Investment thesis

The analysis of Companhia Siderúrgica Nacional (NYSE:SID) reveals several problems and contradictions, with a few positive points. The drop in steel prices has been, this year, the main catalyst for the dampening of its results, and this is a scenario that is not expected to improve in the short term. In summary, there’s a perceived low growth potential, potential undervaluation, and instability.

All of this leads to the conclusion that its stock price may not show much upside soon, and patience is advised. The stance I recommend now is to hold on to the shares for a while and receive what seems good but volatile dividends, but this is not the case for those looking for growth.

Overview

Companhia Siderúrgica Nacional, or simply SID, is a steel producer operating in Brazil and Latin America. It operates in five segments: Steel, Mining, Logistics, Energy, and Cement. Moreover, it operates railway and port facilities; it is involved in the production and supply of cement, and it generates electric power from its thermal and hydroelectric plants.

The company has faced issues with the macroeconomic situation in recent years, as the raw materials industry is sensitive to demand and prices, leading to revenue declines in recent months. As a result, SID’s financial results were negative in the first quarter of the year and modest in the second. The question arises whether the recent drop in the company’s stock price positions it as a buy case. For that, we should take a look at valuation indicators, the company’s growth expectations, and its recent performance.

Past performance and expectations

Before discussing the recent financial results, it is worth mentioning the company’s past performance and expectations for the future. In my opinion, one of the decisive points when buying a stock is its growth potential. Starting with the development rates of revenues and profits, and its ability to beat estimates, SID falls somewhat short.

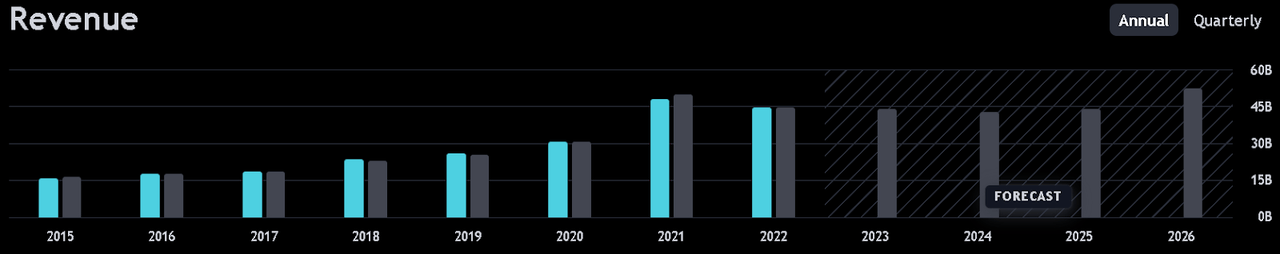

Firstly, the last time they beat an estimate for EPS and Revenue was in April 2021. Since then, there has been a series of misses, and the stock has shown a negative trend. In recent years, revenues have been growing at an average of 13% per year. However, a slowdown in this rate is expected in the coming years, mainly due to challenges that I will soon mention. Now, the estimate is for an 18% growth over the next few years, maintaining a slight negative trend until 2025.

Revenue growth estimates. (TradingView)

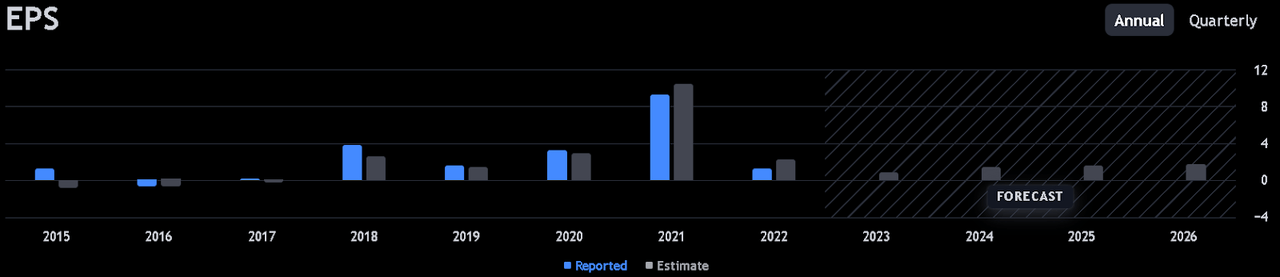

Regarding profits, it is expected to achieve an EPS of 1.7 in 2026 compared to this year’s estimate of 0.77. Although this represents a percentage change of 120%, it does not compare to the performance achieved in previous years.

EPS growth estimate. (TradingView)

Financials

Regarding the latest financial report published, several points are emphasized:

• The company’s sales have increased across all sectors, showing its resilience in a challenging economic environment.

• However, the overall results were impacted by low rates in the mining industry and cost pressures in the steel industry.

• Net revenue dropped by about 2.9% in the second quarter of 2023.

• The cost of goods sold (COGS) increased by 8.3% compared to the previous quarter.

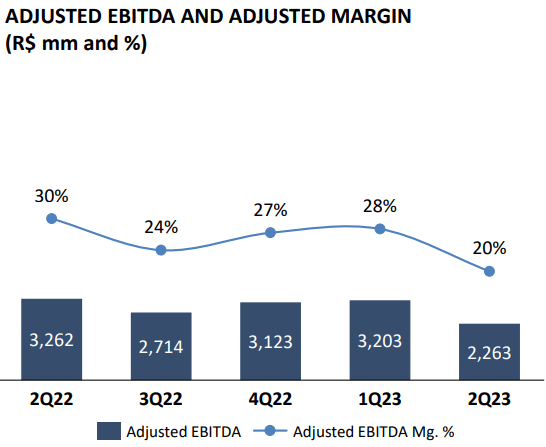

• Lower sales and increased costs reduced the gross margin by 8.3 percentage points, reaching 20.4% in the second quarter of 2023.

In summary, the second quarter of this year revealed a slight recovery in the company’s financial health and a decline in its efficiency. But, despite the drop in net revenue and the rise in costs, the company managed to achieve a positive net result for the quarter, compared to the previous period.

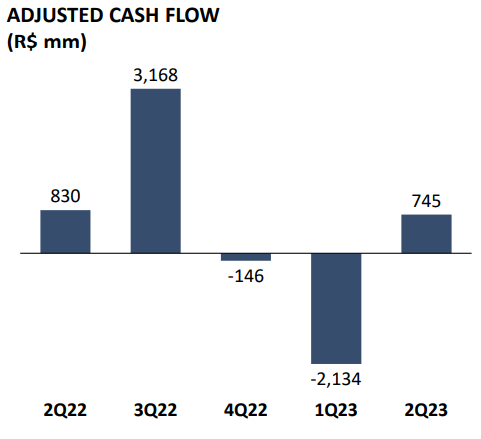

As a result of the normalization of working capital, which offset the increase in investments and the effects of financial expenses during the period, the adjusted cash flow was positive at R$ 745 million. Returning to a positive cash flow is of utmost importance, given that the company pays relatively high dividends compared to the rest of the sector and segment, even though they have been volatile in recent years.

Investor Relations

Investor Relations

Valuation

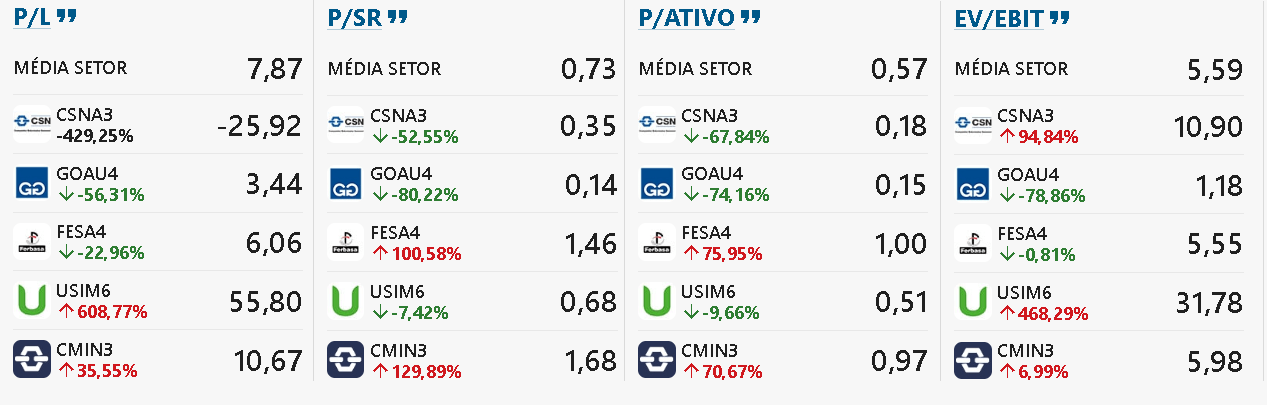

Notably, the company has a negative P/E ratio (TTM) of 26.90, shown in the Portuguese chart below as ‘P/L’, which is far below the sector average of 7.97. Although the P/E ratio is one of the most widely used indicators, in this case, we should disregard it, but it’s clear that among its main competitors, it’s the only negative one. Given that it hasn’t been a profitable company in the past 12 months, other metrics become more significant. For instance, the P/SR (Price to Sales Ratio), considering the net sales which have been growing, currently stands at 0.36, versus 0.74 for the materials sector, suggesting a discount in share price.

Still concerning this indicator, some of the other main players in the market have lower multiples with less sales growth. CSN Mineração S.A. stands at 1.7 and Usiminas S.A. at 0.68, reinforcing the potential undervaluation in this aspect. Even so, Gerdau S.A. (GGB) is more undervalued.

To supplement the analysis, it would be interesting to look at the P/Asset ratio, which is shown as ‘P/Ativo” in the chart below, as it usually carries more significance when analyzing companies more reliant on their assets, especially of an industrial nature, as is the case with SID. It stands at 0.18, which is also below the sector average.

In contrast to the previous data, the EV/EBIT is higher than its main competitors and above the sector’s average. This is a strong negative point in this comparison. SID has a relatively high market value and is less efficient.

Valuation Indicators (StatusInvest)

In general, the Brazilian steel industry’s outlook has not been the best this year, and this can be seen in the devaluation of some companies. SID appears to be particularly undervalued, even though there are some inconsistencies. But is this enough to justify buying it?

Risks

The drop in prices and the weak growth of the global economy at the moment is the main cause of the company’s progress slowdown. Not only Brazil, but other major economies such as the USA and China, Brazil’s main trading partners, are facing issues.

For the materials industry, a favorable macroeconomic situation is greatly beneficial, one that facilitates and attracts imports and investments in general, especially in tangible assets. An improvement in this area is not anticipated in the short or medium term: a terrible influence on SID’s financials.

Moreover, a very substantial risk is based on one of the most attractive points for investing in this steel company: its dividends. As previously mentioned, it’s vital to maintain a positive cash flow to support dividend distribution, which didn’t occur in the past couple of quarters.

Final words

In conclusion, the analysis of Companhia Siderúrgica Nacional reveals a challenging and complex landscape. The company is facing difficulties, particularly due to the materials industry’s sensitivity to demand and prices, resulting in drops in sales in recent months. This has been reflected in SID’s financial results, with a negative first quarter and slightly better results in the second quarter of the year.

Looking at the company’s performance, SID has struggled to meet earnings and revenue estimates in recent years, contributing to a negative trend in its stock. While revenues have grown at an average of 13% annually, a slowdown in this growth rate is expected due to the challenges faced.

Regarding its valuation: most indicators suggest that it is undervalued. When compared to the sector, its metrics are lower, with the exception of EV/EBIT, and they are lower than most of its main competitors, with the exception of Gerdau S.A., which incidentally draws attention and might be a sounder investment.

Therefore, after reviewing all pieces of information, I don’t believe SID’s undervaluation justifies its purchase. The low growth potential combined with the high dividend truly weakens its future outlook. For now, I advise patience and assign a hold case for this stock. I don’t recommend selling it, due to the likelihood of eventual improvement. For those who value dividends, it’s ideal to keep an eye on the next financial result if there’s stability in its cash flows, so that dividends can be distributed consistently.

Read the full article here

Leave a Reply