Investors should buy shares of Comerica Incorporated (NYSE:CMA).

The firm’s equity shares have been beaten down throughout 2023. However, Comerica has a strong 170-plus year history of profitability and returns to shareholders. The firm’s current dividend yield of 7% is quite high, and begs the question: Is Comerica a suitable investment for value-oriented investors?

Catalysts

There are a few key strategic catalysts that may affect Comerica’s future valuation:

1. Geographical Footprint

I believe Comerica’s leadership has been intentional about operating in markets where it feels that the firm’s profitability will be maximized. Founded in 1849 as the Detroit Savings Fund Institute, the modern Comerica has embraced geographical diversification via primarily high-growth demographic environments. This has been particularly evident via the firm’s incursions into Texas, California, and Florida, which are currently the three biggest states in the United States. Moreover, Comerica’s leaders have targeted urban centers for their wealth management and commercial/corporate banking offices. These decisions are not much different from those made by executives at other regional banks. However, Comerica has had success by showing intentionality when selecting prospective office locations to run its various operations. Company leaders have not indicated any new expansion, but seem to be hoping on growing their customer base in the Southeast and Mountain West regions. In addition, pursuing acquisitions of smaller competitors in these areas could help Comerica accelerate growth.

Comerica August 2023 Investor Presentation

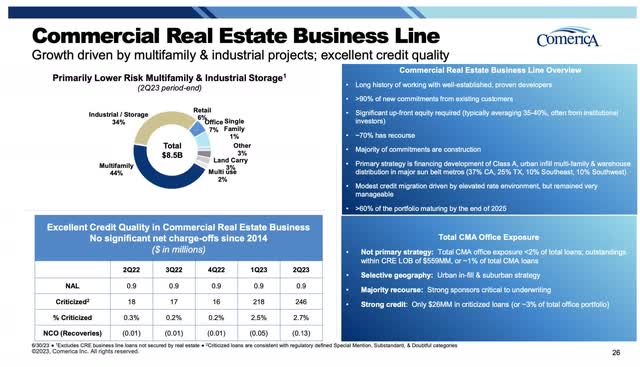

2. Commercial Real Estate

Some investors have postured that a looming commercial real estate crisis will dent the economy. This is a seemingly legitimate concern, and it appears likely that some companies will not renew their leases following the proliferation of work-from-home trends. Retail and office spaces are of particular concern, and make up 13% of Comerica’s total portfolio. Moreover, 70% of Comerica’s CRE portfolio has recourse and can be somewhat recovered in the event of default. Risk management is an important component of any bank’s operations, and Comerica’s managers have shown a desire to minimize CRE risk.

Comerica August 2023 Investor Presentation

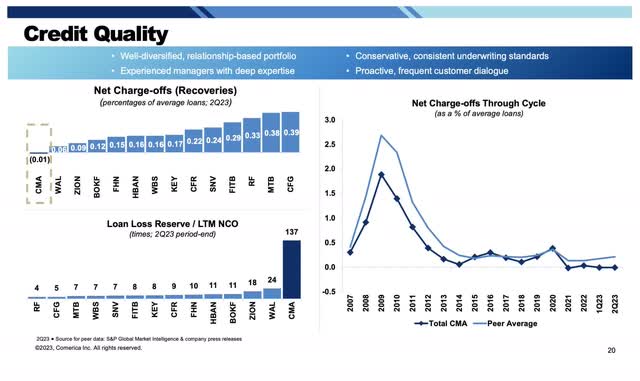

3. Net-charge Offs

I think Credit quality is an area of pride for Comerica’s financial managers. This is especially evident from the way in which they have constructed Comerica’s recent investor presentations. Compared to other regional banks, Comerica has taken significantly fewer charge-offs throughout 2023. In addition, the firm has reported a significant amount of loss reserves to protect against downturns. This is somewhat suspicious because it seems unlikely that Comerica’s loan quality is dramatically different from comparable firms. However, intuition seems to indicate that Comerica’s geographic base in high-density areas has allowed its loan officers to strategically manage who they give loans to.

Comerica August 2023 Investor Presentation

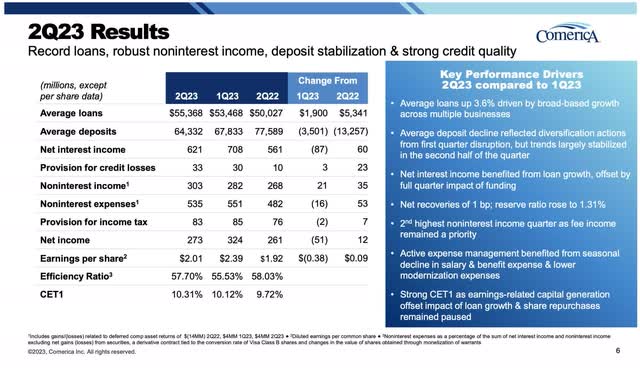

4. Loan and Deposit Growth: Avoiding Bank Runs

Comerica’s deposit base has been decimated between 2Q22 and 2Q23. Bank runs at firms such as SVB Financial Group (OTCPK:SIVBQ) have put a spotlight on the liquidity and stability of each commercial bank across the United States. Comerica’s liquidity has theoretically increased based on its improved Common Equity Tier 1 ratio. However, the substantial decline in the firm’s deposits means that it has less funds to lend out and less opportunities to generate income from these loans. Remarkably, Comerica has maneuvered to increase its net interest income by taking advantage of higher nationwide interest rates.

Comerica August 2023 Investor Presentation

These four catalysts are intended to illustrate the notion that Comerica’s operations have not changed markedly since the March 2023 banking crisis. The market seems to be in continued fear over negative deposit growth, but Comerica’s management has found a way to strengthen the firm’s financial position.

Valuation Modeling

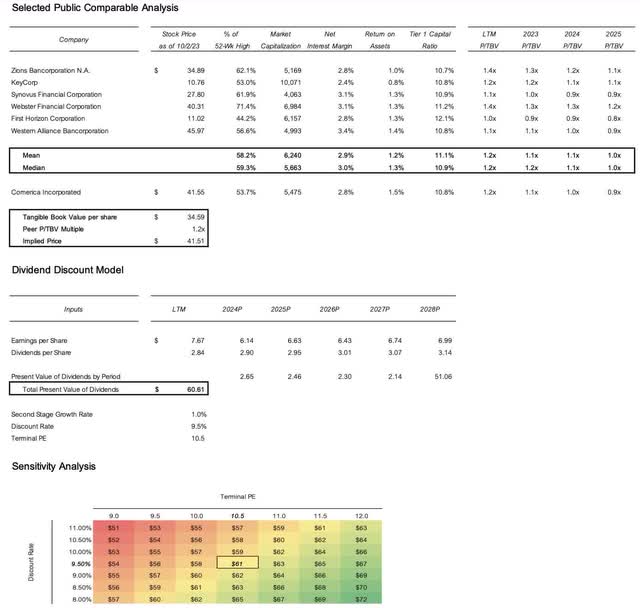

Companies in different industries require distinct valuation methods. While a discounted cash flow model may be appropriate for firms in high-growth industries, banks are generally valued based on balance sheet multiples. Issues with U.S. GAAP accounting are partially to blame for this distinction, but this is remedied by the fact that the majority of a bank’s assets are carried on the balance sheet at their fair values. Therefore, Comerica was valued through a combination of a peer group price to tangible book value multiple and a dividend discount model.

Several considerations were made when selecting an appropriate peer group for Comerica. Market capitalization based on each firm’s share price multiplied by shares outstanding was the main criteria applied to potential comparable companies. Moreover, the geographic distribution, total deposits, and number of branches were also considered. A selected peer group of Zions Bancorporation (ZION), KeyCorp (KEY), Synovus Financial Corporation (SNV), Webster Financial Corporation (WBS), First Horizon Corporation (FHN), and Western Alliance Bancorporation (WAL) was created. This seems to be an appropriate peer group given the similarities in each firm’s business model and strategic objectives.

S&P Capital IQ provided relevant net interest margin, return on assets, tier 1 capital, and price to tangible book value data. Moreover, the average and median of these values for the peer group was calculated to provide a good relative comparison to Comerica. The results indicate that Comerica is reasonably undervalued. The 1.2 times price to tangible book value peer multiple implies that Comerica is worth $41. However, multiples valuation alone is not sufficient to prove whether a firm is fairly valued since forming a peer group is quite subjective.

A dividend discount model was used to find the firm’s intrinsic value. Comerica has a history of paying dividends to shareholders, and these cash flows were used to value the firm. The inspiration for using a DDM was taken from David B. Moore, a CFA with Marathon Capital Holdings in San Diego, California. Mr. Moore published a guide on valuing community banks whereby he argues the merits of using a DDM to price bank stocks.

Based on the firm’s future discounted dividends, Comerica has an intrinsic value of $61 per equity share. This can be further amended to a target range of $51 to $72 per share, which implies significant upside. With respect to assumptions included in the base-case model, a 9.5% discount rate was used in addition to earnings and dividends estimates taken from CapIQ. Moreover, a second stage growth rate of 1% was used along with a terminal price to earnings ratio of 10.5. Please remember that these are estimates and are meant to illustrate a reasonable base case that does not consider a significantly negative or positive event.

Author’s Model

Investment Summary

Comerica is a good option for value and dividend conscious investors. The typical definition of a value stock dictates that a firm’s equity shares have been beaten down irrespective of their true worth. With respect to Comerica, the downfall of a few regional banks last March unleashed a wave of investor fear of regional banks. Fear is a dangerous force in the capital markets, and it will likely take a few years for investors to realize that firms like Comerica are good additions to their equity portfolios. Commercial banking, at its core, is the sale of leverage. American governments, companies and individuals are highly levered and this is likely to continue for the foreseeable future. The relative attraction of high growth tech stocks makes people wary of “boring” small/mid cap banks. I hope that I don’t end up eating my words in my relative bullishness of regional banks.

Read the full article here

Leave a Reply