By Evan Bauman & Aram Green

Staying Consistent Through Recent Weakness

Market and Performance Overview

Equities were pressured in the third quarter by rising bond yields and a hawkish turn by the Federal Reserve. The S&P 500 Index (SP500, SPX) fell 3.27% while the Russell 2000 Index declined 5.13% as the Fed indicated that generationally high interest rates could remain elevated well into 2024. The benchmark Russell 3000 Growth Index gave back some gains, dropping 3.35% and trailing the Russell 3000 Value Index (-3.15%).

Growth remains ahead of value by over 2,200 basis points year-to-date, mostly a function of outperformance among the “Magnificent Seven,” a collection of mega-cap growth companies including Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA), that currently dominate market cap-weighted benchmarks. The ClearBridge Multi Cap Growth Strategy’s lack of exposure to these stocks has led to significant underperformance year-to-date but supported relative results in the third quarter.

Stock selection has also been a performance headwind in 2023 with a handful of holdings suffering declines amid rapidly rising interest rates. Wolfspeed (WOLF), a semiconductor company producing silicon carbide materials and power devices, was one of the primary detractors from Strategy performance in both the third quarter and year-to-date. The company has been hampered by execution issues as it invests to meet the growing demand for substrates and chips for electric vehicles. Additionally, Wolfspeed’s construction of a new silicon carbide fabrication plant in Upstate New York has taken longer than expected to reach critical mass. As one of just a handful of companies in the portfolio that are still not profitable today, Wolfspeed has required additional financing but has been able to secure $1.25 billion in capital from an Apollo-led group as well as $2 billion in upfront cash for a 10-year deal to supply Renesas Electronics (OTCPK:RNECF) with SiC wafers. We remain confident that the company’s addressable market opportunity remains sizable and look for ramping utilization to drive gross margin improvement over time.

Insulet (PODD), a maker of insulin patch pumps for diabetes patients, has also been under pressure. The stock fell victim to inflated expectations in recent quarters related to sales of their next generation Omnipod 5, as well as concerns around the longer-term impact to diabetes exposed stocks following positive cardiovascular readouts for diabetes and obesity treatment semaglutide. The latter concern is based on the notion that if GLP-1s therapeutics are widely adopted, there could be a slowing in the rate of progression of Type 2 diabetes and need for related insulin therapy. Though this is a threat that is weighing on the multiple, it likely would not meaningfully affect the business for many years, especially given how large and underpenetrated the Type 2 diabetes market is for Insulet currently. Additionally, this could require significant improvements in cost, availability, and adherence for GLP-1s. Furthermore, we are encouraged that the majority of Insulet’s business today is still from Type 1 diabetes, where fundamentals remain strong and the company is gaining share.

While the Strategy continued to trail the benchmark in the third quarter, the performance gap narrowed due to improvement among our information technology (IT) holdings, notably cyber security software maker CrowdStrike (CRWD). A lower average market capitalization versus the benchmark, however, remained a headwind as small and mid-cap companies have been more impacted than large caps by tightening liquidity.

Portfolio Positioning

As we have shared in past commentaries, the Strategy has for decades benefited from purchasing attractively priced companies earlier in their growth trajectory capable of compounding free cash flow and earnings over long time periods. We believe these companies possess the appropriate balance of growth, scale, profitability and management prowess.

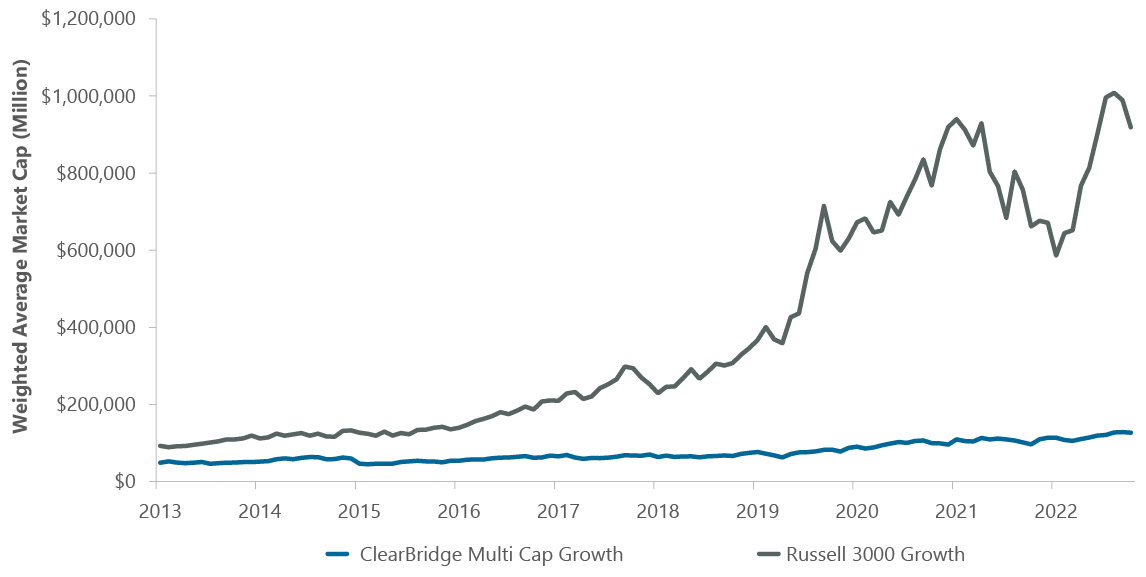

While the team has been consistent in its mission, the benchmark Russell 3000 Growth has become increasingly concentrated with 44.9% of the weight as of quarter end in the aforementioned “Magnificent Seven.” As index concentration has become more extreme, the weighted average market cap of the index has increased more than 10x since 2013 vs. our own which up less than 3x over the same time frame (Exhibit 1).

Exhibit 1: Strategy Market Cap Has Remained Consistent vs. Benchmark

Data as Sept. 30, 2023. Source: FactSet.

We have stayed steadfast in targeting new investments in the $10 billion to $100 billion market cap range at cost, using more mature, larger cap holdings as a source of funds. Along these lines, we took profits in Broadcom (AVGO) in the third quarter, continued to consolidate our traditional media holdings and reduced exposure to cyclical growers Seagate Technology (STX) and Western Digital (WDC), directing the proceeds into the purchase of ServiceNow (NOW).

Application software is an area where we have seen success with disruptors HubSpot (HUBS) and CrowdStrike. ServiceNow is a leading provider of workflow automation software. We see the company as a key enabler of modernization and digital transformation, which is well-positioned as enterprises look to converge on a single platform solution. Despite its sizable customer base, we believe ServiceNow still has substantial room to expand spending with existing customers, as most have not fully leveraged its full product suite. We also are encouraged by the company’s strong leadership team and history of innovation which should enable it to continue to expand wallet share. Additionally, despite ongoing investments in growth, ServiceNow continues to drive healthy operating leverage.

We believe our orientation as long duration investors provides the advantage of allowing us to be opportunistic as market volatility remains elevated. Year-to-date, bouts of weakness have led us to add to positions in disruptors including Airbnb (ABNB) and Pinterest (PINS). We also continue to scale up exposure to sectors where we have historically been underweight, such as consumer discretionary and consumer staples where we have added names that have both offensive and defensive characteristics in this uneven economy like TJX.

Outlook

As market concentration has reached levels rarely seen during our tenure managing the Strategy, especially in the Russell 3000 Growth benchmark, we continue to embrace an investment philosophy that seeks to deliver performance with a low correlation to the benchmark and our peers. We remain committed to targeting growth companies early in their development as we believe the best performance is achieved by holding quality franchises as long-term business owners. To be successful in sourcing these growth leaders of tomorrow, we rely not only on our decades of portfolio management experience but also draw increasingly on the bottom-up insights and analysis of ClearBridge’s central research platform.

One trend we are following closely is merger & acquisition activity. After a lull during the market downdraft last year, we are beginning to see green shoots in deal making. The Strategy has a long history of owning stocks with characteristics attractive to acquirers and has experienced dozens of takeovers over the last several decades. We believe a healthier M&A market will be a boon to companies down the market cap spectrum with strategic value to larger enterprises.

The Strategy has experienced periods of relative underperformance in the past. The difference this time is the duration of that underperformance. We acknowledge the weaker comparative returns are mostly due to the mega cap names we don’t seek to own in the Strategy. While this is exacerbated by an increasingly narrow market, it will not deter us from remaining consistent in our investment approach.

Portfolio Highlights

The ClearBridge Multi Cap Growth Strategy underperformed its benchmark in the third quarter. On an absolute basis, the Strategy endured losses across the seven sectors in which it was invested (out of 11 total). The primary detractors were the IT, health care and industrials sectors.

Relative to the benchmark, overall stock selection detracted from performance while overall sector allocation contributed. In particular, stock selection in the industrials, health care and communication services sectors had a negative impact on results. On the positive side, stock selection in the IT sector and an overweight to health care contributed to performance.

On an individual stock basis, the leading absolute contributors were positions in CrowdStrike, AbbVie (ABBV), Comcast (CMCSA), UnitedHealth Group (UNH), and Ionis Pharmaceuticals (IONS). The primary detractors were Insulet, Johnson Controls (JCI), Wolfspeed, TE Connectivity (TEL) and Doximity (DOCS).

In addition to the transactions mentioned above, we exited a position in Liberty SiriusXM (LSXMK) in the communication services sector.

Evan Bauman, Managing Director, Portfolio Manager

Aram Green, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. Copyright © 2023 ClearBridge Investments, LLC |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply