Civitas Resources (NYSE:CIVI) has remade itself after a series of acquisitions. Slightly over half of its total production is expected to come from the Permian after its latest $2.1 billion Vencer acquisition.

All these acquisitions have resulted in a significant amount of net debt for Civitas, which is projected at around $5 billion at the end of 2023 proforma for its latest acquisition.

Civitas is projected to generate close to $1.5 billion in free cash flow in 2024 at the current strip. It should be able to reduce its debt to a bit over $4.2 billion at the end of 2024, while also paying out around $7 per share in base plus variable dividends.

I now estimate Civitas’s value at around $86 per share in a long-term $75 WTI oil and $3.75 NYMEX gas environment.

Vencer Acquisition

Civitas is paying approximately $2.11 billion for Vencer Energy’s Midland Basin assets. These include around 44,000 net acres with current production that is around 62,000 BOEPD (50% oil).

Civitas is paying $1 billion in cash (subject to purchase price adjustments) at deal close along with 7.3 million shares. Another $550 million in cash is due in January 2025, although this will be reduced to $500 million if Civitas chooses to pay this additional amount at the closing date (expected in early 2024). Civitas is paying a high-single digits interest rate on its borrowings, so it would save a modest amount (net of additional interest costs) if it paid $500 million upon closing.

Civitas expects the production from the acquired assets to decline a bit from current levels in 2024, which should also help cash flow a bit. It expects roughly 55,000 BOEPD (46% oil) in 2024 production, along with approximately $750 million EBITDA at $80 WTI oil and $3.50 NYMEX gas in 2024. With $400 million in projected capex for these assets, that would leave $350 million in asset-level free cash flow for these assets.

At the current 2024 strip of $75 to $76 WTI oil along with around $3.60 NYMEX, 2024 EBITDA would be reduced to around $715 million, resulting in $315 million in free cash flow. The purchase price is thus 2.95x 2024 EBITDA (at current strip) and the free cash flow yield is approximately 15%.

Overall the Vencer deal appears to be fairly typical of the current market in terms of pricing and multiples. Civitas mentions that around 80% of the purchase price is attributable to the proved developed reserves, which suggests a 0.9x multiple to PD PV-10 (at three-year strip) plus around $1 million per gross location for inventory.

Potential 2024 Outlook

If the Vencer acquisition closes at the start of 2024, Civitas expects to average around 335,000 BOEPD in production during 2024. This includes 160,000 barrels per day in oil production. Civitas’s production mix would be approximately 48% oil, 25% NGLs, and 27% natural gas.

Slightly over half of Civitas’s 2024 oil production is coming from its Permian assets. The narrower Permian oil differential should reduce its overall company oil differential to under $3 per barrel.

Current strip is around $75 to $76 WTI oil along with around $3.60 NYMEX gas. At those commodity prices, Civitas is expected to generate $5.544 billion in oil and gas revenues, while its 2024 hedges have around negative $34 million in value. Civitas’s hedging position was last reported as of the end of July 2023.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 58,400,000 |

$73.25 |

$4,278 |

| NGLs (Barrels) | 30,249,375 | $25.00 | $756 |

| Natural Gas [MCF] | 201,753,750 | $2.85 | $575 |

| Hedge Value | -$34 | ||

| Total Revenue | $5,575 |

For 2024, it appears that Civitas’s cash opex could end up slightly under $10 per BOE. This includes lease operating expense, GT&P expense, midstream expense, and cash G&A.

Civitas also expects approximately $2.1 billion in capital expenditures after its Vencer acquisition.

| Expenses | $ Million |

| Cash Opex | $1,192 |

| Production Taxes | $435 |

| Cash Interest | $360 |

| CapEx | $2,100 |

| Total Expenses | $4,087 |

This results in a projection of $1.488 billion in free cash flow for Civitas at the current strip. This doesn’t include the potential impact of cash income taxes for Civitas. It doesn’t expect to pay cash taxes in 2023 but does not appear to have mentioned 2024 expectations yet.

Civitas mentioned expecting approximately $1.8 billion in free cash flow at $80 WTI oil, but the current oil strip is around $4 to $5 lower than that now. I have also assumed that Civitas will largely fund the cash portion of the Vencer acquisition by issuing additional notes (discussed more below), which would increase Civitas’s interest costs.

Debt Situation And Dividends

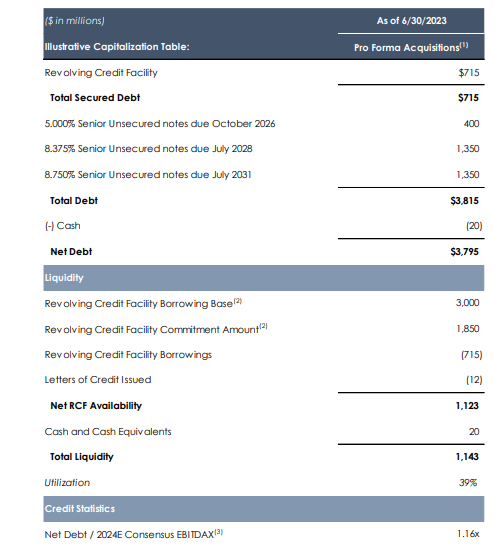

Civitas had approximately $3.8 billion in net debt at the end of Q2 2023, proforma for its Tap Rock and Hibernia acquisitions that closed in August.

Proforma for its Vencer acquisition, it may end 2023 with approximately $5 billion in net debt (including deferred consideration).

I expect Civitas to issue additional notes to help fund the Vencer acquisition, so I am modeling things as if Civitas adds $500 million in 2028 notes and $500 million in 2031 notes as tack-on offerings.

This would leave Civitas with $4.1 billion in outstanding notes and $900 million in credit facility debt at the end of 2023.

Civitas’s Debt (civitasresources.com)

Civitas now has approximately 101 million outstanding shares, so its $0.50 per share quarterly dividend adds up to around $202 million per year. It may also pay around $5 per share in variable dividends in 2024, adding up to around $505 million in variable dividends. Civitas’s variable dividend is based on trailing 12-month free cash flow, so it will take a bit of time for its acquisitions to fully affect its variable dividend.

This leaves $781 million for debt reduction and share repurchases. If Civitas puts that all towards debt reduction, it would end 2024 with around $4.22 billion in net debt or leverage of around 1.1x. This is higher than Civitas’s 0.9x leverage projection, which was done based on $80 WTI oil.

Civitas has also mentioned a target of $300 million in non-core asset sales by mid-2024.

Notes On Valuation

I now estimate Civitas’s value at approximately $86 per share at my long-term commodity price estimates of $75 WTI oil and $3.75 NYMEX gas. This translates into a 3.25x EV to unhedged EBITDA multiple based on Civitas’s 2024 production levels and projected year-end 2024 net debt.

At $86 per share, Civitas should also be able to deliver a 12% to 13% free cash flow yield at $75 WTI oil and $3.75 NYMEX gas while maintaining production levels. This also assumes that Civitas is a full cash income taxpayer. Without cash income taxes, its free cash flow yield would be closer to 16% in this scenario.

Conclusion

Civitas has significantly increased its production through a series of Permian acquisitions, of which the $2.1 billion Vencer acquisition is the most recent one. Civitas now has slightly over 50% of its production coming from the Permian.

This has increased its net debt to around $5 billion after its most recent acquisition, although its overall leverage still appears to be acceptable. Civitas may be able to generate close to $1.5 billion in free cash flow in 2024 at mid-$70s WTI oil. This would allow it to pay $7 per share in total dividends while also paying down its debt by over $750 million.

I estimate Civitas’s value at around $86 per share in a long-term $75 WTI oil and $3.75 NYMEX gas environment. Civitas’s production is around 48% oil, so it is somewhat sensitive to the price of natural gas and NGLs.

Read the full article here

Leave a Reply