By Elisa Mazen, Michael Testorf, CFA & Pawel Wroblewski, CFA

Japanese Reforms Start to Yield Results

Market Overview

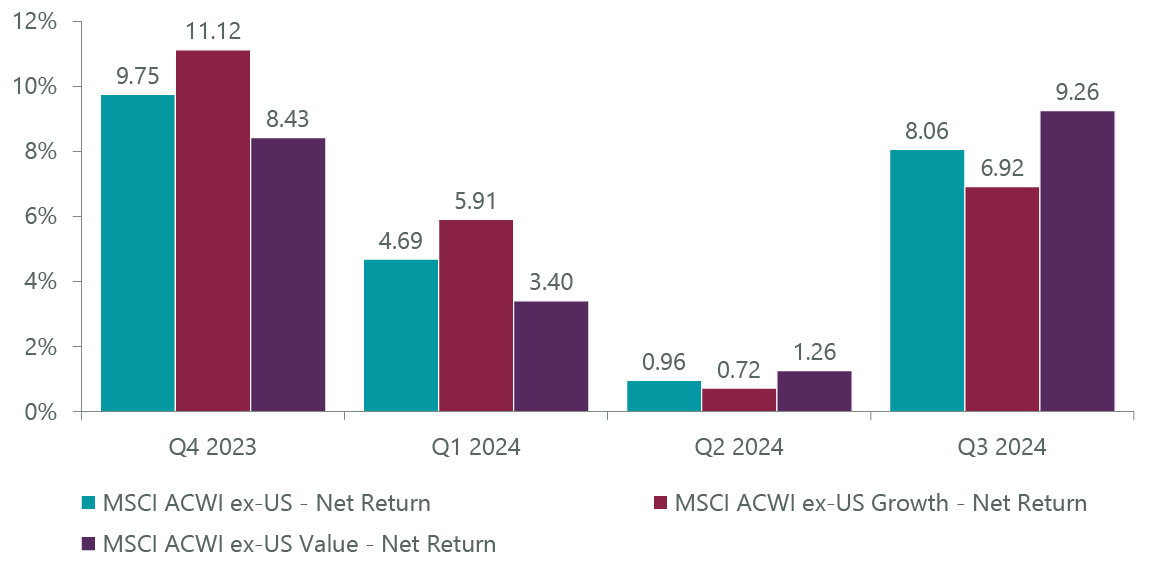

Broadening participation sent international equities higher in the third quarter, with value and cyclical shares leading the way as financial conditions eased across most developed markets. The benchmark MSCI All Country World Ex-U.S. Index advanced 8.06%, the MSCI ACWI Ex-U.S. Small Cap Index jumped 9.03%, while the MSCI Emerging Markets Index added 8.72%.

From a regional standpoint, Asia Ex Japan, North America and emerging markets outperformed the index. The United Kingdom performed in line with the index while Europe Ex U.K. and Japan underperformed in a period that saw currency volatility as a rising yen forced carry trade investors who were short the currency to cover their losses. Chinese equities surged to end the quarter (up 23.49%) following the announcement of aggressive stimulus from Beijing, lifting the performance of broader emerging markets.

Sharp reversals were the order of the day in the third quarter, with some of the worst-performing markets such as Hong Kong staging a sharp turnaround after the announcement of large stimulus packages from Chinese officials. Nearly a year’s worth of trading took place in the last day of the quarter. This led China-focused segments, like materials, to make significant moves higher. Japan’s choice of a new Liberal Democratic Party head to be prime minister also surprised the market, raising fears that he might not follow the corporate policies of the previous administration – something that has since been put to rest – and led to money going back into China from Japan from shorter-term players in the market. Year to date, Japan had been one of the better-performing markets, while China had been unquestionably the worst, hence the strong reversion.

Political drama in France continued with a new prime minister floating the idea of additional corporate tax increases to help salvage the expanding budget deficit; this kept French stocks on their back foot. The 50 basis point Fed rate cut rounded things out at the end of the quarter. Now markets are nervously anticipating the upcoming U.S. election and what that could mean for international trade. The U.S. dollar was broadly weaker throughout the quarter against all major currencies.

International growth stocks rose 6.92% for the quarter but underperformed their value counterparts by 234 basis points as a market rotation away from previous winners in health care and technology ensued.

Exhibit 1: MSCI Growth vs. Value Performance

As of Sept. 30, 2024. Source: FactSet.

The ClearBridge International Growth ACWI Ex-US Strategy underperformed the benchmark in a third-quarter environment favoring value shares. Our diversified focus beyond traditional, higher-growth, higher-beta stocks helped mitigate the degree of underperformance and we believe such an approach is well-suited for broadening markets. Performance was highlighted by strength in both our cyclical holdings in the consumer discretionary sector as well as information technology, although our overweight to the sector neutralized this advantage. Early signs of wider participation are encouraging for us as active, bottom-up growth managers.

Portfolio holdings that had led in a previously narrow international market environment, including GLP-1 pharmaceutical developer Novo Nordisk (NVO) and semiconductor equipment makers ASML and Tokyo Electron (OTCPK:TOELY), gave back gains in the rotation. While Tokyo Electron had been trimmed pretty heavily earlier in the year, we capitalized on late-quarter weakness to bring this position to a more active weight. We maintain confidence in these franchises as leaders in the secular growth market of diabesity treatments, the turnaround of the memory markets in semiconductors and the broadening adoption of Gen AI.

Results were also held back by weakness among the Strategy’s industrial holdings, mainly British pest control provider Rentokil (RTO), which has seen disappointing growth thus far from its U.S. expansion strategy. Japanese industrial filter and valve maker SMC (OTCPK:SMCAY) detracted as well, due to ongoing sluggishness in the Chinese economy. We exited both stocks in favor of better-positioned industrial opportunities.

Portfolio Positioning

We were active in the quarter selling positions where we feel growth is on the decline, upgrading into new ideas with better growth and valuation support. At this point we are convinced that the Japan move to upgrade profitability, capital allocation and shareholder returns is authentic and added five new ideas that reflect this confidence.

In the secular bucket, we purchased Terumo (OTCPK:TRUMF), a Japanese manufacturer of medical equipment for blood management, cardiac and vascular procedures as well as general hospital uses. Its core cardiovascular and vascular device business is growing at above-market rates due to better patient outcomes and improved hospital economics. New product launches in its blood and cell technologies business should further bolster Terumo’s growth. We see the company expanding margins through steady growth in core markets, new business and more aggressive M&A that is possible under its new CEO.

Structural growth companies provide us the opportunity to generate alpha from turnarounds and restructurings as well as broader cyclical drivers. The other four Japan additions fall into this category – Asics (OTCPK:ASCCF), Tokio Marine (OTCPK:TKOMY), Fujikara, an electrical equipment maker, and Nippon Sanso Holdings (OTCPK:TYNPF), a provider of industrial gases. All stand to benefit from both company-specific actions as well as broader reforms in the Japanese market aimed at improving return on equity and shareholder engagement while promoting M&A activity.

Asics is a specialty running shoe designer whose newer management is committed to bringing the business back to industry-like profitability. In addition to its iconic running shoes, the company also develops footwear for the sports lifestyle and health/comfort markets. With better operational focus, inventory management and a move to specialty sales channels, we believe Asics’s well-known quality will allow it to sell more products with better pricing and margins, leading to significant earnings growth.

Tokio Marine is a top global property and casualty insurer. M&A among its smaller rivals in the past few years has created greater parity but Tokio Marine remains the largest insurer by market cap due to its larger overseas portfolio, mostly based in the U.S. We see three sources of price appreciation for the company going forward: premium increases in its domestic P&C business, the selling off of cross holdings that could unlock up to 30% of the company’s current value and bolt-on acquisitions funded by its high cash generation.

The Bank of Japan’s latest Tankan survey confirmed a continued recovery in domestic demand, rising GDP growth and a low risk of deflation returning, conditions conducive to our increasing exposure to the region.

While Beijing’s late-quarter stimulus measures are a good start, ongoing weakness in the world’s second-largest economy has caused us to pare back our direct holdings in the market over the past year. We are now evaluating our indirect exposure as well, which resulted in several exits and trims during the quarter, the largest being the sale of Hong Kong-based life insurer AIA Group (OTCPK:AAGIY). Although AIA’s business has started to improve, wages and employment, particularly among younger consumers, have slowed dramatically, creating concern of less disposable income insurance purchases. Government stimulus through lower rates will also lower investment income for insurers.

One of our bigger sales was Nestle (OTCPK:NSRGY), the Swiss packaged foods giant, where growth appears to have peaked under former CEO Mark Schneider. Nestle’s new CFO has indicated that upward earnings guidance will be pushed out further than anticipated. We exited the long-held name in favor of French food and beverage maker Danone (OTCQX:DANOY), a higher-growth idea in consumer staples.

Outlook

With its September rate cut, the Federal Reserve joined central banks in the eurozone, the U.K., Switzerland and Canada in easing financial conditions. The Fed move has ramifications well beyond the U.S. and is supportive of broadening participation across both developed and emerging equity markets. Combined with China’s aggressive stimulus measures announced late in the quarter, we expect global economic activity will remain positive through the end of the year and into 2025.

Despite the strongly positive reaction by Chinese equities to Beijing’s monetary easing, we believe more needs to be done to restart growth. While the measures are targeted predominantly at the equity markets and local government budgets, we need to see the creation of long-term demand drivers and consumer spending, both of which have been difficult during the housing market declines. China is expected to make additional policy moves at the end of October and with the outcome of U.S. elections soon thereafter, we should know more about the path of its recovery soon.

We are encouraged by the improving conditions across our investable universe as they create a more conducive environment for our diversified approach to growth. Recent performance has highlighted the benefits of complementing core secular growth positions with opportunistic ownership of structural growers and selective exposure to emerging growth names.

Portfolio Highlights

During the third quarter, the ClearBridge International Growth ACWI Ex-US Strategy underperformed its MSCI ACWI Ex-U.S. benchmark. On an absolute basis, the Strategy delivered gains across all nine sectors in which it was invested (out of 11 total), with the consumer discretionary, financials and consumer staples sectors the primary contributors.

On a relative basis, overall stock selection contributed to performance but was offset by negative sector allocation effects. In particular, stock selection in the IT and consumer discretionary sectors and a lack of exposure to energy drove results. Conversely, an overweight to IT, an underweight to financials and stock selection in the industrials and health care sectors detracted from performance.

On a regional basis, stock selection in Japan and the United Kingdom supported performance while stock selection in emerging markets and Europe Ex U.K. and an overweight to Europe Ex U.K. proved detrimental.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Inditex in the consumer discretionary sector, Haleon (HLN) in the consumer staples sector, argenx (ARGX) and HOYA (OTCPK:HOCPY) in the health care sector and London Stock Exchange (OTCPK:LDNXF) in the financials sector. The greatest detractors from absolute returns included positions in Novo Nordisk in health care, ASML, Tokyo Electron and SK hynix (OTCPK:HXSCF) in IT and Rentokil in industrials.

In addition to the transactions mentioned above, we added new positions in Prysmian (OTCPK:PRYMF) in the industrials sector, Coupang (CPNG) in the consumer discretionary sector and repurchased Spotify (SPOT) in the communication services sector. The Strategy also exited positions in Antofagasta (OTC:ANFGF) and Givaudan (OTCPK:GVDBF) in the materials sector, Monday.com (MNDY) and Hexagon (OTCPK:HXGBF) in the IT sector, Daifuku (OTCPK:DFKCY) in the industrials sector and McDonald’s Japan (OTCPK:MDNDF) in the consumer discretionary sector.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Original Post

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply