Intro

Conagra Brands (NYSE:CAG) is a solid consumer staple with a simple business: to sell their packaged food in their variety of brands primarily to retailers. The selloff done in the past month may have bottomed out and provided a good entry point into what I believe is a worthwhile value stock. The main value proposition comes from the company providing a basic necessity – food – at a variety of prices. Some of their products are priced low enough to be considered cheap.

Despite the 31% year to date declines, I remain long in Conagra as a result of their business being a better performer in a recession, while their current headwinds may be temporary. There are risks, such a much more severe pullback in consumer spending indiscriminately, which I will discuss in the article.

Company Profile

Conagra Brands is a company that focuses on the sale of packaged food to locations in the USA and internationally. Some of their brands include Slim Jim, Hunt’s, Chef Boyardee, Act II and Wish Bone, of which altogether make a formidable portfolio of snacks, food and frozen meals that can be part of a sizeable portion of niches inside the supermarket.

As of their Fiscal Year 2023 10-K filing in page 3, their largest customer is Walmart (NYSE: WMT), who consists of 26% of their revenues. With such a prevalence in a widely known supermarket, a lot of people may already be aware of this company and their brands without knowing it.

Investment Thesis

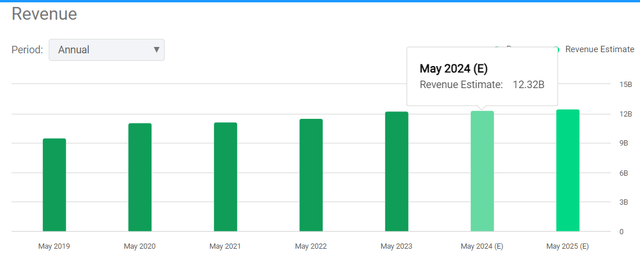

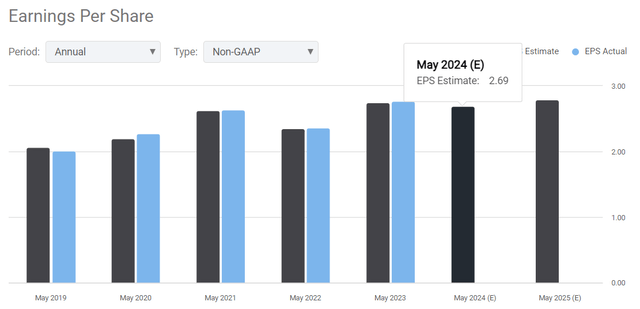

Conagra’s fundamentals are expected to deteriorate due to shifts in customer behavior, compressed purchasing power in the average consumer and potential substitutes being an existential threat to the company. While these are risks to my thesis, the declines seem to exaggerate the results obtained so far as shown in their income statements, summarized here in Seeking Alpha. For convenience, here’s the metrics I’m focusing on and their relative performance:

| Revenue | EPS (GAAP) | EPS (non-GAAP)* | |

| Aug 2023 (Q1 2024) | 2.90B | $0.67 | $0.58 |

| May 2023 (Q4 2023) | 2.97B | $0.08 | $0.50 |

| Feb 2023 (Q3 2023) | 3.09B | $0.72 | $0.58 |

| Nov 2022 (Q2 2023) | 3.31B | $0.80 | $0.66 |

| Aug 2022 (Q1 2023) | 2.90B | ($0.16) | $0.46 |

*Non-GAAP EPS take from “Normalized Diluted EPS” in Supplemental Items in the Income Statement page provided by Seeking Alpha.

As seen in the key numbers, Conagra has been relatively stable, if not improving in some aspects. Why did the stock fall? For that, I want to direct you to the Q&A portion of the company’s latest earnings call. I noticed a lot of skepticism from the Street whether Conagra’s goals are actually attainable. Jason English from Goldman Sachs put it best when it was his turn to ask questions:

Sean, a lot of questions, obviously, today on your back half guidance, and I’m sure it’s not lost on you, there’s clearly some skepticism on your ability to get to the volume growth you’re promising in the back half.

I believe this sentiment opens up an opportunity for other investors to take advantage of the discounted pricing as current levels imply a sizeable decrease in revenues or earnings. That decrease is currently not being forecasted as seen here:

Seeking Alpha Seeking Alpha

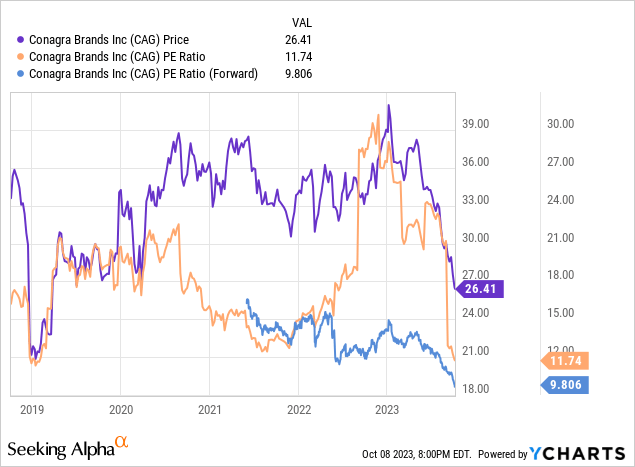

If an investor is interested in averaging down or starting a position, now is the optimal time to do so. Another piece of evidence I can point to favoring value investors is the relatively low PE ratios in the stock price – among the lowest seen in the last 5 years.

So far as seen here, the company is much closer to being undervalued. Another thing that can favor Conagra’s future performance against the market is its dedicated market being a consumer staple, which normally perform relatively well during a recession. On the most basic level, everyone needs food to live, and even food banks don’t seem to be able to provide the entire population with enough food to survive, which can explain why revenue declines aren’t as severe as feared. Due to some relatively low price alternatives already offered, there are not as many cheaper options for a consumer other than the supermarket’s brands or looking for services that provide them with nutritional assistance such as food stamps and the aforementioned food banks.

Ultimately, demand for foodstuffs will always exist as people look to state their unending biological needs, regardless whether there’s a recession or not.

So then, if the opportunity is so great, why would investors be bearish on this company?

Risks

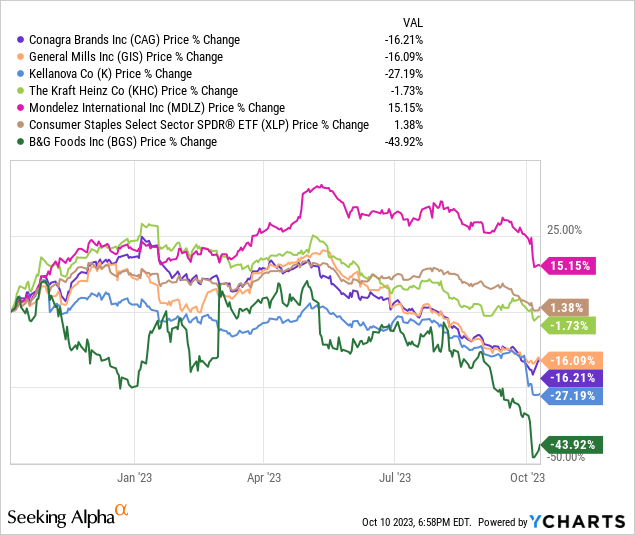

Food packaging is one of the most competitive markets out there. However, the bearish sentiment may be specific to consumer staples as a whole. Here’s the relative performance of General Mills (NYSE: GIS), Kellanova (formerly, Kellogg’s) (NYSE: K), Kraft Heinz (NASDAQ: KHC), B&G Foods (NYSE: BGS) and Mondelez (NASDAQ: MDLZ) and the SPDR consumer staples ETF (NYSEARCA: XLP).

The entire sector has been relatively uneasy with Mondelez International being the best performer of the selected group and the only outperformer while my selected competitors to compare Conagra with have mostly underperformed the sector. Conagra is currently close to the middle of the pack when it comes to relative performance.

Most notably, I want to point out that the majority of the sector has suffered declines very recently. What could be the catalyst? Time to talk about that.

Weight Loss Drugs

It’s not the only concern, but it’s the biggest standout of the past month. Novo Nordisk’s (NYSE: NVO) Ozempic and Eli Lilly’s (NYSE: LLY) Mounjaro have gained popularity among investors, the news and – with some skepticism – consumers. Headlines have been made after Walmart reported a slight pullback in food consumption and correlated it to the increased use of weight loss drugs.

The main concern that could arise is the distant probability of 7% of the USA’s population being under weight loss drugs and cut down around 30% of overall food consumption. That is a genuine concern that may affect these companies in the long run, but due to the time distance between now and 2035, we investors have to see how sustainable is the current trend in the market.

Fellow analysts and market watchers in the comments seem mixed to dismissive of the drug. In my case, I have yet to make any reasonable conclusion as to these drugs except to watch how the situation evolves. With a new medical product on the market, it does take time to see the true long term effects that these products will have on people’s consumption.

As for Conagra, CEO Sean Connolly pointed out that the company is ready to develop new products catering to those looking for a healthier diet. This implies that the company has yet to penetrate this segment, so while it is a risk at the moment, it can turn into an opportunity in the future if handled right.

That isn’t the only thing being a problem, though.

Consumer Spending and Budgets

Remember inflation? Remember consumer sentiment and their lack of savings? Remember their high credit card debt? While the trend right now is that consumers want to travel even at the cost of sacrificing part of their food and grocery budgets, it can potentially improve and return to higher food consumption, which has been hinted by Conagra CEO Sean Connolly. However, I want to point to the possible risk of trends returning to a fully indiscriminate drop in discretionary spending (ergo, the end of the travel boom) along with a continued reduction in consumer spending in consumer staples such as food and household items. If the consumer truly is trying to live within their means amidst a relatively inflationary environment, is taking in credit card debt to survive, and their sentiment looking rather shaky on their personal finances, I would keep in the cards the possibility of further optimization of the consumer budget.

This can mean that as a recession forces people out of work or worsens financial conditions for the average person, these people may end up taking harsher means to survive, such as cutting entire meals daily out of the system, lowering overall intake if not making their food supply last as long as possible. It’s a thought that might have kept some investors on the rails with many food companies, however it’s also a thought that some investors haven’t considered as much due to the US’s culture of eating as a leisure activity and such.

I keep it as one of the risks that could affect Conagra, while I keep on writing down more possible risks, such as:

Walmart

Walmart is their largest revenue source, and as Walmart looks keen to readjust their inventory to favor recent consumer trends, Conagra’s revenues – and by proxy, profits – may find themselves under further pressure if their products do not appear to sell well enough on the supermarket.

This can undermine Conagra’s competitive advantage of a variety of food products due to forces outside of their own, primarily the consumer, and then the retailer.

Cash

This is a risk that I should mention here. Conagra’s fiscal year 2024 10-Q filing shows the company has less than $100 million in cash. This can show confidence from management that the business won’t face any serious hardships in the short term but also can be rather limiting when it comes to financial flexibility when the business starts bleeding more cash as a whole. Getting new debt will mean agreeing to higher interest payments. Conagra’s credit rating according to Fitch is BBB- with a stable outlook. This isn’t bad, per se, but not very encouraging as it’s slightly below what’s considered satisfactory, which can make it hard to get debt at a relatively low interest rate should the economic environment cut into Conagra’s profitability and cash flows.

Finally, I think I should point out one last risk that comes to mind:

Market Crash

Earlier, I pointed out that Conagra is well positioned for a recession due to its market participation as a consumer staple. However, this does not factor the effects of a possible market crash.

Usually, market crashes tend to be indiscriminate as to what stocks get sold and what doesn’t, as the overall psychology is to get out of the market as fast as possible. Few stocks will make it out gaining instead and the dynamics of a crash is typically unpredictable. While I rule it as the most extreme risk due to investors being very strong willed most of the time, I can’t rule it out due to how volatile investor sentiment has been. It’s as some would say, nobody wants the party or the good times to end.

Some recessions are preceded by a market crash, while others can happen out of the blue such as the 2020 crash. The nature of a crash is unpredictable and as such, I learned the hard way that calling a crash is going to happen by x date is a fool’s errand.

Yet, I like to stay cautious, hence why it stays here as a risk to all equities, yet not dramatically affecting the thesis as outperformance is not restricted to staying in the green. Falling less than the market also counts.

Valuation

How will this company be valued? I like to combine some metrics together into this analysis, of which are listed below with their multiples in parentheses:

- Fundamental

- Free Cash Flow (20x)

- EPS (20x)

- EBITDA (5x)

- Modifiers

Free Cash Flow will be considered as “Operating Cash Flow – CapEx” for fiscal year 2023. Since CapEx is not listed as an item, continuous expenses and sales in the company’s investing activities of their cash flow statement will be treated as CapEx. These activities are understood to be necessary to keep the business running smoothly.

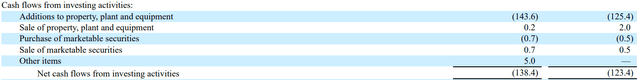

For that, their 2023 10-K filing and recent 2024 10-Q filing will be used. Here’s a screen capture of Conagra’s investing activities as for the 13 weeks ended August 27, 2023 and August 28, 2022.

ConAgra FY Q1 2024 10-Q filing

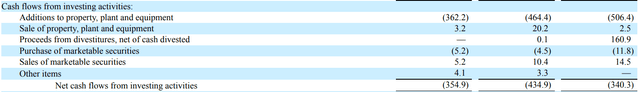

Here’s what their investing activities look like from their 2023 10-K filing. The first column from the left is for fiscal year 2023, the second for 2022, and the third for fiscal year 2021.

ConAgra FY 2023 10-K filing

Since the only repeating expense or gain directly related to their business is “Additions to property, plant and equipment” and “Sale of property, plant and equipment,” it is fair to say that these numbers can be considered as the company’s capital expenditures for the purpose of this article.

I will use the company’s lower end of non-GAAP EPS guidance for 2024 of $2.70 EPS. This guidance can be found on slide 31 of Conagra’s 2023 Q4 presentation.

EBITDA will consider GAAP earnings for fiscal year 2023 and remove depreciation and amortization, interest, taxes and stock compensation to adjust.

Their growth rate from fiscal year 2023 compared to fiscal year 2022 is 6.5%, although flat year over year for the prior quarter, so a valuation reduction of 10% will be reasonable enough for my analysis. This equates to free cash flow and EPS multiples of 18x and EBITDA multiples of 4.5x.

Their equity will be used as a floor, or a minimum expected valuation. Think of it as “how much of the stock price is backed by shareholder’s equity?”

There are 477.96 million shares outstanding, which will be considered in the calculations.

Conagra’s share price as of writing this valuation segment is the same as the closing price of $27.57 achieved Friday October 13th of 2023.

I’ll put these in the table below to show the results of the calculations:

| Metric | Value | Nature | Multiple | Share price | Market cap |

| Free cash flow | $636M | Trailing | 18x | $23.96 | $11.45B |

| non-GAAP EPS | $2.70 | Forward | 18x | $48.60 | $23.23B |

| EBITDA | $1.55B | Trailing | 4.5x | $14.60 | $6.98B |

| Growth Rate | 0%-6.5% | Trailing | -10% | N/A | N/A |

| Equity | $8.96B | Present | 1x | $18.75 | $8.96B |

I’m observing a high level of variation among the three selected valuation methods. An EBITDA valuation implies that the company is overvalued (however, to provide further context between EBITDA vs non-GAAP earnings, an 18x valuation would imply a market cap of $27.9 billion, or $58.37 per share), while the non-GAAP EPS valuation is showing that Conagra is severely undervalued. Meanwhile, free cash flow seems to be closest to the current share price, although the current share price is still slightly higher than the free cash flow valuation.

Combined together evenly, Conagra is valued around $29.05, slightly above the current share price.

The good news that can help the stock price slightly is that most of the current price – around $18.75 per share, is backed up by shareholder’s equity. This gives me confidence in that the company has some liquidity and gives me confidence in what I’m paying for in today’s share price. As such, I’d be fine assigning a slightly higher price target of $30 per share for the time being, considering what’s been covered in this analysis as a whole.

Conclusion

Conagra brands isn’t without it’s risks, but I do believe that investors may have undervalued the company as if expecting something much worse in the near term. However, valuation methods tend to vary widely as to what is a good share price for the company, but the average implies that the company is fairly priced.

Even then, I do believe that there is potential for price appreciation absent of one of the risks materializing in a notable manner, as such making Conagra a worthwhile value stock to invest in. As of writing, Conagra has rebounded sharply from its lows achieved on October 6th and has yet to fall down, which is a slightly bullish sign in the short term and potentially some breathing room for investors, who saw this company’s share price decline around 31% year-to-date.

As such, I rate Conagra Brands a Buy rating that would be equivalent to a score of 3.8 in Seeking Alpha’s meter, around 1.18 points higher than Quant’s rating. The price target for this company will be $30 per share, implying a potential upside of 8.8%.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here

Leave a Reply