By Sean Bogda, CFA, Grace Su, & Jean Yu, CFA, PhD

Value Lags Broader International Rally

Market Overview

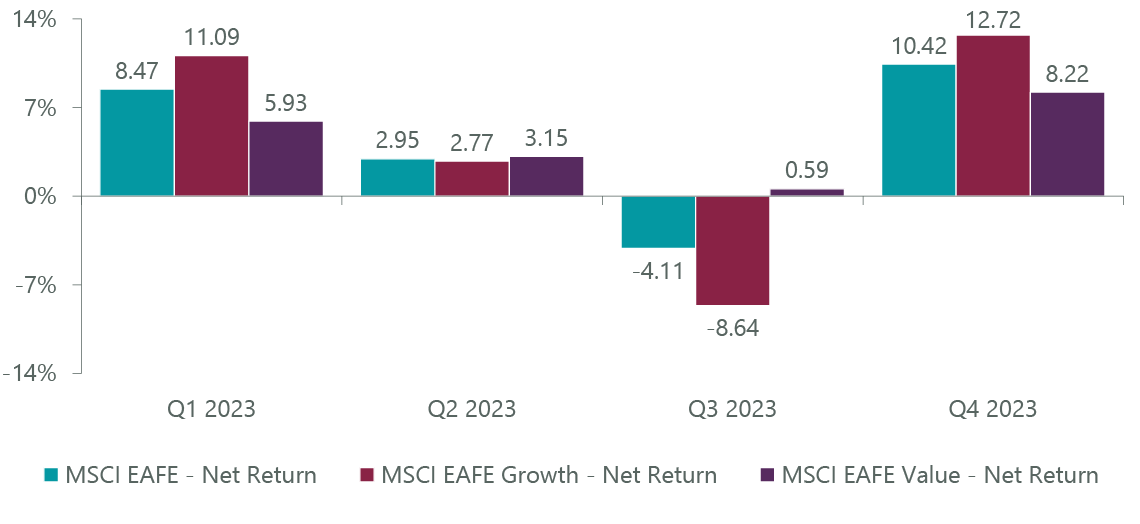

International markets generated positive returns in the fourth quarter, as disinflationary data, renewed hopes of an economic soft landing and declining bond yields in the U.S. and Europe overcame concerns over renewed hostilities in the Middle East and continued economic challenges in China. The benchmark MSCI EAFE Index returned 10.42% for the quarter. A dovish policy pivot by the Federal Reserve helped to spur growth stocks ahead of value stocks for the quarter, with the MSCI EAFE Growth Index returning 12.72% versus the 8.22% return of the MSCI EAFE Value Index (Exhibit 1). While the fourth quarter helped to narrow the full year performance gap, the MSCI EAFE Value Index still ended the year ahead of the Growth Index by approximately 140 basis points.

Exhibit 1: MSCI Growth vs. Value Performance

Data as of Dec. 31, 2023. Source: FactSet.

Despite investor concerns over the possibility and timing of a recession entering the quarter, international markets rallied as disinflationary data in Europe and the U.S. helped to renew investors’ hopes that monetary tightening had peaked. This helped to spur a rally in November and December, particularly benefiting longer duration sectors like information technology (‘IT’) as well as cyclical sectors on hopes of economic re-acceleration.

However, this positive sentiment was not universal. The fourth quarter also saw the outbreak of war in Israel and reprisal attacks on cargo ships in the highly trafficked Red Sea, resulting in elevated investor fears of a deteriorating geopolitical environment in the Middle East and a detrimental impact on global supply chains as ships were re-routed to safer, albeit longer, shipping channels. On the other side of the globe, economic data out of China continued to prove disappointing and failed to restore market confidence despite a myriad of measures and programs rolled out by Beijing aimed at re-igniting the domestic economy. The situation was further exacerbated by a selloff in December, as investor redemptions and geographic repositioning resulted in the Chinese market’s worst performing month of the year and third-largest monthly outflow on record, according to Morgan Stanley. Investors’ exit from China continued to help bolster the Japanese economy, which showed continued positive performance in the fourth quarter thanks to increased investor demand stemming from corporate reform potential and perceived beneficiaries of a strengthening domestic economy.

Against this backdrop, the ClearBridge International Value Strategy underperformed its benchmark in the fourth quarter, as a combination of stock selection in the industrials, financials and health care sectors overcame positive contributions from our consumer discretionary stocks.

Industrials proved to be the biggest detractor from relative performance. Despite our overweight allocation to the sector, several of our holdings failed to keep pace with the rally in the broader industrials sector. The diverse nature of the sector, both geographically and across business lines, can make it difficult to determine short-term movements, but rather than chase price trends we continue to focus on companies with strong underlying businesses and leveraged to long-term trends such as automation and energy transition. For instance, one of our top performers during the quarter was Schneider Electric (OTCPK:SBGSF), a French company specializing in digital automation and energy management. We believe the company will be a long-term beneficiary of the global energy transition given its strong position in various electrical power-related markets. The company’s stock price rose after another quarter of strong earnings, and we believe the company’s growing forward bookings point to continued growth.

Health care also weighed on performance, centered in pharmaceutical holdings Bayer (OTCPK:BAYRY) and Sanofi (SNY). Sanofi, a French drug maker, faced challenges due to revisions in its strategic and financial outlooks after announcing a $1 billion increase in research and development to accelerate its drug development pipeline. Likewise, Bayer, a German pharmaceutical and agriculture company, saw its share price decline after seeing disappointing results from one of its most anticipated anticoagulant pipeline drugs, as well as a legal challenges in its crop business leading to increased liability estimates. Our opinion is that the reactions in both cases were overdone. With Sanofi, we believe that future cost cuts and increased R&D investments are expected to offset short-term earnings impacts and be beneficial to long-term sales growth. Likewise, Bayer’s low valuation indicates that investors have largely given up on any turnaround, meaning that any good news – pharma cost cutting, consumer health sale, a rebound in the crop business or any positive outcomes on the litigation front – could be a positive catalyst.

“From a geographic perspective, the clear value opportunity remains China.”

Stock selection in the consumer discretionary sector was a positive driver. Our top holding in the sector was Spanish clothing, footwear and accessories retailer Industria de Diseno Textil (OTCPK:IDEXY). The company’s flagship destination retail brand, Zara, has seen strong positive performance thanks to a rebound in tourism and the relatively strong performance in southern European markets compared to northern Europe due to strong service components in their economies. The company continues to deliver strong execution driven by investment in both its e-commerce and omnichannel operations to drive balanced growth. Another positive contributor was Arcos Dorados (ARCO), a Latin American owner/operator of McDonald’s quick service restaurant franchises. We believe the market has inherently strong growth prospects, and the company’s positioning as a leader in the space has allowed them to capture significant share. Additionally, we believe the company’s targeted investment in its digital operations is helping to further drive sales.

From a regional standpoint, stock selection in Europe was a detractor from performance. The largest geographical allocation in the portfolio, Europe reflects a challenging economic backdrop, and we continue to evaluate our exposure to the region by focusing on investing in best-in-class businesses at attractive prices. Rather than see these downticks as disappointing, we believe these periods of underperformance provide opportunities and this quarter is no exception. We continue to monitor our European holdings to ensure they are performing in-line with our expectations.

Portfolio Positioning

We made several adjustments to the portfolio during the period, initiating three new positions and exiting one.

We added a new position in Cellnex Telecom (OTCPK:CLNXF), in the communication services sector, a Spanish-headquartered operator of wireless telecommunication infrastructure. As Europe’s largest independent tower company, Cellnex had capitalized on the low-rate environment to grow significantly but has been challenged in recent times as rates spiked. Spurred by demands from activist shareholders for a new management team, Cellnex has refocused its efforts on deleveraging its balance sheet, cost optimization and enabling organic growth.

We also added Capgemini (OTCPK:CAPMF), one of the world’s leading technology outsourcing firms. The French company saw its shares come under pressure due to increased concerns of a slowing macroeconomic backdrop and uncertainty surrounding the impact of generative AI on the demand for IT services. However, as more clarity has emerged surrounding the incredible complexity of generative AI, we believe this will actually prove a tailwind for Capgemini and lead to compelling, long-term returns.

We exited Tencent (OTCPK:TCEHY), a Chinese-based communication services company operating in the value-added services, online advertising, fintech and businesses services industries. The company’s shares have been under pressure for the last few years due to investor concerns surrounding the Chinese government’s scrutiny of the digital economy, and the fourth quarter witnessed another episode of potential regulatory changes in the gaming business. We believe these regulations create significant challenges to Tencent’s ability to deploy capital freely and maximize shareholder value, and we elected to exit the position in favor of investments with a better risk/reward profile.

Outlook

In contrast to the pessimism entering 2023, the market appears to be pricing in a hopeful outlook for 2024, expecting better real income growth, less constraints from rising rates, margin upside from input disinflation, and a return of accommodative monetary policy as sequential inflation data eases back to target levels. With the bar of expectations now raised, we believe it is beneficial to increase portfolio diversification.

On the one hand, we continue to like companies with secular growth tailwinds from megatrends such as infrastructure spending and energy transition, many of which are concentrated in the industrials sector. Complementing this, we also maintain high exposure to deep value areas, believing that equity returns should broaden out to laggards at attractive valuations. The energy sector is a good example of this, with the strong profitability and capital discipline allowing companies to return significant amounts of capital even as underlying commodity prices remain range bound. Similarly, in financials, we are invested in well capitalized banks that have committed to significant capital returns over the next few years. Energy and financials could also prove to be good hedges if the market’s disinflation narrative fails to play out and we remain in a higher-for-longer regime. Lastly, selective defensive groups such as utilities and consumer staples significantly underperformed last year, allowing us to buy insurance against a growth slowdown at compelling entry points.

From a geographic perspective, the clear value opportunity remains China, where the market is trading at half the valuation of the global index and the earnings yield to bond yield differential (5.7%) is the highest in two decades. We hesitate to speculate on the next moves of the Xi administration but maintain a few high-quality names in the portfolio where upside optionality is high. The other large contrarian opportunity we see is the U.K., where Brexit and the cost of living crisis in recent years have deterred investor interest. However, as real wage growth and consumer confidence continue to improve, it is a market that could play catchup, particularly in the consumer and financial sectors which remain very out of favor and attractively priced. Lastly, we continue to look for opportunities to add to our Japan exposure as the economy exits the deflationary era and further implements governance reforms to bolster returns. As always, the goal is to build a diversified portfolio of stocks where we believe risk/reward is mispriced and significant alpha generation is possible.

Portfolio Highlights

The ClearBridge International Value Strategy underperformed its MSCI EAFE benchmark during the fourth quarter. On an absolute basis, the Strategy had gains across seven of the 10 sectors in which it was invested (out of 11 sectors total). The IT, consumer discretionary and industrials sectors were the main contributors, while the health care and energy sectors detracted.

On a relative basis, overall stock selection and sector allocation weighed on performance. Specifically, stock selection in the industrials, health care, financials, materials and communication services sectors and an overweight allocation to the energy sector detracted. Conversely, stock selection in the consumer discretionary and consumer staples sectors and an underweight allocation to the health care sector proved beneficial.

On a regional basis, stock selection in Europe Ex U.K., Asia Ex Japan, the U.K. and Japan and an overweight to North America weighed on performance. Stock selection in North America and an overweight to emerging markets positively contributed.

On an individual stock basis, Samsung Electronics (OTCPK:SSNLF), Industria de Diseno Textil, Holcim (OTCPK:HCMLF), Schneider Electric and Arcos Dorados were the leading contributors to absolute returns during the quarter. The largest detractors were Bayer, Julius Baer (JBPCF), Sanofi, Inpex (OTCPK:IPXHF) and Standard Chartered (OTCPK:SCBFF).

During the quarter, in addition to the transactions mentioned above, the Strategy initiated a new position in Gerresheimer (OTCPK:GRRMF) in the health care sector.

Sean Bogda, CFA, Managing Director, Portfolio Manager

Grace Su, Managing Director, Portfolio Manager

Jean Yu, CFA, PhD, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply