Thesis

I give Clearwater Analytics (NYSE:CWAN) a ‘Hold’ rating primarily due to their margin contraction and their reasonable valuation.

Business Overview

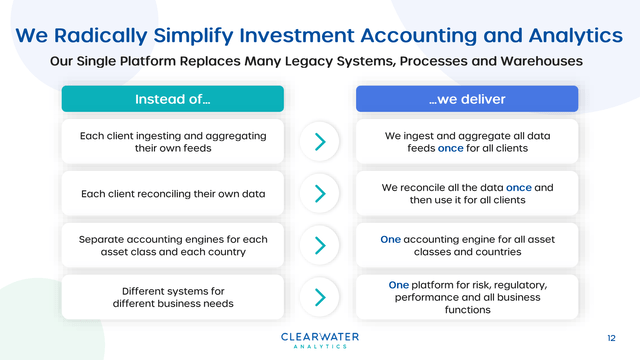

Clearwater Analytics is a developer of cloud-based investment accounting and analytics software, helping customers consolidate a traditional patchwork of legacy softwares. The main customer verticals that they serve are asset managers, corporations, insurers, and public sector entities.

Clearwater Analytics Q4 2023 Investor Presentation

For a moment, consider how complicated your personal finances are. You have several open bank accounts, a plethora of credit cards, a mortgage on your house, a loan on your car, investments in several brokerage accounts, etc. With all your personal assets and liabilities scattered across dozens of accounts, it’s difficult to understand the full picture of your current financial health. This dilemma is what has made personal finance softwares so popular because they help consolidate an individual’s entire financial profile into one location. Increased financial clarity helps users make informed decisions.

This same principle applies to what Clearwater offers their clients. Personal finance software is to personal finance, what Clearwater is to institutional finance. Clearwater’s software helps their clients consolidate their entire financial profile into one location, enabling them to make better and more informed decisions. Of course, this metaphor is a gross oversimplification of Clearwater’s entire business, but it helps create context for the value that their software provides for customers.

Clients are naturally inclined to trust Clearwater because of their sheer size. As you can imagine, clients are trusting the company with sensitive information. Clearwater has leveraged this imperative need and turned it into one of their competitive advantages. Clients recognize that Clearwater has demonstrated proper security of their clients’ data, as evidenced by their clients’ $7.3 trillion of assets under management, and are more inclined to trust them moving forward. This advantage helps Clearwater to close approximately 80% of all qualified leads that they engage with.

As of December 2023, Clearwater has 1,349 clients. A few of Clearwater’s customers include JPMorgan (JPM), Snowflake (SNOW), Dell (DELL), and Spotify (SPOT), among others.

Clearwater was founded in 2004 in Boise, Idaho. They remain headquartered in Boise, but their 1,700+ employees are spread throughout 12 offices around the globe.

Financials

In 2023, Clearwater generated $368 million of revenue, up 21% from the prior year’s total of $303 million. This trend in revenue growth has been right in line with previous years as well. Year-over-year revenue growth for the years 2020-2022 came in at 21%, 24%, and 20%. Revenue growth over the next year is projected to be 19.5%. Management has commented during earnings calls that they have long-term conviction that revenue growth in the 20% range is sustainable for the foreseeable future.

Looking forward, Clearwater is turning towards AI to help fuel growth. They announced Clearwater GPT in July of 2023, and began rolling it out to select customers in the second half of the year. Features such as this will make Clearwater’s offering more compelling, ultimately aiding them as they seek to expand their client base.

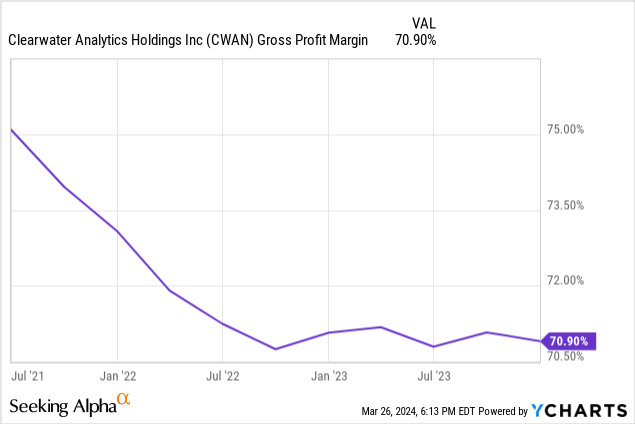

Interestingly, Clearwater’s gross margins have contracted since 2020. Gross margins in 2020 were 73.8%. Last year, Clearwater posted a gross margin of 70.9%. It’s odd to see gross margin contraction for a software company, given that the majority of their cost of revenue should be hosting costs.

Management commented on Clearwater’s gross margin during their most recent earnings call. However, they only spoke about them in a non-GAAP context. This is noteworthy because the gross margin reported by management was expanding, while the company’s gross margin is contracting on a GAAP-basis. Such discrepancies test my faith in management. Sure, they may have their own adjusted measures that they believe reflect the nature of their business in a more accurate way. But more often than not, investors put weight on profitability measures on a GAAP-basis, which are conveniently omitted by management in this instance.

It’s uncertain what exactly has led to the pressure on gross margins, but there are a few things that could be the culprit. For example, an increase in hosting costs or a need for more customer support resources are two such factors that could contribute to the margin contraction.

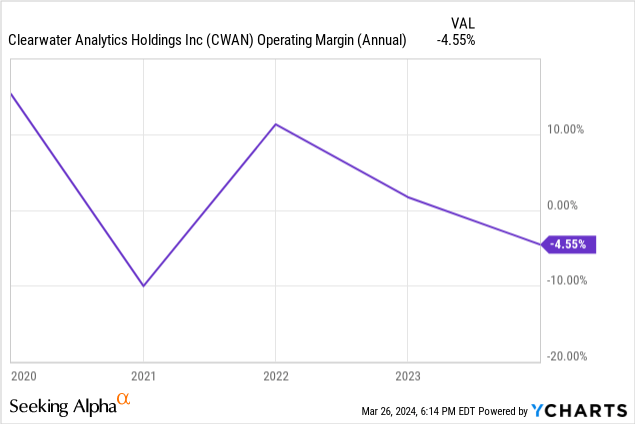

Another concerning trend comes in the form of operating expenses. Clearwater’s growth in operating expenses has consistently outpaced their revenue growth over the last four years. For example, in 2023, the company grew revenue by 21.3%. At the same time, Clearwater’s SG&A increased 24% YoY, and R&D increased 30.2% YoY—leading to an overall growth in operating expenses of 26.9%.

Although it’s not uncommon to have operating expenses outpace growth in revenue every once in a while, this has been a consistent trend for the company. SG&A and R&D expenses have outpaced revenue growth in each year from 2020-2022, as well as 2023’s totals. This is quite atypical of a software company. Software companies are often the poster children of margin expansion due to the low incremental costs associated with selling an additional unit of software. But despite these strong unit economics, Clearwater hasn’t quite shown that they can do more with less.

As for Clearwater’s balance sheet, it’s strong and robust. They have $296.2 million of cash and short-term investments, while only having $72.1 million of total debt. Their Altman Z score is 15, indicating their strong financial health. Also, Clearwater’s 24-month beta is 0.87, which is quite low for a software company, indicating that their stock has been less volatile than the market.

Although Clearwater is not profitable on a GAAP-basis, they are cash flow positive. Cash from operations in 2023 was $84.6 million, up 45.9% from the year prior. And considering that spending on capital expenditures has only been around $5 million over the last few years, Clearwater has a healthy cash flow cushion should any hiccups arise in the business.

Valuation

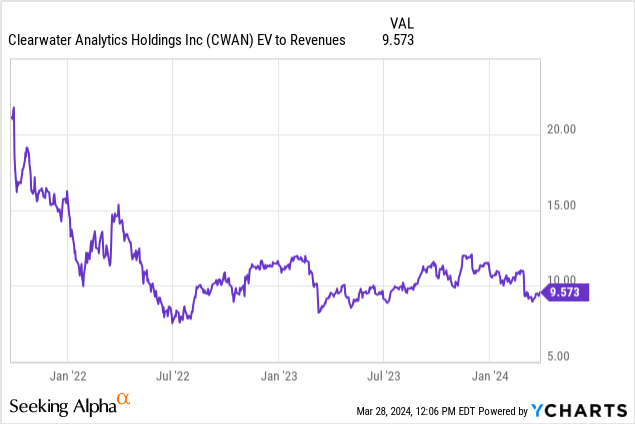

Clearwater is currently trading at an EV/Revenue multiple of 9.6x, which is reasonable for an enterprise software company. However, the company is lagging behind in several of the hallmark enterprise software metrics—namely retention and margins.

For a niche, vertical enterprise software solution like Clearwater, intuition would lead me to guess that their gross margins should be around 75% to 80% or greater. For example, Autodesk (ADSK), another niche, vertical enterprise software solution, has gross margins of 91.6%. However, as discussed earlier, this is not the case for Clearwater as their gross margins have hovered around 70% over the last few years. This leads me to believe that the company may not have strong pricing power with their customers. A lack of pricing power could be a cause for concern, particularly if more competitors were to enter the investment accounting and analytics software market.

Furthermore, intuition, and a 9.6x EV/Revenue multiple, would lead me to believe that their net revenue retention would be in the range of 110%-115%. This is not the case though, as their net retention for 2023 was 107%. While this is still strong, it’s far from an industry-leading level of retention.

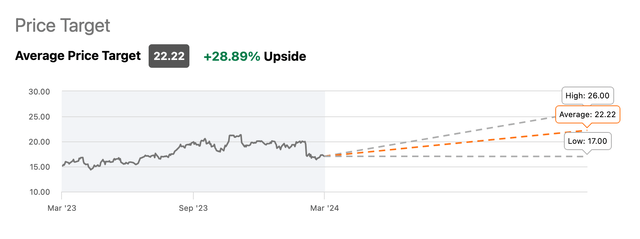

The average price target for Clearwater’s stock, according to Wall Street analysts, is $22.22. This is close to an implied upside of 30% based on the price that the stock trades at today. However, the analyst estimates range anywhere from as low as $17, to as high as $26.

Seeking Alpha

Of the 11 Wall Street analysts that are actively covering the stock, five rate it as a ‘Strong Buy,’ and one rates it as a ‘Buy.’ Four analysts rate it a ‘Hold,’ and one rates it a ‘Sell.’ Considering that I’m more bearish on the stock than the majority of the analysts, I would guide Clearwater’s valuation to the lower end of the spectrum of analyst price targets.

Looking at Clearwater’s historical EV/Revenue multiple shows an interesting trend. It’s clear that upon going public, the company went through a fair amount of price discovery. Then, once the Federal Reserve started raising interest rates in March of 2022, Clearwater’s multiple dropped. Of course, this is no outlier as it was a broad trend for technology stocks. But ever since that period, Clearwater’s valuation has ranged between approximately 8x-12x EV/Revenue, with 10x appearing to be a rough median.

Using these historical valuations as a benchmark, a 10x EV/Revenue multiple seems reasonable. Such a multiple would imply an enterprise value of approximately $3.68 billion ($368 million of trailing revenue multiplied by 10), which is only marginally above its current enterprise value of $3.64 billion. Additionally, this multiple seems appropriate because Clearwater’s growth in the foreseeable future is projected to be in-line with what it has been in the recent past.

Risks

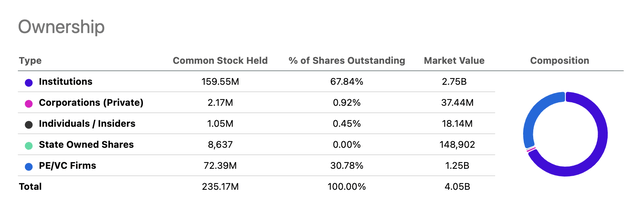

Two key risks that stand out for Clearwater’s business are the company’s sizable amounts of stock-based compensation, coupled with the low amount of insider ownership.

Over the course of 2023, Clearwater paid out $104.4 million of stock-based compensation. This amounts to almost 30% of revenue and is up almost 60% year-over-year. Although stock-based compensation is a great way to align the interests of management with those of shareholders, overcompensating can come at the expense of shareholders. Furthermore, despite these high levels of stock-based compensation, Seeking Alpha shows that insiders and individuals only own 0.45% of the shares outstanding, or $18.1 million worth of market value. This level of insider ownership pales in comparison to the company’s $4.3 billion market cap.

Seeking Alpha

The low levels of insider ownership, coupled with high stock-based compensation, pose a unique risk for investors. These factors can lead to an environment where management prioritizes short-term gains to reach certain compensation milestones, with less regard for long-term consequences since they hold few shares over the long-run. And although I don’t foresee these dynamics as an impending risk, they will be important for investors to monitor moving forward.

Catalysts

The leading catalysts for a company like Clearwater will be their quarterly earnings announcements. Due to the nature of their recurring revenue model, Clearwater’s business is much more predictable than the average company in the stock market. While this is helpful at times, it also comes with its drawbacks. Predictability, by nature, limits the quantity of potential catalysts for a stock.

In Clearwater’s case, I find it more likely that a series of catalysts, in the form of future earnings announcements (either favorable or unfavorable), will be what shape the future trajectory of the stock. In addition to monitoring the standard fundamentals reported at earnings, watching the trends in profitability margins and net revenue retention will be key for investors.

Conclusion

Overall, Clearwater Analytics has a strong business. They boast an impressive clientele and have demonstrated steady top-line growth. However, they’re not without their blemishes. Their margin profile shows signs of concern as expenses have outpaced top-line growth, and insider ownership and compensation serve as other areas of question. Given these factors, their current valuation seems reasonable, resulting in a ‘Hold’ rating.

Read the full article here

Leave a Reply