Interest rate-sensitive stocks are among the few that may perform well in a bear market, particularly those that have lost value as interest rates have risen. One potential example is the telecommunications REIT Crown Castle (NYSE:CCI), which had lost around half its value from 2021 to 2023 due primarily to higher interest rates. As rates rose, the company’s interest costs also did, resulting in a sharp increase in its effective leverage (times interest earned). Further, as a REIT, the fair value of its dividend rose with higher real interest rates, creating an added headwind for its valuation.

I was bearish on telecommunication REITs from 2021, believing the sector to be overvalued amid excessive investor exuberance surrounding 5G, “IOT,” and, more recently, AI. Those trends play some role in the company and are essential for its future. That said, there is little reason to believe they will result in significant organic profit growth, requiring material R&D, CapEx, and other investment costs to innovate. A large portion of Crown Castle’s income goes to these investments, keeping it competitive with American Tower (AMT).

In 2022, I reiterated my bearish view on telecom REITs, specifically CCI. My updated view was that inflation was a net negative and that its growth estimates were overestimated. Since then, CCI has lost an additional 10% of its value. Its revenue slowed and is now falling, with its income and cash flows also falling.

Looking forward, Crown Castle’s performance will largely depend on changes in its interest costs and developments in the telecommunications sector. In the short term, I think there is a clear tailwind from impending interest rate cuts, though that will depend mainly on how far the Fed cuts rates. Further, in the event of significant rate cuts, I believe the negative secular and cyclical trends facing the telecommunications REIT market may accelerate, potentially offsetting gains. Still, CCI’s valuation is undoubtedly lower and more reasonable than in the past.

Will CCI’s Sales and Income Rebound?

A core theme of my previous analysis of the cell-tower REIT industry is that it is inherently cyclical and faces notable economic and competitive risks. On the one hand, it is cheaper and quicker to build a new telecommunications asset than a new building, giving CCI significant growth potential in the past. On the other hand, the low relative cost of construction results in lower locational monopoly value, creating minor competition, particularly in urban environments. Secondly, although the initial costs of building telecommunications towers are not huge, they have more significant overhead costs and higher exposure to skilled labor inflation.

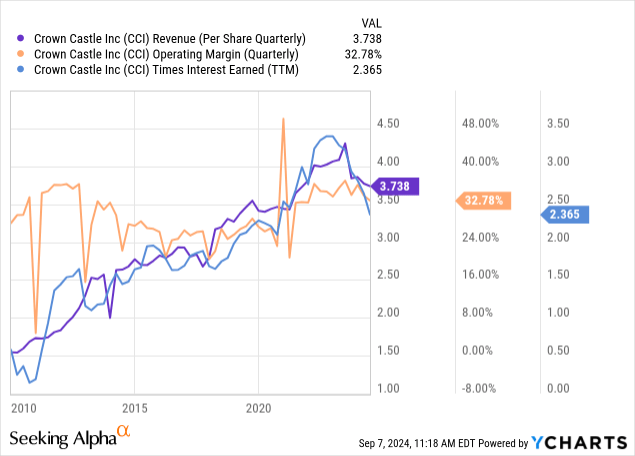

The company saw a sharp decline in sales last quarter due to a fall in rental revenue. Its operating margins slipped, too, but the company said it is looking toward layoffs to improve profitability. Its operating margins are decent today but are stagnant and potentially under pressure. Further, its times-interest-earned has turned sharply lower, indicating more of its EBITDA is going to interest costs. See below:

To me, the critical issue with CCI is its high debt and underappreciated risk. Indeed, the tower industry is a relatively low-risk market. Although it faces competition, it is not on the scale seen in most businesses but higher than that of utilities. However, in my view, many investors, including creditors, have treated Crown Castle as if it were a monopoly utility in the past, allowing it to take on excessive leverage under the assumption it would never see cash-flow pressures.

Its TTM debt-to-EBITDA is 6X while its total liabilities to assets are 85%, implying it is highly leveraged. Its debt maturity schedule ranges from this year to 2051, though it has a large “maturity wall” around 2027 to 2029. Its debt is predominantly fixed, with rates around 1-6% depending on whether it was loaned before or after 2022. Its upcoming maturities (2024 and 2025) are all pre-2022 debt, with rates in the low 1-4% range.

Given its BBB (negative outlook) credit rating, I expect this debt to be refinanced at around 5-6%. With around $2B in debt maturities through 2025, that may increase its interest costs by around $60M annually, which is not huge given its TTM interest expense is ~$880M. However, the more significant issue is if rates fail to substantially decline around 2026-2029, as the company has around $9B in maturities over that period. A 3% rate increase by adding around $270M in interest costs. Further, in that scenario, its falling times interest earned may push its credit rating lower, giving it higher refinancing costs that could cut much deeper into its net income (~$1.2B TTM).

Now, interest rates are expected to decline by then. The five-year rate is about 2% lower than the current one-month rate, indicating only a slight increase in refinancing costs for that 2026-2029 debt. Further, rates may decline more than the market expects in a recessionary scenario. Of course, I expect a recession would result in excess stimulus that may promote inflation and repeat the 2020-2022 cycle, potentially leaving higher rates. It is challenging to speculate on rates that far out, but Crown Castle has too much debt that it is somewhat dependent on ultra-low rates.

Fiber and Tower Demand is Stagnating

The company operates through two segments: towers and fiber. Towers are its core business, primarily built in the 2010s, while fiber expansion has been its more recent endeavor. The company earns two-thirds of its revenue from towers and around three-quarters of its profits from that segment. Fiber may have growth potential, but it’s less profitable due to greater competition. This year, most of CapEx spending has gone to fiber ($562M) compared to towers ($64M).

Its fiber business is controversial, and the company’s co-founder deems it a shameful adventure. Activist fund Elliot Management formed a stake in the company, looking to sell the segment. Still, it has encouraged Crown Castle to cut overhead and make the fiber more profitable.

Despite all the buzzwords regarding telecommunications demand, the data indicates that demand growth is slowing. Yes, 5G and other innovations will change the market, but they are not dramatically increasing the US need for more towers and internet cables. AI is, to me, not relevant to Crown Castle, being more critical for data centers. The fiber business may also face competition from Elon Musk’s Starlink. Although Starlink is, at this point, more expensive and slower than fiber, I expect it will continue to see speed and price improvements, breaking monopoly power in many internet fiber markets. At the least, that may discourage internet providers from renting fiber cables years from now.

The tower business, to me, has little long-term organic growth potential. People may look back at Crown Castle’s growth and assume it will continue, but that was during a period (2007-2019) when smartphone adoption and data demand were rising exponentially. In my experience, the change from 3G to 4G seemed far more significant than from 4G to 5G, as I do not experience slow loading on 4G but face faster battery drain on 5G. Although an excellent push for 5G remains, it doesn’t seem close to the significant consumer-driven tailwind from 4G.

There is still a general trend toward cellular data demand growth, which should persist for some time, but not close to the magnitude of previous levels. To me, it boils down to people not having more time to spend on phones than they already do (around 4.5 hours), smartphone adoption being ubiquitous, and data demand from improved screen resolution being marginal.

Increasing competition among cell providers is also pushing per-GW prices down significantly, potentially implying towers are as valuable as in the past. Crown Castle is seeing some growth by developing new small cell towers in urban areas to help with 5G connectivity. Still, its performance over the past two years validates my long-term view that 5G is not a revenue driver.

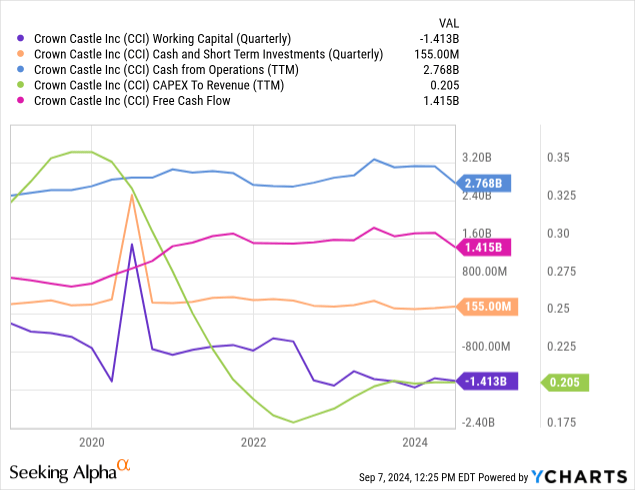

Now, Crown Castle is best keeping its CapEx low and, ideally, paying down its debt. Indeed, there seems to be a shift away from growth. See below:

The company has reduced capital spending compared to its sales, improving its FCF since 2018. However, its operating cash flow is slipping with its sales due to what I view as competitive and economic risks. Its liquidity is not strong, with little cash and ST investments with significant negative working capital due to debt maturities. Still, its cash flow is high enough to have no liquidity concerns, just a generally weak balance sheet.

The Bottom Line

In my view, Crown Castle’s risk is due to the combination of its high leverage and the “surprise” stagnation and recent declines in tower site rental revenues. At this point, data demand is not rising so fast that we can assume the towers are monopolies. If either Crown Castle or American Tower continues to develop, they’ll likely create a negative net impact by lowering competitive pricing. Thus, Crown Castle is spending more on fiber investments, facing more significant competitive pressure. In the long run, innovations from Starlink or expanding low-earth-orbit satellite technology may devalue fiber and telecommunications towers. That is certainly not an immediate competitive risk, but with leverage as high as Crown Castle’s, there is little room for falling profits.

I’ll continue watching CCI as it faces significant long-term risks. That said, I am neutral on CCI because its valuation is reasonable, given its immediate profit outlook. Its FFO per share is around $6.8 TTM, down from roughly $7.5, and may rebound if its rent headwinds are as temporary as the company expects. Its price-to-FFO is undoubtedly not low at 17X, but it is also not excessively high. Its dividend yield of 5.4% is also far from low, given its risk profile, but it is not at the extreme lows seen when I first became bearish on the tower market.

Still, taking a long-term outlook, I think CCI faces greater downside risk than reward potential. Interest rate reductions may aid its short-term outlook, mitigating some headwinds in refinancing, but only if the Fed cuts rates dramatically. Though I am neutral on CCI, I may become bearish if credit rating agencies downgrade the company’s debt, as that may push its future interest costs up ahead of larger debt refinancings, potentially creating a significant headwind for their profits.

Read the full article here

Leave a Reply