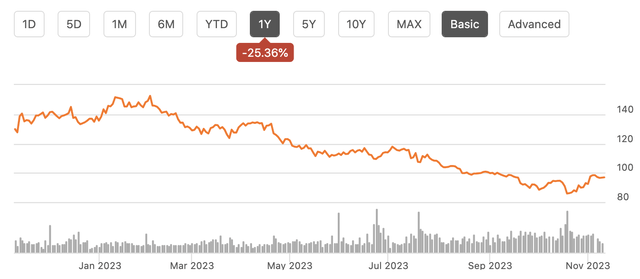

Shares of Crown Castle (NYSE:CCI) have been an incredibly disappointing performer over the past year, shedding about a quarter of their value. While higher interest rates have undoubtedly played a role, reducing valuations across the REIT sector, operational performance has also not met expectations. Last year, I argued incorrectly that CCI was a buy given its contract profile and capacity for dividend growth. Now below $100, with a ~6.5% yield, it is worth revisiting shares. While there are some transitory problems, CCI is engaged in some concerning, aggressive actions as well, and I do not expect a share price recovery.

Seeking Alpha

In the company’s third quarter, CCI generated $1.77 in funds from operations, which was $0.03 below consensus. Given the need to invest in 5G networks, and Crown Castle’s focus on small cell-cites that generate higher starting returns, I had viewed the company as having mid-to-upper single-digit growth prospects. Unfortunately, CCI expects adjusted FFO growth of just 2% this year, or $7.54. Even more troubling, next year it projects $6.91, at the midpoint, down 8% as revenue falls by 2%. So, where have things gone wrong?

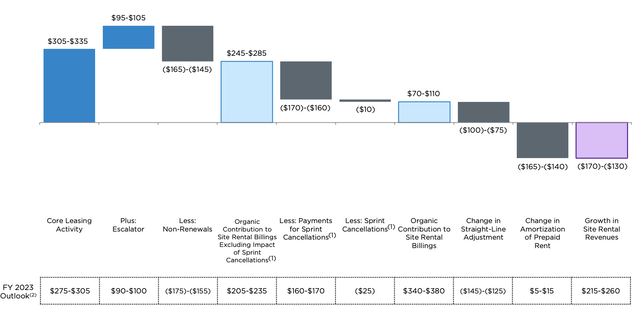

In 2023, it still expects 5% organic revenue growth from towers and 10,000 small cell nodes; however, cancellations by Sprint have reduced revenue, though the company did get a $165 million payment this year for that contract cancellation. That will not repeat next year and is about a 3% year-over-year headwind to revenue.

Crown Castle is also feeling some pressure from inflation, in Q3, revenue rose by 1% (organically, by 4%), but EBITDA declined by 3% and FFO 5%. Site rental revenue rose by $9 million, but site rental costs rose by $15 million. The tower/small-cell business has significant fixed cost. Often, it is leasing land or space for its equipment, which it then contracts out to support wireless networks. With Sprint cancelling contracts, its effective network utilization has declined, but it still has fixed costs, rental payments etc, which are narrowing margins. Because of this, the company has undertaken a $105 million cost reduction program, which should begin to bear fruit next year.

Next year, organic towers growth will be 4.5% with 14,000 small cell nodes. However, site rental growth will be -2%. As you can see below, there are a lot of moving parts. The Sprint cancellation payment creates an unfavorable comparison, and there are $240 million in non-cash items relating to schedules for depreciation and amortization for prepaid rent. Frankly, these items, particularly noncash ones driven by accounting rules around timing, worry me less than variances in underlying organic growth.

Crown Castle

These items, clearly exacerbate the decline CCI is posting, and they do make 2024 look worse than it will be. However, “normal” organic revenue growth of ~$265 million is below 5%. We need to consider the fact that its net discretionary capital spending is going to be about $1.2 billion next year. CCI has about $15.7 billion in property, plant, and equipment on its balance sheet. That capital spending represents about 8% of its fixed asset base. The company does carry goodwill, but I view it best to look past intangibles, which can be written down.

With an 8% increase in the tangible capital base, 4-5% organic revenue growth is really disappointing, in part because non-renewals remain elevated. Management is noting that it’s spending just 20% on small-cell sites to deliver 40% more of them (14k vs 10k), but this increased capital efficiency in terms of nodes completed is not translating into greater capital efficiency in terms of revenue generated, which is the more relevant factor for investors.

Crown Castle has a backlog of 60,000 small nodes, so this level of revenue growth is fairly lackluster and points to either lingering issues from the Sprint cancellations or underwhelming pricing power. Nonetheless, the business is clearly growing more slowly than hoped for, even netting out non-cash issues.

Additionally, next year, while site rental income is falling $141 million in 2024, costs are rising $43 million, according to guidance, as the weaker utilization continues to weigh. Now management, expects these issues to fade over the year, and as its cost-cutting program takes hold, AFFO will bottom in H1 2024 and begin to rise. Ex Sprint, and noncash items, AFFO growth would be up about $65 million, just 2%. Again, given the capital spending, that is not compelling growth.

CCI is maintaining its dividend with the aim of growing it again “after 2025,” as stated on the earnings call. Shares do offer a 6.5% yield, but any dividend growth is more than 2 years away. As it is, the dividend will be 90% of adjusted FFO next year. Here, is where I have some concerns. As noted, CCI has a $1.2 billion cap-ex budget, up $200 million from this year.

Again, spending more on cap-ex as underlying growth is subpar is already an aggressive action in my view. Because the dividend consumes 90% of cash flow, CCI needs external financing for this spending. It has ruled out equity issuance and instead will rely on debt financing for this spending. With rates elevated relative to recent history, this is an expensive source of funding. As such, interest expense is expected to rise $104 million, next year. This is also a reason AFFO is underperforming in revenue growth.

Now when a balance sheet has little debt, adding debt can be accretive, even if rates have risen. However, CCI already has a 71% debt to capitalization with $22.7 billion of debt. Assuming it adds $1.2 billion of debt in 2024, its debt to EBITDA leverage ratio will rise to 5.7x from 4.9x this year. Adding nearly 1x of leverage in a single year is a meaningful increase in debt.

Maintaining investment grade ratings is essential given CCI is a constant debt-issuer for growth projects as well as refinancing maturities, and facing increased costs on this would reduce cash flow. As such, it will want to bring leverage back to a more sustainable 5x over time. This is why the company has already pushed out dividend growth until after 2025, and even then, dividend growth may lag underlying AFFO growth for some time.

Interestingly, CCI announced in Q3 that the CFO is leaving next March, with a search ongoing. The fact he is not leaving immediately is a good sign that it is not an unruly departure. However, the lack of a successor is a sign this was not a planned succession. In situations like this, I often think a disagreement over financial policy or strategy may be a contributing factor.

Taking on a lot more debt while the business is slowing is an aggressive strategy. I fully understand that dividends are sacrosanct, and there should be a very high bar to cutting them. I would rather have seen CCI announce a much smaller cap-ex budget, recognizing the cost of debt financing and slower organic growth. Instead, it is spending more on cap-ex, likely borrowing north of 6.5% in the process, and with a return on that investment that seems to be weaker than in the past, given the smaller incremental gain in revenue.

This is a difficult situation, and no one likes to downgrade a stock after it has already fallen by 25%, but we should think about the future, not the past. Yes, shares offer a 6.5% yield, but that dividend will not grow for 2 years, if not longer. The underlying business is slowing, and the company is adding leverage at a time of high interest rates. That is a troubling combination, and over the next five years, dividend growth is likely to be below 2.5%, considering its weak coverage today, higher interest expense, and 2 years of no growth. Moreover, if there is a business misstep, I do fear a dividend cut will be necessary to retain cash and protect the balance sheet.

Given this backdrop, I view shares as dead money. I do think the dividend will be maintained, but I struggle to see a path to growth for some time, and the aggressive financial policy troubles me. I see better opportunities for income investors in a company like Hess Midstream (HESM) or Kimco (KIM), and I would rotate out of CCI here.

Read the full article here

Leave a Reply