Investment Thesis

Cloudflare, Inc. (NYSE:NET) is rarely on sale. And yet, the company continues to deliver very strong results.

According to my estimates, the stock is priced at 114x forward non-GAAP operating profits. Thus, making NET perhaps one of the most expensive SAAS stocks in the market. I believe this puts NET in line with CrowdStrke (CRWD). So, why my buy rating?

I put a tepid Buy rating on NET stock only for the fact that its growth rates are now reaching $2 billion in annualized revenues and growing this sort of revenue at close to 30% CAGR is a very challenging feat, which reflects the high demand for its products.

Rapid Recap

Back in January, I said in a bullish analysis:

There’s no doubt that the company is growing at a rapid pace. The main question that looms over Cloudflare is whether it can continue delivering more than 30% CAGR in 2024.

That being said, the stock is priced very much in line with other fast-growing peers. However, the big advantage that Cloudflare has relative to many of its peers, is that I believe it can reach clean GAAP breakeven within 2 years.

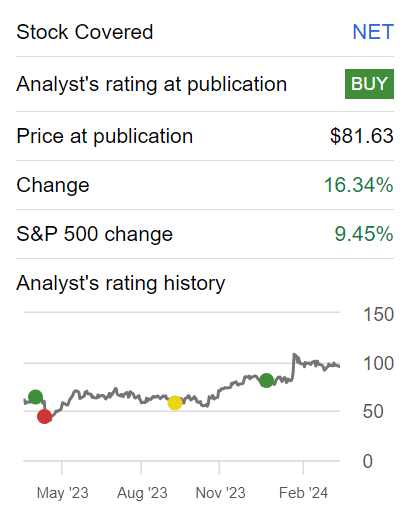

Author’s work on NET

Since my previous bullish analysis, the stock has grown faster than the S&P 500 (SP500), delivering a 16% return versus just under 10% for the S&P 500.

And I now believe that the answer to my previous question is ”very close to 30% CAGR” will be on the cards this year. Here’s why I’m tepidly bullish on this stock.

Cloudflare’s Near-Term Prospects

Cloudflare provides services to make websites faster, safer, and more reliable. Essentially, they act as a middleman between a website and its visitors, helping to protect the site from cyberattacks, optimize its performance, and ensure it stays online even during times of heavy traffic or network disruptions.

In simpler terms, Cloudflare helps websites load faster, keeps them secure from online threats and ensures they remain accessible to users around the world.

On the one hand, Cloudflare’s near-term prospects appear promising. With a revenue increase of 32% y/y in Q4 and a record number of new large customers, Cloudflare demonstrates its ability to retain clients, especially those with significant spending power. The company’s focus on refining its go-to-market strategies and operations, as highlighted by improvements in pipeline growth rates, sales productivity, and average deal size, positions it well for sustained growth.

However, Cloudflare faces challenges too. The IT sector is widely reported to be going through a period of digestion, indicating headwinds in the IT buying landscape.

Furthermore, Cloudflare is now facing intensifying competition from established players, most notably Amazon’s (AMZN) CloudFront (content delivery network).

Given this background, let’s now discuss its fundamentals.

Cloudflare Set to Grow by Nearly 30% CAGR

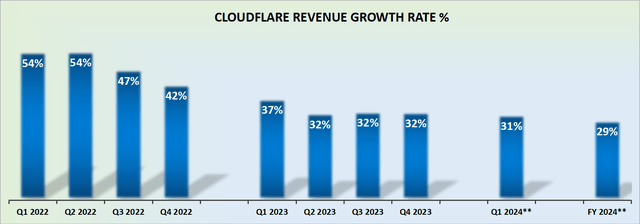

NET revenue growth rates

Cloudflare has a long habit of being conservative with its estimates to allow for an easier beat later on, right? That’s what high-quality management teams deliver, right? They ”know” how to play the Wall Street game, right?

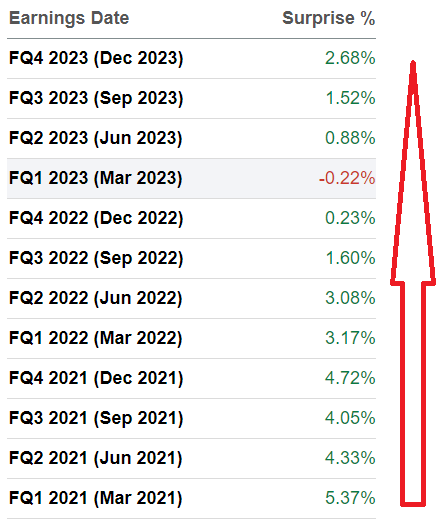

SA Premium

Well, the facts are not reflecting that story. The facts show that the size of Cloudflare’s revenue beats has become smaller with time.

This is natural, given that Cloudflare is now annualizing close to $2 billion of revenues, as a forward run-rate. Finding extra revenue each quarter to beat analysts’ estimates is going to be a challenge.

Nevertheless, the reason why Cloudflare is as highly priced by investors as it is, is because this company has very high visibility into its future revenue stream.

Consequently, when Cloudflare guides for 28% y/y growth for 2024 we can practically bank on getting at least 29% CAGR. However, I don’t expect much more than 30% CAGR.

That being said, getting to around 29% to 30% CAGR in 2024 should be a relatively easy hurdle to reach given the significant deceleration in revenue growth rates from 2022 into 2023, which makes for easier comparables for 2024.

Given that framework, let’s discuss its valuation.

NET Stock Valuation — 114x Forward Operating Profits

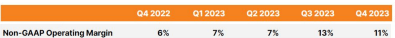

NET Q4 2023

Cloudflare saw its non-GAAP operating margins expand by 500 basis points y/y in Q4 2023. This implies that there should be room for Cloudflare to expand its to around 15% non-GAAP operating income. After all, Q3 2023 already saw 13% of non-GAAP operating income.

And with enough effort, I believe that most investors would concur that there’s still more juice left in the tank for Cloudflare.

Consequently, I believe $280 million of non-GAAP operating income could be reached as a forward run rate at some point in the next twelve months. For this, as a reference point note that Cloudflare has already guided for $160 million since the start of 2024. Then, with some further raises throughout 2024 and this should validate my estimate of $280 million on a forward run-rate.

Is this cheap? Absolutely not. No way. But is this justified? Yes, I believe it is.

The Bottom Line

In summary, Cloudflare, Inc. stock is trading at a steep valuation of 114x forward non-GAAP operating profits, making it one of the priciest SAAS stocks in the market. Despite this, a tepid buy rating is warranted due to the company’s robust growth prospects. With revenue nearing $2 billion and growing at close to a 30% CAGR, Cloudflare demonstrates strong demand for its products. While facing challenges such as competition and market headwinds, Cloudflare’s high visibility into future revenue streams and potential for margin expansion justify its current valuation, offering investors an opportunity to benefit from its long-term growth trajectory.

Read the full article here

Leave a Reply