Dear subscribers,

About 2 months since I last gave you an opinion on Crown Castle (NYSE:CCI) and gave the company a “BUY”. Since that time, we’ve seen a non-trivial decline in the share price, and what I would view as now a materially improved valuation thesis.

It’s always tricky investing in companies that have very few growth prospects. In today’s interest rate environment, this requires substantial asset and portfolio safety to offset the lack of growth risk. We also shouldn’t be buying non-growing companies at anything approaching premium valuations.

Luckily, Crown Castle is now in a position to be considered undervalued no matter how you slice this one.

So let me show you why I’ve added to my position, and also added the company to my commercial portfolio.

Looking at Crown Castle once again.

I’ve written about Cell Tower REITs before – and between owning a whole slew of my portfolio in qualitative telcos which all are, in one way or another, bringing their tower properties to bear, there’s a lot to be said for the stability and earnings potential of a qualitative Cell tower telco. Remember, I’m a major investor in these companies.

I own businesses that help people communicate to a degree of over 18% of my total portfolio value, spread out over companies like Deutsche Telekom (OTCQX:DTEGY), Telenor (OTCPK:TELNY), Telia (OTCPK:TLSNF), Tele2 (OTCPK:TLTZF), Orange (ORAN), AT&T (T) and Verizon (VZ) – as well as others. These companies provide high dividends with high, relative margins of safety while not providing us with that much overall growth. That’s the reason I have a high interest in something like Cell tower REITs.

People often ask me how I think about income versus growth investments – how I think about my portfolio in terms of expected returns. My answer is that I tend to use a 60/40 approach – where 60% of my portfolio is weighted more toward companies that are income focused. This is where you’d find REITs, Telcos, finance companies, and other businesses with an above-average yield but solid fundamentals where my focus is on the attractive dividend. I want an upside regardless of this – usually 10-15% per year – but I’m fine with that, and the income I get.

The remaining 40% are focused on companies that are more towards delivering growth in my principal. This is where we find companies with sub-2-3% yield, but with a capital appreciation upside usually with a potential TSR of 70-300% over a period of several years. That way, I combine both growths in my portfolio with an impressive income.

People also ask me what “direction” my strategy will develop as I become “wealthier”.

I always try to be transparent in such questions. When I started writing on SA, I was 80-90% income-focused. And I expect that within 3-5 years, less than 20-30% of my portfolio will be focused on income – instead focusing on the growth of capital appreciation.

This is not because I don’t want income, but because as your portfolio and yields grow, you need less and less of the portion of your portfolio tiered towards income. You’re able to wait longer amounts of time for upsides to materialize.

Even today, 60% towards income is in fact far too high for me.

While I am actively reducing this, Crown Castle is an investment definitely more towards the income side of things. But when I see good opportunities, I never let those pass by.

Many analysts would, due to a collapsed share price, start to consider this REIT a bit of a “value trap”. However, I would be in strong disagreement with such an assessment. The company may be somewhat average in terms of debt. It has 6.93x debt/EBITDA, which has put it at a BBB rating in terms of credit. Far from the best. However, its overall margins are solid, producing a reliable, recurring set of earnings/FFO – even if that FFO is now set to decline marginally over the next few years.

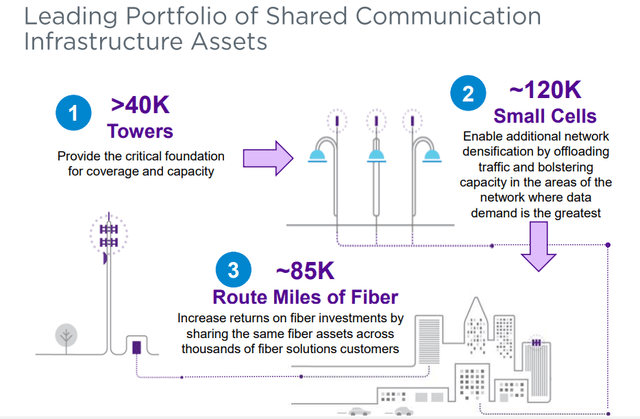

However, despite this, CCI is still the largest provider of communications infrastructure in USA and one of the largest in the world. It owns over 40,000 towers, 120,000+ small cell towers as well as over 85,00 route miles of Fiber infrastructure.

None of this is going anywhere in a short timeframe.

Thanks to the decline in valuation due to earnings, we now have a yield of over 5.5% for a cell tower accompany, where typical historical have been closer to 3%. Investing in telcos and their related companies now usually comes at a growth risk – meaning growth is either negative, not there, or very, very small – in an environment not only of increasing costs but increasing inflation and other factors that could negatively impact the business.

CCI IR (CCI IR)

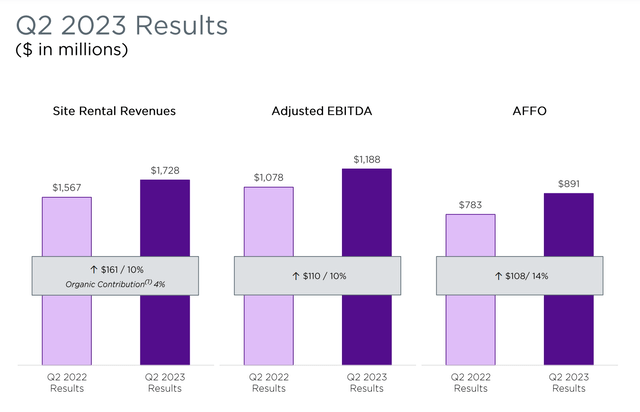

2Q23 is the reason for the latest drop In share price. The results were within what was viewed as the company’s expectations – but the overall issue was slowing activity in the tower segments. In one way, it can be viewed as odd that the company dropped in light of results such as these…

CCI IR (CCI IR)

But at the same time, clear, because the company’s adjusted outlook includes a downward expectation for $50M less in terms of EBITDA, and $40M less in FFO than previous estimates, and now includes the very real potential for both lower company EBITDA and lower company FFO for the full year. Whenever a company begins its earnings call by saying that they want “to provide context”, which is what CCI did, you’re going to want to pay attention.

Nothing of what CCI said was strange, and similar trends have been seen in Europe. We’ve seen telco investments for spectrum and infrastructure reaching an apex for the past few year/years, and it’s not illogical to assume going forward that this will go down. CCI is seeing this through slowing tower activity – significant slowing, as a matter of fact, resulting in the guidance slowdown.

This slowdown combined with interest expense increases due to higher rates and overall expense increases from things like energy, wages, and inflation.

Significant headwinds are coming from network spending reductions, and with interest cost increases, it wouldn’t have been wrong to expect AFFO/FFO to decrease even more. However, due to cost-reducing actions, the fall is only expected to be just south of 10 cents on a per-share basis.

Still, CCI has a combination of balance sheet strength and portfolio appeal. The balance sheet is because CCI was one of the few companies to issue longer-dated debt at interest rates that at the time seemed high, but now seem low. The company was able to pay down higher-expense debt with the proceeds of this, and it has resulted in a stellar debt/EBITDA rate. I would argue that the company, with only around 4.5x, is indeed as high as BBB+ or even A-rated. That makes it one of the highest-rated Tower infrastructure companies around.

We have to realize that CapEx spending is going to be under pressure on a forward basis – telcos are very aware of expense management, and the easiest way to cut this is to defer investments and various forms of CapEx. Expect telcos to do exactly that where possible, and also expect the potential downside for CCI to be somewhat larger due to this.

This does not make the company uninvestable – valuation is actually superb here.

Crown Castle International – A “BUY” here due to valuation.

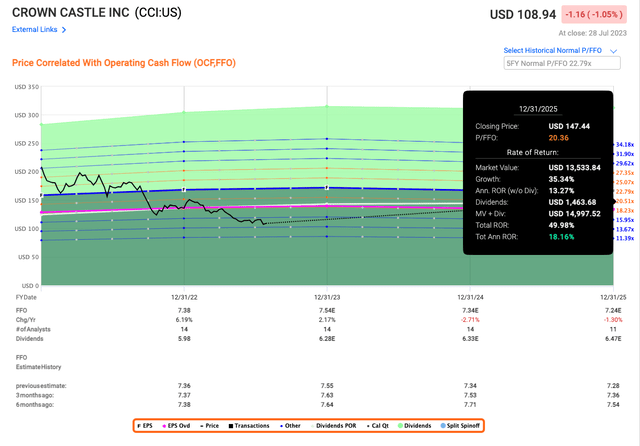

The company now trades at a P/FFO below 15x. That turns the company “cheap” for the first time in many years. The upside even just on a 15-16x P/FFO, meaning completely flat development here is now almost 8.5% per year or 21% per year. At a 5.75% yield, that’s what I would consider acceptable for an investment like this.

Any sort of reversal in the company’s fortunes towards a 20-22x P/FFO, and you’ll see a 17-22% annualized even at very low growth here, or almost 50-70% in 3-5 years. That’s the power of reversal and normalization.

Likely? I don’t think so – not unless we see a reversal in the company here. This is a company you’ll “BUY” because you think it probably won’t go much lower here. If you expect the company to go much lower, then it’s a good idea to wait. I think it might go lower – but I also think it may stabilize around the $100 mark, which makes a $108/share a good price target to enter this investment.

F.A.S.T. Graphs Crown Castle (F.A.S.T. Graphs)

S&P Global averages have already been adjusted. CCI was at an average of $200/share less than a year ago. It’s now down to an average PT of $128 – and that’s from a low of $91 up to $162. Out of 17 analysts, only 4 are at “BUY”, and 9 out of 17 are either at “BUY” or “Outperform”. Most of the analysts are at “HOLD” or “Underperform”. That still leaves an 18.2% upside to the PT, with a price/NAV at currently 0.64x. I would pay around 0.7x for these assets, which is also my overall PT of $135 – a price target that I’m not changing in the least.

I didn’t buy the company at $200/share. Wasn’t even interested in it at the time. I bought other, more undervalued companies. I’ll do the same here, going forward, but now CCI is actually cheap for what it offers.

I believe investors who paid nearly 30x P/FFO must have been caught up in the mania that accompanied ZIRP. Thankfully, I avoided all such investments, by avoiding in general investments having to do with growth as opposed to value. Value has been, and continues to be my best defense against investing in companies that are not solid enough.

at a $135/share PT, you’re buying the company at a below 0.7x NAV. This is conservative enough to see a solid upside, even if we’re in for months or even 1-2 years of sub-par returns, as long as the company eventually recovers.

What would cause me to change my positive thesis for this company is a significant deterioration of the company’s fundamentals – something I view as unlikely, but could of course happen in the “wrong” situation or if the industry trends see a serious decline. But given the outlook and forecasts for the company at this particular time, it would take significant further bad news for this to be relevant.

Remember also, that company peers like American Tower (AMT), are actually trading at 19x P/FFO. Either AMT is going to drop (because I do expect results for AMT to compress as well), or CCI is going to grow. But some normalization is likely to happen here.

Here is my updated, post-Q2 thesis for CCI.

Thesis

-

Crown Castle Inc. is among the market-leading cell tower/infrastructure REITs. It yields over 5.6% and while it won’t grow much, its yield is covered and solid. At the same time, leverage remains a concern though one that’s being paid down, this is the only actual risk/Drawback, aside from the lack of growth seemingly inherent here.

-

I would value CCI at 17-18x P/FFO for a “BUY”. That means that as the valuation stands today, we can actually buy the company.

-

There is an upside, and my PT is $135/share or below.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is now “cheap”, fulfilling 5 out of 5 criteria for investment. That makes it a “BUY”. I would consider it cheap at double digits, not above.

Read the full article here

Leave a Reply