Coinbase (NASDAQ:COIN) in the intricate tapestry of the cryptocurrency world, has carved a distinctive niche for itself. Its blend of meticulous financial strategy with innovative interventions has rightfully positioned it as a vanguard in the realm of digital currencies. We believe that at current prices there is a moderate Risk/Reward ratio and we are placing a rating of ‘Buy’ on the stock. We believe at current price levels Coinbase offers a discount for exposure to the whole crypto ecosystem. In the following article we will dive in to the details of Coinbase’s operations, why we believe COIN offers upside and we offer recommendations for investors to help manage the volatility associated with Coinbase’s pricing.

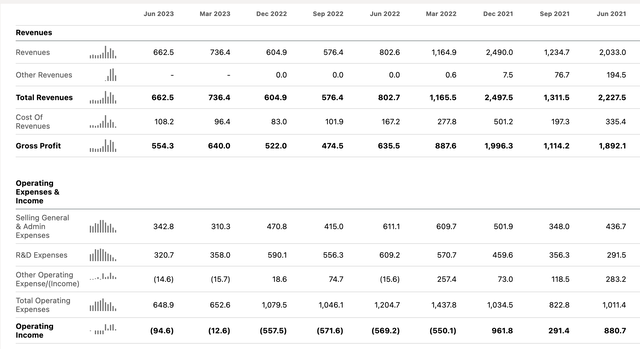

Operational Review Q2

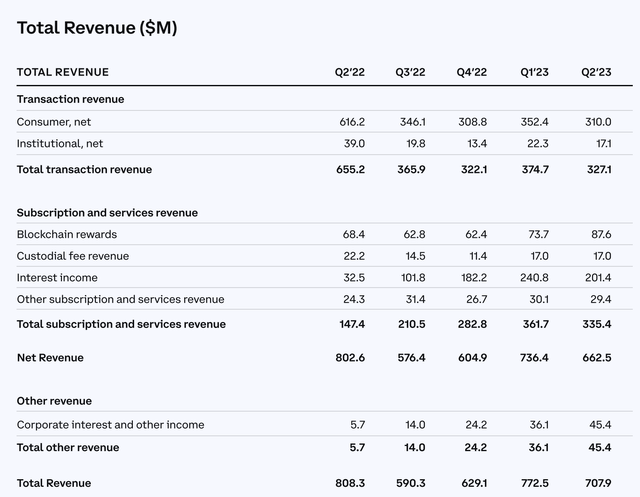

Coinbase, traditionally recognized as a cryptocurrency exchange, is witnessing a notable diversification in its revenue streams. Despite the anticipated dip in consumer transaction revenue — a direct consequence of the significant price drops in Bitcoin and Ethereum in recent quarters — the surge in other revenue sources is striking. The growth is particularly evident in blockchain rewards. However, the standout performer is the interest income, which has seen a meteoric rise from $32.5 million to an impressive $201.4 million in Q2 2023.

Coinbase

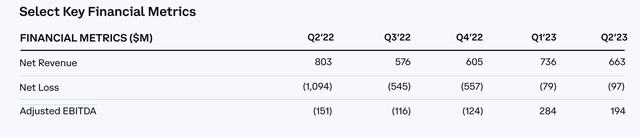

The company’s latest earnings report is emblematic of its ability to stay ahead, even in turbulent times. Reporting an adjusted EBITDA of $194 million in the recent quarter is no minor feat especially when compared to Q2 2022 where revenue was $140 million greater but losses were $345 million greater. Such figures are rarely the result of serendipity; they often echo a brand’s prowess in financial management. It’s remarkable to note the company’s conscious efforts in reducing operational expenses by nearly 50% year-over-year. This achievement is not just about numbers; it’s a testament to its operational efficiency and strategic foresight. Lowering operational expenses this dramatically opens up further operational leverage down the line. While this reduction in Opex is massive it does raise some concerns around why they had that level of spending to begin with considering how easy it has been for them to reduce the costs. With that said, if another strong crypto rally emerges Coinbase is more than prepared to capture significant upside.

Coinbase

Coinbase

In an industry where trust can be more than elusive, Coinbase has managed to stand out as a beacon of reliability. Across diverse markets, the brand has managed to foster a reputation synonymous with trustworthiness in the crypto arena. Such reputations are cultivated over time and are a product of unwavering commitment, transparent operations, and a user-centric approach. This earned trust is evident not just in its primary trading platform but also in its diversified offerings. With ventures spanning from versatile financial products like savings, rewards, and the pioneering Coinbase card to its forays into the revolutionary Web3 space, Coinbase’s strategy is unmistakably holistic and offers ecosystem wide upside.

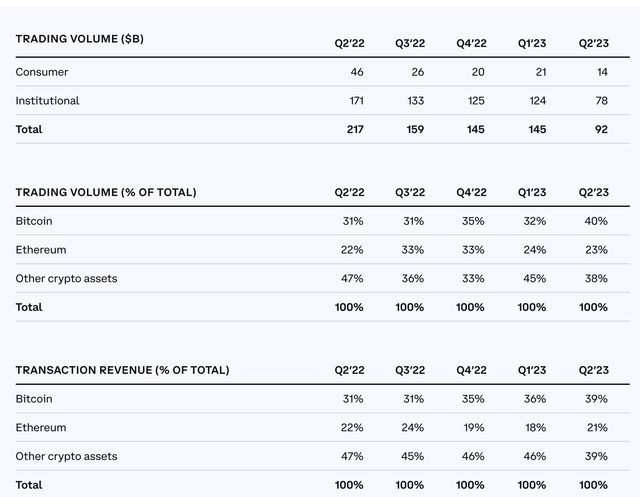

Changing Dynamics

An interesting insight from the company’s data is the evolving user engagement with cryptocurrencies. What was once predominantly seen as a volatile trading asset is now being embraced for its multifaceted utility. This shift underscores a broader evolution in the crypto market and aligns seamlessly with Coinbase’s forward-looking vision, which sees the role of crypto expanding beyond just trading and becoming a part of digital life.

On the international stage, Coinbase’s ambitions are clearly delineated. The initiation of a derivatives exchange in a curated list of international markets signals its commitment to broaden its horizons. But its global aspirations don’t stop at mere market expansion. Coinbase is methodically embedding itself in the institutional framework of the cryptocurrency world. This is evident in its strategic positioning in the realm of ETF applications, indicating its readiness to be an institutional pivot in the crypto sphere. As leading Crypto Exchange Binance continues to wobble we expect to see Coinbase to seize more market share internationally.

Technology, as one would expect in such a domain, remains at the core of Coinbase’s endeavors. By emphasizing scalable Layer 2 blockchain solutions, Coinbase is not only addressing the pressing needs of the present but is also laying robust foundations for the future. Such technological foresight is crucial in an industry marked by rapid advancements and equally swift obsolescence. The recent announcement of their Base product will enable them to help developers expand the overall business opportunities of crypto products while also granting them upside through these products being built on their scalable solution.

The crypto realm, for all its dynamism, has often found itself at loggerheads with regulatory frameworks. Here too, Coinbase has chosen to be a long term trailblazer. Instead of a reactive stance, which is often the norm, the company has taken the bull by the horns. Through proactive engagements, grassroots campaigns, and strategic interventions like the “Stand with Crypto” initiative, Coinbase has transitioned from a mere participant to a key influencer in policy determinations. The company’s role in the advancements of the crypto market structure Bill is indicative of its proactive and influential stance in the regulatory space. With the recent SEC troubles it is important to highlight that there are continued regulatory pressures and risks to Coinbase. While Coinbase is pushing to have the case dropped we believe that it is important to highlight that these risks are likely to remain until clear regulation is passed.

Valuation

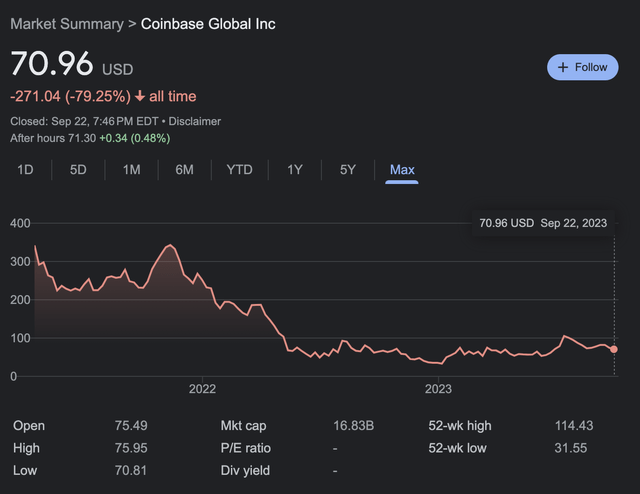

In recent quarters, Coinbase has undergone a notable valuation adjustment. During the cryptocurrency boom, Coinbase was perceived as a high-growth company, and its valuation was primarily driven by revenue growth metrics. Long-term profitability took a backseat in favor of aggressive expansion. However, as market conditions became less favorable, there was a clear shift in Coinbase’s strategy towards emphasizing profitability. This change in direction is evident in recent quarters, particularly with the reduction in operational expenses. Although Coinbase has yet to report a positive Operating Income, the reduction in its cash burn rate is commendable. Comparatively, just a year ago, the company was burning through $570 million each quarter.

Seeking Alpha

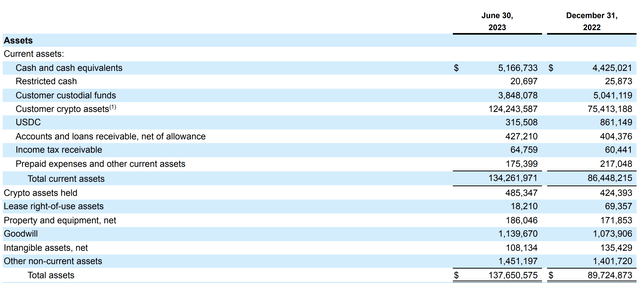

Although the cash flow of the business is garnering significant and well-deserved attention, we argue that the real potential lies in the customer deposits held on the platform. As illustrated in the provided data, customer assets on the platform saw an impressive surge of nearly $50 billion from Q4 2022 to Q2 2023. While some of this growth might be attributed to the challenges faced by competitors like Binance and FTX, we interpret this spike in deposits as a testament to the power and credibility of the Coinbase brand.

Coinbase

Although it’s not entirely accurate to equate total assets with customer deposits directly, we contend that Coinbase’s total assets can serve as a reasonable proxy for gauging customer deposits.

Seeking Alpha

Considering that September 2021 marked Coinbase’s peak revenue quarter, the almost tenfold increase in deposits on the platform since then underscores a remarkable transformation in Coinbase’s market stance. As Coinbase evolves into a comprehensive financial institution within the crypto sphere, it stands to benefit from broader ecosystem opportunities that a mere exchange platform couldn’t offer with the biggest risk to their continued growth being either regulation or continued drops in interest in the crypto space.

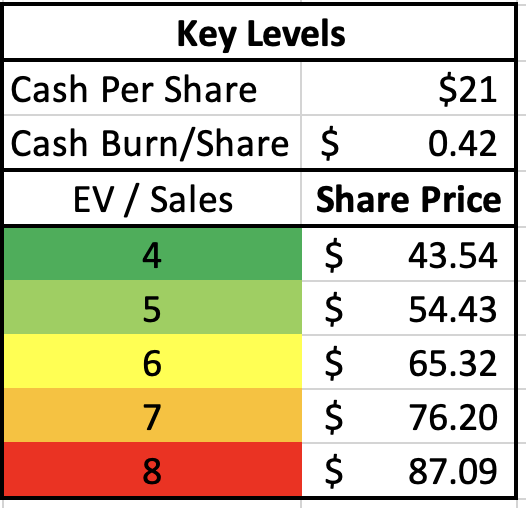

Using traditional Enterprise Valuation metrics Coinbase current sits at $16 Billion and has a TTM revenue of $2.5 Billion pricing them at roughly 6.4X Revenue/EV. Adding in their crypto holdings of ~$800 million brings the EV/Sales to ~6.0X. Which brings it in line with companies such as: ATVI:7.4X RBLX:5.9X U:7.5X CBOE: 4.5X

While none of these offer a direct comparison it does highlight the valuation of COIN relative to the other in the tech space. While Coinbase doesn’t offer a dramatic discount to others it does present a decent entry point for the crypto ecosystem if you are a believer in its long term success. Due to its lack of obvious discount we are placing a ‘Buy’ rating on it vs a ‘Strong Buy.’ Below we highlight some of our key levels of what we believe is fair pricing considering the current metrics.

Key Levels for Coinbase (Author)

Based off of these various levels we plan to initiate a few trades using options to reach some of these key levels. We believe that crypto and web3 is here to stay and that AI will help developers innovate and develop rapidly and that Coinbase’s suite of options will enable even further development. In addition to this we have a long term bullish view for both BTC and ETH and that factors in to our opinion of Coinbase.

We believe that profitability is near, especially as interest rates continue to climb. They are well capitalized and their midterm survival is not in doubt. They are definitely a high risk/high reward trade and we recommend selling options to take advantage of the high volatility.

Conclusion

In a domain characterized by volatility, both in terms of market prices and brand fortunes, Coinbase’s journey stands out. Its blend of strategic initiatives, technological innovations, regulatory engagements, and a keen understanding of market dynamics make it a force to reckon with in the crypto world. As the contours of the digital currency landscape continue to evolve, Coinbase’s role is becoming increasingly pivotal. It’s not just a witness to the changing tides but is actively shaping the future of this vibrant ecosystem. It will be intriguing to see how this brand, with its clear vision and unwavering commitment, continues to mold the future of digital currencies and we believe in the long-term of Coinbase and place a rating of ‘Buy’ on them.

Read the full article here

Leave a Reply