Investment Thesis

Confluent (NASDAQ:CFLT) negatively surprised investors by reducing its revenue guidance. That’s the superficial take.

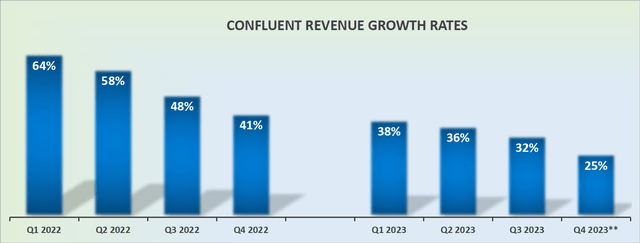

The more detailed insight notes two considerations. Firstly, this implies that Q4 is going to be growing at around 25% CAGR, which is a large drop from the 32% y/y CAGR just reported.

Secondly, given this slower growth rate and particularly since Confluent is now growing at less than 30% CAGR, investors will be more attentive in weighing up its underlying profitability.

According to my estimates, the stock is now priced at around 180x next year’s non-GAAP operating profits. A valuation that already assumes the best-case scenario for Confluent’s profitability next year.

Altogether, I believe CFLT stock is best avoided.

Quick Recap,

In my previous analysis, I said,

There’s plenty to like about Confluent, a high-growth story that is cutting its way towards non-GAAP breakeven profitability. But at the same time, I find its valuation rich, with a stock that’s priced at 12x forward sales. Consequently, I’m sticking to the sidelines here.

[…] My thesis is clear, I’m not bullish or bearish on this stock. I assert that something further is needed to galvanize this share price to move higher.

The company is making significant progress toward improving its underlying profitability. But at the same time, it’s difficult to make the case that the stock is not already richly valued.

And that’s the problem for Confluent. When you are richly valued, you need to bedazzle investors, to court them, lure them in with impressive fundamentals that back up your narrative. And that’s clearly, not what’s happening with Confluent.

Confluent’s Near-Term Prospects

Confluent, a leading data streaming platform, faces some headwinds associated with changes in the go-to-market strategy and customer transitions (more on this soon).

Meanwhile, the company strives to capitalize on the growing demand for data streaming solutions, particularly with the impending release of the Flink platform.

During the earnings call, the company discussed its strong focus on consumption transformation and its efforts to align its sales approach with customer preferences, indicating a proactive response to evolving market trends.

Moreover, Confluent’s emphasis on integrating the Flink platform with Kafka underscores its commitment to providing a comprehensive and streamlined data processing solution, potentially offering a competitive edge in the market. With a notable interest in the digital native customer segment and the anticipation surrounding the adoption curve for the Flink platform.

That’s the bull case. Next, we’ll dig into the negative aspects.

Revenue Growth Rates Slow Down

CFLT revenue growth rates

Confluent, while poised for innovation, faces several challenges that impact its revenue growth rates.

I’ve stated on countless occasions that companies that change their business model to a consumption-based business model, unless they have a strong monopoly or duopoly are doomed to fail. Why?

Because you are literally putting yourself head-to-head against your customer. Rather than making it more compelling for customers to embrace your platform, you are disincentivising all but the most necessary use.

In the short-term, that boosts your revenues, as your customers are left with a bill.

But longer term, that’s going to see your customers moving elsewhere. The example I often provide is Blockbuster versus Netflix (NFLX). But you can also think about Amazon Prime (AMZN), where they give you Prime members so much free content just to keep you engaged and loyal to the platform.

Customer Adoption Curve Poses a Problem

To reinforce my assertion that changing one’s business model is often a last-ditch effort to squeeze any growth left in the business, consider this customer adoption curve, for customers spending more than $100K of ARR.

Q3 2022: 39% y/y

Q4 2022: 35% y/y

Q1 2023: 34% y/y

Q2 2023: 33% y/y

Q3 2023: 25% y/y

This time last year, Confluent saw customer growth of 39% y/y. While this latest quarter saw customer growth of 25% y/y. And this is on a business that’s making $200 million per quarter. That’s hardly commensurate with massive revenues that are close to saturating its end market.

When asked for more details about Confluent’s customer adoption curve and the fact that some customers are moving back to on-premise, management stated the following

I mean, look, we can speculate either way. I guess, I feel like we hear about this every couple of year really. We heard about the Dropbox doing it. Every year, you hear about some example, companies selling private cloud stuff, put it on the front page of everything to make a big deal to how the cloud is over. That’s not really what we see, like broadly, when we talk to our customer base, including the digital natives, I don’t see a big movement there.

Profitability Is Now in Focus

When a company is delivering very fast growth rates, nobody is going to ask difficult questions about profitability. It even feels like bad taste to ponder over profitability concerns.

But when a company suddenly sees its growth rates dip below 30% CAGR, all of a sudden investors start to postulate, what sort of profitability will this business have?

And here’s the thing, looking out to next year, Confluent will probably have around 2% operating margins. This will probably translate into around $30 million of non-GAAP operating profits.

This means that Confluent is priced at meaningfully more than 180x next year’s operating profits. And that’s just too expensive for a business that’s seeing its growth rates slow down at such a rapid clip.

The Bottom Line

In conclusion, Confluent’s recent guidance reduction has unveiled a concerning picture of its future growth potential. With revenue growth rates tapering down and the company’s shift towards a consumption-based business model, the underlying profitability has come under increased scrutiny. Notably, the stock’s current valuation at around 180 times next year’s non-GAAP operating profits is exorbitantly high, especially considering the deceleration in its growth trajectory. This valuation seems unjustified given the company’s current challenges and slower growth rate, suggesting that the stock is overpriced and possibly in need of a reality check in the market. Investors should exercise caution and consider the risks before making any investment decisions.

Read the full article here

Leave a Reply