Introduction

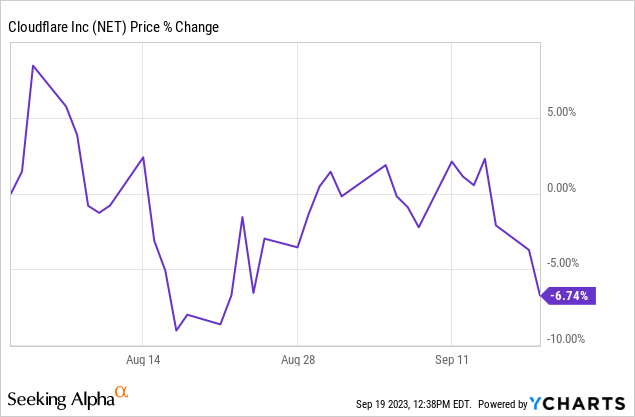

Cloudflare’s (NYSE:NET) stock price didn’t move much after its Q2 2023 earnings. Well, if you are a growth investor, that is. For investors in stocks of more mature companies, this volatility over a month and a half would probably be a very turbulent period.

Growth investing is all about the future, and I think that Cloudflare has a great future. The sudden and unexpected breakthrough of AI and more specifically large-language models shows that the company was prepared for new trends, even though it didn’t really foresee AI taking off in such a way. OpenAI is a Cloudflare customer and many startups focusing on AI as well. In this article, we’ll see why, but first we go through the earnings results.

The Results

Let’s refresh our minds by looking at the results, as they were already released in early August. The expectations for Cloudflare were high, but the company didn’t disappoint with its Q2 numbers.

For revenue, the company reported $308.5 million, $2.68 million more than the consensus and up 31.6% year-over-year.

Operating income came in at $20.3 million, compared to a negative $891,000 in Q2 2022. Non-GAAP net income clocked in at $33.7 million. That translated to EPS of $0.10, surpassing expectations by $0.03. Operating margin was 6.6%, from -0.4% last year. There was $20 million in free cash flow or 6% of revenue, up from -2% in the same quarter last year.

Remaining performance obligations or RPO came in at $1 billion, up 8% sequentially and 36% year-over-year. Current RPO, which will be recognized in the next twelve months, was 75% of the total RPO. This shows that it’s very likely that Cloudflare can keep up its 30%+ growth for the next 12 months.

Also, important was guidance. For Q3 2023, Cloudflare projects revenue between $330 million and $331 million, slightly ahead of the consensus of $329.8 million. Non-GAAP income is expected to be $20 million to $21 million, which translates to EPS of $0.10, slightly above the expectations of $0.09.

Cloudflare’s full-year projections came in between $1.283 billion and $1.287 billion, close to the consensus of $1.28B and up almost 32% year-over-year at the midpoint. Non-GAAP income for the year is estimated to fall between $81 million and $85 million or $0.37 per share, 3 cents above the consensus.

This is a neat overview of the consensus, taken from the company’s earnings call presentation.

Cloudflare Q2 2023 earnings slides

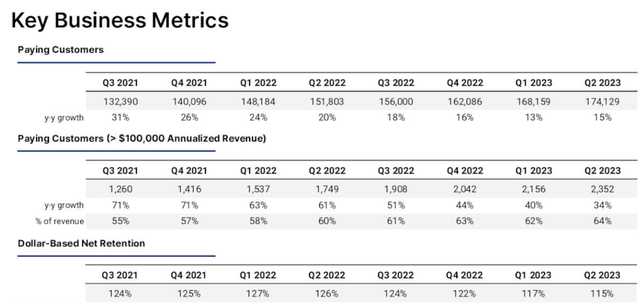

Here’s a summary of the KPIs, also from the company’s earnings presentation.

Cloudflare Q2 2023 earnings call slides

Dollar-based net retention kept decreasing, but 115% is still solid in this environment. Management pointed out on the earnings call that you should see this in the proper context:

Dollar-based net retention is a lagging indicator. So it will be slower to reflect the go-to-market improvements we are seeing.

Management is very confident the trend will turn around and said it could be the bottom for dollar-based net retention rate or DNR, as CFO Thomas Seifert called it on the conference call:

We think we are seeing bottoming of the DNR development. So we are quite sure we’ll move that upwards to where and beyond where we came from.

For the rest, we see 15% more paying customers, coming in at 174,129. The addition of big customers, paying more than $100,000 per year, remains strong at 34% growth year-over-year. Big customers already account for 64% of revenue, up from 55% two years ago. At the same, this means there is still potential for expansion. Many companies in the tech industry have 80%+ of their revenue from big customers.

Humor And Performance

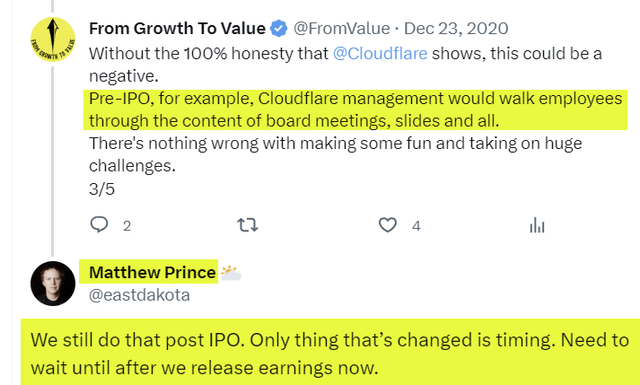

Matthew Prince is always a pleasure to listen to on conference calls. Some thought he was arrogant in the previous quarter when he pointed at certain salespeople not performing. I have followed Prince for years, and it’s not arrogance but radical honesty. It is just how he is and how he and Michelle Zatlyn have formed the company – with radical openness and full transparency. This reminds me of when Matthew Prince answered my tweet in December 2020:

X

I also refer to fun in this tweet and there was another example on this earnings call:

These days feel like membership in the CEO club is predicated on saying AI as many times as possible in your earnings call script. I have to confess, I still find it a bit awkward. When we first pitched Cloudflare to venture capitalists back in 2010, at one point, I described us as, “The first AI powered security company for the cloud.” The eye rolls around the table were so intense that I’m still a bit scared. But more than a decade later, here we are.

And then later in the conference call:

I think I’ve only said AI 11 times so far, putting me way behind Satya.

Prince is always swift with action, in his own words because of co-founder, COO, and President Michelle Zatlyn. You could see that again with this sales execution problem. Many companies would still be thinking about the problem months after they first identified the problem. Not Prince.

As we discussed last quarter, we made significant changes in our sales team to proactively address underperformance. That went very well, both qualitatively and quantitatively. Our top performers are invigorated. We saw a marked improvement in the average account executive productivity. At the same time, we’ve implemented robust onboarding, enablement, and training programs.

And that already yielded results:

Our focus on go-to-market improvements is already paying off. After we saw sales cycles increase 20% in Q1, disciplined around deals had them return to levels closer to what we saw last year.

We can’t really check this, but there is no reason to doubt this statement and it shows impressive execution. Management also stressed that for the enterprise segment, the effects would only be visible later, in several quarters. The mid-market saw faster effects, but there too, it’s still early.

CFO Thomas Seifert also shared that of the 196 new $100,000+ customers, there were more new customers than existing customers passing the threshold. In the past, this was about 50%/50%. This also shows the panicky messages from market watchers about sales execution at Cloudflare after the previous quarter were not warranted.

In general, macro seems to be stabilizing, Matthew Prince said.

My sense, talking to customers is that while the macro environment is still challenging, it is stabilized.

That’s also what we heard on the Datadog earnings call and several other consumption-based models. There are two possibilities: either the macro is stabilizing, or companies have trimmed the fat and are not able to cut more if they don’t want to cut in their own meat, so to speak. Or it can be a combination of both, of course. No matter which one it is, it’s promising. Of course, we have to be careful, as CFO Thomas Seifert also emphasized:

We still think, we need to apply a good portion of caution to our outlook. One data point doesn’t really make a trend. At this point, we do not assume that the macroeconomic environment is improving significantly. We still see significant mixed macroeconomic data points that we factored into our guidance.

Matthew Prince also emphasized that the lower net retention rate had nothing to do with increased competition:

It’s also important to note that we did not see any new competitive pressure or churn throughout the quarter.

AI Will Be The Next Growth Driver

AI continues to be a great revenue booster and opportunity for Cloudflare. This is what Mattew Prince shared about a big AI company, probably OpenAI, which is a Cloudflare customer:

One of the fastest growing generative AI company expanded their relationship with Cloudflare, signing a one year $1.7 million contract, less than a year after first starting to use our platform.

Like many AI companies in the space, this customer relies on a multi-cloud architecture for training and processing requests. R2 lets them unlock the best prices and performance across multiple cloud providers.

In their words, “We see Cloudflare as a strategic foundational glue across all our services. Cloudflare continues to be our best strategic partner of all partners.” That’s great to hear from many customers, but it’s especially fun coming from a company that’s doing such cutting-edge work.

That sounds really good and it could mean Cloudflare was where the puck would come before the pass was given. After all, Cloudflare had not foreseen that R2 would become a resource for many AI companies. But it’s not just R2. Cloudflare says it is the most commonly used cloud for AI startups, which also use Cloudflare’s security products. Inference could even become bigger.

And by our estimates, Cloudflare is the most commonly used cloud provider across the leading AI startups. They’re using R2 to help arbitrage the lowest GPU cost to train their models. They’re using our security tools themselves powered by AI or what our team would prefer to call machine learning to protect their own AI systems. And increasingly, they’re using the edge of our network to perform inference. We are continuing to invest in this area and believe that we are uniquely positioned to win the inference market, which we believe will be substantially larger than the AI training market.

That could mean this is just the start and Cloudflare can sustain this kind of growth for a long time or even re-accelerate revenue growth if the macro picture would improve.

A bit more explanation about inference. In the context of AI, inference is using a trained AI model to make predictions or interpret new information. In other words, if you use ChatGPT, the responses you get are the result of inference.

Some inference will be done on the device. If you have a self-driving car, you don’t want it to connect to the cloud if a dog suddenly crosses the street. You want it to act now, without latency. That’s why the device will be best. For other data, Cloudflare will benefit from the bigger data consumption, as for many things (think of ChatGPT) data closer to the end user is faster and faster is better. But there is a second revenue driver in this, not just speed. According to Matthew Prince, this one is even much more substantial:

We’re already seeing it play out some of the regulatory efforts that are happening around the world is that a lot of times for these inference tasks, the data that there is very private. People and governments want that to stay as close to the actual end user as possible.

So we’ve already seen action in Italy that has restricted the use of certain AI tools (he means ChatGPT, Kris) because it sends data out of the country. What Cloudflare can uniquely do because we’re positioned across more than 250 cities worldwide, we are in the vast majority of countries worldwide is that we can actually process that information locally.

Prince also gave a great explanation about the cutting edge of this technology, why Cloudflare can play a role, and where it doesn’t even compete. This gives insight into the whole industry, so it’s also interesting if you are a shareholder of Nvidia (NVDA), or hold one of the hyperscalers: Microsoft (MSFT), Amazon (AMZN) or Alphabet (GOOGL) (GOOG).

And what I think is a little bit confusing is most of, if you’re trying to do the training of the models, then having the absolute latest, greatest GPU, the H100 from Nvidia right now, there’s a lot of constraint in getting those chips. But there’s actually a sweet spot for inference tasks, which isn’t necessarily at the absolute cutting edge of the models. And so Cloudflare is not the right place to actually process the training of models. That’s — that makes much more sense to do in a more traditional, centralized data center model, much like much of the traditional hyper scale public clouds.

And in those cases, you have to have the latest, greatest GPUs. But when you’re doing inference, again, a lot of that’s going to run on your device. And a lot of that is also going to run inside the network. And we’re going to be able to, with a much lower capex spend, leverage the edge of our network, in order to be able to do that processing extremely efficiently.

Now that Cloudflare has seen that the AI companies have found their way, the company wants to serve them as optimal as possible:

Q3 will feature our annual birthday week (note from Kris: during Birthday Week, they always announce a slew of new products and updates), and we have a lot more in store to provide picks and shovels to enable AI companies to build the future.

These kinds of trends are for the long term. Just look at the cloud, for example. While everyone has been talking about it since at least 2010, 55% of companies are still on-prem. And the opportunity is growing fast. Matthew Prince gave an example:

Another generative AI company expanded their relationship with us, signing a three-year $1.3 million contract. They came to us for our developer platform, signing up as a pay-as-you-go customer. Because their developers loved us, they approached us about a security need and signed a deal to use our application security and Zero Trust products. They’re only 100 seats, but they’re growing like crazy and building Cloudflare deep into their whole stack.

Matthew Prince explained the clear plan the company has, emphasizing how early AI still is.

I would still say Act 1 is application security, Act 2 is Zero Trust and Act 3 is Workers. But I would say that we have been very pleasantly surprised at how quickly the Workers’ platform is taking off. But we are not, at this time, optimizing that platform for how can we bring as many dollars out of it as possible. We think that studying developer platforms across history, what we’ve seen is what you really need is adoption.

There was also a question about Microsoft Entra, announced in July. This zero-trust product is targeted at the SMB sector, where Cloudflare is also very active. An analyst asked for Matthew Prince’s reaction.

Out of character, Prince was somewhat careful in his answer, as Microsoft is both a partner and a competitor of Microsoft. He said Cloudflare would cooperate where possible and compete where needed. But he also clearly showed that Cloudflare had an advantage:

What customers really want is they want a solution that works across not just one vendor’s products, but the entire IT stack. And I think that’s what we see time and time again as the reason why customers are selecting Cloudflare Zero Trust solutions.

I think this makes sense.

Conclusion

After the previous quarter, which was somewhat of a disappointment, Cloudflare posted a quarter as we have become accustomed to. It also showed that you can trust management. In the previous quarter, Prince spoke about some underperformance from some salespeople and this was taken on immediately and already visible in the numbers.

There are several growth drivers left for Cloudflare and AI is the newest break-out technology which could boost the company’s revenue growth for the next few years.

In the meantime, keep growing!

Read the full article here

Leave a Reply