In May of this year, we published an article titled “Coinbase: Diversifying Revenue, Cutting Costs, And Well Positioned For The Next Bull Market”.

The main thesis behind our “Buy” rating on the stock at that point in time was that Coinbase (NASDAQ:COIN), in our view, was meaningfully diversifying away from its core transaction business towards a more fully featured financial platform.

Since then, the stock is up 40%+ and progress continues to be made on all fronts.

Today, we’ll be breaking down the Q3 results, which, in our minds, were extremely promising. Combine it with a recent surge in Bitcoin and other assets, which should show up in Q4’s transaction data, and we think the valuation for this stock – at under 6x sales (and with incredible leverage to any improvement in the underlying crypto markets) – is a fair deal that investors should jump on.

Let’s dive in.

Coinbase Q3

If you could summarize our previous take on Coinbase and its financials, it would look like this:

- Coinbase’s financial performance has historically been highly volatile, with the ability to generate significant profits in bullish crypto markets but suffering losses when market interest wanes, as evidenced by the steep decline in revenue and operating profits following the peak in Q4 2021.

- The company’s reliance on transaction fees has been a weakness during bear markets; however, management is actively diversifying its revenue streams with new ventures such as an offshore futures exchange and the launch of Base, its Ethereum L2 rollup chain.

- Despite lower revenues, Coinbase had begun to improve its financials due to aggressive cost-cutting measures, and the company is continuing to improve its product offerings, indicating strong operating leverage.

Thus, this Q3 was about 2 important things in our mind: The revenue diversification, and the stickiness of the cost-cutting.

Thankfully, we were excited by the progress on both fronts.

On the product front, Coinbase continues to innovate, as services revenue continues to increase:

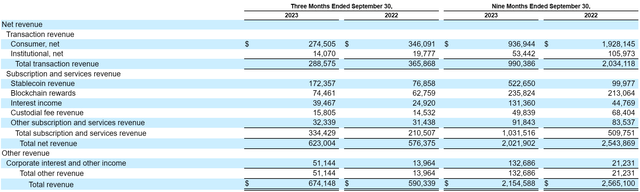

10Q

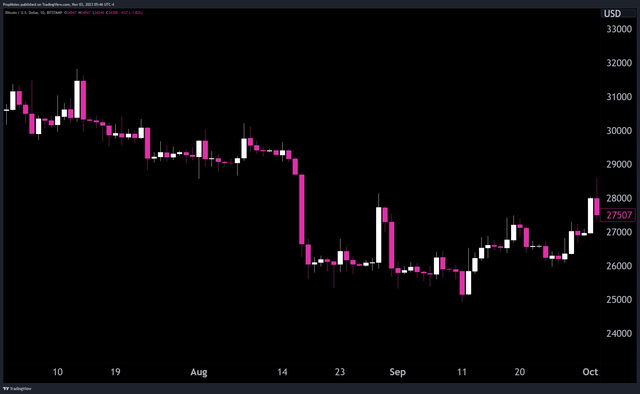

Transaction revenue actually fell in Q3 vs. Q2, from $323 million to $283 million, an overall drop as the crypto markets stayed incredibly flat and “boring”, with the exception of a few days in mid-August:

TradingView

That said, the company did make some progress on the derivatives front, which should bolster transaction revenue going forward:

Let’s talk about derivatives. Unlocking the ability to offer derivatives products to users is a huge opportunity for Coinbase as the global derivatives market for crypto represents 75% of all trading volume. Trading volume that up until now was largely going through unregulated offshore exchanges. Derivatives products are an important tool as the ability to trade crypto using margin essentially giving traders the ability to use margin, increases our capital efficiency and access to the crypto market with less upfront investment.

In Q3, Coinbase International Exchange received regulatory approval from the Bermuda Monetary Authority to enable perpetual futures for eligible non-U.S. retail customers, which we began offering just last month. And Coinbase Financial Markets also received regulatory approval from the National Futures Association to offer futures to eligible U.S. customers via advanced trading. And as of yesterday, we now offer regulated futures to U.S. customers via Coinbase Financial Markets.

Zooming back out, the key here is that transaction revenue was offset by strong services revenue that actually came in higher, at $334 million. Thus, while top line results were similar to Q2, at $674 million vs. $662 million, the mix was much stronger due to the increased value of more predictable, stable services revenue.

This services revenue comes from a few places:

- Stablecoin Revenue: Income from the USDC arrangement, dependent on the USDC balance on Coinbase’s platform, USDC’s market cap, and interest rates.

- Blockchain Rewards: Earnings from participating in proof-of-stake networks and various blockchain protocols.

- Staking Revenue: Part of blockchain rewards, linked to customer staked balances, asset prices, and protocol reward rates.

- Interest Income: Generated from customer custodial funds and loans, fluctuating with trading volumes and interest rates.

- Custodial Fee Revenue: Fees from crypto assets held in cold storage, calculated as a percentage of their daily value.

- Other Revenue: Includes earnings from Coinbase One, Coinbase Cloud, Learning Rewards, Prime Financing, and subscription licenses.

We’ve seen in the comments here on Seeking Alpha and elsewhere that many view this revenue, especially the stablecoin revenue, as “low quality”, but we think that’s inaccurate.

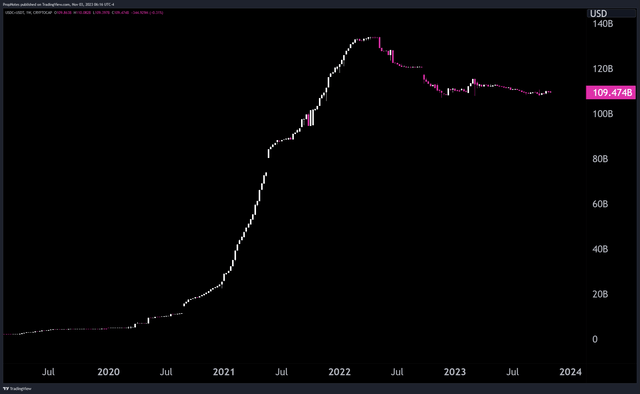

Stablecoins businesses are simple and profitable. Stablecoins are needed to bridge “real world value” onto various chains, and thus while demand will fluctuate over time for these assets, they should continue to capture the interest spread over time:

TradingView

Right now, that spread is incredibly solid due to heightened interest rates.

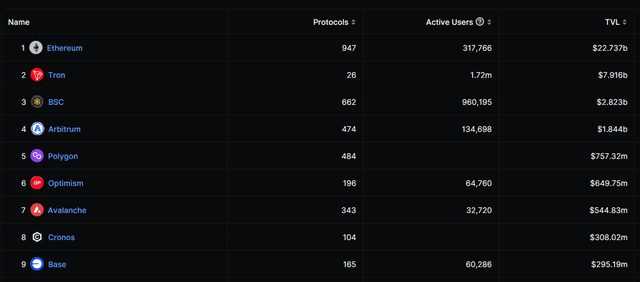

One final note; Coinbase’s “Base” chain has achieved significant adoption throughout its launch so far, becoming a top 10 chain in terms of TVL, or “Total Value Locked”:

DefiLlama

We remain bullish on Coinbase’s revenue platform, while also bullish on the ‘call option’ like transaction business that should print cash if and when crypto begins to get its mojo back.

On the cost front, COIN has also done a good job doing more with less. As the company has made progress with its offerings, costs haven’t increased from their new, lower level:

Total operating expenses declined 4% quarter-over-quarter to $754 million. Technology and development, general and administrative and sales and marketing were collectively $654 million down 1% quarter-over-quarter. Expenses did come in at the low end of our outlook, driven primarily by a shift in timing of certain legal and marketing expenses from Q3 to Q4.

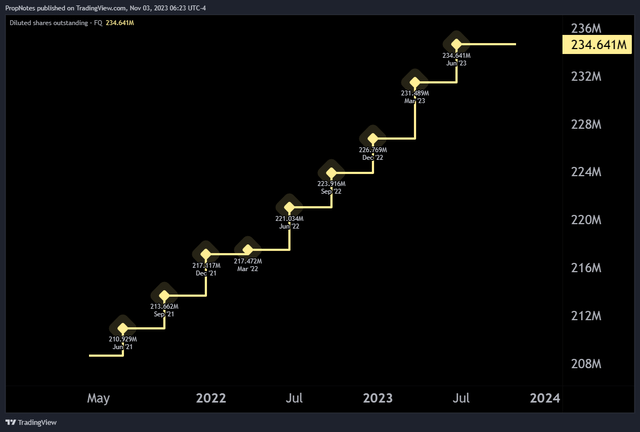

While some of these costs will show up in Q4 as mentioned, a majority of the savings had to do with lower stock-based compensation, which is progress, given the high rate of dilution:

TradingView

This progress on expense management shows that COIN has substantial operating leverage built into the business, which is great for shareholders.

All in all, we think Q3 showed progress on both the sales and operating costs front, and as the company continues to solidify its financial base, the stock could demand a higher and higher premium.

Valuation

Right now, Coinbase is valued at 5.9x revenue, which seems like a relatively good deal to us:

TradingView

Some may view the multiple as expensive, given that the company is mostly breakeven from an operating standpoint. However, nobody knows where crypto will go in the future. It could go to zero, or it could take over certain aspects of the modern financial system.

Brian Armstrong certainly sees crypto as inevitable:

Onchain is the new online. The Internet was and is a game changing technology that redefined our modes of communication, business and social interaction. It broke down barriers, democratized access to information and made knowledge universally accessible. Blockchain and crypto are doing the same thing today with a redecentralization of the web and the introduction of a new building block ownership.

Thus, for us, paying a ~6x sales multiple for a company which already has an established business and brand, solid gross margins, and the upside to be a next generation tech giant seems reasonable.

While it may not be the best price in the world, the valuation isn’t a reason to stay away from this growth story & improving execution.

Risks

At this point, the risks are well-known for folks who are looking to invest, but we’ll cover them anyway.

First is the regulatory risk. The SEC and other regulators have been a thorn in the side of COIN for years now, and the headline risk that COIN has been indicted or some other legal proceeding has been undertaken should be considered.

When COIN received a Wells Notice earlier this year, the stock dropped considerably.

That said, the tide does seem to be turning. Ripple (XRP-USD) recently (mostly) won its case against the SEC, and regulators are being asked to step up and do a better job at issuing fair and free regulations on the industry that has, up until this point, been a ‘wild west’ of sorts.

We view this risk more as a nuisance than something existential for Coinbase. We also realize we are potentially in the minority in that.

Second is the volatility risk. While the company has made some progress on increasing its revenue diversity, the company is still prone to swings in the underlying digital economy which it serves.

Judging from chain transactions, active addresses, and other digital economy health indicators, our sense is that the economy has reached a “floor” of sorts in terms of interest, trading, and investment.

That said, it definitely could deteriorate more, which could impact earnings, the multiple, and the share price.

Summary

It’s true that there are risks with investing into COIN – perhaps more than almost any other stock on the market due to its underlying volatility.

However, continued progress on the business front, combined with the company’s potential to become a tech giant of tomorrow means that taking a shot here on Coinbase’s continually improving situation makes sense.

We reiterate our rating of “Buy” for COIN.

Cheers!

Read the full article here

Leave a Reply