Introduction

The diverse nature of Compass Diversified (NYSE:CODI) has played out very well in their favor so far. The company has managed to return a significant amount of capital to shareholders as the yield right now is over 5%. The payout ratio is not worrisomely high at just over 70%. I think that CODI will be able to continue yielding investors a significant return over the long term and will be rating it a buy. The recent pullback towards $18 per share I think has been a great opportunity to either open a position in the business or add more to an existing one.

Company Structure

CODI is a private equity firm with a strategic focus on various aspects of the investment landscape. The company specializes in a range of financial strategies, including add-on acquisitions, buyouts, industry consolidation, recapitalization, and investments in late-stage and middle-market companies. Their investment approach is geared towards identifying and supporting niche industrial and branded consumer companies. This diverse investment strategy allows CODI to explore opportunities across different sectors of the economy, making it a versatile player in the private equity arena.

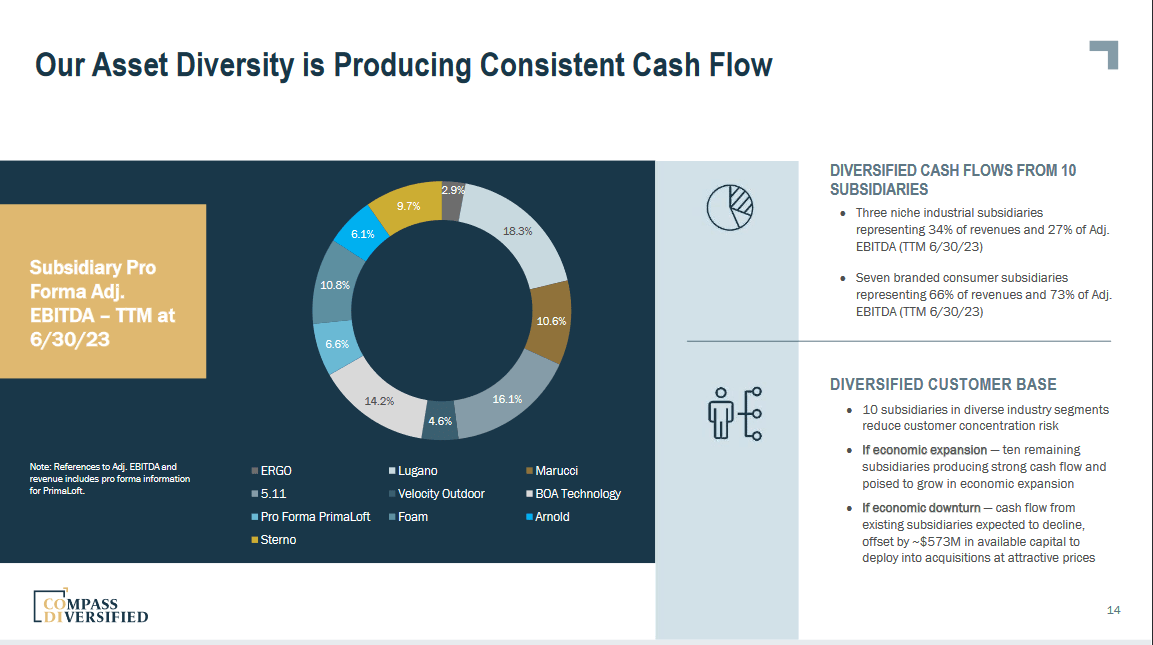

Asset Overview (Investor Presentation)

One of the leading factors behind the success of the shareholder returns that CODI has been able to have over the years comes from the strong amount of cash flows they are generating from the portfolio right now. The asset-diverse approach that CODI has, has been very impressive.

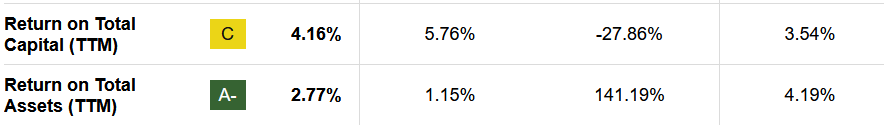

ROE (Seeking Alpha)

The ROA of the company is at 2.77% right now, which may be below the 4.19% it has had historically over the last 5 years, but I think the reason for this is the higher interest rates which have suppressed some of the potential returns that equities and some securities have been able to yield to investors or companies like CODI. I would expect that CODI can return to historical levels and perhaps even outgrow them as time goes on.

Earnings Transcript

From the last earnings call that was held on August 2, the CEO of CODI Elias Sabo had some very good comments on the company’s recent performance and where they see themselves heading in 2023 and beyond.

-

“Looking at our niche industrial businesses, unit sales remained strong, but the easing of inflationary pressures negatively impacted revenue, while positively impacting margins. Our industrial businesses continue to perform above expectations, reporting high single-digit EBITDA growth for the quarter and growth of 12% year-to-date. Notwithstanding the macro headwinds and slowing global economy, we expect our industrial businesses to continue to produce solid growth and adjusted EBITDA over the remainder of the year”.

The markets that CODI operates in are quite diverse and even though the lack of revenue growth is not nice to see, the growth of margins is offsetting quite a lot of that in my opinion. The company is still able to post a significant double-digit level of growth in the industrial business segments as well. This seems to also be one of the more resilient parts of the business as it’s expected to yield strong growth still.

-

“Despite the aggressive Fed tightening cycle and slowing global growth, the performance of our industrial businesses, coupled with performance from Lugano and Marucci, give us confidence that our company is well positioned, and when distortions from the pandemic are behind us, we expect to deliver solid growth”.

The company remains very positive towards its position in the markets right now and I would agree with them. Even if the interest rates have increased and affected the earnings of CODI seeing as they have debts of $1.7 billion they remain in a favorable position once the rates start to decrease.

Valuation & Comparison

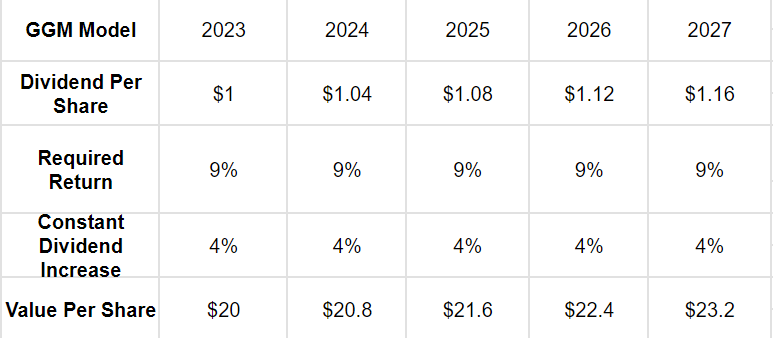

GGM Model (Author)

Looking at the GGM model above here I think it further displays the favorable investment opportunity that is present with CODI right now. The target prices are above where the company is trading currently which indicates an immediate upside potential. With a terminal dividend increase of 4%, I think it’s possible given the market position the company has and the rapid potential growth that could occur once the interest rates are lowered further. I am happy to take the bet on CODI and with the p/s at 0.6 right now the downside seems quite limited as this is 72% below the rest of the sector.

Risk Associated

Like many financial services firms, CODI is exposed to macroeconomic risks that can influence its performance. The company has experienced a noticeable slowdown in merger and acquisition activity, which has had a tangible effect on its financial results. If CODI continues to face significant earnings declines, it may lead to a substantial reduction in its share price to better reflect the diminished earnings potential of the business. This underscores the importance of monitoring macroeconomic conditions and their impact on CODI’s bottom line for potential investors.

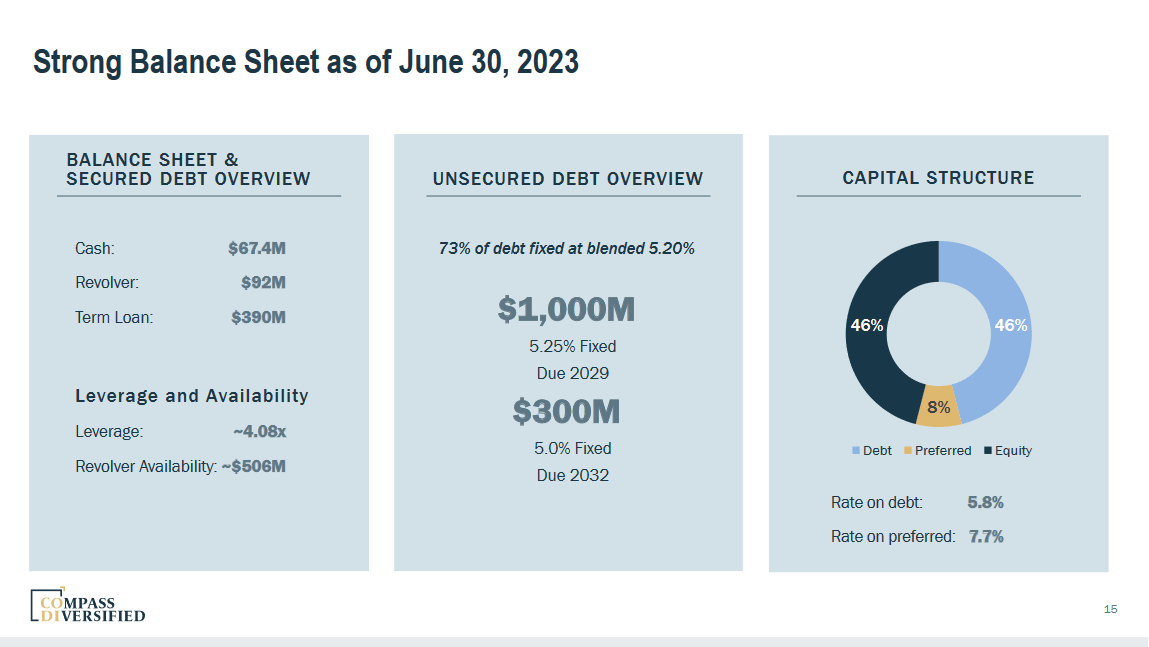

Balance Sheet (Investor Presentation)

With higher interest rates usually also comes a higher rate of delinquencies. Seeing as CODI is investing quite heavily into smaller businesses it needs to have a very risky favorable profile of the balance sheet and capital position of these companies. If they are heavily indebted and CODI still takes on the risk it could deleverage CODI instead and result in further drawdowns in the share price, leaving a sour taste for investors.

Investor Takeaway

CODI has managed to grow very well over the years and deliver a strong shareholder return as well. The company has a yield of over 5% right now and once the interest rates start to go down I think it’s likely to assume that perhaps we see an increase in it as well.

The valuation of the company is currently below my target price which makes it a buy in my book right now.

Read the full article here

Leave a Reply