Investment Rundown

The specialty chemicals industry is quite volatile because the companies are heavily reliant on favorable commodity prices and lower material costs to drive higher earnings potential. In the case of Core Molding Technologies Inc (NYSE:CMT), the company has had a fantastic last 12 months as the share price is up over 159% in total. Looking at the last earnings report from the company, the last quarter saw the top line decrease slightly YoY, but the opposite happened for the bottom line. The EBITDA for example managed to grow from $7.9 million to $13.7 million in total. This has added a lot of fuel and momentum to the company and I think the market is also realizing that CMT has access to a pretty large total addressable market (TAM) valued at over $10 billion right now. I like the performance of the company and being able to expand margins that quickly is impressive and deserves a buy rating in my opinion.

Company Segments

CMT and its subsidiaries are experts in the manufacturing of thermoplastic and thermoset structural products. The company employs a diverse range of manufacturing techniques, including compression molding of sheet molding compounds, resin transfer molding, and liquid molding of dicyclopentadiene. Their proficiency in these processes enables them to offer a broad spectrum of high-quality molded products for various applications.

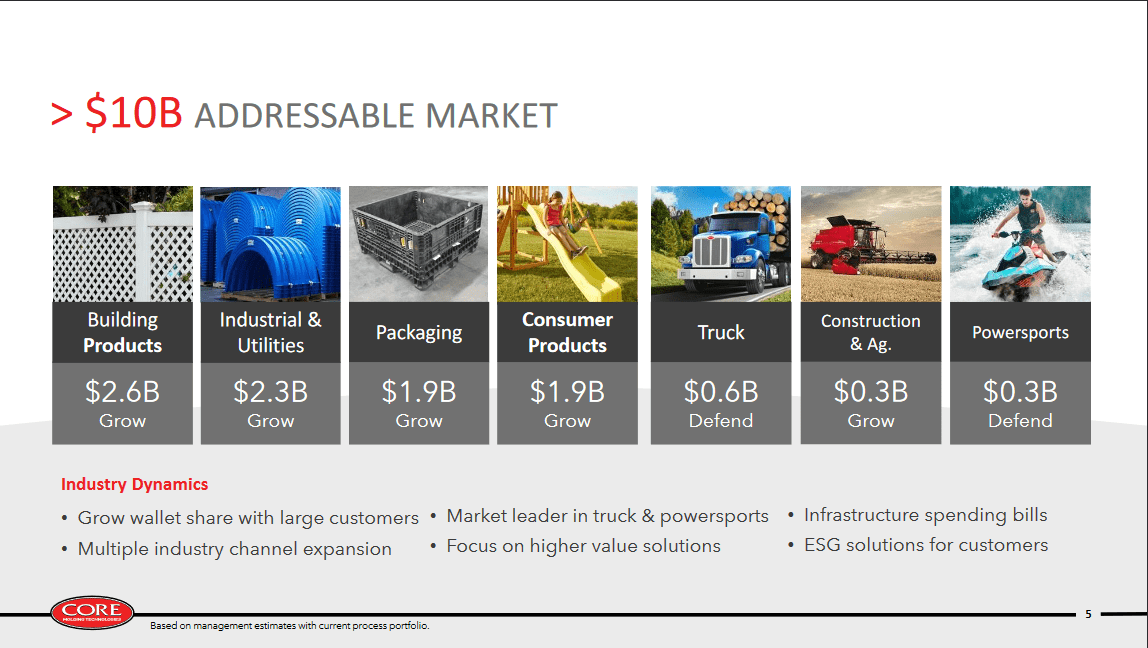

TAM (Investor Presentation)

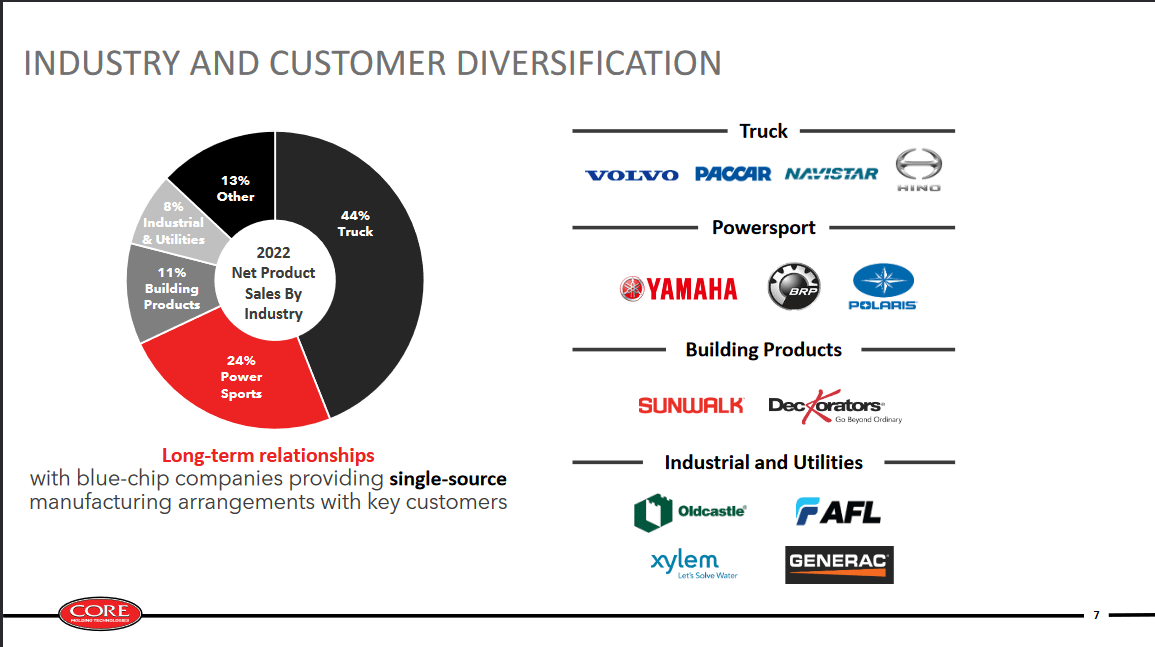

The company operates in diverse markets across the United States, Mexico, Canada, and other countries. Their market reach extends to various sectors, encompassing medium and heavy-duty trucks, automobiles, power sports, construction, agriculture, building materials, and a wide array of commercial industries. This broad market presence showcases the company’s versatility and ability to cater to a wide range of customer needs. This is one of the main strengths of the company in my opinion as the broad set of products the company has lets them focus on certain areas. In times when demand perhaps is softer they can deliver on products that continue to face demand, whilst slowing down production for those that don’t. The market seems to be waking up to the fact that CMT has a TAM of over $10 billion and is quickly growing its bottom line. If this trend keeps up and CMT invests that capital into stronger production capabilities then they could capture even more of the TAM in my opinion.

Markets They Are In

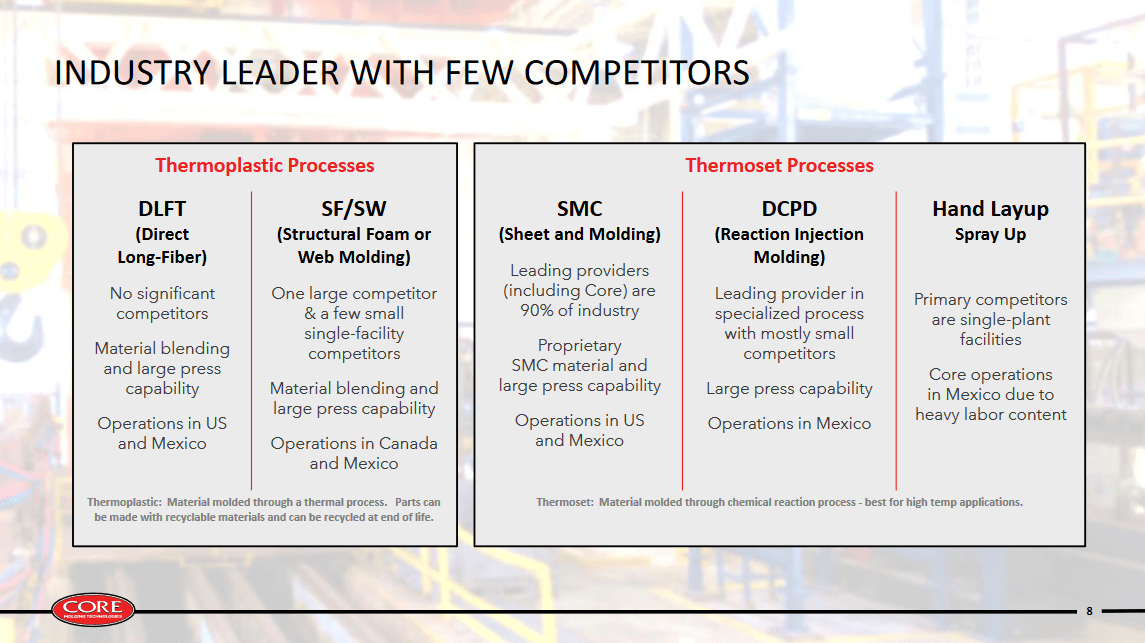

Market Position (Investor Presentation)

Some of the criticism the company may receive circles around its small size and how it could face competitors. But to that, I would say that CMT is still in a strong position as the business is a leader in this smaller market. In the thermoplastic processes for example there is only really one large competitor in the structural foam and web molding more specifically. In markets like sheet and molding CMT holds a 90% market share. The hope is that as the TAM expands, CMT can reach a position where they can pass on expenses even more and scale production. This should ultimately lead to even stronger revenue and earnings potential. As for the market expectations, it sees CMT growing EPS by 61% YoY which values it at 11.3x FWD earnings. A fair price to pay as it exhibits a nearly 20% discount to the sector. As for why I say this is a fair price to pay it comes down to my personal preference for a margin of safety. A discount based on earnings of at least 15% is something that I look for in investments. Given that you are getting more than that with CMT justifies my buy rating I think.

Earnings Highlights

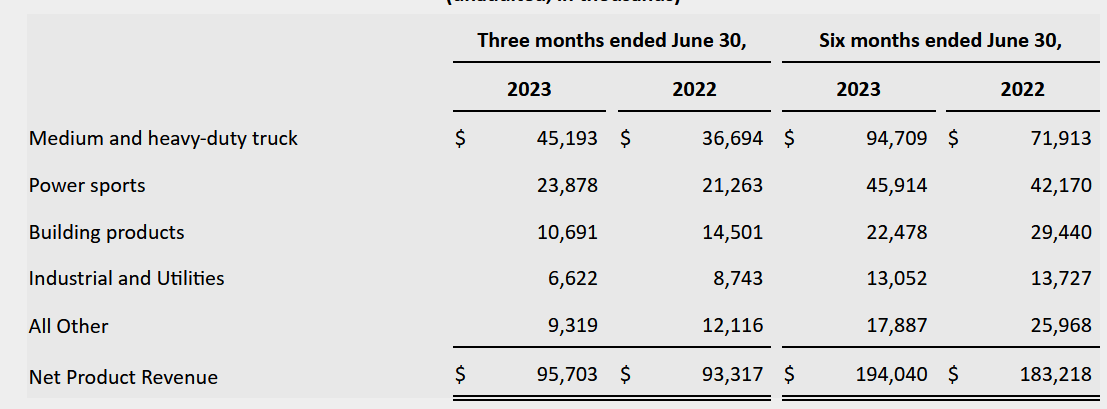

Income Statement (Earnings Report)

The market that delivered the most revenues for CMT last quarter was medium and heavy-duty trucks, reaching $45 million in total. This is up heavily from $36 million a year prior. However, there was some softer demand in others that ultimately led to only a slight increase in net product revenues for Q2. Building products sales were $4 million lower. The industrial and utilities industry also saw a decrease of around $2 million.

Risks

CMT operations hinge on a diverse range of raw materials, encompassing both thermoplastics and thermosets. The company’s financial performance and overall cost structure are susceptible to fluctuations in the prices of these materials. Such variability in material costs could potentially result in periodic fluctuations in earnings reports, consequently influencing share price volatility. But with a diverse set of customers that they are working with I think this should help hedge against some of the higher materials cost as CMT seems to have the possibility of passing down costs.

Industry Comparison (Investor Presentation)

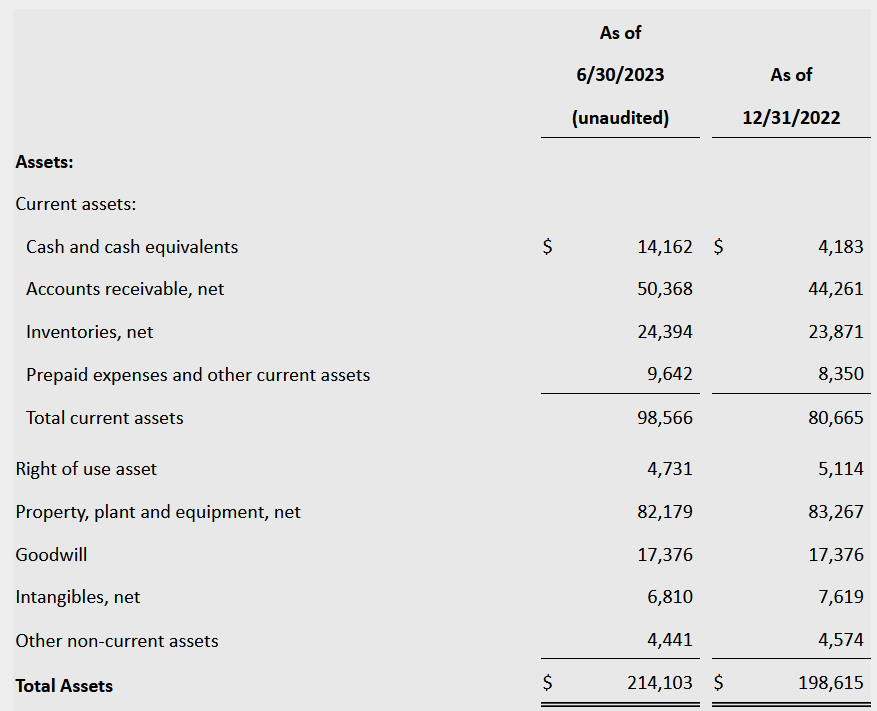

The supply chain of CMT is susceptible to disruptions, which may arise from delayed material deliveries or supplier interruptions. These disruptions can impact the company’s production schedules, fulfillment of customer commitments, and overall operational efficiency. Additionally, a significant increase in inventory levels without a corresponding rise in revenues could serve as an early indicator of weakened demand, potentially leading to a decline in the company’s share price. The current inventory levels are at $24.3 million, up from $23.8 million on December 31, 2022. I don’t think this is perhaps enough to warrant that demand is softening, but it certainly, is something I will be watching over the next few quarters at least. The ROA of CMT has been very solid over the last 12 months, sitting at a margin of 9.3%, far above the 5-year average of 0.46% for the business.

Financials

Asset Base (Earnings Report)

Even with the small size of CMT, they have made some very good progress on the asset side of the balance sheet. The cash now sits at $14 million which is an increase of $10 million since December 31, 2022. This means that CMT can now comfortably cover at least 50% of their long-term debts and still have cash left over. This puts them in a very free financial position and one that should help them expand more easily going forward. Going into the next few quarters though, I think that CMT would do good from increasing it further as the market could potentially reward it with a higher price as more stability is exhibited.

Final Words

CMT has managed to gather up a very diverse set of end markets that it serves. Right now I think that the valuation looks very appealing as based on just a p/e basis, there is a 20% discount to the sector median. In terms of margins of safeties that I am looking for, it mostly comes down to 15%. So with 20%, I am more than comfortable rating CMT a buy right now. Looking at a further margin expansion in the coming quarters will be key, but in the long term, I have a strong conviction that CMT will continue to dominate their markets.

Read the full article here

Leave a Reply