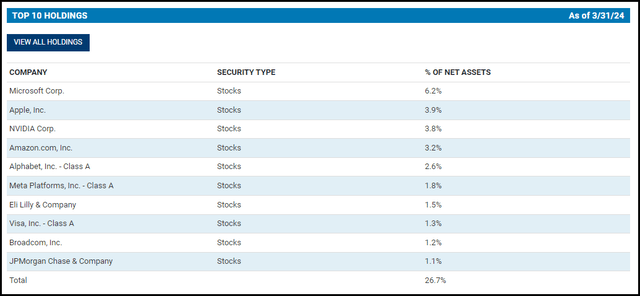

CSQ Top Ten Holdings (Calamos)

According to the fund’s total holding list — which unfortunately doesn’t match the March 31, 2024, timeframe that we see for the top 10 —TSLA was the 17th largest holding as of February 29, 2024.

Overall, the actual percentage weights of holdings in this fund fall quite dramatically after the first several names. That makes this fund incredibly diversified, and according to CEFConnect, it has 824 holdings.

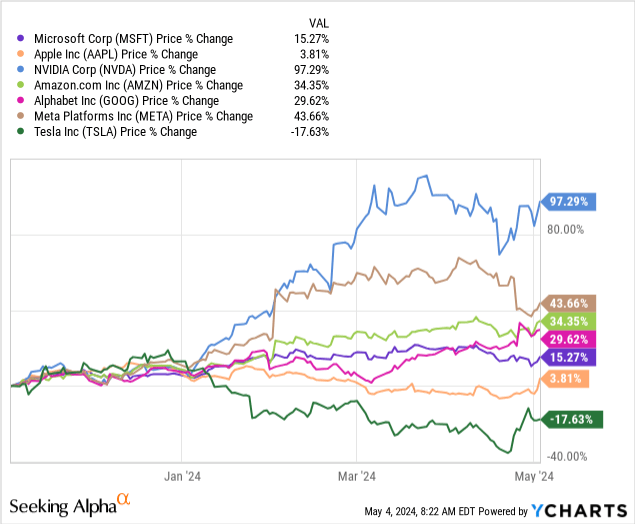

So, TSLA performing terribly hasn’t been too much of a problem for CSQ. Here is a look at the last six months in terms of price changes only of the ‘Mag 7’ names, which some now refer to as the ‘Mag 6’ to exclude TSLA. On the other hand, Apple (AAPL) hadn’t been performing particularly well either, but thanks to announcing a massive $110 billion buyback with their earnings, the stock popped.

Ycharts

Conclusion

CSQ has provided a solid track record of performance historically, but the fund’s shallow discount could mean it is not the best time to consider adding too aggressively here. The fund’s narrow discount and even flirting with a premium over its NAV has been an ongoing event for the last five years now. However, more patient investors could likely wait for those 5%+ discount levels that have shown up on occasion to add more meaningfully. An overall market correction could also make it a more interesting time to consider this fund, which could likely get that discount to loosen up a bit more as well.

Read the full article here

Leave a Reply