We added Crescent Capital BDC (NASDAQ:CCAP) to our portfolio in late May after CCAP completed its acquisition of First Eagle Alternative Capital BDC (FCRD) in the first quarter.

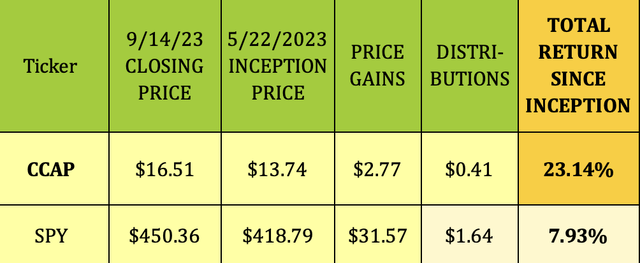

CCAP has been a winner for the portfolio so far in 2023, with a 23% total return, vs. ~8% for the S&P 500 during the same period. That makes sense, as rising rates have been ramping up BDC profits for the past several quarters.

Hidden Dividend Stocks Plus

Company Profile:

CCAP is focused on originating and investing in the debt of private middle-market companies which are also supported by sponsors. A key factor for BDCs is that the companies that they invest in also have sponsorship from venture capital and/or private equity companies, which will add further support to them in tough times, such as during the pandemic.

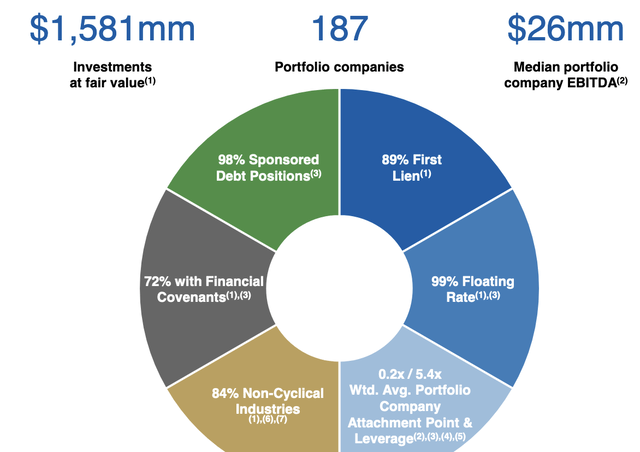

As of June 30, 2023, CCAP had investments in 187 portfolio companies with an aggregate portfolio fair value of $1,581M and a median annual EBITDA of $26M. The portfolio grew 24% vs. Q4 ’22, mainly due to the acquisition of First Eagle BDC in Q1 ’23.

Holdings:

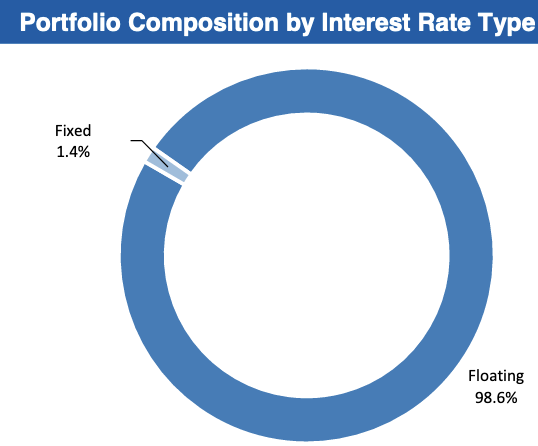

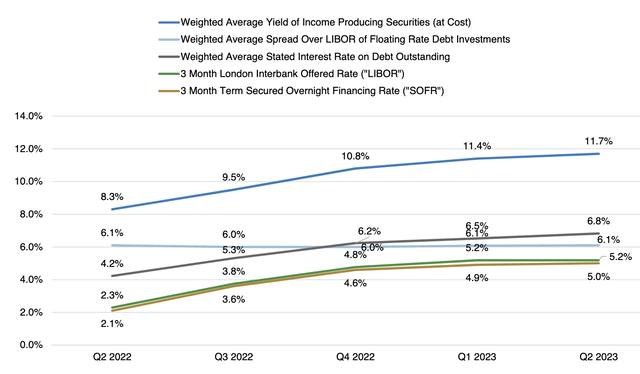

98.6% of CCAP’s portfolio investments are floating rate, which has been a big boon over the past year, with the Fed raising its rate 11 times for a total of 500 basis points since March 2022.

CCAP Aug. ’23 Presentation

Another plus for CCAP is that 98.6% of its debt positions also are sponsored by hedge or equity funds, which tend to have much more at stake in the underlying companies. Hence, these sponsors offer support to the underlying companies in tough times, in order not to lose their equity.

89% of CCAP’s loans are 1st Lien, with 72% having additional financial covenants.

CCAP Aug. ’23 Presentation

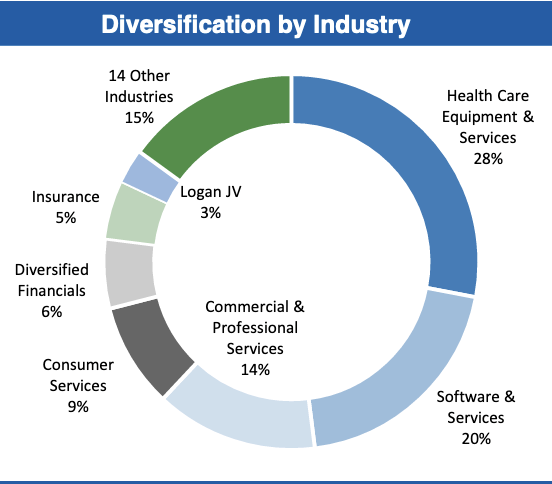

Health Care Equipment & Services is the biggest sub-sector exposure at 28%, followed by Tech/Software & Services at 20%, Commercial & Professional Services at 14%; Consumer Services at 9%, Financials at 6%, Insurance at 5%, and 14 other industries comprising 15% of the portfolio.

CCAP Aug. ’23 Presentation

Rising interest rates have increased CCAP’s weighted average yield all the way from 8.3% in Q2 ’22 to 11.7% in Q2 ’23:

CCAP Aug. ’23 Presentation

Ratings:

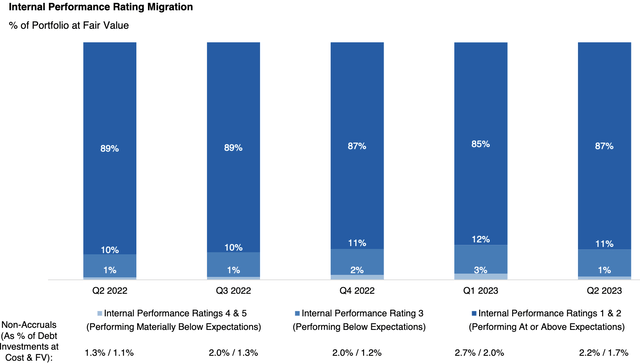

Like other BDCs, CCAP’s management rates its holdings on a quarterly basis. The scale is from 1 – the highest, to 4 & 5, the lowest. Tier 4 bottomed out in Q2 ’20, during the pandemic lockdowns, at 2.1% of the portfolio.

The top 2 tiers have been in a steady range of 85% to 89% over the past four quarters. Non-accruals rose from 2% to 2.7% in Q1 ’23, due to the acquisition of First Eagle. However, they improved to 2.2% in Q2 ’23.

CCAP Aug. ’23 Presentation

Earnings:

Q2 ’23: CCAP invested $38.1M across two new portfolio companies and several follow-on revolver and delayed draw fundings, and had $27.6M in aggregate exits, sales, and repayments.

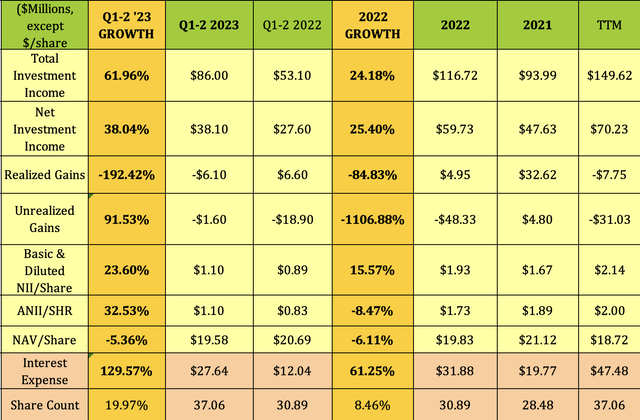

Topline and earnings growth were very strong due to the First Eagle acquisition. Total investment income totaled $46.7M, up 75%, vs. $26.7M in Q2 ’22. Net investment income was $20.6M, or $0.56/share, up 32%.

Q1-2 ’23: Total investment income rose 62%, with NII up 38%, NII/Share up 23/6%, and Adjusted NII/share up 32.5%. NAV/Share fell 5.4%, with the share count up 20%, as part of the acquisition financing. Interest expense rose $15M+ on higher rates and a larger portfolio to finance.

Hidden Dividend Stocks Plus

Dividends:

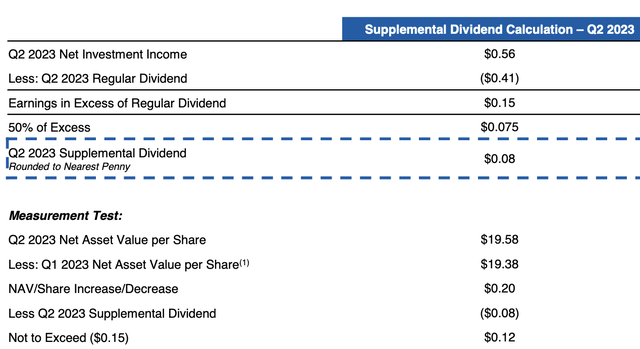

Management has launched a supplemental quarterly dividend this quarter, developing a calculation formula.

New Supplemental Dividend Formula – The regular dividend is deducted from NII/Share, leaving whatever excess there remains. 50% of that excess is planned to be distributed as a Supplemental Dividend for the quarter.

Management’s measurement test will cap the supplemental dividend such that any decline in NAV over the prior two quarters plus the supplemental dividend will be no more than $0.15 per share:

CCAP Aug. ’23 Presentation

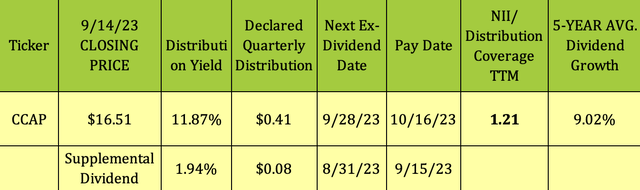

At its 9/14/23 $16.51 closing price, CCAP’s regular dividend yield was 11.87%. Annualizing the $.08 supplemental dividend adds another 1.94%, for a total yield of 13.81%.

The supplemental dividend is being paid 9/15/23, while the regular dividend goes ex-dividend on 9/28/23, with a 10/16/23 pay date.

Hidden Dividend Stocks Plus,

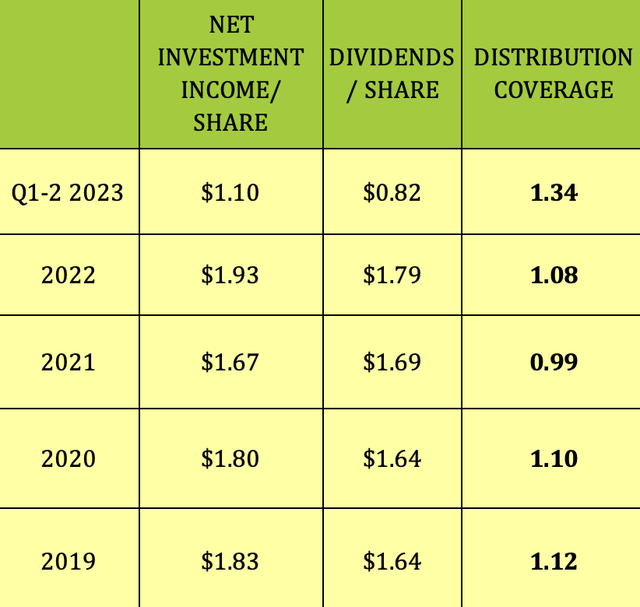

CCAP had very strong dividend coverage of 1.34X for Q1-2 ’23, and 1.08X coverage in full year 2022. Its trailing 12-month coverage has averaged 1.21X, which is better than the 1.11X BDC average.

Hidden Dividend Stocks Plus

Taxes:

2022 dividends were ordinary dividends, with 12.46% qualified dividends.

Profitability and Leverage:

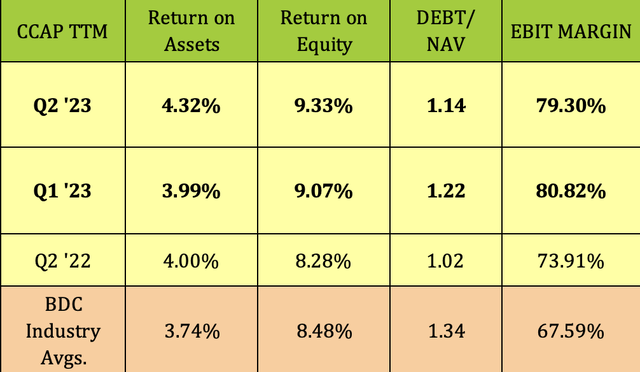

ROA and ROE rose slightly in Q2 ’23, and remained a bit above BDC averages, while EBIT Margin was roughly steady and also above average. Debt/NAV leverage eased somewhat and is more conservative than average.

Hidden Dividend Stocks Plus

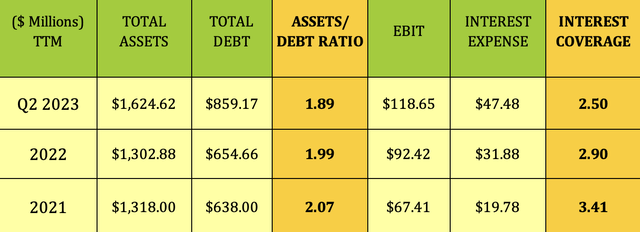

Assets/debt was down slightly, whereas interest coverage was much lower, due to much higher interest rates. Average BDC Interest coverage is ~2.6X, slightly stronger than CCAP’s coverage.

Hidden Dividend Stocks Plus

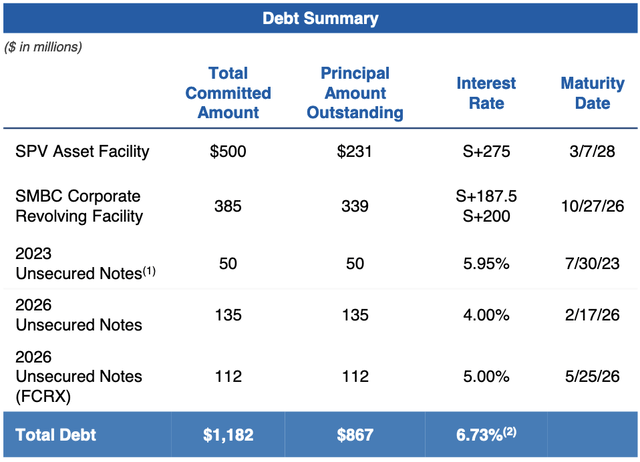

Debt and Liquidity:

CCAP had ~$323M in liquidity as of 6/30/23, with $315M in its two credit facilities, and $7.5M in cash.

On May 9, CCAP completed a private offering of $50M aggregate principal amount of 7.54% senior unsecured notes due July 28, 2026. These 2026 notes became effective upon the repayment of the 2023 Unsecured Notes at their maturity on July 30, 2023.

Hence, there are no debt maturities until 2026.

CCAP site

Performance:

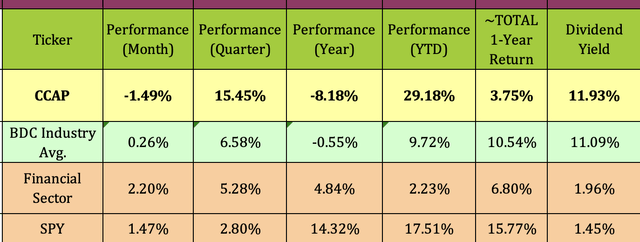

CCAP has outperformed the BDC industry, the financial sector, and the S&P 500 over the past quarter, and so far in 2023.

Hidden Dividend Stocks Plus

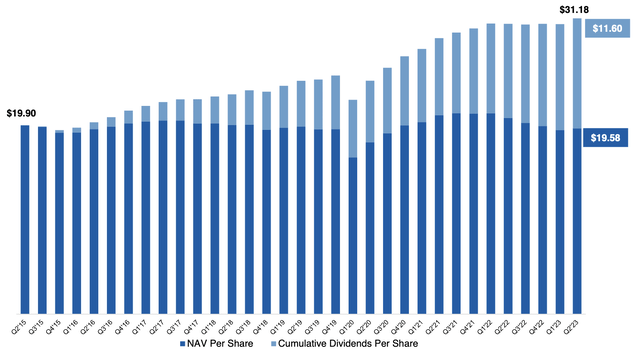

CCAP has distributed $11.60/share in cumulative dividends since its Q2 ’15 IPO. The total value was $31.18 as of 6/30/23, vs. its IPO NAV of $19.90:

CCAP site

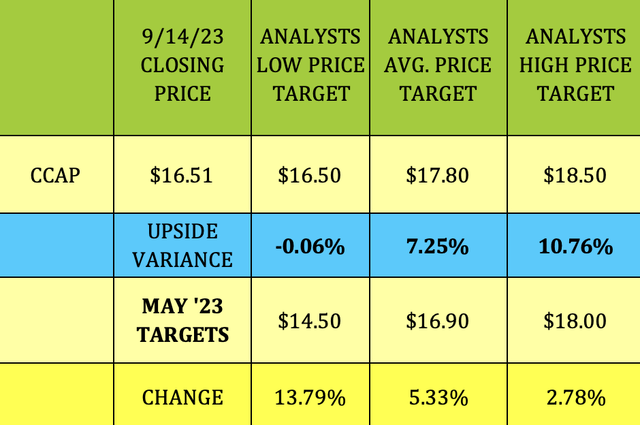

Analyst Targets:

Wall Street analysts have raised CCAP’s lowest price target by 13.8% since May, from $14.50 to $16.50, and by 5% to its average price target of $17.80. At $16.51, it’s 7.25% below the average price target.

These price targets seem too low, in relation to CCAP’s much lower-than-average price to NAV/share.

Hidden Dividend Stocks Plus

Valuations:

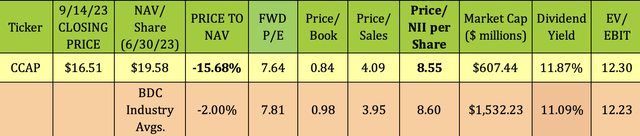

CCAP’s main undervaluation is its -15.68% price to NAV/share, which is much cheaper than the BDC average of -2%. CCAP’s forward P/E is slightly cheaper than the BDC average Forward P/E, while its P/NII is in line with the BDC average, as is CCAP’s EV/EBIT.

Hidden Dividend Stocks Plus

Parting Thoughts:

CCAP, like other BDCs, should be able to enjoy high rates for the next few quarters, which should result in more supplemental quarterly distributions, in addition to the regular $.41 dividend. With no near-term debt issues, low non-accruals, and good dividend coverage, we rate CCAP a Buy.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here

Leave a Reply