Copper stocks are not a frequent topic of conversation among investors when compared to the S&P 500, Nasdaq, or the tech sector. But the metal, which has a seemingly infinite number of applications and uses, received the nickname “Dr. Copper” long ago for good reason. As the saying goes, it has a PhD in Economics, due to copper’s ability to move in the direction of the economy, before the economy itself makes that move.

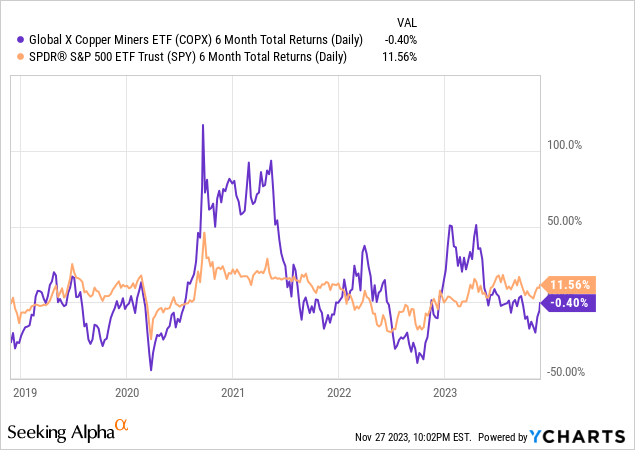

And, while its message is not as clear as it has been at times in the past, the current path of copper stocks, as represented by the Global X Copper Miners ETF (NYSEARCA:COPX) is hinting that its recent flash rally may be preparing to roll over. If that happens, we can add another one of those “smells like recession” indicators to what has become a lengthy list. I rate COPX a Hold here but with a bearish leaning.

Copper: so many uses, but so cyclical

Copper is in a very interesting place right now. As a necessary mineral for the expected transition to “green energy,” copper is in high demand. This is in part due to the US electrical grid being based on centralized electricity, requiring miles of copper wire to carry electricity from electrical plants to transmission and storage, to homes, businesses, and industrial factories. Currently, over 40% of global copper supply is used for power generation, distribution, and transmission, while another 12% is used in transportation. Perhaps most notable within that last category is the use of copper in the electrical components of vehicles. That is only expected to grow, assuming the current trend toward consumer adoption of electric engines continues.

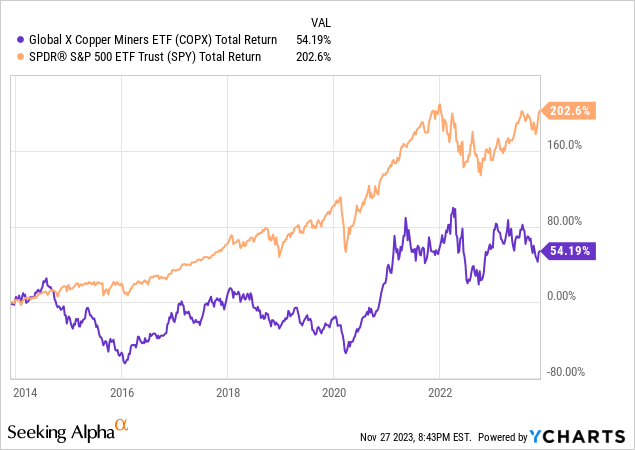

One look at the chart above would convince an investor that copper has been an inferior investment over the past 10 years. That is only the case if one views it as a buy-and-hold forever type of investment. COPX is, like many ETFs I cover, best used as a modest-sized tactical portion of a more diversified portfolio.

COPX and copper stocks in general tend to track the market price of copper closely. The chart below shows that, as with many commodity stock ETFs, copper is also correlated with the S&P 500, at times. The important takeaway I get from this picture is that when the SPY ETF is really flying, and that is due to anticipated economic strength, COPX is akin to a levered bet on that strong economy, without actual leverage. If we think about copper this way, it helps determine when to use ETFs like COPX a little, a lot, or not at all.

The primary production of copper is mining, which creates a quandary for some environmentalists, who agree that a greener future for the planet is based on alternative sources of electrical energy. That faction also understands that mining destroys the planet.

Fortunately for them, creating usable copper doesn’t only happen through mining, as copper is also recycled. In fact, it is one of the few minerals that can be recycled repeatedly without any loss in performance or quality.

Long-term copper demand means there should be more cyclical rallies

The global demand for copper is expected to double by 2050 from 25 million tons in 2020 to 50 million tons – driven by critical decarbonization technologies, such as wind turbines, photovoltaic panels, heat pumps, electric vehicles, and energy-efficient equipment, according to the International Copper Alliance.

Against this backdrop of demand is the current drama of ESG (Environmental, Social, Governance) is causing disruptions to the current copper supply. As recently as October 2023, a global copper surplus was predicted for copper in 2024, by around 467 million metric tons, which was expected to suppress the price of copper. However, as smelters and mines begin their rounds of contract negotiations for 2024, there is significant copper mine disruption due to environmental protests and a variety of governance regulations.

In September the International Copper Study Group (ICSG) downgraded its mine production forecast for this year from 3.0% to 1.9%, citing disruptions including geotechnical issues, equipment failure, adverse weather, community actions, a slower-than-expected ramp-up of projects, revised company guidance and lower grades, according to Reuters.

These disruptions may only be temporary if companies can rise to the challenge and mitigate the diversity of risks. However, as more companies and countries move to cash in on the current trajectory of copper demand, several new smelters for copper are coming online, putting even more pressure on the global supply of recycled copper and copper ore.

All of these point toward higher long-term prices for copper, as demand outpaces supply. The question is whether miners are able to keep pace with both the demand for copper, and the demand from shareholders and investors for cleaner, greener, and more sustainable primary production copper. But none of this changes the cyclical nature of the economy, and thus, COPX will be a cyclical performer, not an S&P 500-hugger.

Global X Copper Miners ETF is a fairly large ETF at more than $1.3 billion in assets and trades about $13 million of average daily volume. It is the largest ETF of its kind. It is a global ETF, which helps reduce single-country equity market risk. 40% is allocated to the US and Canada, with the remainder split roughly evenly between companies based in Europe and Asia.

COPX’s 45 stock holdings span all capitalization sizes, from large to small, but with a large cap tilt. And, as I prefer, it is a concentrated fund, with 14 stocks accounting for approximately 66% of assets. COPX’s portfolio sells at about 12x trailing earnings but what catches my eye from a valuation standpoint is a price/sales ratio below 0.6, quite low in today’s US market. That’s the influence of the non-US holdings to some degree. COPX yields 2.65%.

This all adds up to an intriguing position to own, but not all the time. As noted above, COPX is likely to ebb and flow with the economy, and its price pattern looks like the economy to me. Specifically, it is teetering after a sharp run up, but is still in a downtrend.

I’m no doctor, but I like to listen to them. So I’ll be watching to see if COPX, representing Dr. Copper’s industry, makes a definitive prognosis sometime soon.

Read the full article here

Leave a Reply